- Home

- Packaging Products

- Security Tape Market Size, Future Growth and Forecast 2033

Security Tape Market Size, Future Growth and Forecast 2033

Security Tape Market Segments - by Material Type (Polypropylene, Polyvinyl Chloride, Others), Application (Carton Sealing, Strapping & Bundling, Others), End-User (Logistics, Retail, Manufacturing, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Security Tape Market Outlook

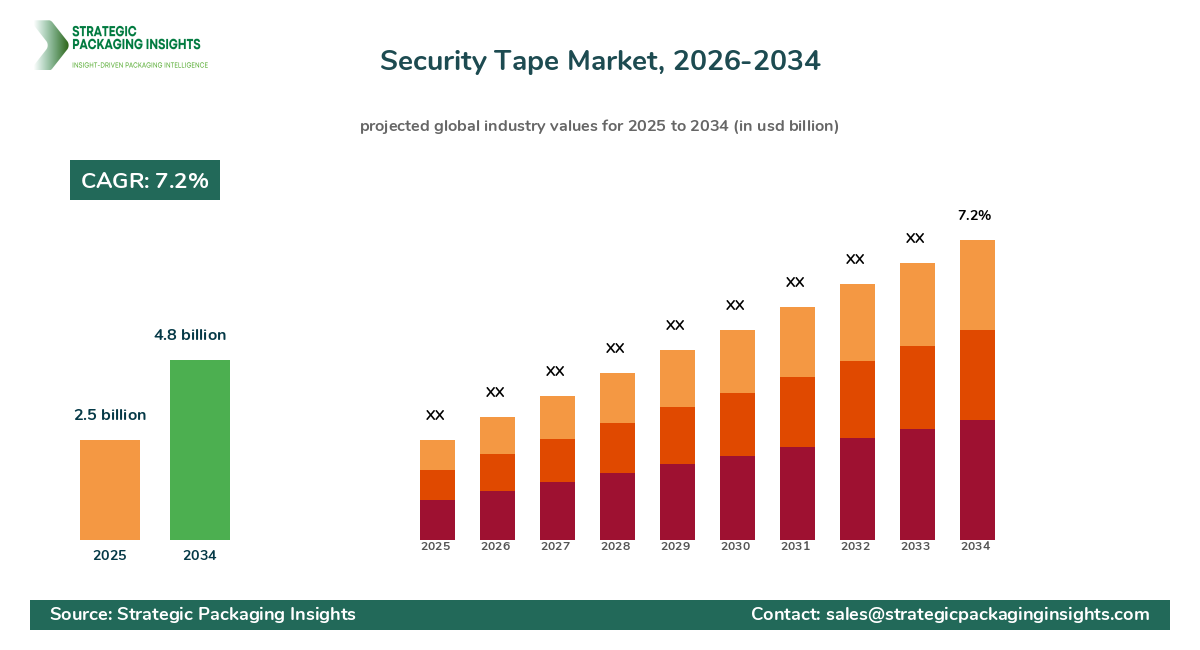

The security tape market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033. Security tapes are increasingly being used across various industries for tamper-evident packaging solutions. The demand is driven by the need for enhanced security in logistics and retail sectors, where the protection of goods during transit is paramount. The rise in e-commerce and global trade has further fueled the demand for security tapes, as businesses seek to ensure the integrity of their shipments. Additionally, advancements in material technology have led to the development of more durable and effective security tapes, which are gaining traction in the market.

Despite the promising growth prospects, the security tape market faces certain challenges. Regulatory constraints regarding the use of specific materials in packaging can limit market expansion. Moreover, the high cost of advanced security tapes compared to traditional packaging solutions can be a deterrent for small and medium enterprises. However, the increasing awareness about the importance of secure packaging and the potential for innovation in eco-friendly security tapes present significant growth opportunities. Companies are investing in research and development to create cost-effective and sustainable security tape solutions, which are expected to drive market growth in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Security Tape Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 237 |

| Material Type | Polypropylene, Polyvinyl Chloride, Others |

| Application | Carton Sealing, Strapping & Bundling, Others |

| End-User | Logistics, Retail, Manufacturing, Others |

| Customization Available | Yes* |

Opportunities & Threats

The security tape market is poised for significant opportunities, primarily driven by the burgeoning e-commerce industry. As online shopping continues to grow, the need for secure packaging solutions to prevent tampering and ensure product integrity during transit becomes increasingly critical. Security tapes offer a reliable solution for e-commerce businesses to safeguard their products, thereby enhancing customer trust and satisfaction. Additionally, the rise in global trade and logistics activities presents another opportunity for the security tape market. With goods being transported across borders, the demand for tamper-evident packaging solutions is on the rise, providing a lucrative market for security tape manufacturers.

Another opportunity lies in the development of eco-friendly security tapes. As environmental concerns gain prominence, there is a growing demand for Sustainable Packaging solutions. Security tape manufacturers can capitalize on this trend by developing biodegradable and recyclable tapes that meet the needs of environmentally conscious consumers. This not only helps in reducing the carbon footprint but also aligns with the sustainability goals of many organizations, thereby expanding the market reach of security tapes.

However, the market also faces certain threats that could hinder its growth. One of the primary challenges is the high cost associated with advanced security tapes. While these tapes offer superior protection, their higher price point can be a barrier for small and medium-sized enterprises. Additionally, stringent regulations regarding the use of certain materials in packaging can pose a challenge for manufacturers. Compliance with these regulations can increase production costs and limit the use of certain materials, thereby affecting the overall market growth.

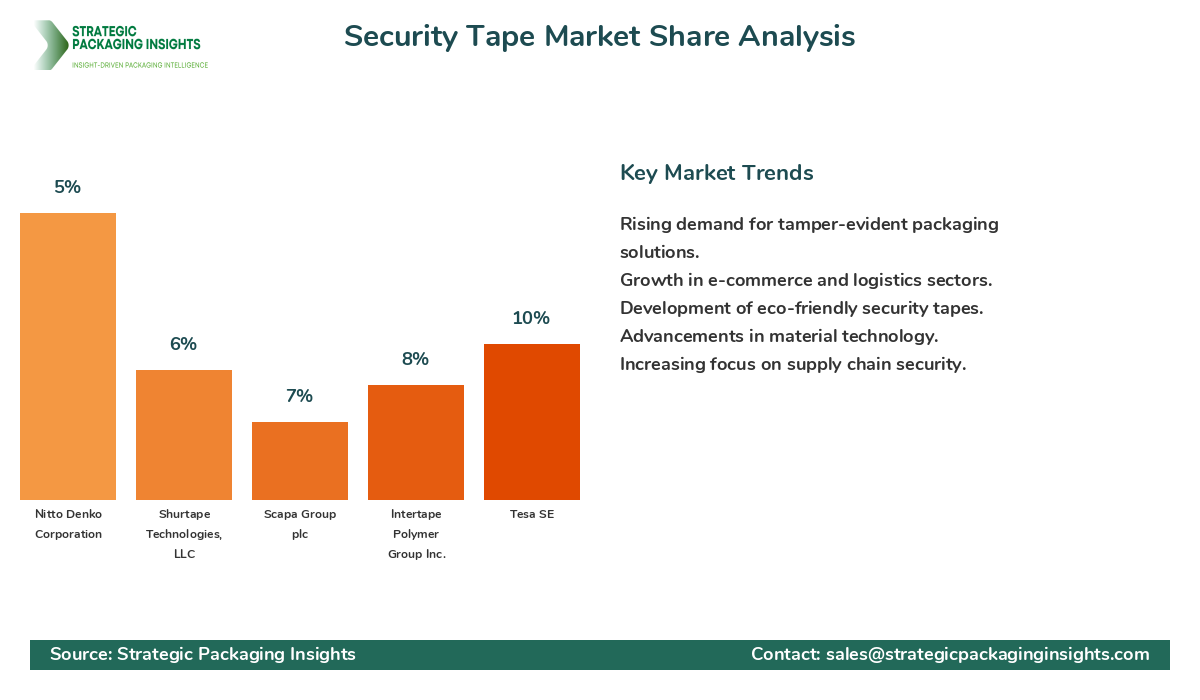

The security tape market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few large companies, but there is also a significant presence of small and medium-sized enterprises that contribute to the market dynamics. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are focusing on expanding their product portfolios and enhancing their distribution channels to gain a competitive edge in the market.

3M Company holds a significant share in the security tape market, known for its innovative product offerings and strong distribution network. The company has a diverse product portfolio that caters to various industries, including logistics, retail, and manufacturing. Avery Dennison Corporation is another major player, recognized for its advanced adhesive technologies and commitment to sustainability. The company's focus on developing eco-friendly security tapes has helped it gain a competitive advantage in the market.

Tesa SE, a leading manufacturer of adhesive tapes, has a strong presence in the security tape market. The company's emphasis on research and development has resulted in the introduction of high-performance security tapes that cater to the evolving needs of customers. Intertape Polymer Group Inc. is also a key player, known for its extensive range of packaging solutions, including security tapes. The company's strategic acquisitions and partnerships have strengthened its market position.

Other notable companies in the security tape market include Scapa Group plc, Shurtape Technologies, LLC, and Nitto Denko Corporation. These companies are focusing on expanding their product offerings and enhancing their geographic reach to capture a larger share of the market. The competitive landscape is further intensified by the presence of regional players who offer customized solutions to meet the specific needs of local markets.

Key Highlights Security Tape Market

- The security tape market is projected to grow at a CAGR of 7.2% from 2025 to 2033.

- Increasing demand from the e-commerce and logistics sectors is driving market growth.

- Development of eco-friendly security tapes presents significant growth opportunities.

- Regulatory constraints and high costs are key challenges for market players.

- 3M Company and Avery Dennison Corporation are leading players in the market.

- Product innovation and distribution network expansion are key strategies for market players.

- Regional players offer customized solutions to meet local market needs.

- Advancements in material technology are enhancing the effectiveness of security tapes.

- Growing awareness about secure packaging is boosting market demand.

Competitive Intelligence

The security tape market is highly competitive, with several key players striving to maintain their market positions. 3M Company is a dominant player, leveraging its strong brand reputation and extensive distribution network to capture a significant share of the market. The company's focus on innovation and product development has enabled it to introduce advanced security tapes that cater to the diverse needs of its customers. Avery Dennison Corporation is another major player, known for its cutting-edge adhesive technologies and commitment to sustainability. The company's emphasis on developing eco-friendly security tapes has helped it gain a competitive edge in the market.

Tesa SE is a leading manufacturer of adhesive tapes, with a strong presence in the security tape market. The company's focus on research and development has resulted in the introduction of high-performance security tapes that cater to the evolving needs of customers. Intertape Polymer Group Inc. is also a key player, known for its extensive range of packaging solutions, including security tapes. The company's strategic acquisitions and partnerships have strengthened its market position.

Other notable companies in the security tape market include Scapa Group plc, Shurtape Technologies, LLC, and Nitto Denko Corporation. These companies are focusing on expanding their product offerings and enhancing their geographic reach to capture a larger share of the market. The competitive landscape is further intensified by the presence of regional players who offer customized solutions to meet the specific needs of local markets.

In terms of market share, 3M Company and Avery Dennison Corporation are leading the market, followed by Tesa SE and Intertape Polymer Group Inc. The competitive landscape is characterized by a mix of large multinational corporations and regional players, each vying for a share of the growing security tape market. Companies are focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market positions and gain a competitive advantage.

Regional Market Intelligence of Security Tape

The global security tape market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region presents unique growth opportunities and challenges for market players. In North America, the security tape market is driven by the strong presence of e-commerce and logistics industries. The region's focus on secure packaging solutions to prevent tampering and ensure product integrity is fueling market growth. Additionally, the presence of major market players and technological advancements in material science are contributing to the market's expansion.

In Europe, the security tape market is characterized by a growing demand for eco-friendly packaging solutions. The region's stringent regulations regarding packaging materials are driving the development of sustainable security tapes. The increasing awareness about the importance of secure packaging in the logistics and retail sectors is also boosting market demand. In Asia-Pacific, the security tape market is experiencing rapid growth, driven by the expanding e-commerce industry and the rise in global trade activities. The region's focus on enhancing supply chain security and the increasing adoption of Advanced Packaging solutions are contributing to market growth.

In Latin America, the security tape market is driven by the growing demand for secure packaging solutions in the logistics and retail sectors. The region's focus on improving supply chain security and the increasing adoption of advanced packaging technologies are contributing to market growth. In Middle East & Africa, the security tape market is characterized by a growing demand for tamper-evident packaging solutions. The region's focus on enhancing supply chain security and the increasing adoption of advanced packaging solutions are contributing to market growth.

Top Countries Insights in Security Tape

In the United States, the security tape market is valued at approximately $800 million, with a CAGR of 6%. The country's strong e-commerce and logistics sectors are driving the demand for secure packaging solutions. The focus on preventing tampering and ensuring product integrity during transit is a key growth driver. In Germany, the security tape market is valued at around $500 million, with a CAGR of 5%. The country's stringent regulations regarding packaging materials and the growing demand for eco-friendly solutions are driving market growth.

In China, the security tape market is valued at approximately $700 million, with a CAGR of 8%. The country's expanding e-commerce industry and the rise in global trade activities are fueling market growth. The focus on enhancing supply chain security and the increasing adoption of advanced packaging solutions are key growth drivers. In India, the security tape market is valued at around $400 million, with a CAGR of 9%. The country's growing logistics and retail sectors are driving the demand for secure packaging solutions.

In Brazil, the security tape market is valued at approximately $300 million, with a CAGR of 7%. The country's focus on improving supply chain security and the increasing adoption of advanced packaging technologies are contributing to market growth. The demand for tamper-evident packaging solutions in the logistics and retail sectors is a key growth driver.

Security Tape Market Segments Insights

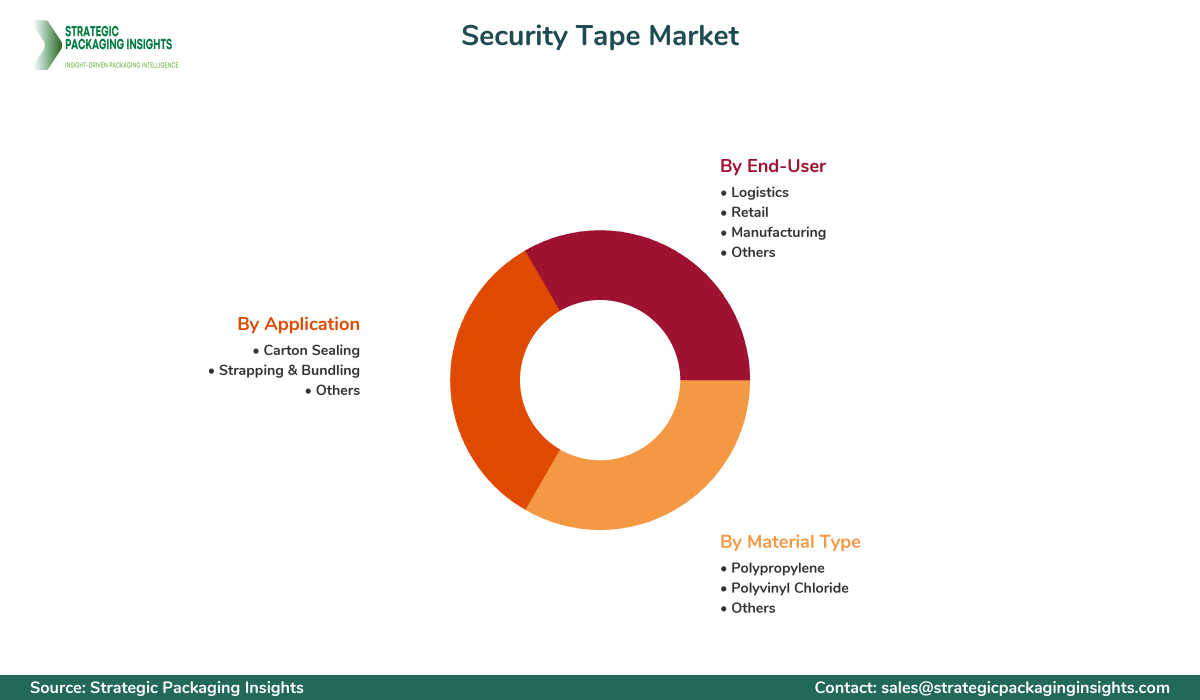

Material Type Analysis

The security tape market is segmented by material type into polypropylene, polyvinyl chloride, and others. Polypropylene is the most widely used material due to its excellent adhesive properties and cost-effectiveness. It is favored in various applications, including carton sealing and bundling, due to its durability and resistance to environmental factors. The demand for polypropylene security tapes is driven by their versatility and ability to provide secure packaging solutions across different industries. Polyvinyl chloride (PVC) security tapes are also popular, particularly in applications requiring high strength and resistance to tampering. The demand for PVC tapes is driven by their superior performance in harsh environments and their ability to provide a strong barrier against unauthorized access.

Other materials used in security tapes include paper and fabric, which are gaining popularity due to their eco-friendly properties. The demand for these materials is driven by the growing awareness about sustainable packaging solutions and the increasing focus on reducing the environmental impact of packaging materials. Companies are investing in research and development to create innovative security tapes using these materials, which are expected to gain traction in the market.

Application Analysis

The security tape market is segmented by application into carton sealing, strapping & bundling, and others. Carton sealing is the largest application segment, driven by the increasing demand for secure packaging solutions in the logistics and retail sectors. Security tapes are widely used in carton sealing to prevent tampering and ensure the integrity of products during transit. The demand for Carton Sealing Tapes is driven by the rise in e-commerce and global trade activities, which require secure packaging solutions to protect goods during transportation.

Strapping and bundling is another significant application segment, where security tapes are used to secure and bundle products for transportation and storage. The demand for strapping and bundling tapes is driven by the need for secure packaging solutions in industries such as manufacturing and logistics. Other applications of security tapes include labeling and identification, where they are used to provide tamper-evident solutions for products and packages.

End-User Analysis

The security tape market is segmented by end-user into logistics, retail, manufacturing, and others. The logistics sector is the largest end-user segment, driven by the increasing demand for secure packaging solutions to prevent tampering and ensure product integrity during transit. The rise in e-commerce and global trade activities is fueling the demand for security tapes in the logistics sector. The retail sector is another significant end-user segment, where security tapes are used to provide tamper-evident solutions for products and packages.

The manufacturing sector is also a key end-user of security tapes, where they are used to secure and bundle products for transportation and storage. The demand for security tapes in the manufacturing sector is driven by the need for secure packaging solutions to protect goods during transportation and storage. Other end-users of security tapes include the healthcare and food industries, where they are used to provide tamper-evident solutions for products and packages.

Market Share Analysis

The security tape market is characterized by a competitive landscape with several key players vying for market share. 3M Company and Avery Dennison Corporation are leading the market, followed by Tesa SE and Intertape Polymer Group Inc. The competitive landscape is characterized by a mix of large multinational corporations and regional players, each vying for a share of the growing security tape market. Companies are focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market positions and gain a competitive advantage. The market share distribution affects pricing, innovation, and partnerships, with leading companies setting the pace for market trends and developments.

Security Tape Market Segments

The Security Tape market has been segmented on the basis of

Material Type

- Polypropylene

- Polyvinyl Chloride

- Others

Application

- Carton Sealing

- Strapping & Bundling

- Others

End-User

- Logistics

- Retail

- Manufacturing

- Others

Primary Interview Insights

What are the key drivers for the security tape market?

What challenges does the security tape market face?

How is the market responding to environmental concerns?

Which regions are experiencing the fastest growth?

What strategies are companies using to gain a competitive edge?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.