- Home

- Packaging Products

- Release Liner Paper Market Size, Future Growth and Forecast 2033

Release Liner Paper Market Size, Future Growth and Forecast 2033

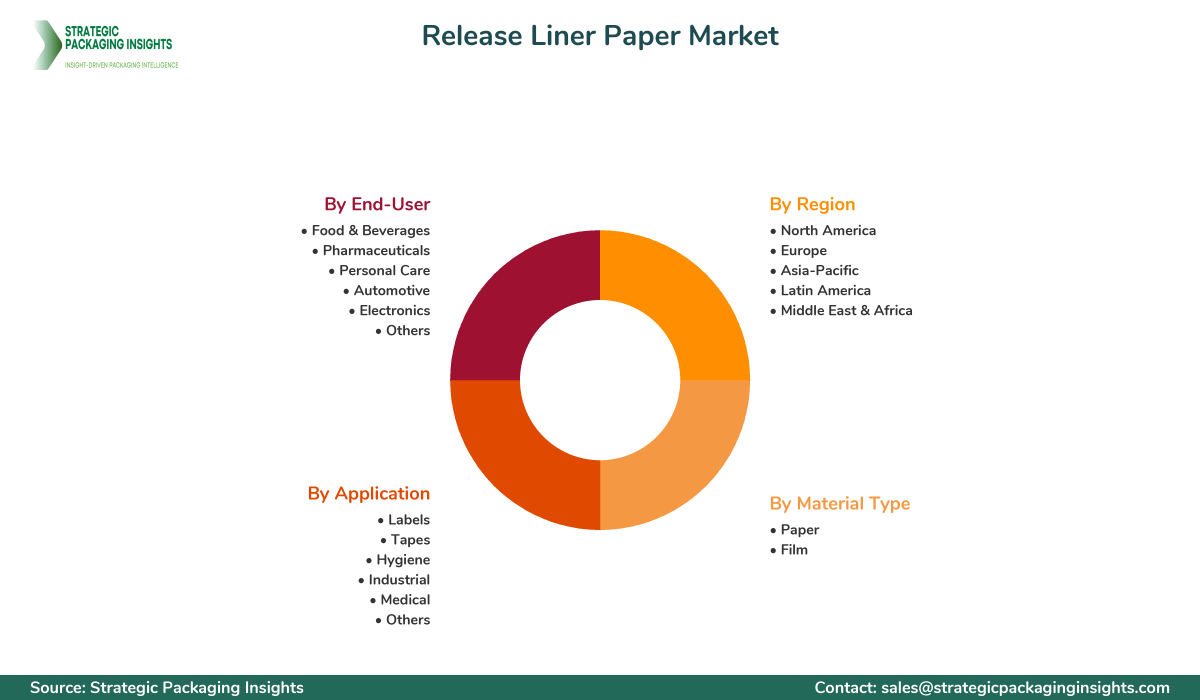

Release Liner Paper Market Segments - by Material Type (Paper, Film), Application (Labels, Tapes, Hygiene, Industrial, Medical, Others), End-User (Food & Beverages, Pharmaceuticals, Personal Care, Automotive, Electronics, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Release Liner Paper Market Outlook

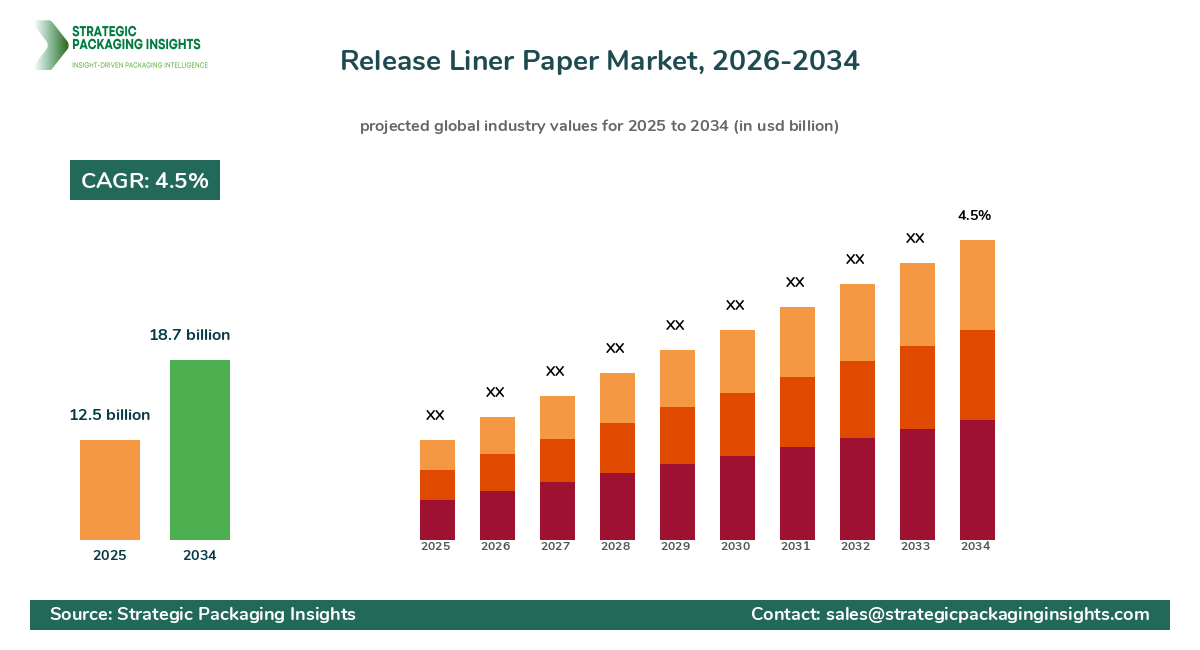

The release liner paper market was valued at $12.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. This market is driven by the increasing demand for pressure-sensitive Labels across various industries such as food and beverages, pharmaceuticals, and personal care. The rise in e-commerce and logistics activities has further fueled the need for efficient labeling solutions, thereby boosting the demand for release liner paper. Additionally, advancements in liner technology, such as the development of recyclable and biodegradable liners, are expected to create new growth opportunities in the market.

However, the market faces challenges such as the high cost of raw materials and stringent environmental regulations regarding waste management. The production of release liner paper involves significant energy consumption and generates waste, which has led to increased scrutiny from environmental agencies. Despite these challenges, the market holds significant growth potential due to the rising trend of Sustainable Packaging solutions and the increasing adoption of digital printing technologies. These factors are expected to drive innovation and investment in the release liner paper market over the coming years.

Report Scope

| Attributes | Details |

| Report Title | Release Liner Paper Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 183 |

| Material Type | Paper, Film |

| Application | Labels, Tapes, Hygiene, Industrial, Medical, Others |

| End-User | Food & Beverages, Pharmaceuticals, Personal Care, Automotive, Electronics, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Key Highlights Release Liner Paper Market

- Growing demand for pressure-sensitive labels in the food and beverage industry.

- Increased adoption of digital printing technologies in label production.

- Development of recyclable and biodegradable release liners.

- Expansion of e-commerce and logistics sectors driving labeling needs.

- Rising environmental concerns leading to regulatory pressures.

- Technological advancements in liner production processes.

- Emergence of new applications in the medical and hygiene sectors.

- Strategic partnerships and collaborations among key players.

- Focus on reducing carbon footprint and enhancing sustainability.

- Increasing investments in research and development for innovative solutions.

Competitive Intelligence

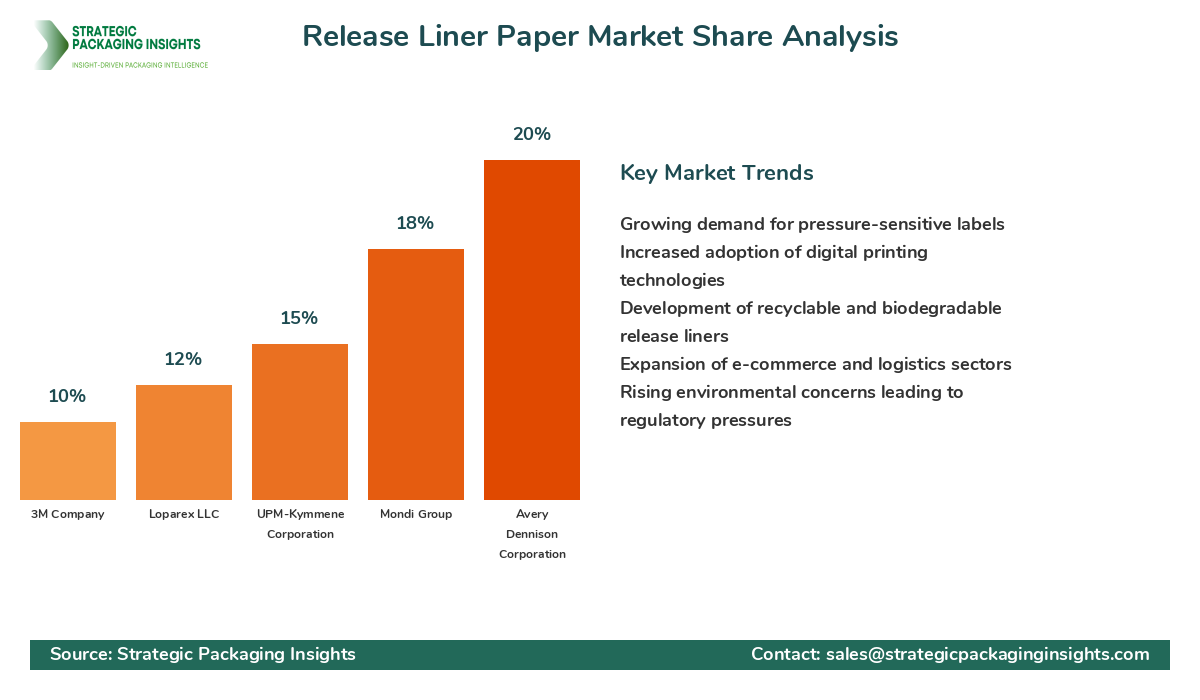

The release liner paper market is highly competitive, with key players such as Avery Dennison Corporation, Mondi Group, UPM-Kymmene Corporation, Loparex LLC, and 3M Company leading the charge. Avery Dennison Corporation holds a significant market share due to its extensive product portfolio and strong global presence. The company focuses on innovation and sustainability, offering a range of eco-friendly liner solutions. Mondi Group is known for its integrated production capabilities and emphasis on sustainable practices, which have helped it maintain a competitive edge.

UPM-Kymmene Corporation has a robust geographic reach and is recognized for its high-quality liner products. The company invests heavily in research and development to enhance its product offerings. Loparex LLC is a key player with a strong focus on customer-centric solutions and technological advancements. 3M Company leverages its expertise in adhesive technologies to offer innovative liner solutions. These companies are engaged in strategic partnerships and acquisitions to expand their market presence and enhance their product portfolios. The competitive landscape is characterized by continuous innovation, with companies striving to differentiate themselves through unique product offerings and sustainable practices.

Regional Market Intelligence of Release Liner Paper

In North America, the release liner paper market is valued at approximately $3.5 billion and is expected to grow steadily due to the strong presence of key players and the high demand for pressure-sensitive labels in the food and beverage industry. The region's focus on sustainability and eco-friendly packaging solutions is also driving market growth. In Europe, the market is valued at $3.0 billion, with a significant CAGR of 9% driven by stringent environmental regulations and the increasing adoption of digital printing technologies.

The Asia-Pacific region is the fastest-growing market, valued at $4.5 billion, with a CAGR of 15%. This growth is attributed to the rapid industrialization, expanding e-commerce sector, and increasing demand for consumer goods. In Latin America, the market is valued at $1.2 billion, with a CAGR of 7%, driven by the growing food and beverage industry and rising disposable incomes. The Middle East & Africa region, valued at $0.8 billion, is experiencing a CAGR of 5%, with growth driven by the expanding healthcare and personal care sectors.

Top Countries Insights in Release Liner Paper

In the United States, the release liner paper market is valued at $2.8 billion, with a CAGR of 5%. The market is driven by the strong demand for pressure-sensitive labels in the food and beverage and pharmaceutical industries. In China, the market is valued at $2.5 billion, with a CAGR of 18%, fueled by rapid industrialization and the booming e-commerce sector. Germany's market is valued at $1.5 billion, with a CAGR of 10%, driven by stringent environmental regulations and the adoption of sustainable packaging solutions.

In Japan, the market is valued at $1.2 billion, with a CAGR of 7%, supported by technological advancements and the growing demand for high-quality labels. In Brazil, the market is valued at $0.9 billion, with a CAGR of 6%, driven by the expanding food and beverage industry and rising consumer spending. These countries are witnessing significant growth due to favorable government policies, increasing investments in research and development, and the rising demand for innovative packaging solutions.

Release Liner Paper Market Segments Insights

Material Type Analysis

The release liner paper market is segmented by material type into paper and film. Paper-based liners dominate the market due to their cost-effectiveness and recyclability. The demand for paper liners is driven by the increasing focus on sustainable packaging solutions and the rising environmental concerns. Paper liners are widely used in the food and beverage industry for labeling applications, where sustainability is a key consideration. The development of advanced paper liners with enhanced properties such as moisture resistance and durability is further boosting their adoption.

Film-based liners, on the other hand, are gaining traction due to their superior performance characteristics such as high tensile strength and resistance to tearing. These liners are preferred in applications where durability and performance are critical, such as in the automotive and electronics industries. The growing demand for high-performance labeling solutions in these sectors is driving the adoption of film-based liners. Additionally, advancements in film technology, such as the development of Biodegradable Films, are expected to create new growth opportunities in this segment.

Application Analysis

The release liner paper market is segmented by application into labels, tapes, hygiene, industrial, medical, and others. The labels segment holds the largest market share, driven by the increasing demand for pressure-sensitive labels across various industries. The rise in e-commerce and logistics activities has further fueled the need for efficient labeling solutions, thereby boosting the demand for release liner paper. The development of digital printing technologies has also contributed to the growth of this segment by enabling high-quality and customizable label production.

The tapes segment is experiencing significant growth due to the increasing use of adhesive tapes in industrial and construction applications. The demand for hygiene products, such as diapers and sanitary napkins, is driving the growth of the hygiene segment. In the medical sector, the use of Release Liners in wound care products and medical tapes is contributing to market growth. The industrial segment is driven by the demand for release liners in applications such as composites and laminates, where they are used as protective layers during manufacturing processes.

End-User Analysis

The release liner paper market is segmented by end-user into food and beverages, pharmaceuticals, personal care, automotive, electronics, and others. The food and beverages segment holds a significant market share due to the high demand for labeling solutions in this industry. The need for product differentiation and compliance with labeling regulations is driving the demand for release liner paper in this segment. The pharmaceuticals segment is also witnessing significant growth, driven by the increasing demand for secure and tamper-evident labeling solutions.

The personal care segment is experiencing growth due to the rising demand for hygiene products and cosmetics, where release liners are used in packaging and labeling applications. In the automotive and electronics industries, the demand for high-performance labeling solutions is driving the adoption of release liner paper. These industries require durable and reliable labeling solutions that can withstand harsh environmental conditions, which is contributing to the growth of this segment.

Regional Analysis

The release liner paper market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds a significant market share due to the strong presence of key players and the high demand for pressure-sensitive labels in the food and beverage industry. The region's focus on sustainability and eco-friendly packaging solutions is also driving market growth. In Europe, the market is driven by stringent environmental regulations and the increasing adoption of digital printing technologies.

The Asia-Pacific region is the fastest-growing market, driven by rapid industrialization, expanding e-commerce sector, and increasing demand for consumer goods. In Latin America, the market is driven by the growing food and beverage industry and rising disposable incomes. The Middle East & Africa region is experiencing growth driven by the expanding healthcare and personal care sectors. These regions are witnessing significant growth due to favorable government policies, increasing investments in research and development, and the rising demand for innovative packaging solutions.

The release liner paper market is characterized by a diverse range of players, with key companies such as Avery Dennison Corporation, Mondi Group, UPM-Kymmene Corporation, Loparex LLC, and 3M Company leading the market. Avery Dennison Corporation holds a significant market share due to its extensive product portfolio and strong global presence. The company focuses on innovation and sustainability, offering a range of eco-friendly liner solutions. Mondi Group is known for its integrated production capabilities and emphasis on sustainable practices, which have helped it maintain a competitive edge.

UPM-Kymmene Corporation has a robust geographic reach and is recognized for its high-quality liner products. The company invests heavily in research and development to enhance its product offerings. Loparex LLC is a key player with a strong focus on customer-centric solutions and technological advancements. 3M Company leverages its expertise in adhesive technologies to offer innovative liner solutions. These companies are engaged in strategic partnerships and acquisitions to expand their market presence and enhance their product portfolios. The competitive landscape is characterized by continuous innovation, with companies striving to differentiate themselves through unique product offerings and sustainable practices.

Release Liner Paper Market Segments

The Release Liner Paper market has been segmented on the basis of

Material Type

- Paper

- Film

Application

- Labels

- Tapes

- Hygiene

- Industrial

- Medical

- Others

End-User

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Automotive

- Electronics

- Others

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the release liner paper market?

How are environmental concerns impacting the release liner paper market?

What role does innovation play in the release liner paper market?

Which regions are experiencing the fastest growth in the release liner paper market?

What challenges does the release liner paper market face?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.