- Home

- Packaging Products

- Punnet Packaging Market Size, Future Growth and Forecast 2033

Punnet Packaging Market Size, Future Growth and Forecast 2033

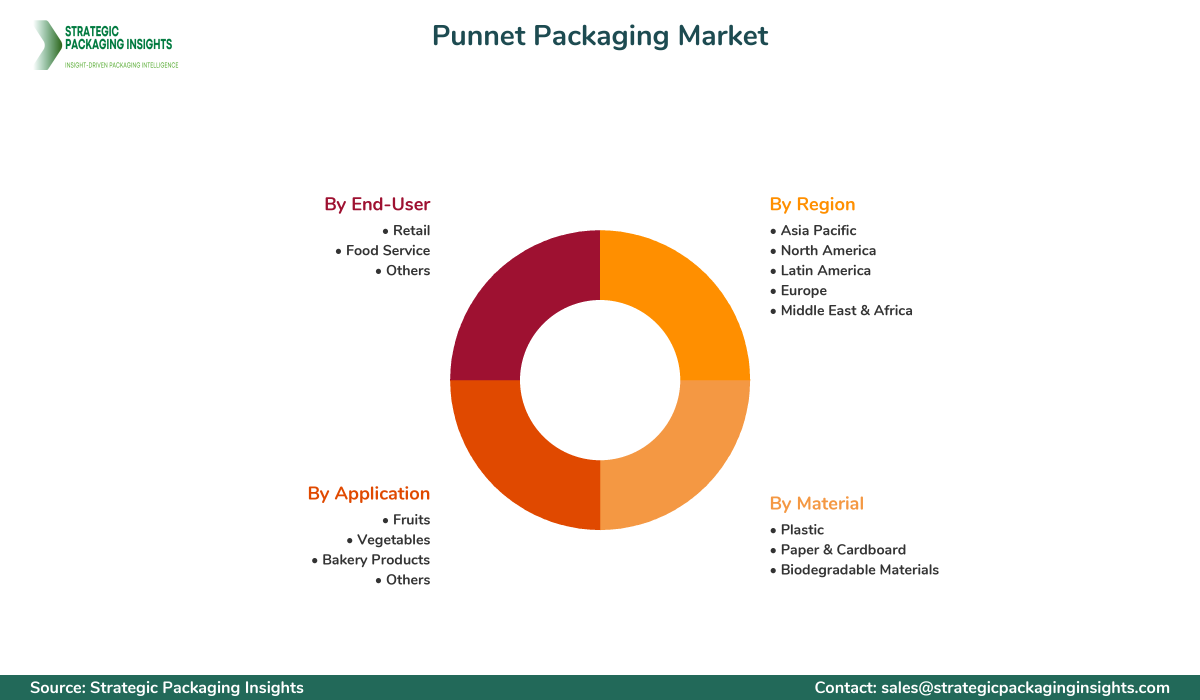

Punnet Packaging Market Segments - by Material (Plastic, Paper & Cardboard, Biodegradable Materials), Application (Fruits, Vegetables, Bakery Products, Others), End-User (Retail, Food Service, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Punnet Packaging Market Outlook

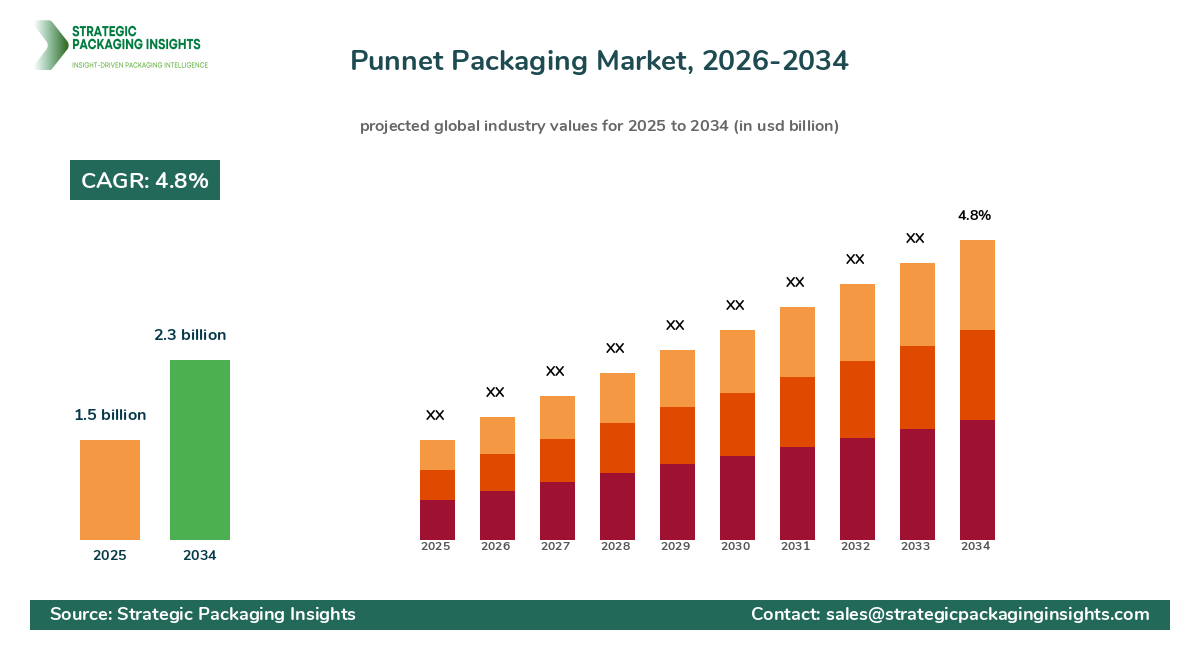

The punnet packaging market was valued at $1.5 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033. This growth is driven by increasing consumer demand for sustainable and convenient packaging solutions, particularly in the food sector. The rise in fresh produce consumption, coupled with the need for efficient packaging that extends shelf life, is propelling the market forward. Additionally, innovations in biodegradable and recyclable materials are attracting environmentally conscious consumers and businesses, further boosting market expansion.

Report Scope

| Attributes | Details |

| Report Title | Punnet Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 246 |

| Material | Plastic, Paper & Cardboard, Biodegradable Materials |

| Application | Fruits, Vegetables, Bakery Products, Others |

| End-User | Retail, Food Service, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The punnet packaging market presents significant opportunities, particularly in the realm of Sustainable Packaging solutions. As consumers become more environmentally conscious, there is a growing demand for packaging that minimizes environmental impact. This trend is driving innovation in biodegradable and recyclable materials, offering companies the chance to differentiate themselves by providing eco-friendly options. Furthermore, the increasing popularity of online grocery shopping is creating a need for packaging that ensures product safety and freshness during transit, opening new avenues for growth in the e-commerce sector.

Another opportunity lies in the customization of punnet packaging to meet specific consumer needs. With advancements in printing technology, companies can offer Personalized Packaging solutions that enhance brand visibility and consumer engagement. This trend is particularly relevant in the retail sector, where packaging plays a crucial role in influencing purchasing decisions. By offering unique and visually appealing packaging, companies can capture consumer attention and drive sales.

However, the market also faces certain restraints, primarily related to the cost of sustainable materials. While there is a strong push towards eco-friendly packaging, the higher cost of biodegradable and recyclable materials can be a barrier for some companies, particularly small and medium-sized enterprises. Additionally, regulatory challenges related to packaging waste and recycling standards can pose hurdles for market players, requiring them to navigate complex compliance requirements.

The punnet packaging market is characterized by a competitive landscape with several key players vying for market share. Companies are focusing on innovation, sustainability, and strategic partnerships to strengthen their market position. The market is witnessing a trend towards consolidation, with larger companies acquiring smaller players to expand their product offerings and geographic reach. This consolidation is leading to increased competition and driving companies to differentiate themselves through unique product features and value-added services.

Major companies in the punnet packaging market include Amcor plc, Berry Global Inc., DS Smith Plc, Mondi Group, and Smurfit Kappa Group. Amcor plc is a leading player known for its innovative packaging solutions and commitment to sustainability. The company offers a wide range of punnet packaging options, including those made from recycled materials, catering to the growing demand for eco-friendly products.

Berry Global Inc. is another prominent player, offering a diverse portfolio of packaging solutions for various applications. The company focuses on delivering high-quality, sustainable packaging that meets the needs of its customers. With a strong emphasis on research and development, Berry Global Inc. continues to innovate and expand its product offerings.

DS Smith Plc is recognized for its expertise in sustainable packaging solutions. The company provides a range of punnet packaging options designed to reduce environmental impact while maintaining product integrity. DS Smith Plc's commitment to sustainability is reflected in its use of recycled materials and its efforts to promote circular economy practices.

Key Highlights Punnet Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Growth in online grocery shopping driving demand for protective packaging.

- Advancements in biodegradable and recyclable materials.

- Customization and personalization of packaging to enhance brand visibility.

- Regulatory challenges related to packaging waste and recycling standards.

- Consolidation trend with larger companies acquiring smaller players.

- Focus on innovation and strategic partnerships to strengthen market position.

Premium Insights - Key Investment Analysis

The punnet packaging market is attracting significant investment, driven by the growing demand for sustainable packaging solutions. Venture capital activity is on the rise, with investors keen to support companies that offer innovative and eco-friendly packaging options. Mergers and acquisitions are also prevalent, as larger companies seek to expand their product portfolios and geographic presence. Investment valuations in the market are high, reflecting the strong growth potential and increasing consumer demand for sustainable packaging.

Emerging investment themes in the punnet packaging market include the development of biodegradable and recyclable materials, as well as the integration of smart packaging technologies. These innovations are expected to drive market growth and attract investor interest. However, investors should be aware of potential risk factors, such as regulatory challenges and the higher cost of sustainable materials. Despite these challenges, the market offers high-potential investment opportunities, particularly in the areas of material innovation and E-Commerce Packaging solutions.

Punnet Packaging Market Segments Insights

Material Analysis

The material segment of the punnet packaging market is dominated by plastic, paper & cardboard, and biodegradable materials. Plastic remains a popular choice due to its durability and cost-effectiveness. However, the environmental impact of plastic is driving a shift towards more sustainable options. Paper & cardboard are gaining traction as eco-friendly alternatives, offering recyclability and biodegradability. Biodegradable materials are also emerging as a key trend, with companies investing in research and development to create innovative solutions that meet consumer demand for sustainable packaging.

Within the plastic sub-segment, companies are focusing on developing recyclable and compostable options to address environmental concerns. The paper & cardboard sub-segment is benefiting from advancements in printing technology, allowing for customization and enhanced brand visibility. Biodegradable materials are attracting significant attention, with companies exploring new formulations and technologies to improve performance and reduce costs. Overall, the material segment is characterized by a strong focus on sustainability and innovation, with companies striving to meet the evolving needs of consumers and regulatory requirements.

Application Analysis

The application segment of the punnet packaging market includes fruits, vegetables, bakery products, and others. The fruits and vegetables sub-segments are the largest, driven by the increasing consumption of fresh produce and the need for packaging that extends shelf life. Punnet packaging is particularly popular in these sub-segments due to its ability to protect delicate items and maintain freshness. The bakery products sub-segment is also experiencing growth, with punnet packaging offering a convenient and attractive solution for packaging baked goods.

Within the fruits and vegetables sub-segments, companies are focusing on developing packaging solutions that enhance product visibility and appeal to consumers. The use of transparent materials and innovative designs is helping to differentiate products and drive sales. In the bakery products sub-segment, the emphasis is on providing packaging that maintains product freshness and prevents damage during transit. Overall, the application segment is characterized by a strong focus on meeting consumer needs and enhancing product appeal through innovative packaging solutions.

End-User Analysis

The end-user segment of the punnet packaging market includes retail, food service, and others. The retail sub-segment is the largest, driven by the increasing demand for convenient and attractive packaging solutions that enhance product visibility and influence purchasing decisions. Punnet packaging is particularly popular in the retail sector due to its ability to showcase products and provide a convenient solution for consumers.

The food service sub-segment is also experiencing growth, with punnet packaging offering a practical and efficient solution for packaging and transporting food items. The emphasis in this sub-segment is on providing packaging that maintains product integrity and ensures food safety. Overall, the end-user segment is characterized by a strong focus on meeting the needs of consumers and businesses through innovative and practical packaging solutions.

Regional Analysis

The regional segment of the punnet packaging market includes Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Asia Pacific is the largest market, driven by the increasing consumption of fresh produce and the growing demand for sustainable packaging solutions. The region is characterized by a strong focus on innovation and the development of eco-friendly packaging options.

North America and Europe are also significant markets, with a strong emphasis on sustainability and regulatory compliance. The demand for biodegradable and recyclable materials is driving growth in these regions, with companies investing in research and development to create innovative solutions. Latin America and Middle East & Africa are emerging markets, with increasing consumer awareness and demand for sustainable packaging solutions driving growth. Overall, the regional segment is characterized by a strong focus on sustainability and innovation, with companies striving to meet the evolving needs of consumers and regulatory requirements.

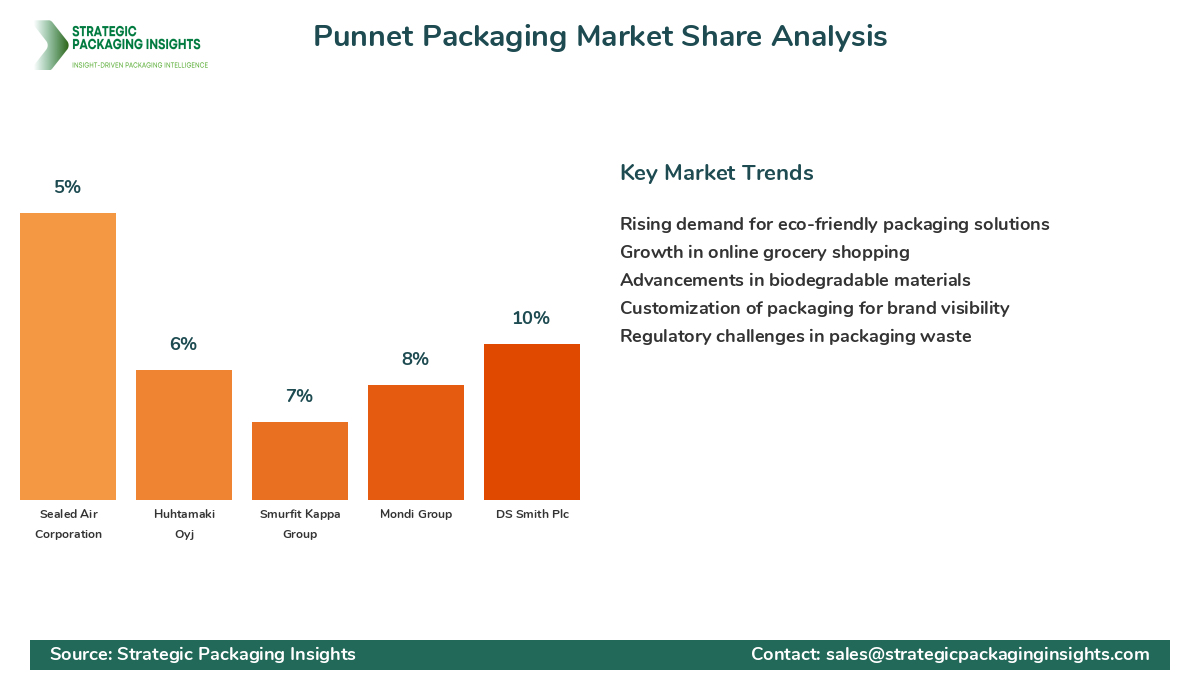

Market Share Analysis

The market share distribution in the punnet packaging market is influenced by several key players who are leading the industry. Companies like Amcor plc, Berry Global Inc., and DS Smith Plc are at the forefront, leveraging their extensive product portfolios and commitment to sustainability to capture significant market share. These companies are gaining share through strategic acquisitions and partnerships, allowing them to expand their geographic reach and product offerings. Meanwhile, smaller players are focusing on niche markets and innovative solutions to carve out their own space in the market.

The competitive positioning in the market is driving companies to invest in research and development to differentiate their products and offer unique value propositions. This focus on innovation is leading to the development of new materials and packaging designs that meet consumer demand for sustainability and convenience. The market share distribution also affects pricing strategies, with companies competing on both cost and value-added features. Partnerships and collaborations are becoming increasingly important as companies seek to leverage each other's strengths and enhance their market position.

Top Countries Insights in Punnet Packaging

In the punnet packaging market, the United States, China, Germany, the United Kingdom, and India are among the top countries driving growth. The United States, with a market size of $400 million and a CAGR of 5%, is a leader in innovation and sustainability, with companies focusing on developing eco-friendly packaging solutions. The demand for fresh produce and convenience packaging is a key growth driver in the country.

China, with a market size of $350 million and a CAGR of 6%, is experiencing rapid growth due to increasing consumer awareness and demand for sustainable packaging. The country's large population and growing middle class are driving demand for fresh produce and convenient packaging solutions. Germany, with a market size of $300 million and a CAGR of 4%, is characterized by a strong focus on sustainability and regulatory compliance, with companies investing in research and development to create innovative solutions.

The United Kingdom, with a market size of $250 million and a CAGR of 3%, is also a significant market, driven by the demand for eco-friendly packaging solutions and the increasing popularity of online grocery shopping. India, with a market size of $200 million and a CAGR of 7%, is an emerging market with significant growth potential, driven by increasing consumer awareness and demand for sustainable packaging solutions. Overall, these countries are characterized by a strong focus on sustainability and innovation, with companies striving to meet the evolving needs of consumers and regulatory requirements.

Punnet Packaging Market Segments

The Punnet Packaging market has been segmented on the basis of

Material

- Plastic

- Paper & Cardboard

- Biodegradable Materials

Application

- Fruits

- Vegetables

- Bakery Products

- Others

End-User

- Retail

- Food Service

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the punnet packaging market?

What challenges do companies face in the punnet packaging market?

How are companies differentiating themselves in the market?

What investment opportunities exist in the punnet packaging market?

Which regions are experiencing the most growth in the punnet packaging market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.