- Home

- Packaging Products

- Poly Tubing Market Size, Future Growth and Forecast 2033

Poly Tubing Market Size, Future Growth and Forecast 2033

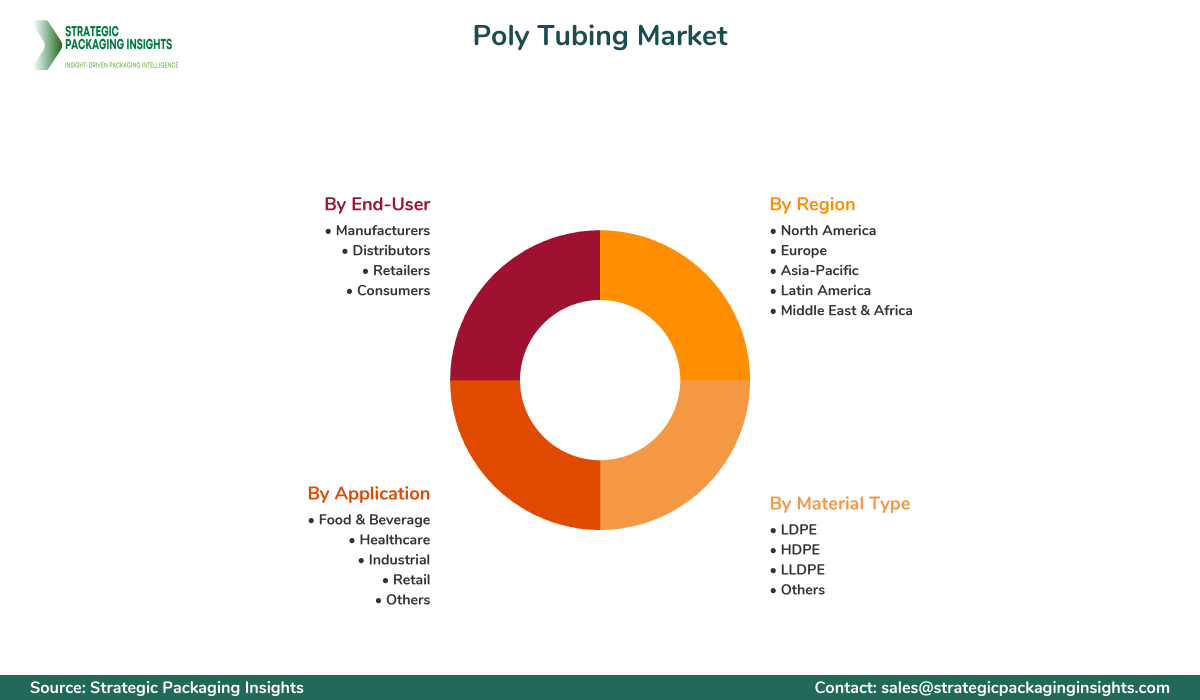

Poly Tubing Market Segments - by Material Type (LDPE, HDPE, LLDPE, Others), Application (Food & Beverage, Healthcare, Industrial, Retail, Others), End-User (Manufacturers, Distributors, Retailers, Consumers), and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Poly Tubing Market Outlook

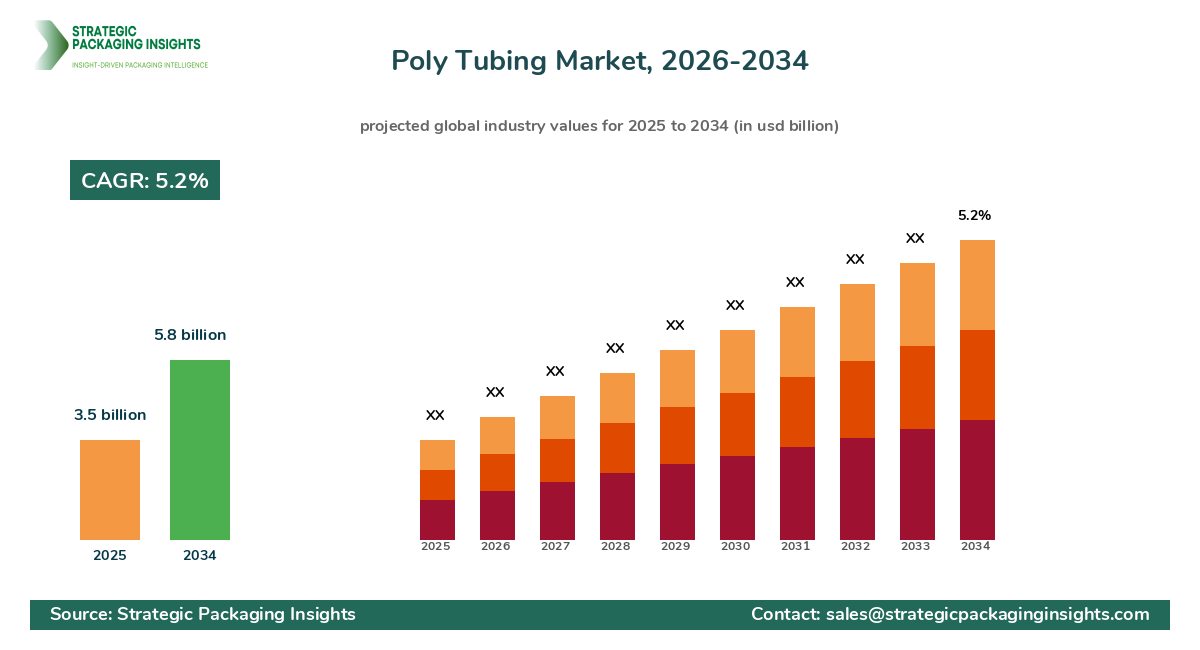

The poly tubing market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025-2033. Poly tubing, a versatile packaging solution, is gaining traction due to its adaptability across various industries such as food and beverage, healthcare, and retail. The market's growth is driven by the increasing demand for Flexible Packaging solutions that offer durability, cost-effectiveness, and environmental benefits. The rise in e-commerce and the need for efficient packaging solutions further bolster the demand for poly tubing. Additionally, advancements in material technology, such as the development of biodegradable and recyclable poly tubing, are expected to provide significant growth opportunities.

Report Scope

| Attributes | Details |

| Report Title | Poly Tubing Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 127 |

| Material Type | LDPE, HDPE, LLDPE, Others |

| Application | Food & Beverage, Healthcare, Industrial, Retail, Others |

| End-User | Manufacturers, Distributors, Retailers, Consumers |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The poly tubing market presents numerous opportunities, particularly with the growing emphasis on Sustainable Packaging solutions. As consumers and businesses become more environmentally conscious, the demand for eco-friendly packaging materials is on the rise. Poly tubing manufacturers are increasingly focusing on developing biodegradable and recyclable products to meet this demand. Furthermore, the expansion of the e-commerce sector is creating a surge in demand for flexible packaging solutions, as poly tubing offers the versatility and protection needed for shipping a wide range of products. The healthcare industry also presents significant opportunities, as poly tubing is used for packaging medical supplies and pharmaceuticals, driven by the increasing need for safe and hygienic packaging solutions.

Another opportunity lies in the technological advancements in poly tubing production. Innovations in material science are leading to the development of high-performance poly tubing that offers enhanced strength, clarity, and barrier properties. These advancements are enabling manufacturers to cater to specific industry requirements, such as high-barrier packaging for food products or UV-resistant tubing for outdoor applications. Additionally, the customization capabilities of poly tubing, such as printing and sizing options, are attracting businesses looking for Personalized Packaging solutions to enhance their brand visibility and consumer engagement.

However, the poly tubing market faces certain restraints that could hinder its growth. One of the primary challenges is the fluctuating prices of raw materials, particularly polyethylene, which is derived from petroleum. Volatility in crude oil prices can impact the cost of production and, consequently, the pricing of poly tubing products. Additionally, stringent regulations regarding plastic usage and disposal in various regions pose a challenge for manufacturers. Compliance with these regulations requires significant investment in research and development to create sustainable alternatives, which can increase operational costs. Moreover, the growing competition from alternative packaging solutions, such as paper and biodegradable materials, presents a threat to the poly tubing market.

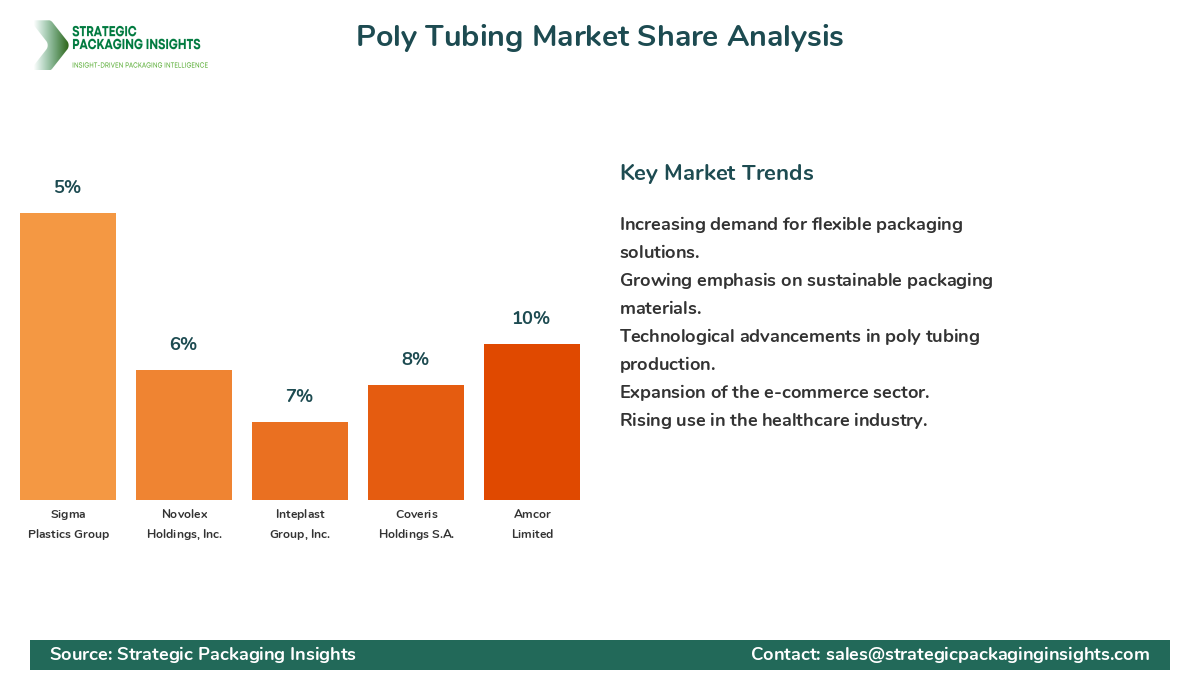

The poly tubing market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of large multinational corporations and regional players, each striving to enhance their product offerings and expand their geographical reach. Companies are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to strengthen their market position. The competitive rivalry is further intensified by the continuous innovation in product development and the introduction of new technologies.

Among the major companies in the poly tubing market, Berry Global Inc. holds a significant market share due to its extensive product portfolio and strong distribution network. The company is known for its innovative solutions and commitment to sustainability, which has helped it maintain a competitive edge. Another key player, Sealed Air Corporation, is recognized for its Advanced Packaging technologies and focus on customer-centric solutions. The company's emphasis on research and development has enabled it to introduce high-performance poly tubing products that cater to diverse industry needs.

Amcor Limited is another prominent player in the poly tubing market, known for its global presence and comprehensive range of packaging solutions. The company's strategic acquisitions and investments in emerging markets have bolstered its market position. Similarly, Coveris Holdings S.A. is a key player with a strong focus on sustainability and innovation. The company's efforts to develop eco-friendly packaging solutions have resonated well with environmentally conscious consumers and businesses.

Other notable companies in the poly tubing market include Inteplast Group, Inc., known for its wide range of polyethylene products and commitment to quality. The company's extensive manufacturing capabilities and focus on customer satisfaction have contributed to its success. Additionally, Novolex Holdings, Inc. is recognized for its diverse product offerings and strategic partnerships, which have enabled it to expand its market presence. The competitive landscape of the poly tubing market is dynamic, with companies continuously striving to enhance their product offerings and gain a competitive advantage.

Key Highlights Poly Tubing Market

- Increasing demand for flexible and sustainable packaging solutions across various industries.

- Technological advancements in poly tubing production, leading to high-performance products.

- Growing emphasis on eco-friendly packaging materials, driving innovation in biodegradable and recyclable poly tubing.

- Expansion of the e-commerce sector, boosting demand for versatile packaging solutions.

- Rising use of poly tubing in the healthcare industry for safe and hygienic packaging.

- Fluctuating raw material prices posing a challenge to market growth.

- Stringent regulations on plastic usage and disposal impacting the market dynamics.

- Intense competition from alternative packaging solutions such as paper and biodegradable materials.

- Strategic initiatives by key players to enhance market position and expand geographical reach.

- Customization capabilities of poly tubing attracting businesses seeking personalized packaging solutions.

Competitive Intelligence

The poly tubing market is highly competitive, with several key players striving to maintain and enhance their market positions. Berry Global Inc. is a leader in the market, known for its extensive product portfolio and strong distribution network. The company's focus on sustainability and innovation has helped it maintain a competitive edge. Sealed Air Corporation is another major player, recognized for its advanced packaging technologies and customer-centric solutions. The company's emphasis on research and development has enabled it to introduce high-performance poly tubing products that cater to diverse industry needs.

Amcor Limited is a prominent player in the poly tubing market, known for its global presence and comprehensive range of packaging solutions. The company's strategic acquisitions and investments in emerging markets have bolstered its market position. Coveris Holdings S.A. is also a key player, with a strong focus on sustainability and innovation. The company's efforts to develop eco-friendly packaging solutions have resonated well with environmentally conscious consumers and businesses.

Inteplast Group, Inc. is recognized for its wide range of polyethylene products and commitment to quality. The company's extensive manufacturing capabilities and focus on customer satisfaction have contributed to its success. Novolex Holdings, Inc. is known for its diverse product offerings and strategic partnerships, which have enabled it to expand its market presence. The competitive landscape of the poly tubing market is dynamic, with companies continuously striving to enhance their product offerings and gain a competitive advantage.

Other notable players in the market include Sigma Plastics Group, known for its innovative solutions and strong customer relationships. The company's focus on sustainability and product development has helped it maintain a competitive position. Additionally, Poly-America, L.P. is recognized for its extensive product range and commitment to quality. The company's strategic initiatives and focus on customer satisfaction have contributed to its success in the poly tubing market.

Regional Market Intelligence of Poly Tubing

The global poly tubing market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for flexible packaging solutions in the food and beverage industry. The region's well-established e-commerce sector also contributes to the growth of the poly tubing market. In Europe, stringent regulations on plastic usage and disposal are driving the demand for sustainable packaging solutions, including biodegradable and recyclable poly tubing. The region's focus on environmental sustainability is a key growth driver.

The Asia-Pacific region is expected to witness significant growth in the poly tubing market, driven by the rapid expansion of the e-commerce sector and increasing demand for flexible packaging solutions. The region's growing population and rising disposable income levels are also contributing to the market's growth. In Latin America, the market is driven by the increasing demand for packaging solutions in the food and beverage industry. The region's focus on sustainability and environmental conservation is also driving the demand for eco-friendly poly tubing products.

In the Middle East & Africa, the poly tubing market is driven by the increasing demand for packaging solutions in the healthcare and industrial sectors. The region's focus on economic diversification and industrialization is contributing to the market's growth. Additionally, the increasing awareness of environmental sustainability is driving the demand for biodegradable and recyclable poly tubing products in the region.

Top Countries Insights in Poly Tubing

The United States is a leading market for poly tubing, with a current market size of $1.2 billion and a CAGR of 5%. The country's well-established e-commerce sector and increasing demand for flexible packaging solutions are key growth drivers. In China, the poly tubing market is valued at $900 million, with a CAGR of 7%. The rapid expansion of the e-commerce sector and increasing demand for sustainable packaging solutions are driving the market's growth.

Germany is another key market, with a market size of $600 million and a CAGR of 4%. The country's stringent regulations on plastic usage and disposal are driving the demand for eco-friendly poly tubing products. In Brazil, the poly tubing market is valued at $400 million, with a CAGR of 6%. The increasing demand for packaging solutions in the food and beverage industry is a key growth driver.

India is also a significant market, with a market size of $300 million and a CAGR of 8%. The country's growing population and rising disposable income levels are contributing to the market's growth. The increasing demand for flexible packaging solutions in the e-commerce sector is also driving the market's growth in India.

Poly Tubing Market Segments Insights

Material Type Analysis

The poly tubing market is segmented by material type into LDPE, HDPE, LLDPE, and others. LDPE, or low-density polyethylene, is widely used due to its flexibility, transparency, and ease of processing. It is favored in applications requiring lightweight and durable packaging solutions. The demand for LDPE is driven by its cost-effectiveness and versatility, making it suitable for a wide range of applications, including food packaging and retail. HDPE, or high-density polyethylene, is known for its strength and resistance to impact and chemicals. It is commonly used in industrial applications where durability and protection are paramount. The demand for HDPE is driven by its superior barrier properties and recyclability, aligning with the growing emphasis on sustainable packaging solutions.

LLDPE, or linear low-density polyethylene, offers a balance between flexibility and strength, making it ideal for applications requiring stretchability and puncture resistance. The demand for LLDPE is driven by its ability to provide enhanced performance in demanding applications, such as stretch film and agricultural films. Other materials, including biodegradable and recyclable options, are gaining traction as manufacturers seek to meet the growing demand for eco-friendly packaging solutions. The development of innovative materials that offer improved performance and sustainability is a key trend in the poly tubing market.

Application Analysis

The poly tubing market is segmented by application into food and beverage, healthcare, industrial, retail, and others. In the food and beverage industry, poly tubing is used for packaging a wide range of products, including fresh produce, meat, and dairy. The demand for poly tubing in this sector is driven by the need for flexible and hygienic packaging solutions that extend the shelf life of products. In the healthcare industry, poly tubing is used for packaging medical supplies and pharmaceuticals, driven by the increasing need for safe and hygienic packaging solutions. The demand for poly tubing in this sector is also driven by the growing emphasis on infection control and patient safety.

In the industrial sector, poly tubing is used for packaging a wide range of products, including chemicals, construction materials, and automotive parts. The demand for poly tubing in this sector is driven by the need for durable and Protective Packaging solutions that can withstand harsh environments. In the retail sector, poly tubing is used for packaging a wide range of consumer goods, including clothing, electronics, and household items. The demand for poly tubing in this sector is driven by the need for versatile and customizable packaging solutions that enhance brand visibility and consumer engagement.

End-User Analysis

The poly tubing market is segmented by end-user into manufacturers, distributors, retailers, and consumers. Manufacturers are the primary end-users of poly tubing, using it for packaging a wide range of products across various industries. The demand for poly tubing among manufacturers is driven by the need for cost-effective and efficient packaging solutions that enhance product protection and shelf life. Distributors are also significant end-users of poly tubing, using it for packaging and transporting products to retailers and consumers. The demand for poly tubing among distributors is driven by the need for durable and protective packaging solutions that ensure product integrity during transit.

Retailers are another key end-user of poly tubing, using it for packaging a wide range of consumer goods. The demand for poly tubing among retailers is driven by the need for versatile and customizable packaging solutions that enhance brand visibility and consumer engagement. Consumers are also end-users of poly tubing, using it for packaging and storing a wide range of household items. The demand for poly tubing among consumers is driven by the need for convenient and cost-effective packaging solutions that offer durability and protection.

Region Analysis

The poly tubing market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for flexible packaging solutions in the food and beverage industry. The region's well-established e-commerce sector also contributes to the growth of the poly tubing market. In Europe, stringent regulations on plastic usage and disposal are driving the demand for sustainable packaging solutions, including biodegradable and recyclable poly tubing. The region's focus on environmental sustainability is a key growth driver.

The Asia-Pacific region is expected to witness significant growth in the poly tubing market, driven by the rapid expansion of the e-commerce sector and increasing demand for flexible packaging solutions. The region's growing population and rising disposable income levels are also contributing to the market's growth. In Latin America, the market is driven by the increasing demand for packaging solutions in the food and beverage industry. The region's focus on sustainability and environmental conservation is also driving the demand for eco-friendly poly tubing products.

Market Share Analysis

The poly tubing market is characterized by a competitive landscape with several key players vying for market share. Berry Global Inc. holds a significant market share due to its extensive product portfolio and strong distribution network. The company is known for its innovative solutions and commitment to sustainability, which has helped it maintain a competitive edge. Sealed Air Corporation is another major player, recognized for its advanced packaging technologies and focus on customer-centric solutions. The company's emphasis on research and development has enabled it to introduce high-performance poly tubing products that cater to diverse industry needs.

Poly Tubing Market Segments

The Poly Tubing market has been segmented on the basis of

Material Type

- LDPE

- HDPE

- LLDPE

- Others

Application

- Food & Beverage

- Healthcare

- Industrial

- Retail

- Others

End-User

- Manufacturers

- Distributors

- Retailers

- Consumers

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the poly tubing market?

What challenges does the poly tubing market face?

How are companies addressing sustainability in the poly tubing market?

What role does innovation play in the poly tubing market?

Which regions are expected to witness significant growth in the poly tubing market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.