- Home

- Packaging Products

- Opp Packaging Tape Market Size, Future Growth and Forecast 2033

Opp Packaging Tape Market Size, Future Growth and Forecast 2033

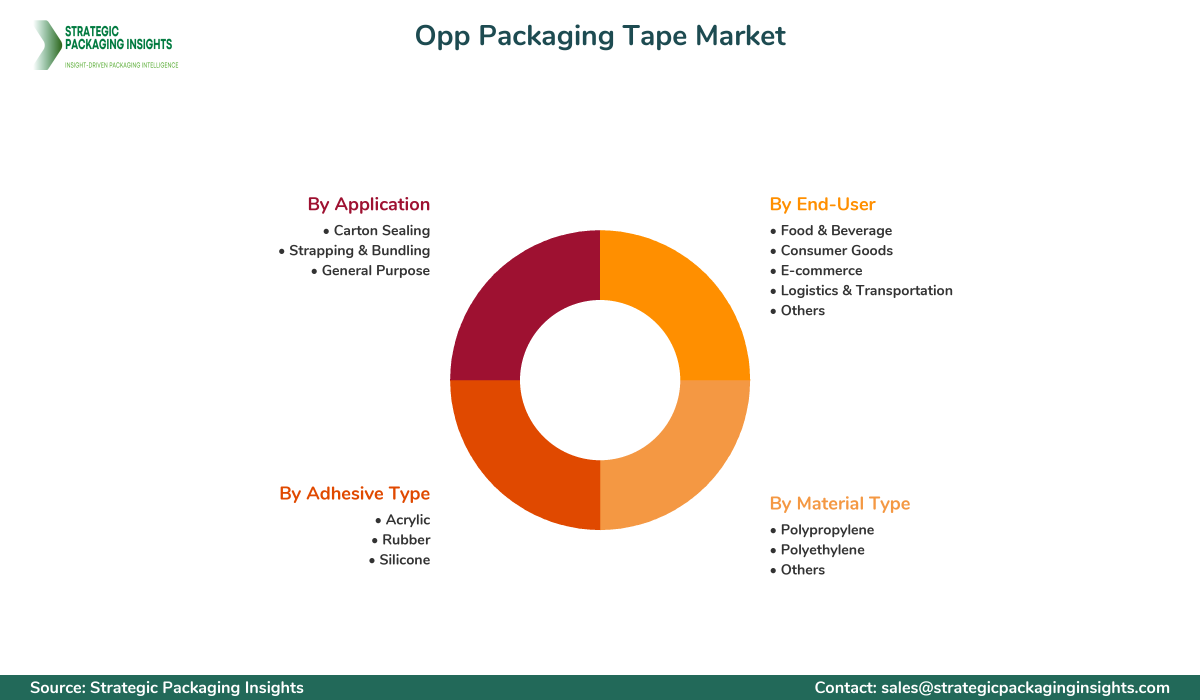

Opp Packaging Tape Market Segments - by Material Type (Polypropylene, Polyethylene, Others), Adhesive Type (Acrylic, Rubber, Silicone), Application (Carton Sealing, Strapping & Bundling, General Purpose), End-User (Food & Beverage, Consumer Goods, E-commerce, Logistics & Transportation, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Opp Packaging Tape Market Outlook

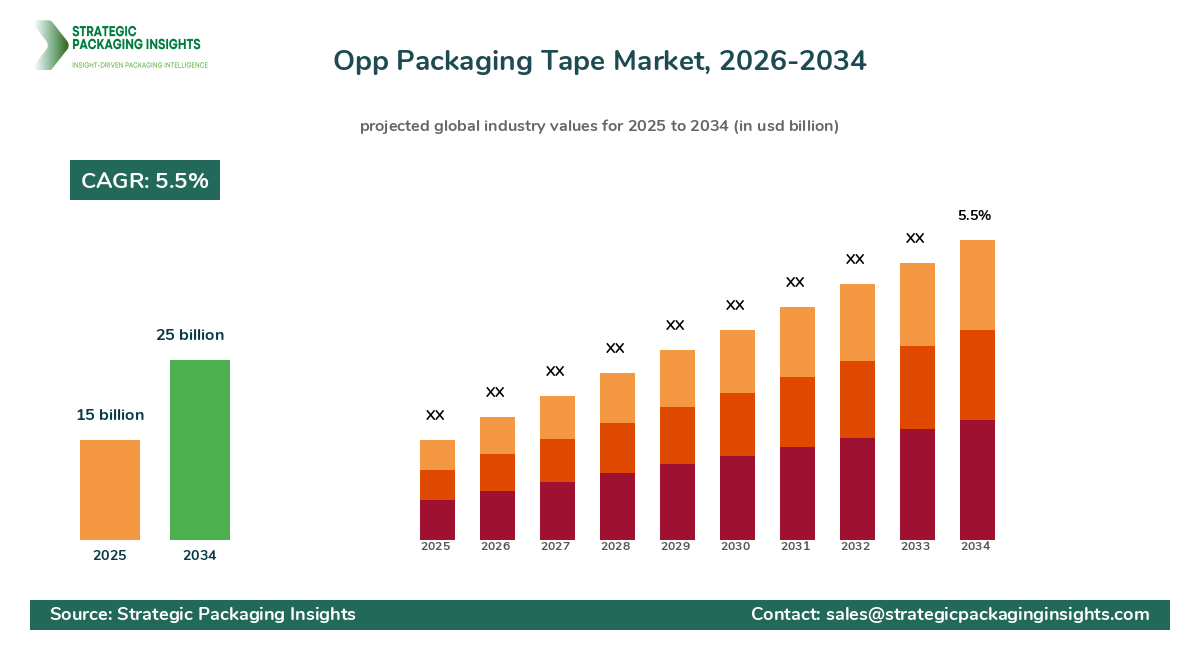

The Opp Packaging Tape market was valued at $15 billion in 2024 and is projected to reach $25 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033. This market is driven by the increasing demand for efficient and reliable packaging solutions across various industries, including food and beverage, consumer goods, and e-commerce. The rise in online shopping and the need for secure packaging to prevent damage during transit are significant factors contributing to the market's growth. Additionally, advancements in adhesive technologies and the development of eco-friendly Packaging Tapes are expected to further propel the market.

Report Scope

| Attributes | Details |

| Report Title | Opp Packaging Tape Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 164 |

| Material Type | Polypropylene, Polyethylene, Others |

| Adhesive Type | Acrylic, Rubber, Silicone |

| Application | Carton Sealing, Strapping & Bundling, General Purpose |

| End-User | Food & Beverage, Consumer Goods, E-commerce, Logistics & Transportation, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the primary opportunities in the Opp Packaging Tape market is the growing e-commerce sector. With the surge in online shopping, there is an increasing demand for packaging tapes that ensure the safe delivery of products. This trend is particularly prominent in emerging markets where e-commerce is rapidly expanding. Additionally, the shift towards Sustainable Packaging solutions presents a significant opportunity for manufacturers to develop eco-friendly tapes that cater to environmentally conscious consumers. The development of biodegradable and recyclable tapes can open new avenues for growth in this market.

Another opportunity lies in the technological advancements in adhesive formulations. Innovations in adhesive technology have led to the development of tapes with enhanced bonding strength and durability. These advancements allow for the creation of tapes that can withstand extreme temperatures and harsh environmental conditions, making them suitable for a wide range of applications. Furthermore, the increasing focus on product customization and branding provides opportunities for manufacturers to offer Personalized Packaging solutions, thereby enhancing customer engagement and brand recognition.

However, the market faces certain restraints, such as the volatility in raw material prices. The cost of raw materials, particularly petroleum-based products, can significantly impact the production costs of Opp Packaging Tapes. Fluctuations in crude oil prices can lead to increased manufacturing costs, which may affect the profit margins of manufacturers. Additionally, stringent regulations regarding the use of plastic materials in packaging can pose challenges for market players, necessitating the development of alternative materials and sustainable practices.

The Opp Packaging Tape market is characterized by intense competition, with several key players vying for market share. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to gain a competitive edge. Strategic partnerships and collaborations are also common strategies adopted by market players to strengthen their market position.

Leading companies in the market include 3M Company, Tesa SE, Intertape Polymer Group, and Avery Dennison Corporation. These companies have established a strong presence in the market through their extensive product offerings and robust distribution networks. 3M Company, for instance, is known for its innovative adhesive technologies and a wide range of packaging solutions. Tesa SE, on the other hand, focuses on providing high-performance tapes for various industrial applications.

Intertape Polymer Group is a prominent player in the Opp Packaging Tape market, offering a diverse range of tapes for different applications. The company emphasizes sustainability and has introduced eco-friendly products to cater to the growing demand for Green Packaging solutions. Avery Dennison Corporation is another key player, known for its advanced adhesive technologies and commitment to sustainability. The company has a strong global presence and continues to invest in research and development to enhance its product offerings.

Key Highlights Opp Packaging Tape Market

- The market is projected to grow at a CAGR of 5.5% from 2025 to 2033.

- Increasing demand from the e-commerce sector is a major growth driver.

- Technological advancements in adhesive formulations are enhancing product performance.

- Eco-friendly and sustainable packaging solutions are gaining traction.

- Volatility in raw material prices poses a challenge to market growth.

- Leading players are focusing on product innovation and strategic partnerships.

- Stringent regulations on plastic usage are influencing market dynamics.

- Customization and branding opportunities are expanding in the packaging sector.

Premium Insights - Key Investment Analysis

The Opp Packaging Tape market is witnessing significant investment activity, driven by the growing demand for innovative and sustainable packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and high-performance tapes. The market has seen a surge in mergers and acquisitions as companies seek to expand their product portfolios and enhance their market presence. Strategic investments in research and development are also on the rise, with companies aiming to develop advanced adhesive technologies and sustainable materials.

Investment valuations in the Opp Packaging Tape market are influenced by factors such as market potential, technological advancements, and regulatory compliance. Investors are particularly interested in companies that demonstrate strong growth potential and a commitment to sustainability. The return on investment (ROI) expectations in this market are high, given the increasing demand for packaging solutions across various industries. Emerging investment themes include the development of Biodegradable Tapes, the use of renewable materials, and the integration of smart packaging technologies.

Opp Packaging Tape Market Segments Insights

Material Type Analysis

The Opp Packaging Tape market is segmented by material type into polypropylene, polyethylene, and others. Polypropylene is the most widely used material due to its excellent mechanical properties and cost-effectiveness. It offers high tensile strength and resistance to moisture, making it ideal for packaging applications. The demand for polypropylene tapes is driven by their versatility and ability to adhere to various surfaces. Polyethylene tapes, on the other hand, are gaining popularity due to their flexibility and environmental benefits. They are often used in applications where a softer and more conformable tape is required.

The market for other materials, such as biodegradable and recycled materials, is also growing as companies seek to reduce their environmental impact. The development of sustainable materials is a key trend in the Opp Packaging Tape market, with manufacturers focusing on creating eco-friendly alternatives to traditional plastic tapes. This shift towards sustainability is driven by consumer demand for greener products and regulatory pressures to reduce plastic waste.

Adhesive Type Analysis

The adhesive type segment of the Opp Packaging Tape market includes acrylic, rubber, and silicone adhesives. Acrylic adhesives are the most commonly used due to their excellent adhesion properties and resistance to aging and UV light. They are suitable for a wide range of applications, including carton sealing and general-purpose packaging. Rubber adhesives, known for their strong initial tack and flexibility, are preferred for applications requiring high bonding strength. Silicone adhesives, although less common, offer superior temperature resistance and are used in specialized applications.

The choice of adhesive type is influenced by factors such as application requirements, environmental conditions, and cost considerations. Manufacturers are investing in research and development to enhance the performance of adhesives and meet the evolving needs of customers. The trend towards high-performance adhesives is expected to continue, driven by the demand for tapes that can withstand extreme conditions and provide reliable sealing solutions.

Application Analysis

The Opp Packaging Tape market is segmented by application into carton sealing, Strapping & bundling, and general-purpose applications. Carton sealing is the largest application segment, driven by the growing demand for secure and efficient packaging solutions in the e-commerce and logistics sectors. The need for reliable sealing solutions to prevent product damage during transit is a key driver for this segment. Strapping and bundling applications are also significant, particularly in industries such as manufacturing and transportation, where secure packaging is essential.

General-purpose applications of Opp Packaging Tapes include a wide range of uses, from household to industrial applications. The versatility of these tapes makes them suitable for various tasks, including repairs, bundling, and temporary fixes. The demand for general-purpose tapes is supported by their affordability and ease of use. As consumer preferences shift towards convenience and efficiency, the market for general-purpose tapes is expected to grow.

End-User Analysis

The end-user segment of the Opp Packaging Tape market includes food & beverage, consumer goods, e-commerce, logistics & transportation, and others. The food & beverage industry is a major end-user, requiring packaging tapes that ensure product safety and integrity. The demand for packaging tapes in this sector is driven by the need for secure sealing solutions that prevent contamination and extend shelf life. The consumer goods sector also represents a significant market, with tapes used for packaging a wide range of products, from electronics to personal care items.

The e-commerce and logistics & transportation sectors are experiencing rapid growth, driven by the increasing demand for efficient and reliable packaging solutions. The rise in online shopping and the need for secure delivery of products are key factors contributing to the demand for Opp Packaging Tapes in these sectors. As the e-commerce industry continues to expand, the demand for packaging tapes is expected to increase, providing significant growth opportunities for market players.

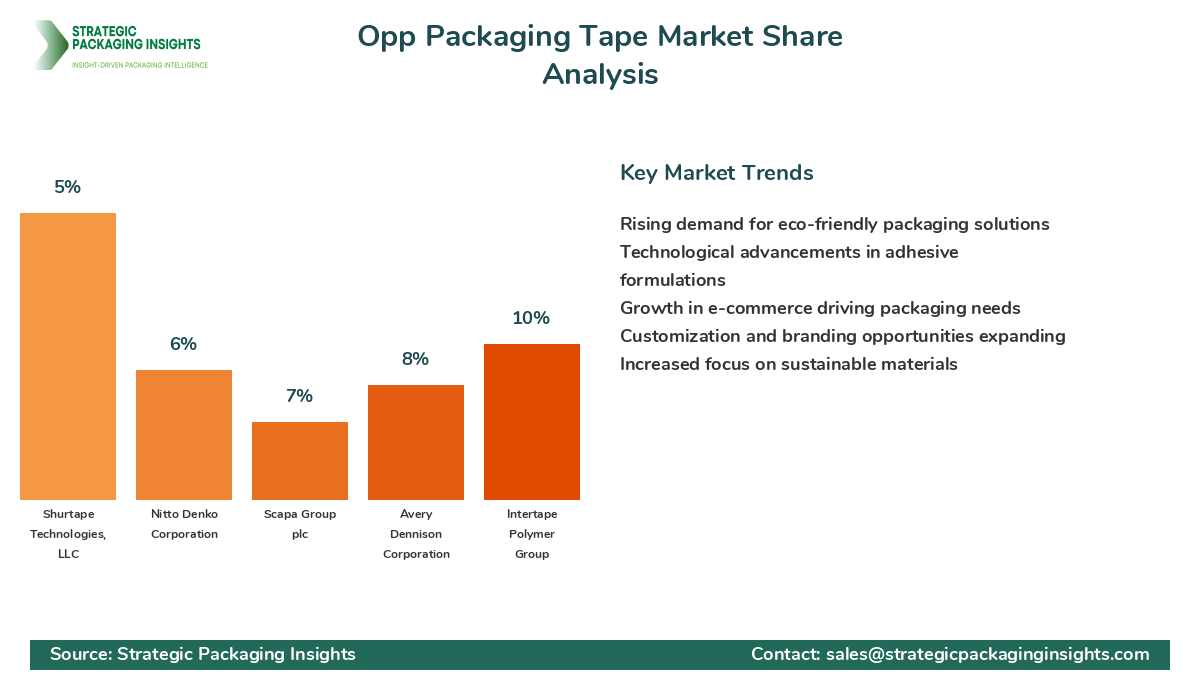

Market Share Analysis

The market share distribution of key players in the Opp Packaging Tape market is influenced by factors such as product innovation, pricing strategies, and distribution networks. Leading companies, such as 3M Company, Tesa SE, and Intertape Polymer Group, hold significant market shares due to their extensive product offerings and strong brand recognition. These companies are focused on expanding their market presence through strategic partnerships and collaborations, as well as investing in research and development to enhance their product portfolios.

Companies that are gaining market share are those that prioritize sustainability and innovation. The development of eco-friendly and high-performance tapes is a key strategy for gaining a competitive edge in the market. On the other hand, companies that fail to adapt to changing market dynamics and consumer preferences may lose market share. The market share distribution also affects pricing strategies, with leading players able to command premium prices for their innovative and high-quality products. Additionally, partnerships and collaborations with distributors and retailers play a crucial role in expanding market reach and enhancing competitive positioning.

Top Countries Insights in Opp Packaging Tape

The United States is a leading market for Opp Packaging Tapes, with a market size of $3 billion and a CAGR of 4%. The growth in this market is driven by the strong presence of e-commerce and logistics industries, as well as the demand for efficient packaging solutions. The focus on sustainability and the development of eco-friendly tapes are also key growth drivers in the U.S. market.

China is another significant market, with a market size of $2.5 billion and a CAGR of 6%. The rapid expansion of the e-commerce sector and the increasing demand for packaging solutions in the manufacturing industry are driving growth in this market. Government initiatives to promote sustainable packaging practices are also contributing to the market's expansion.

Germany, with a market size of $1.8 billion and a CAGR of 5%, is a key market in Europe. The demand for high-quality packaging solutions in the automotive and consumer goods industries is a major growth driver. The focus on sustainability and the development of biodegradable tapes are also influencing market dynamics in Germany.

India, with a market size of $1.5 billion and a CAGR of 7%, is experiencing rapid growth in the Opp Packaging Tape market. The expansion of the e-commerce sector and the increasing demand for packaging solutions in the food and beverage industry are key growth drivers. The government's emphasis on sustainable packaging practices is also contributing to market growth.

Brazil, with a market size of $1.2 billion and a CAGR of 5%, is a growing market for Opp Packaging Tapes. The demand for packaging solutions in the consumer goods and logistics sectors is driving growth in this market. The focus on sustainability and the development of eco-friendly tapes are also key trends in the Brazilian market.

Opp Packaging Tape Market Segments

The Opp Packaging Tape market has been segmented on the basis of

Material Type

- Polypropylene

- Polyethylene

- Others

Adhesive Type

- Acrylic

- Rubber

- Silicone

Application

- Carton Sealing

- Strapping & Bundling

- General Purpose

End-User

- Food & Beverage

- Consumer Goods

- E-commerce

- Logistics & Transportation

- Others

Primary Interview Insights

What are the key drivers for the Opp Packaging Tape market?

How is sustainability impacting the Opp Packaging Tape market?

What challenges does the Opp Packaging Tape market face?

Which regions are experiencing the fastest growth in the Opp Packaging Tape market?

What are the emerging trends in the Opp Packaging Tape market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.