- Home

- Packaging Products

- Polyethylene Terephthalate Containers Market Size, Future Growth and Forecast 2033

Polyethylene Terephthalate Containers Market Size, Future Growth and Forecast 2033

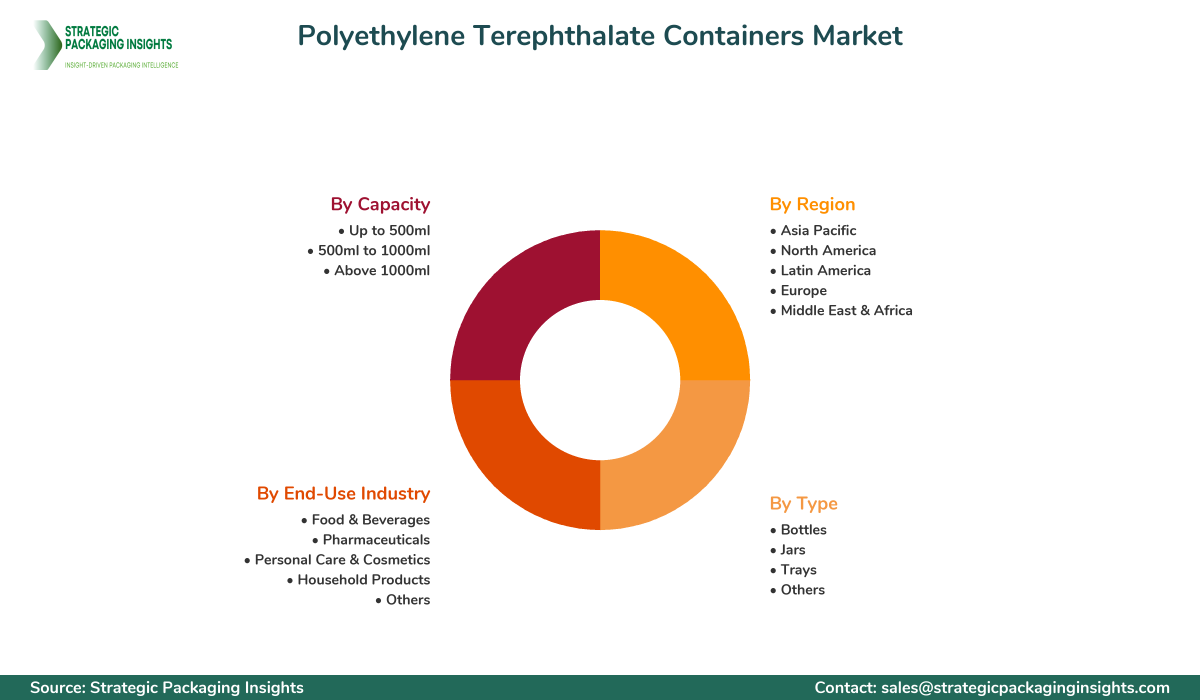

Polyethylene Terephthalate Containers Market Segments - by Type (Bottles, Jars, Trays, Others), End-Use Industry (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Household Products, Others), Capacity (Up to 500ml, 500ml to 1000ml, Above 1000ml), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Polyethylene Terephthalate Containers Market Outlook

The Polyethylene Terephthalate (PET) Containers market was valued at $39.5 billion in 2024 and is projected to reach $60.9 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033. This growth is driven by the increasing demand for lightweight, durable, and Recyclable Packaging solutions across various industries. PET containers are favored for their excellent barrier properties, clarity, and strength, making them ideal for packaging beverages, food products, pharmaceuticals, and personal care items. The rising consumer preference for Sustainable Packaging and the expansion of the food and beverage industry are significant contributors to the market's expansion.

However, the market faces challenges such as stringent environmental regulations and the availability of alternative packaging materials like glass and aluminum. Despite these restraints, the market holds substantial growth potential due to ongoing innovations in PET container designs and the development of bio-based PET materials. The increasing focus on reducing carbon footprints and enhancing recycling processes further supports the market's positive outlook.

Report Scope

| Attributes | Details |

| Report Title | Polyethylene Terephthalate Containers Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 205 |

| Type | Bottles, Jars, Trays, Others |

| End-Use Industry | Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Household Products, Others |

| Capacity | Up to 500ml, 500ml to 1000ml, Above 1000ml |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Polyethylene Terephthalate Containers market presents numerous opportunities, particularly in the realm of sustainability and innovation. As consumers and regulatory bodies push for more eco-friendly packaging solutions, companies are investing in the development of bio-based PET containers. These innovations not only reduce reliance on fossil fuels but also enhance the recyclability of PET products, aligning with global sustainability goals. Additionally, the growing e-commerce sector is driving demand for durable and lightweight packaging solutions, providing further growth avenues for PET containers.

Another significant opportunity lies in the expanding food and beverage industry, particularly in emerging markets. As disposable incomes rise and consumer lifestyles evolve, there is an increasing demand for convenient and safe packaging solutions. PET containers, with their excellent barrier properties and lightweight nature, are well-positioned to meet these demands. Furthermore, advancements in PET recycling technologies are opening new doors for market players to enhance their sustainability credentials and appeal to environmentally conscious consumers.

Despite these opportunities, the market faces threats from alternative packaging materials such as glass, aluminum, and biodegradable plastics. These materials are often perceived as more environmentally friendly, posing a challenge to PET containers. Additionally, stringent regulations regarding plastic usage and disposal can hinder market growth. Companies must navigate these regulatory landscapes carefully and invest in sustainable practices to mitigate these threats.

The competitive landscape of the Polyethylene Terephthalate Containers market is characterized by the presence of several key players who dominate the market with their extensive product portfolios and strong distribution networks. Companies such as Amcor plc, Berry Global Inc., and Gerresheimer AG hold significant market shares due to their innovative product offerings and strategic partnerships. These companies focus on expanding their geographic reach and enhancing their production capabilities to maintain their competitive edge.

Amcor plc, a leading player in the market, is known for its commitment to sustainability and innovation. The company has made significant investments in developing recyclable and lightweight PET containers, catering to the growing demand for eco-friendly packaging solutions. Berry Global Inc. is another major player, renowned for its diverse product range and strong customer relationships. The company's focus on product innovation and strategic acquisitions has helped it maintain a robust market position.

Gerresheimer AG, with its extensive experience in the packaging industry, offers a wide range of PET containers for various applications. The company's emphasis on quality and customer satisfaction has earned it a loyal customer base. Other notable players in the market include Plastipak Holdings, Inc., Graham Packaging Company, and Resilux NV, each contributing to the market's competitive dynamics through their unique offerings and strategic initiatives.

Key Highlights Polyethylene Terephthalate Containers Market

- The market is projected to grow at a CAGR of 4.9% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Advancements in PET recycling technologies are enhancing market prospects.

- The food and beverage industry is a major end-user of PET containers.

- Emerging markets offer significant growth opportunities for market players.

- Stringent environmental regulations pose challenges to market expansion.

- Innovations in bio-based PET materials are gaining traction.

- Key players are focusing on expanding their geographic reach and product portfolios.

- The e-commerce sector is boosting demand for lightweight and durable packaging solutions.

Competitive Intelligence

The Polyethylene Terephthalate Containers market is highly competitive, with key players focusing on innovation, sustainability, and strategic partnerships to gain a competitive edge. Amcor plc leads the market with its strong emphasis on developing recyclable and lightweight PET containers. The company's strategic acquisitions and partnerships have expanded its product offerings and geographic reach, solidifying its market position.

Berry Global Inc. is another prominent player, known for its diverse product range and commitment to sustainability. The company invests heavily in research and development to introduce innovative packaging solutions that meet evolving consumer demands. Gerresheimer AG, with its extensive experience in the packaging industry, focuses on quality and customer satisfaction, offering a wide range of PET containers for various applications.

Plastipak Holdings, Inc. and Graham Packaging Company are also key players in the market, known for their innovative product offerings and strong distribution networks. These companies are investing in advanced manufacturing technologies and expanding their production capacities to cater to the growing demand for PET containers. Resilux NV, with its focus on sustainability and innovation, is gaining traction in the market by offering eco-friendly packaging solutions.

Overall, the competitive landscape is shaped by the players' ability to innovate and adapt to changing market dynamics. Companies that prioritize sustainability and invest in advanced technologies are likely to gain a competitive advantage in the market.

Regional Market Intelligence of Polyethylene Terephthalate Containers

The global Polyethylene Terephthalate Containers market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of key market players. The region's well-established food and beverage industry further supports market growth.

In Europe, stringent environmental regulations and a strong focus on sustainability are key drivers of the market. The region's commitment to reducing plastic waste and enhancing recycling processes is boosting the demand for PET containers. Asia-Pacific is the fastest-growing region, with a high CAGR of 15%, driven by the expanding food and beverage industry and rising consumer awareness about sustainable packaging.

Latin America and Middle East & Africa are also witnessing significant growth, albeit at a slower pace. In Latin America, the market is driven by the increasing demand for convenient packaging solutions, while in Middle East & Africa, the growing population and urbanization are key growth drivers. Overall, the regional market dynamics are shaped by factors such as consumer preferences, regulatory landscapes, and economic conditions.

Top Countries Insights in Polyethylene Terephthalate Containers

In the Polyethylene Terephthalate Containers market, the United States is a leading country with a market size of $10.5 billion and a CAGR of 5%. The country's strong focus on sustainability and the presence of major market players drive its market growth. China, with a market size of $8.2 billion and a CAGR of 7%, is another key player, driven by its expanding food and beverage industry and rising consumer awareness about eco-friendly packaging.

Germany, with a market size of $6.3 billion and a CAGR of 4%, is a significant market in Europe, driven by stringent environmental regulations and a strong focus on recycling. India, with a market size of $5.7 billion and a CAGR of 8%, is experiencing rapid growth due to its expanding middle class and increasing demand for convenient packaging solutions.

Brazil, with a market size of $4.1 billion and a CAGR of 6%, is a key market in Latin America, driven by the growing demand for packaged food and beverages. These countries are shaping the global market dynamics with their unique growth drivers and challenges.

Polyethylene Terephthalate Containers Market Segments Insights

Type Analysis

The Polyethylene Terephthalate Containers market is segmented by type into bottles, jars, trays, and others. Bottles dominate the market due to their widespread use in the beverage industry. The demand for PET bottles is driven by their lightweight nature, durability, and excellent barrier properties, making them ideal for packaging carbonated drinks, water, and juices. Jars and trays are also gaining traction, particularly in the food and personal care industries, where they are used for packaging products like sauces, creams, and ready-to-eat meals.

Innovation in design and functionality is a key trend in this segment, with companies focusing on developing unique shapes and features to enhance consumer convenience and product differentiation. The growing emphasis on sustainability is also driving the demand for recyclable and bio-based PET containers, further boosting the market's growth prospects.

End-Use Industry Analysis

The end-use industry segment of the Polyethylene Terephthalate Containers market includes food & beverages, pharmaceuticals, personal care & cosmetics, household products, and others. The food & beverages industry is the largest end-user, accounting for a significant share of the market. The demand for PET containers in this industry is driven by the need for safe, lightweight, and durable packaging solutions that preserve product freshness and extend shelf life.

The pharmaceuticals and personal care industries are also key contributors to the market, with PET containers being used for packaging medicines, creams, and lotions. The growing focus on hygiene and safety in these industries is driving the demand for high-quality PET containers. Additionally, the household products segment is witnessing growth due to the increasing demand for convenient and eco-friendly packaging solutions.

Capacity Analysis

The Polyethylene Terephthalate Containers market is segmented by capacity into up to 500ml, 500ml to 1000ml, and above 1000ml. The up to 500ml segment is the largest, driven by the demand for small-sized packaging solutions in the beverage and personal care industries. These containers are ideal for single-use applications, offering convenience and portability to consumers.

The 500ml to 1000ml segment is also significant, particularly in the food and beverage industry, where these containers are used for packaging products like juices, sauces, and ready-to-drink beverages. The above 1000ml segment is gaining traction in the household products industry, where larger containers are used for packaging cleaning agents and detergents. The demand for these containers is driven by the need for cost-effective and sustainable packaging solutions.

Regional Analysis

The regional analysis of the Polyethylene Terephthalate Containers market highlights the varying growth dynamics across different regions. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of key market players. The region's well-established food and beverage industry further supports market growth.

In Europe, stringent environmental regulations and a strong focus on sustainability are key drivers of the market. The region's commitment to reducing plastic waste and enhancing recycling processes is boosting the demand for PET containers. Asia-Pacific is the fastest-growing region, with a high CAGR of 15%, driven by the expanding food and beverage industry and rising consumer awareness about sustainable packaging.

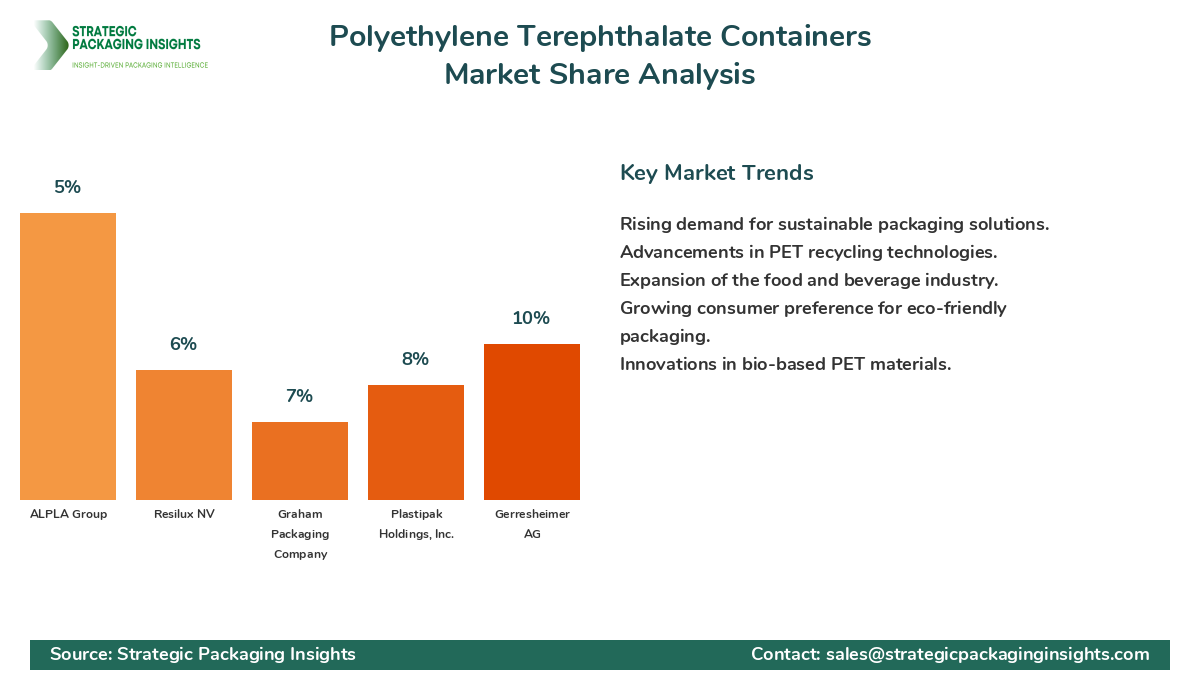

Market Share Analysis

The market share distribution of key players in the Polyethylene Terephthalate Containers market is influenced by factors such as innovation, sustainability, and strategic partnerships. Companies like Amcor plc, Berry Global Inc., and Gerresheimer AG lead the market with their extensive product portfolios and strong distribution networks. These companies focus on expanding their geographic reach and enhancing their production capabilities to maintain their competitive edge.

Amcor plc is known for its commitment to sustainability and innovation, investing in the development of recyclable and lightweight PET containers. Berry Global Inc. is renowned for its diverse product range and strong customer relationships, focusing on product innovation and strategic acquisitions. Gerresheimer AG, with its extensive experience in the packaging industry, offers a wide range of PET containers for various applications, emphasizing quality and customer satisfaction.

Other notable players in the market include Plastipak Holdings, Inc., Graham Packaging Company, and Resilux NV, each contributing to the market's competitive dynamics through their unique offerings and strategic initiatives. The market share distribution affects pricing, innovation, and partnerships, with companies that prioritize sustainability and invest in advanced technologies likely to gain a competitive advantage.

Polyethylene Terephthalate Containers Market Segments

The Polyethylene Terephthalate Containers market has been segmented on the basis of

Type

- Bottles

- Jars

- Trays

- Others

End-Use Industry

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Household Products

- Others

Capacity

- Up to 500ml

- 500ml to 1000ml

- Above 1000ml

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the PET containers market?

What challenges does the PET containers market face?

How are companies addressing sustainability in the PET containers market?

Which regions are experiencing the fastest growth in the PET containers market?

What role does innovation play in the PET containers market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.