- Home

- Packaging Products

- Two Piece Can Market Size, Future Growth and Forecast 2033

Two Piece Can Market Size, Future Growth and Forecast 2033

Two Piece Can Market Segments - by Material (Aluminum, Steel), Application (Beverages, Food, Personal Care, Pharmaceuticals, Others), Manufacturing Process (Drawn and Ironed, Drawn and Redrawn), End-User (Beverage Industry, Food Industry, Personal Care Industry, Pharmaceutical Industry, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Two Piece Can Market Outlook

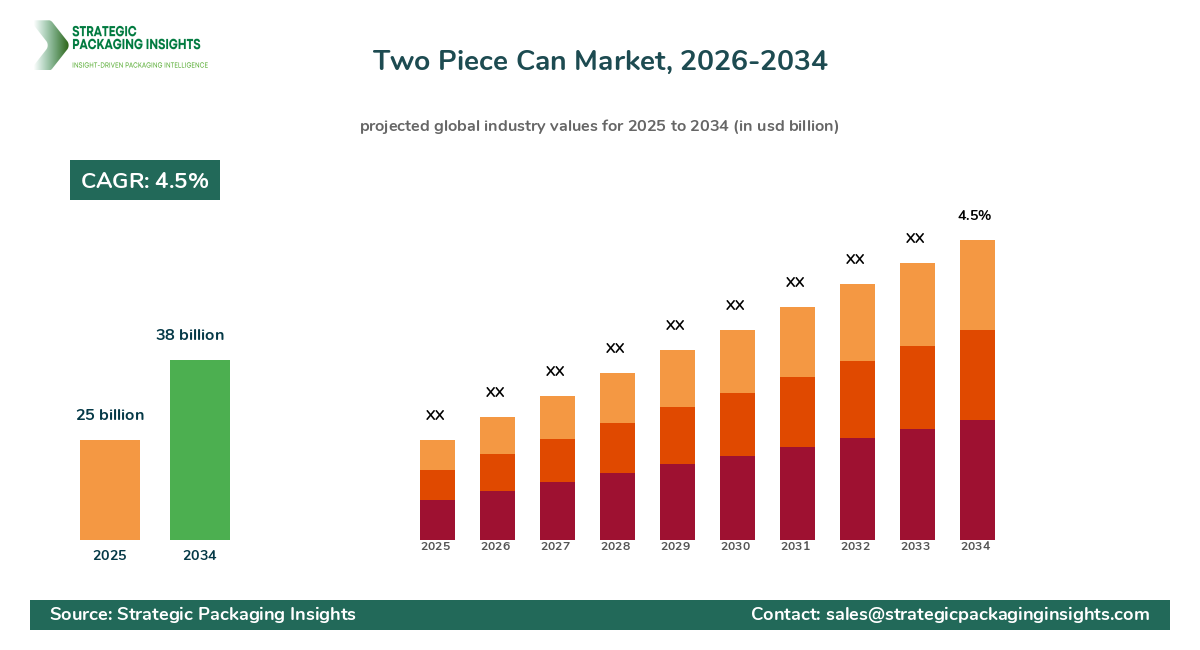

The Two Piece Can market was valued at $25 billion in 2024 and is projected to reach $38 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033. This market is driven by the increasing demand for sustainable and Recyclable Packaging solutions, particularly in the beverage and food industries. The two piece can, known for its durability and lightweight properties, is becoming a preferred choice among manufacturers aiming to reduce their carbon footprint. The market's growth is further fueled by advancements in can manufacturing technologies, which enhance production efficiency and reduce costs.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations. Despite these restraints, the growth potential remains significant due to the rising consumer preference for canned products, which offer convenience and extended shelf life. The market is also witnessing a surge in demand from emerging economies, where urbanization and changing lifestyles are driving the consumption of canned beverages and foods. As a result, manufacturers are focusing on expanding their production capacities and investing in research and development to innovate new can designs that cater to diverse consumer needs.

Report Scope

| Attributes | Details |

| Report Title | Two Piece Can Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 102 |

| Material | Aluminum, Steel |

| Application | Beverages, Food, Personal Care, Pharmaceuticals, Others |

| Manufacturing Process | Drawn and Ironed, Drawn and Redrawn |

| End-User | Beverage Industry, Food Industry, Personal Care Industry, Pharmaceutical Industry, Others |

| Customization Available | Yes* |

Opportunities & Threats

The Two Piece Can market presents numerous opportunities, particularly in the realm of sustainability. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that are not only recyclable but also made from recycled materials. This trend is pushing manufacturers to innovate and develop cans that meet these criteria, thereby opening up new avenues for growth. Additionally, the increasing popularity of ready-to-drink beverages and canned foods in urban areas is driving demand for two piece cans, as they offer convenience and portability. This shift in consumer preferences is expected to create significant opportunities for market players to expand their product offerings and capture a larger market share.

Another opportunity lies in the technological advancements in can manufacturing processes. Innovations such as digital printing and improved coating technologies are enabling manufacturers to produce cans with enhanced aesthetic appeal and functionality. These advancements not only improve the visual appeal of the cans but also enhance their barrier properties, making them more suitable for a wider range of applications. As a result, companies that invest in these technologies are likely to gain a competitive edge in the market. Furthermore, the growing trend of premiumization in the beverage industry is driving demand for high-quality, aesthetically pleasing packaging solutions, providing additional growth opportunities for the two piece can market.

Despite these opportunities, the market faces certain threats that could hinder its growth. One of the primary challenges is the volatility in raw material prices, particularly aluminum and steel, which are the key materials used in the production of two piece cans. Fluctuations in the prices of these materials can significantly impact the profitability of manufacturers, making it essential for them to adopt effective cost management strategies. Additionally, the market is subject to stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Compliance with these regulations can increase operational costs for manufacturers, posing a threat to their profitability. However, companies that proactively adopt sustainable practices and invest in eco-friendly technologies are likely to mitigate these risks and thrive in the market.

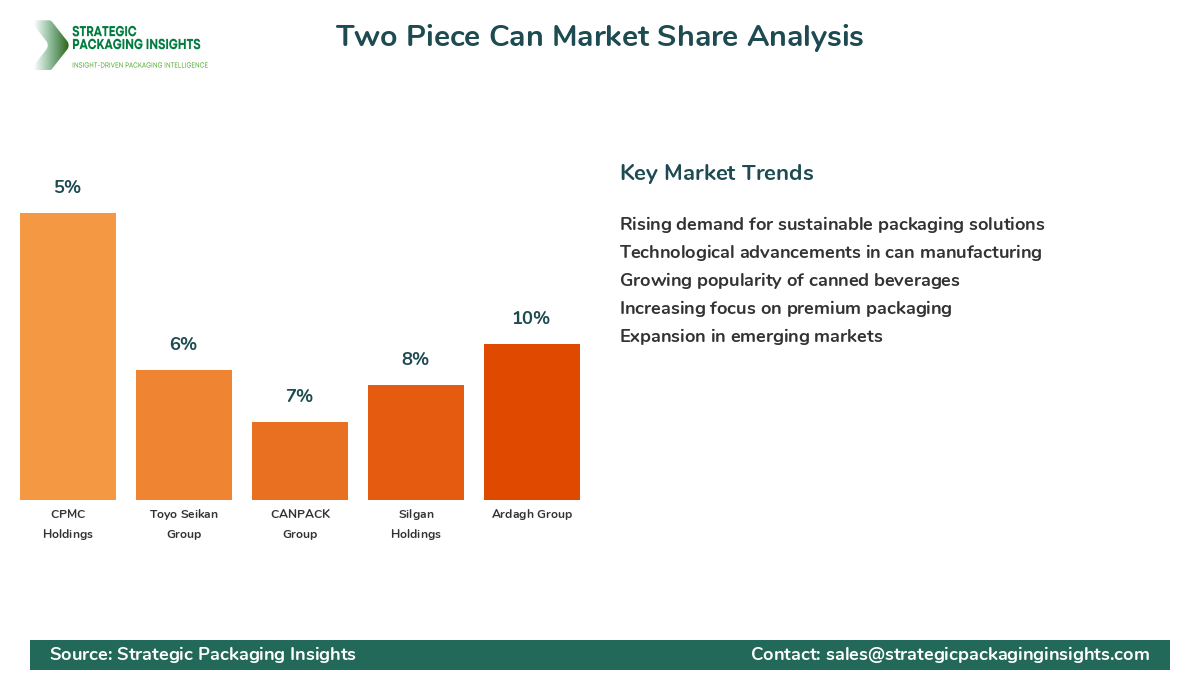

The competitive landscape of the Two Piece Can market is characterized by the presence of several key players who hold significant market shares. These companies are continuously striving to enhance their product offerings and expand their market presence through strategic initiatives such as mergers and acquisitions, partnerships, and collaborations. The market is highly competitive, with players focusing on innovation and sustainability to differentiate their products and gain a competitive edge. The leading companies in the market are investing heavily in research and development to develop new can designs and manufacturing processes that cater to the evolving needs of consumers.

Ball Corporation is one of the major players in the Two Piece Can market, holding a substantial market share. The company is known for its innovative packaging solutions and commitment to sustainability. Ball Corporation has a strong global presence, with manufacturing facilities in various regions, enabling it to cater to a diverse customer base. Crown Holdings, another key player, is renowned for its extensive product portfolio and focus on technological advancements. The company has been actively expanding its production capacities to meet the growing demand for two piece cans, particularly in emerging markets.

Ardagh Group is also a prominent player in the market, known for its high-quality packaging solutions and emphasis on sustainability. The company has a robust distribution network and a strong presence in both developed and developing regions. Silgan Holdings, a leading supplier of Rigid Packaging solutions, is another key player in the market. The company has been focusing on expanding its product offerings and enhancing its manufacturing capabilities to strengthen its market position. Other notable players in the market include CANPACK Group, Toyo Seikan Group, and CPMC Holdings, each of which holds a significant market share and is actively involved in strategic initiatives to drive growth.

These companies are leveraging their expertise and resources to develop innovative packaging solutions that meet the changing demands of consumers. They are also focusing on sustainability initiatives, such as reducing carbon emissions and increasing the use of recycled materials, to align with the growing environmental consciousness among consumers. By adopting these strategies, the leading players in the Two Piece Can market are well-positioned to capitalize on the growth opportunities and maintain their competitive edge in the industry.

Key Highlights Two Piece Can Market

- The Two Piece Can market is projected to grow at a CAGR of 4.5% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Technological advancements in can manufacturing processes are enhancing production efficiency.

- Fluctuating raw material prices pose a challenge to market growth.

- Emerging economies are witnessing a surge in demand for canned beverages and foods.

- Leading companies are focusing on expanding their production capacities and product offerings.

- Stringent environmental regulations are impacting operational costs for manufacturers.

- Premiumization in the beverage industry is driving demand for high-quality packaging solutions.

- Companies are investing in research and development to innovate new can designs.

- Growing consumer preference for canned products offers significant growth potential.

Top Countries Insights in Two Piece Can

The United States is one of the leading markets for two piece cans, with a market size of $6 billion and a CAGR of 5%. The country's strong demand for canned beverages and foods, driven by consumer convenience and lifestyle changes, is a major growth driver. Additionally, the presence of key market players and advancements in can manufacturing technologies are contributing to the market's expansion. However, the industry faces challenges such as stringent environmental regulations and fluctuating raw material prices, which could impact growth.

China is another significant market for two piece cans, with a market size of $4.5 billion and a CAGR of 6%. The country's rapid urbanization and increasing disposable income levels are driving demand for canned products, particularly in the beverage sector. The government's focus on promoting Sustainable Packaging solutions is also encouraging manufacturers to adopt eco-friendly practices, further boosting market growth. However, the market faces challenges such as intense competition and regulatory compliance, which could hinder growth.

Germany is a key market in Europe, with a market size of $3 billion and a CAGR of 4%. The country's strong emphasis on sustainability and recycling is driving demand for two piece cans, as they are highly recyclable and environmentally friendly. Additionally, the presence of leading market players and technological advancements in can manufacturing processes are contributing to the market's growth. However, the industry faces challenges such as high production costs and stringent environmental regulations, which could impact growth.

India is an emerging market for two piece cans, with a market size of $2.5 billion and a CAGR of 7%. The country's growing population and increasing urbanization are driving demand for canned beverages and foods, particularly among the younger demographic. The government's initiatives to promote sustainable packaging solutions are also encouraging manufacturers to adopt eco-friendly practices, further boosting market growth. However, the market faces challenges such as high competition and regulatory compliance, which could hinder growth.

Brazil is a significant market in Latin America, with a market size of $2 billion and a CAGR of 5%. The country's strong demand for canned beverages and foods, driven by consumer convenience and lifestyle changes, is a major growth driver. Additionally, the presence of key market players and advancements in can manufacturing technologies are contributing to the market's expansion. However, the industry faces challenges such as fluctuating raw material prices and regulatory compliance, which could impact growth.

Value Chain Profitability Analysis

The value chain of the Two Piece Can market involves several key stakeholders, each playing a crucial role in the production and distribution of cans. The primary stakeholders include raw material suppliers, can manufacturers, distributors, and end-users. Raw material suppliers provide the essential materials, such as aluminum and steel, which are critical for can production. These suppliers capture a significant portion of the value chain's profitability, as the cost of raw materials directly impacts the overall production costs.

Can manufacturers are responsible for transforming raw materials into finished products. They invest in advanced manufacturing technologies and processes to enhance production efficiency and reduce costs. The profitability of can manufacturers is influenced by factors such as production efficiency, technological advancements, and economies of scale. Distributors play a vital role in the value chain by ensuring the timely delivery of cans to end-users. They capture a smaller portion of the value chain's profitability, as their primary focus is on logistics and distribution.

End-users, including beverage and food companies, are the final stakeholders in the value chain. They utilize two piece cans for packaging their products, benefiting from the cans' durability, lightweight properties, and recyclability. The profitability of end-users is influenced by factors such as consumer demand, product pricing, and market competition. Overall, the value chain of the Two Piece Can market is characterized by a complex interplay of various stakeholders, each contributing to the market's overall profitability and growth.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The Two Piece Can market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences, technological advancements, and regulatory developments. During this period, the market experienced a steady growth rate, with a CAGR of 3.5%. The increasing demand for sustainable packaging solutions and the rising popularity of canned beverages and foods were key drivers of market growth. Additionally, advancements in can manufacturing technologies, such as digital printing and improved coating processes, enhanced production efficiency and reduced costs, further contributing to market expansion.

Looking ahead to the forecast period of 2025 to 2033, the Two Piece Can market is expected to experience accelerated growth, with a projected CAGR of 4.5%. The market's expansion will be driven by several factors, including the growing consumer preference for eco-friendly packaging solutions and the increasing demand for premium packaging in the beverage industry. Technological advancements in can manufacturing processes will continue to play a crucial role in enhancing production efficiency and reducing costs. Additionally, the market will benefit from the rising demand for canned products in emerging economies, where urbanization and changing lifestyles are driving consumption.

However, the market will also face challenges during the forecast period, such as fluctuating raw material prices and stringent environmental regulations. Companies that proactively adopt sustainable practices and invest in eco-friendly technologies will be better positioned to mitigate these risks and capitalize on growth opportunities. Overall, the Two Piece Can market is poised for significant growth in the coming years, driven by a combination of consumer demand, technological advancements, and regulatory developments.

Two Piece Can Market Segments Insights

Material Analysis

The material segment of the Two Piece Can market is primarily divided into aluminum and steel. Aluminum is the most widely used material due to its lightweight properties, corrosion resistance, and recyclability. The demand for aluminum cans is driven by the beverage industry's need for sustainable and eco-friendly packaging solutions. Aluminum cans are also favored for their ability to preserve the taste and quality of beverages, making them a preferred choice among manufacturers. The steel segment, although smaller, is gaining traction due to its strength and durability, making it suitable for packaging food products that require longer shelf life.

The competition within the material segment is intense, with manufacturers focusing on developing innovative solutions to enhance the performance and sustainability of their products. The increasing emphasis on reducing carbon emissions and promoting recycling is driving manufacturers to adopt eco-friendly practices and invest in research and development. As a result, companies that offer sustainable and high-performance materials are likely to gain a competitive edge in the market. The growing consumer preference for environmentally friendly packaging solutions is expected to drive the demand for aluminum and Steel Cans, contributing to the overall growth of the material segment.

Application Analysis

The application segment of the Two Piece Can market is categorized into beverages, food, personal care, pharmaceuticals, and others. The beverage segment holds the largest market share, driven by the increasing demand for canned beverages such as soft drinks, energy drinks, and alcoholic beverages. The convenience and portability offered by two piece cans make them a popular choice among consumers, particularly in urban areas. The food segment is also witnessing significant growth, with canned foods gaining popularity due to their extended shelf life and ease of storage.

The personal care and pharmaceutical segments are emerging as potential growth areas, driven by the increasing demand for convenient and hygienic packaging solutions. The use of two piece cans in these segments is gaining traction due to their ability to protect products from contamination and extend their shelf life. The competition within the application segment is intense, with manufacturers focusing on expanding their product offerings to cater to diverse consumer needs. The growing trend of premiumization in the beverage industry is also driving demand for high-quality, aesthetically pleasing packaging solutions, providing additional growth opportunities for the application segment.

Manufacturing Process Analysis

The manufacturing process segment of the Two Piece Can market is divided into drawn and ironed and drawn and redrawn processes. The drawn and ironed process is the most widely used method, known for its efficiency and ability to produce lightweight cans with thin walls. This process is favored by manufacturers due to its cost-effectiveness and ability to produce high-quality cans at a faster rate. The drawn and redrawn process, although less common, is gaining popularity due to its ability to produce cans with thicker walls, making them suitable for packaging products that require additional strength and durability.

The competition within the manufacturing process segment is driven by the need for efficiency and cost-effectiveness. Manufacturers are investing in advanced technologies and equipment to enhance their production capabilities and reduce costs. The increasing demand for sustainable and eco-friendly packaging solutions is also driving manufacturers to adopt innovative manufacturing processes that minimize waste and reduce environmental impact. As a result, companies that invest in advanced manufacturing technologies and processes are likely to gain a competitive edge in the market, contributing to the overall growth of the manufacturing process segment.

End-User Analysis

The end-user segment of the Two Piece Can market is categorized into the beverage industry, food industry, personal care industry, pharmaceutical industry, and others. The beverage industry holds the largest market share, driven by the increasing demand for canned beverages and the growing trend of premiumization. The food industry is also witnessing significant growth, with canned foods gaining popularity due to their convenience and extended shelf life. The personal care and pharmaceutical industries are emerging as potential growth areas, driven by the increasing demand for convenient and hygienic packaging solutions.

The competition within the end-user segment is intense, with manufacturers focusing on expanding their product offerings to cater to diverse consumer needs. The growing consumer preference for eco-friendly packaging solutions is driving demand for two piece cans, as they are highly recyclable and environmentally friendly. The increasing emphasis on sustainability and recycling is also encouraging manufacturers to adopt eco-friendly practices and invest in research and development. As a result, companies that offer sustainable and high-performance packaging solutions are likely to gain a competitive edge in the market, contributing to the overall growth of the end-user segment.

Two Piece Can Market Segments

The Two Piece Can market has been segmented on the basis of

Material

- Aluminum

- Steel

Application

- Beverages

- Food

- Personal Care

- Pharmaceuticals

- Others

Manufacturing Process

- Drawn and Ironed

- Drawn and Redrawn

End-User

- Beverage Industry

- Food Industry

- Personal Care Industry

- Pharmaceutical Industry

- Others

Primary Interview Insights

What are the key drivers of growth in the Two Piece Can market?

What challenges does the Two Piece Can market face?

How are companies addressing sustainability in the Two Piece Can market?

What opportunities exist for growth in the Two Piece Can market?

How is the demand for premium packaging impacting the Two Piece Can market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.