- Home

- Packaging Products

- Stretch Films Packs Market Size, Future Growth and Forecast 2033

Stretch Films Packs Market Size, Future Growth and Forecast 2033

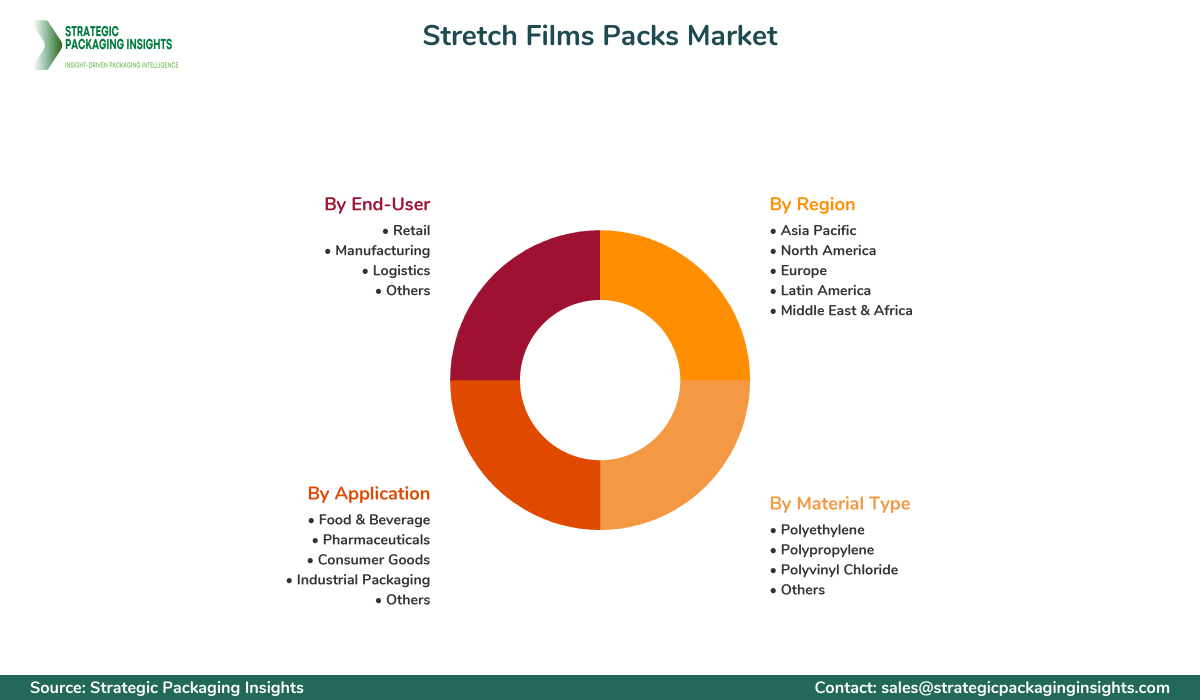

Stretch Films Packs Market Segments - by Material Type (Polyethylene, Polypropylene, Polyvinyl Chloride, Others), Application (Food & Beverage, Pharmaceuticals, Consumer Goods, Industrial Packaging, Others), End-User (Retail, Manufacturing, Logistics, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Stretch Films Packs Market Outlook

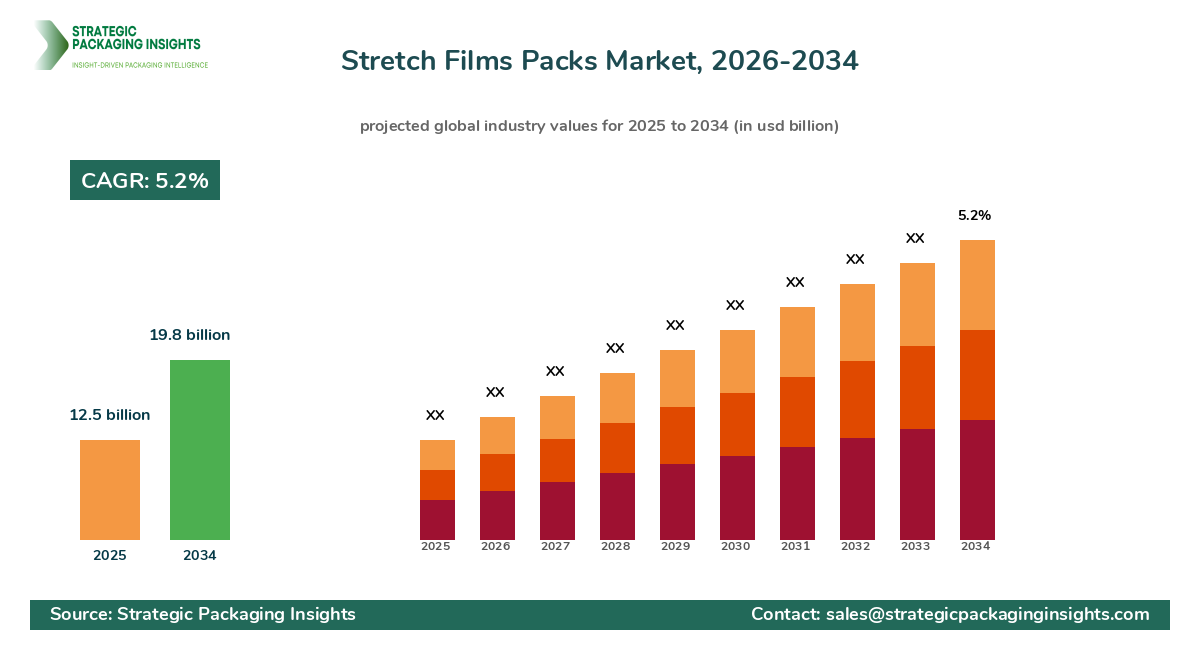

The Stretch Films Packs market was valued at $12.5 billion in 2024 and is projected to reach $19.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033. This market is driven by the increasing demand for efficient packaging solutions across various industries, including food and beverage, pharmaceuticals, and consumer goods. The versatility and cost-effectiveness of stretch films make them a preferred choice for packaging, ensuring product safety and reducing transportation costs. Additionally, the rise in e-commerce and logistics sectors has further fueled the demand for stretch films, as they provide excellent load stability and protection during transit.

However, the market faces challenges such as environmental concerns related to plastic waste and stringent regulations on plastic usage. These factors have prompted manufacturers to innovate and develop eco-friendly alternatives, such as biodegradable and recyclable stretch films. Despite these challenges, the market holds significant growth potential due to technological advancements and the increasing adoption of Sustainable Packaging solutions. The development of high-performance films with enhanced properties, such as puncture resistance and clarity, is expected to create new opportunities for market players.

Report Scope

| Attributes | Details |

| Report Title | Stretch Films Packs Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 146 |

| Material Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Application | Food & Beverage, Pharmaceuticals, Consumer Goods, Industrial Packaging, Others |

| End-User | Retail, Manufacturing, Logistics, Others |

| Region | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Stretch Films Packs market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable packaging solutions. As environmental concerns continue to rise, consumers and businesses are seeking eco-friendly alternatives to traditional plastic packaging. This shift in consumer preference has led to the development of biodegradable and recyclable stretch films, which are gaining traction in the market. Additionally, advancements in material science have enabled the production of high-performance films with enhanced properties, such as improved puncture resistance and clarity, further expanding their application across various industries.

Another significant opportunity lies in the growing e-commerce and logistics sectors, which have witnessed a surge in demand for efficient packaging solutions. Stretch films offer excellent load stability and protection during transit, making them an ideal choice for packaging goods in these sectors. The increasing adoption of automation in packaging processes is also expected to drive the demand for stretch films, as they are compatible with automated wrapping machines, enhancing operational efficiency and reducing labor costs.

Despite the promising opportunities, the Stretch Films Packs market faces certain threats that could hinder its growth. One of the primary challenges is the stringent regulations on plastic usage, which have been implemented by various governments to address environmental concerns. These regulations have prompted manufacturers to invest in research and development to create sustainable alternatives, which may increase production costs. Additionally, the fluctuating prices of raw materials, such as polyethylene and polypropylene, can impact the profitability of manufacturers, posing a threat to market growth.

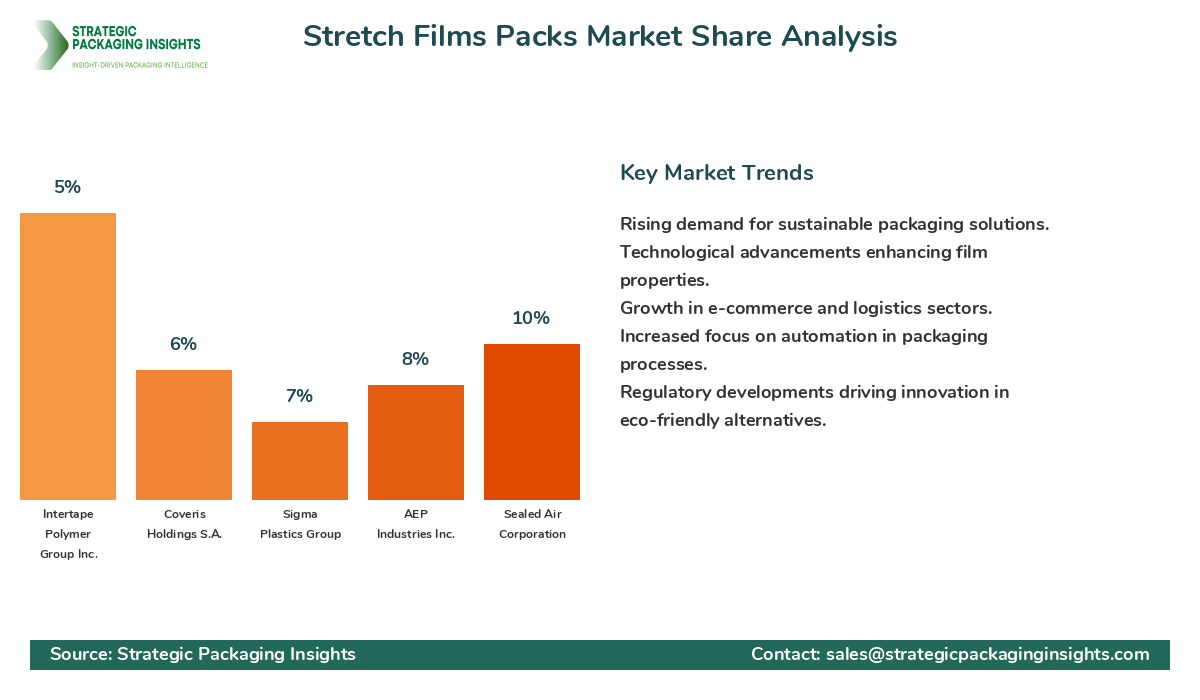

The Stretch Films Packs market is characterized by intense competition, with several key players vying for market share. The competitive landscape is dominated by a mix of global and regional players, each striving to enhance their product offerings and expand their market presence. Companies are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to strengthen their foothold in the market. Additionally, investments in research and development to innovate and develop sustainable packaging solutions are a common strategy among market players.

Some of the major companies operating in the Stretch Films Packs market include Berry Global Inc., Amcor plc, Sealed Air Corporation, AEP Industries Inc., and Sigma Plastics Group. These companies hold a significant share of the market, owing to their extensive product portfolios, strong distribution networks, and focus on sustainability. Berry Global Inc., for instance, is a leading player in the market, known for its innovative packaging solutions and commitment to sustainability. The company has been actively investing in the development of eco-friendly stretch films to cater to the growing demand for sustainable packaging.

Amcor plc is another prominent player in the market, offering a wide range of packaging solutions, including stretch films. The company has a strong global presence and is known for its focus on innovation and sustainability. Amcor has been investing in research and development to create high-performance films with enhanced properties, such as improved puncture resistance and clarity. Sealed Air Corporation, a key player in the market, is renowned for its protective packaging solutions and has been actively expanding its product portfolio to include sustainable stretch films.

AEP Industries Inc. and Sigma Plastics Group are also significant players in the Stretch Films Packs market, known for their extensive product offerings and focus on customer satisfaction. These companies have been investing in advanced manufacturing technologies to enhance their production capabilities and meet the growing demand for stretch films. Overall, the competitive landscape of the Stretch Films Packs market is dynamic, with companies continuously striving to innovate and expand their market presence.

Key Highlights Stretch Films Packs Market

- Increasing demand for sustainable packaging solutions is driving market growth.

- Technological advancements in material science are enhancing film properties.

- Growing e-commerce and logistics sectors are boosting demand for stretch films.

- Stringent regulations on plastic usage are prompting innovation in eco-friendly alternatives.

- Automation in packaging processes is increasing the adoption of stretch films.

- Fluctuating raw material prices pose a challenge to market profitability.

- Key players are focusing on mergers, acquisitions, and partnerships to strengthen market presence.

- Investments in research and development are driving innovation in sustainable packaging solutions.

- Regional players are expanding their product portfolios to cater to diverse customer needs.

- Market players are enhancing distribution networks to reach a wider customer base.

Top Countries Insights in Stretch Films Packs

The United States is a leading market for Stretch Films Packs, with a market size of $3.5 billion and a CAGR of 4%. The country's robust logistics and e-commerce sectors are key drivers of demand, as stretch films provide essential protection and stability during transportation. Additionally, the increasing focus on sustainability has led to the adoption of eco-friendly packaging solutions, further boosting market growth. However, regulatory challenges related to plastic usage remain a concern for manufacturers.

China is another significant market, with a market size of $2.8 billion and a CAGR of 6%. The country's booming manufacturing sector and rapid urbanization are driving demand for efficient packaging solutions. The government's initiatives to promote sustainable practices have also encouraged the adoption of biodegradable and recyclable stretch films. However, the market faces challenges such as fluctuating raw material prices and intense competition among local players.

Germany, with a market size of $1.5 billion and a CAGR of 3%, is a key player in the European Stretch Films Packs market. The country's strong industrial base and emphasis on sustainability are driving demand for high-performance packaging solutions. The presence of leading packaging companies and a well-established logistics sector further contribute to market growth. However, stringent regulations on plastic usage pose a challenge for manufacturers.

India, with a market size of $1.2 billion and a CAGR of 7%, is experiencing rapid growth in the Stretch Films Packs market. The country's expanding retail and e-commerce sectors are key drivers of demand, as stretch films offer cost-effective and efficient packaging solutions. The government's focus on promoting sustainable practices has also led to the adoption of eco-friendly packaging alternatives. However, the market faces challenges such as inadequate infrastructure and regulatory hurdles.

Brazil, with a market size of $0.9 billion and a CAGR of 5%, is a growing market for Stretch Films Packs in Latin America. The country's expanding industrial and logistics sectors are driving demand for efficient packaging solutions. The government's initiatives to promote sustainable practices have also encouraged the adoption of biodegradable and recyclable stretch films. However, economic instability and fluctuating raw material prices pose challenges for market growth.

Value Chain Profitability Analysis

The value chain of the Stretch Films Packs market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Each stage of the value chain contributes to the overall profitability of the market, with varying profit margins and revenue distribution. Raw material suppliers, such as producers of polyethylene and polypropylene, play a crucial role in the value chain, providing essential inputs for the production of stretch films. These suppliers typically operate with moderate profit margins, as they are subject to fluctuations in raw material prices and regulatory challenges.

Manufacturers of stretch films are key players in the value chain, responsible for converting raw materials into finished products. These companies invest in advanced manufacturing technologies and research and development to enhance their product offerings and meet the growing demand for sustainable packaging solutions. Manufacturers typically operate with higher profit margins, as they add significant value to the raw materials through processing and innovation.

Distributors and wholesalers play a critical role in the value chain, facilitating the distribution of stretch films to end-users across various industries. These stakeholders typically operate with moderate profit margins, as they are responsible for managing logistics and inventory. End-users, such as companies in the food and beverage, pharmaceuticals, and consumer goods sectors, are the final link in the value chain, utilizing stretch films for packaging and transportation purposes. The profitability of end-users varies depending on their industry and the efficiency of their packaging processes.

Overall, the value chain of the Stretch Films Packs market is characterized by a complex interplay of stakeholders, each contributing to the overall profitability of the market. The increasing focus on sustainability and technological advancements is reshaping the value chain, with digital transformation creating new revenue opportunities for market players. As the market continues to evolve, stakeholders are expected to adapt their strategies to capture a larger share of the overall market value.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The Stretch Films Packs market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences, technological advancements, and regulatory developments. During this period, the market experienced steady growth, with a CAGR of 4.5%, as demand for efficient and sustainable packaging solutions increased across various industries. The rise of e-commerce and logistics sectors further fueled market growth, as stretch films provided essential protection and stability during transportation.

Looking ahead to the forecast period of 2025 to 2033, the Stretch Films Packs market is expected to witness accelerated growth, with a projected CAGR of 5.2%. This growth will be driven by the increasing adoption of sustainable packaging solutions, as environmental concerns continue to rise. Technological advancements in material science are expected to enhance the properties of stretch films, expanding their application across various industries. Additionally, the growing focus on automation in packaging processes is expected to drive demand for stretch films, as they are compatible with automated wrapping machines.

During the forecast period, the market is expected to witness significant shifts in segment distribution, with the food and beverage and pharmaceuticals sectors emerging as key growth drivers. The increasing focus on sustainability and regulatory developments are expected to reshape the competitive landscape, with companies investing in research and development to create innovative and eco-friendly packaging solutions. Overall, the Stretch Films Packs market is poised for significant growth, with evolving market dynamics and strategic foresight shaping the future landscape.

Stretch Films Packs Market Segments Insights

Material Type Analysis

The Stretch Films Packs market is segmented by material type, with polyethylene, polypropylene, polyvinyl chloride, and others being the primary materials used in the production of stretch films. Polyethylene is the most widely used material, owing to its excellent stretchability, puncture resistance, and cost-effectiveness. The demand for polyethylene-based stretch films is driven by their versatility and ability to provide superior load stability and protection during transportation. However, environmental concerns related to plastic waste have prompted manufacturers to explore alternative materials, such as biodegradable and recyclable options.

Polypropylene is another popular material used in the production of stretch films, known for its high clarity and strength. The demand for polypropylene-based stretch films is driven by their application in industries such as food and beverage, where product visibility and protection are critical. Polyvinyl chloride (PVC) is also used in the production of stretch films, offering excellent clarity and flexibility. However, the use of PVC is declining due to environmental concerns and regulatory restrictions, prompting manufacturers to explore alternative materials.

Application Analysis

The Stretch Films Packs market is segmented by application, with food and beverage, pharmaceuticals, consumer goods, industrial packaging, and others being the primary end-use sectors. The food and beverage sector is a major driver of demand for stretch films, as they provide essential protection and stability during transportation. The increasing focus on food safety and hygiene has further boosted the demand for stretch films in this sector, as they offer excellent barrier properties and prevent contamination.

The pharmaceuticals sector is another key application area for stretch films, driven by the need for secure and efficient packaging solutions. Stretch films provide excellent protection for pharmaceutical products during transportation, ensuring product integrity and safety. The consumer goods sector is also a significant driver of demand for stretch films, as they offer cost-effective and efficient packaging solutions for a wide range of products. The industrial packaging sector is witnessing growing demand for stretch films, driven by the need for secure and stable packaging solutions for heavy and bulky goods.

End-User Analysis

The Stretch Films Packs market is segmented by end-user, with retail, manufacturing, logistics, and others being the primary sectors utilizing stretch films. The retail sector is a major driver of demand for stretch films, as they provide essential protection and stability for products during transportation and storage. The increasing focus on sustainability and efficient packaging solutions has further boosted the demand for stretch films in the retail sector.

The manufacturing sector is another key end-user of stretch films, driven by the need for secure and efficient packaging solutions for a wide range of products. The logistics sector is witnessing growing demand for stretch films, as they offer excellent load stability and protection during transportation. The increasing adoption of automation in packaging processes is also driving demand for stretch films, as they are compatible with automated wrapping machines, enhancing operational efficiency and reducing labor costs.

Regional Analysis

The Stretch Films Packs market is segmented by region, with Asia Pacific, North America, Europe, Latin America, and Middle East & Africa being the primary regions. Asia Pacific is the largest market for stretch films, driven by the booming manufacturing sector and rapid urbanization in countries such as China and India. The increasing focus on sustainability and government initiatives to promote eco-friendly packaging solutions are further boosting market growth in the region.

North America is another significant market for stretch films, driven by the robust logistics and e-commerce sectors in the United States. The increasing focus on sustainability and regulatory developments are reshaping the competitive landscape, with companies investing in research and development to create innovative and eco-friendly packaging solutions. Europe is witnessing steady growth in the stretch films market, driven by the strong industrial base and emphasis on sustainability in countries such as Germany and the United Kingdom.

Stretch Films Packs Market Segments

The Stretch Films Packs market has been segmented on the basis of

Material Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Application

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Industrial Packaging

- Others

End-User

- Retail

- Manufacturing

- Logistics

- Others

Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the Stretch Films Packs market?

What challenges does the Stretch Films Packs market face?

How are companies addressing environmental concerns in the Stretch Films Packs market?

What role does automation play in the Stretch Films Packs market?

Which regions are experiencing significant growth in the Stretch Films Packs market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.