- Home

- Packaging Products

- Rigid Packaging Container Market Size, Future Growth and Forecast 2033

Rigid Packaging Container Market Size, Future Growth and Forecast 2033

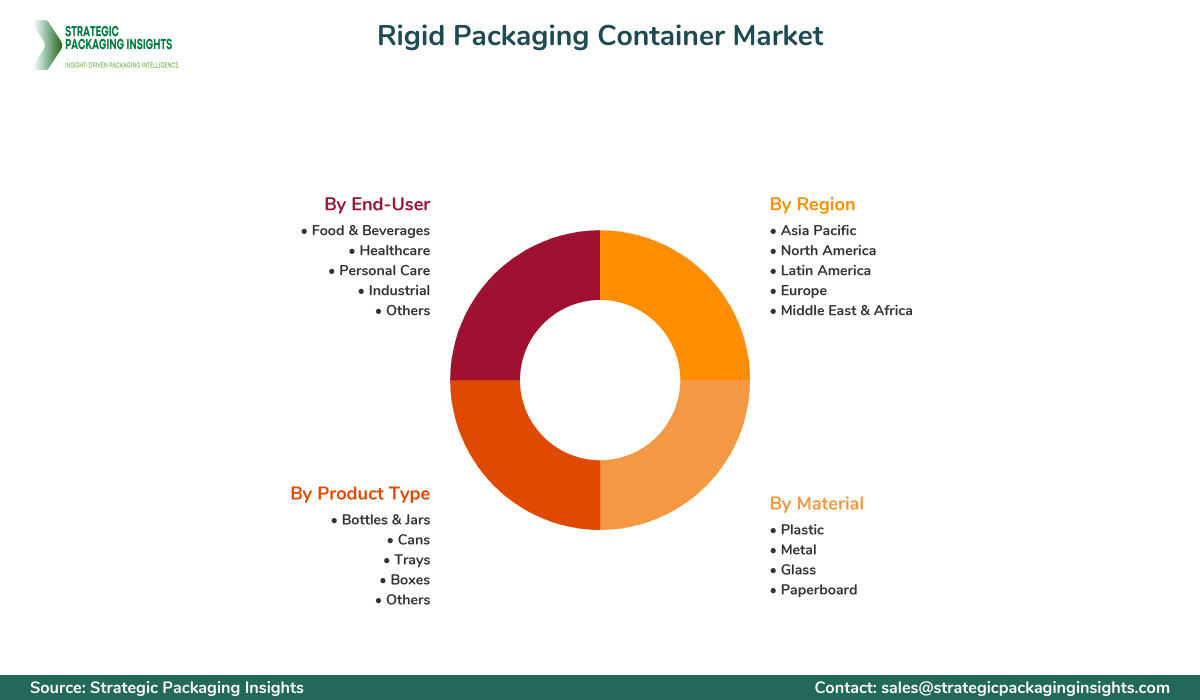

Rigid Packaging Container Market Segments - by Material (Plastic, Metal, Glass, Paperboard), Product Type (Bottles & Jars, Cans, Trays, Boxes, Others), End-User (Food & Beverages, Healthcare, Personal Care, Industrial, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Rigid Packaging Container Market Outlook

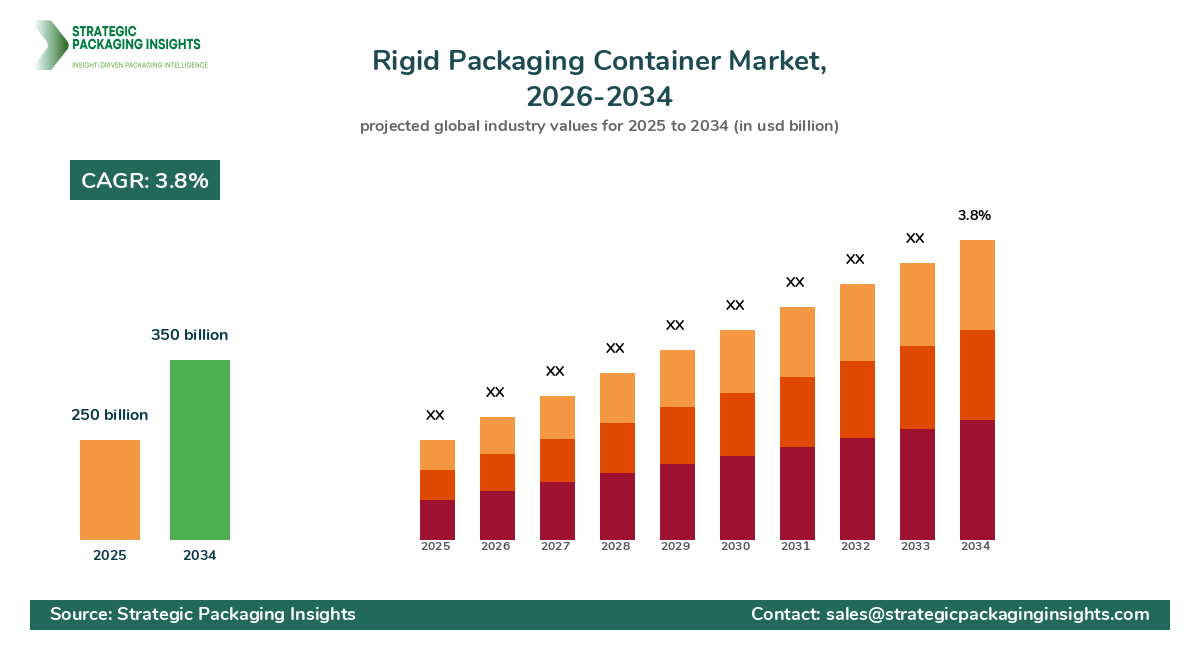

The rigid packaging container market was valued at $250 billion in 2024 and is projected to reach $350 billion by 2033, growing at a CAGR of 3.8% during the forecast period 2025-2033. This market is driven by the increasing demand for durable and Protective Packaging solutions across various industries such as food and beverages, healthcare, and personal care. The rise in e-commerce and the need for efficient logistics have further propelled the demand for rigid packaging containers, which offer superior protection and stackability. Additionally, the growing consumer preference for sustainable and recyclable packaging materials is encouraging manufacturers to innovate and develop eco-friendly rigid packaging solutions.

However, the market faces challenges such as the high cost of raw materials and stringent environmental regulations regarding plastic usage. Despite these restraints, the market holds significant growth potential due to the increasing adoption of advanced manufacturing technologies and the expansion of the retail sector in emerging economies. The shift towards lightweight and cost-effective packaging solutions is also expected to create lucrative opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Rigid Packaging Container Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 103 |

| Material | Plastic, Metal, Glass, Paperboard |

| Product Type | Bottles & Jars, Cans, Trays, Boxes, Others |

| End-User | Food & Beverages, Healthcare, Personal Care, Industrial, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Rigid Packaging container market presents numerous opportunities, particularly in the realm of sustainable packaging solutions. With growing environmental concerns and regulatory pressures, there is a significant push towards the development of eco-friendly packaging materials. Companies are investing in research and development to create biodegradable and Recyclable Rigid packaging options, which not only meet regulatory standards but also cater to the increasing consumer demand for sustainable products. This trend is expected to drive innovation and open new avenues for growth in the market.

Another opportunity lies in the expansion of the e-commerce sector, which has seen exponential growth in recent years. The need for secure and durable packaging solutions to protect products during transit has led to an increased demand for rigid packaging containers. As online shopping continues to rise, especially in developing regions, the market for rigid packaging containers is poised for substantial growth. Companies that can offer innovative, cost-effective, and customizable packaging solutions are likely to gain a competitive edge in this evolving landscape.

Despite these opportunities, the market faces certain threats, primarily from the fluctuating prices of raw materials such as plastic and metal. These price variations can significantly impact the production costs and profit margins of manufacturers. Additionally, the increasing regulatory scrutiny on plastic usage and waste management poses a challenge for companies relying heavily on plastic-based rigid packaging solutions. To mitigate these threats, companies are exploring alternative materials and investing in recycling technologies to ensure compliance and sustainability.

The rigid packaging container market is characterized by intense competition, with several key players vying for market share. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to cater to the diverse needs of end-users. Strategic partnerships and mergers and acquisitions are also common strategies employed by market players to strengthen their market position and expand their geographical reach.

Major companies in the rigid packaging container market include Amcor plc, Ball Corporation, Crown Holdings, Inc., Berry Global, Inc., and Silgan Holdings Inc. Amcor plc is a leading player known for its innovative packaging solutions and strong focus on sustainability. The company has a significant presence in the global market, with a diverse product portfolio catering to various industries. Ball Corporation is another prominent player, renowned for its metal packaging solutions and extensive global operations.

Crown Holdings, Inc. is a key player in the metal packaging segment, offering a wide range of products for the food and beverage industry. The company is known for its advanced manufacturing technologies and commitment to sustainability. Berry Global, Inc. is a major player in the Plastic Packaging segment, with a strong emphasis on product innovation and customer-centric solutions. Silgan Holdings Inc. is recognized for its comprehensive range of rigid packaging solutions, including metal and plastic containers, catering to diverse end-user industries.

Key Highlights Rigid Packaging Container Market

- Increasing demand for sustainable and recyclable packaging solutions.

- Expansion of the e-commerce sector driving demand for durable packaging.

- Technological advancements in manufacturing processes.

- Growing consumer preference for lightweight and cost-effective packaging.

- Rising regulatory pressures on plastic usage and waste management.

- Strategic partnerships and mergers and acquisitions among key players.

- Emergence of biodegradable and eco-friendly packaging materials.

- Expansion of retail and consumer goods sectors in emerging economies.

- Focus on product innovation and customization to meet diverse consumer needs.

- Increasing investment in research and development for sustainable packaging solutions.

Premium Insights - Key Investment Analysis

The rigid packaging container market has witnessed significant investment activity, driven by the growing demand for sustainable and innovative packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and technologically Advanced Packaging options. The market has seen a surge in mergers and acquisitions, with major players acquiring smaller companies to enhance their product offerings and expand their market presence.

Investment valuations in the rigid packaging container market are influenced by factors such as the company's market share, product portfolio, and technological capabilities. Investors are particularly interested in companies that demonstrate strong growth potential and have a robust pipeline of innovative products. The return on investment (ROI) expectations in this market are high, given the increasing demand for Sustainable Packaging solutions and the expansion of the e-commerce sector.

Emerging investment themes in the market include the development of biodegradable and recyclable packaging materials, the adoption of advanced manufacturing technologies, and the expansion of production capacities in emerging markets. Risk factors for investors include fluctuating raw material prices, regulatory challenges, and intense competition. However, the strategic rationale behind major deals is often driven by the need to enhance product offerings, expand geographical reach, and strengthen market position.

Rigid Packaging Container Market Segments Insights

Material Analysis

The material segment of the rigid packaging container market is dominated by plastic, metal, glass, and paperboard. Plastic remains the most widely used material due to its versatility, durability, and cost-effectiveness. However, the increasing environmental concerns and regulatory pressures are driving the demand for alternative materials such as biodegradable plastics and recycled paperboard. Metal packaging, particularly aluminum, is gaining traction due to its recyclability and superior barrier properties. Glass packaging is preferred for premium products, offering excellent protection and aesthetic appeal.

The demand for paperboard packaging is rising, driven by the growing consumer preference for sustainable and eco-friendly packaging solutions. Companies are investing in research and development to enhance the strength and durability of paperboard containers, making them suitable for a wider range of applications. The competition in the material segment is intense, with companies focusing on product innovation and sustainability to gain a competitive edge.

Product Type Analysis

The product type segment includes bottles and jars, cans, trays, boxes, and others. Bottles and jars are the most commonly used rigid packaging containers, particularly in the food and beverage and personal care industries. The demand for cans is driven by the beverage industry, where they are preferred for their convenience and recyclability. Trays and boxes are widely used in the food industry for packaging ready-to-eat meals and fresh produce.

The demand for innovative and customizable packaging solutions is driving the growth of the product type segment. Companies are focusing on developing lightweight and cost-effective packaging options that offer superior protection and convenience. The competition in this segment is fierce, with companies investing in advanced manufacturing technologies and product innovation to meet the evolving consumer demands.

End-User Analysis

The end-user segment of the rigid packaging container market includes food and beverages, healthcare, personal care, industrial, and others. The food and beverage industry is the largest end-user, driven by the increasing demand for packaged and processed foods. The healthcare industry is also a significant contributor, with the need for secure and tamper-proof packaging solutions for pharmaceuticals and medical devices.

The personal care industry is witnessing a growing demand for premium and aesthetically appealing packaging solutions. The industrial sector requires durable and protective packaging for the transportation and storage of goods. The competition in the end-user segment is intense, with companies focusing on product innovation and customization to cater to the diverse needs of consumers.

Regional Analysis

The rigid packaging container market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is the largest market, driven by the rapid industrialization and urbanization in countries such as China and India. The increasing disposable income and changing consumer preferences are also contributing to the growth of the market in this region.

North America and Europe are mature markets, with a strong focus on sustainability and innovation. The demand for eco-friendly and recyclable packaging solutions is driving the growth of the market in these regions. Latin America and the Middle East & Africa are emerging markets, with significant growth potential due to the expanding retail and consumer goods sectors.

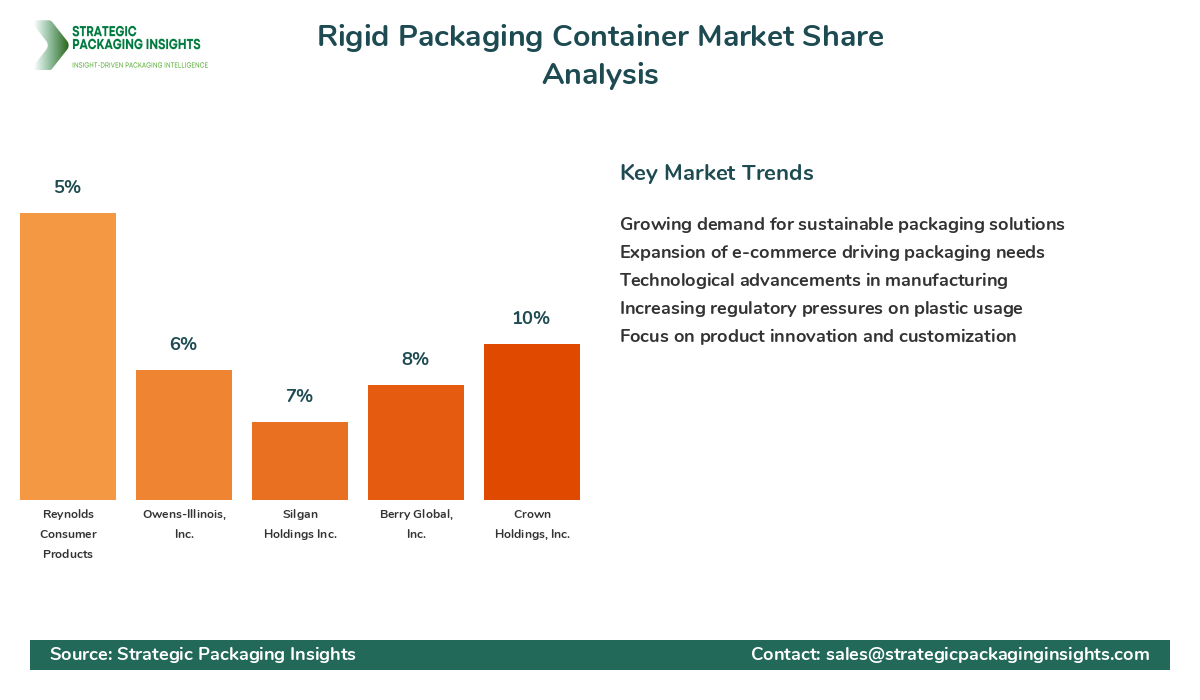

Market Share Analysis

The market share distribution of key players in the rigid packaging container market is influenced by factors such as product innovation, pricing strategies, and distribution networks. Companies like Amcor plc, Ball Corporation, and Crown Holdings, Inc. are leading the market, leveraging their extensive product portfolios and strong global presence. These companies are gaining market share through strategic partnerships, mergers and acquisitions, and investments in research and development.

However, the market is highly competitive, with several regional and local players vying for market share. The competition is driving companies to focus on product differentiation and innovation to maintain their competitive edge. The market share distribution affects pricing strategies, with companies offering competitive pricing to attract and retain customers. Innovation is a key factor in gaining market share, with companies investing in advanced manufacturing technologies and sustainable packaging solutions.

Top Countries Insights in Rigid Packaging Container

The United States is a leading market for rigid packaging containers, with a market size of $50 billion and a CAGR of 4%. The demand is driven by the expanding e-commerce sector and the increasing consumer preference for sustainable packaging solutions. The regulatory environment in the U.S. is also favorable, with a strong focus on sustainability and waste management.

China is another major market, with a market size of $40 billion and a CAGR of 6%. The rapid industrialization and urbanization in China are driving the demand for rigid packaging containers. The government initiatives to promote sustainable packaging solutions are also contributing to the growth of the market in this region.

Germany is a key market in Europe, with a market size of $30 billion and a CAGR of 3%. The demand is driven by the strong focus on sustainability and innovation in the packaging industry. The regulatory environment in Germany is also favorable, with stringent regulations on plastic usage and waste management.

India is an emerging market, with a market size of $20 billion and a CAGR of 8%. The increasing disposable income and changing consumer preferences are driving the demand for rigid packaging containers. The government initiatives to promote sustainable packaging solutions are also contributing to the growth of the market in this region.

Brazil is a significant market in Latin America, with a market size of $15 billion and a CAGR of 5%. The expanding retail and consumer goods sectors are driving the demand for rigid packaging containers. The regulatory environment in Brazil is also favorable, with a strong focus on sustainability and waste management.

Rigid Packaging Container Market Segments

The Rigid Packaging Container market has been segmented on the basis of

Material

- Plastic

- Metal

- Glass

- Paperboard

Product Type

- Bottles & Jars

- Cans

- Trays

- Boxes

- Others

End-User

- Food & Beverages

- Healthcare

- Personal Care

- Industrial

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the rigid packaging container market?

What challenges does the rigid packaging container market face?

How is the market responding to environmental concerns?

What opportunities exist in the rigid packaging container market?

Which regions are expected to see the most growth in the rigid packaging container market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.