- Home

- Packaging Products

- Metallized Flexible Plastic Packaging Film Market Size, Future Growth and Forecast 2033

Metallized Flexible Plastic Packaging Film Market Size, Future Growth and Forecast 2033

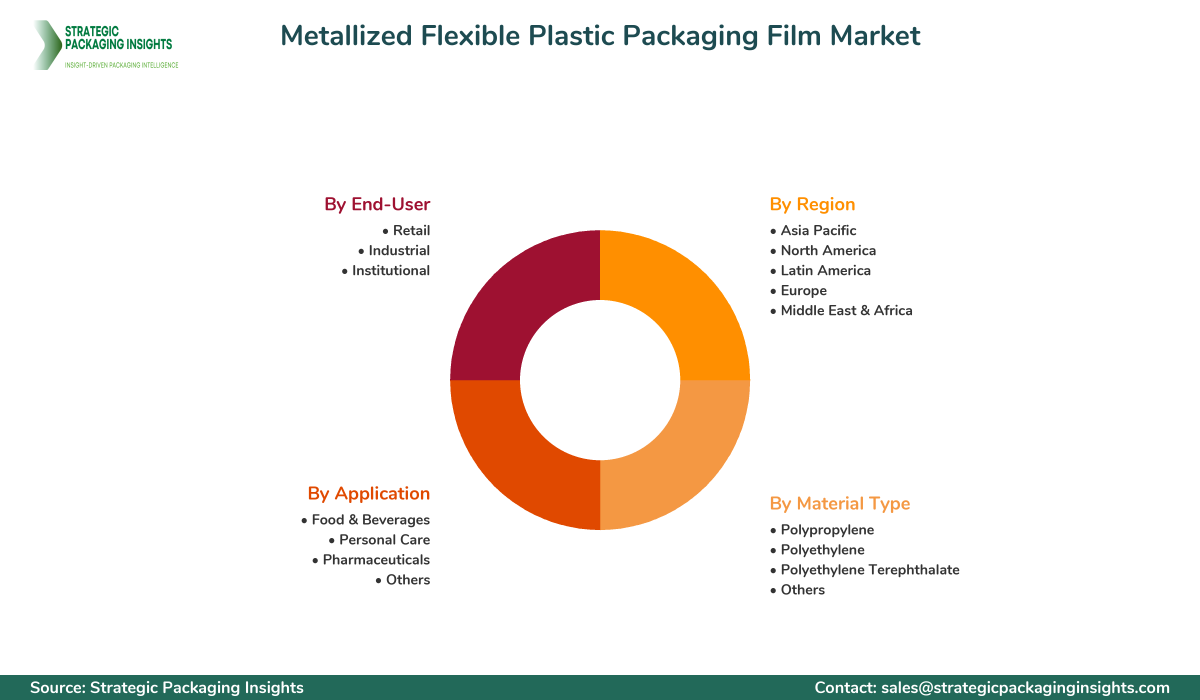

Metallized Flexible Plastic Packaging Film Market Segments - by Material Type (Polypropylene, Polyethylene, Polyethylene Terephthalate, Others), Application (Food & Beverages, Personal Care, Pharmaceuticals, Others), End-User (Retail, Industrial, Institutional), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Metallized Flexible Plastic Packaging Film Market Outlook

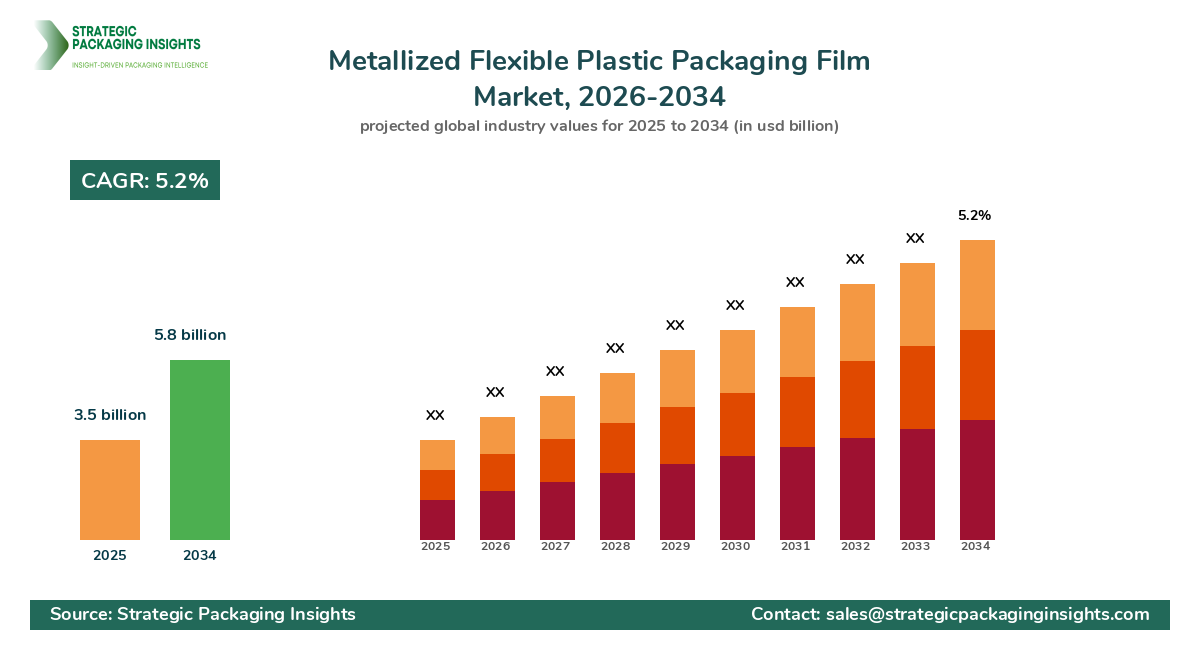

The metallized flexible Plastic Packaging film market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033. This market is driven by the increasing demand for lightweight and durable packaging solutions across various industries, including food and beverages, personal care, and pharmaceuticals. The versatility of metallized films, which offer superior barrier properties against moisture, light, and oxygen, makes them an attractive choice for manufacturers looking to extend the shelf life of their products. Additionally, the growing trend towards sustainable and recyclable packaging materials is further propelling the market growth, as metallized films can be produced with reduced material usage and energy consumption.

However, the market faces certain challenges, such as the high cost of raw materials and the complex manufacturing processes involved in producing metallized films. Regulatory restrictions on the use of certain plastics and environmental concerns related to plastic waste are also potential restraints. Despite these challenges, the market holds significant growth potential, driven by technological advancements in film production and the increasing adoption of Flexible Packaging solutions in emerging economies. The development of bio-based and biodegradable metallized films presents new opportunities for market players to cater to the growing demand for eco-friendly packaging solutions.

Report Scope

| Attributes | Details |

| Report Title | Metallized Flexible Plastic Packaging Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 197 |

| Material Type | Polypropylene, Polyethylene, Polyethylene Terephthalate, Others |

| Application | Food & Beverages, Personal Care, Pharmaceuticals, Others |

| End-User | Retail, Industrial, Institutional |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The metallized flexible plastic Packaging Film market is poised for substantial growth, driven by several key opportunities. One of the primary opportunities lies in the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable and have a lower environmental impact. Metallized films, with their ability to reduce material usage and energy consumption during production, align well with this trend. Additionally, the development of bio-based and biodegradable metallized films offers a promising avenue for market expansion, as these materials can further enhance the sustainability profile of packaging solutions.

Another significant opportunity for the market is the rising demand for convenience and ready-to-eat food products. As lifestyles become busier, consumers are increasingly seeking packaging solutions that offer convenience and ease of use. Metallized films, with their excellent barrier properties and lightweight nature, are ideal for packaging a wide range of food products, including snacks, confectionery, and ready-to-eat meals. The growing popularity of e-commerce and online food delivery services further boosts the demand for flexible packaging solutions, as these platforms require packaging materials that can withstand the rigors of transportation and handling.

Despite the promising opportunities, the metallized Flexible Plastic packaging film market faces certain threats that could hinder its growth. One of the primary challenges is the volatility in raw material prices, which can impact the cost of production and, subsequently, the pricing of finished products. Additionally, stringent regulations on the use of certain plastics and environmental concerns related to plastic waste pose significant challenges for market players. Companies need to invest in research and development to create innovative solutions that comply with regulatory standards and address environmental concerns. The competitive landscape is also intensifying, with numerous players vying for market share, which could lead to pricing pressures and reduced profit margins.

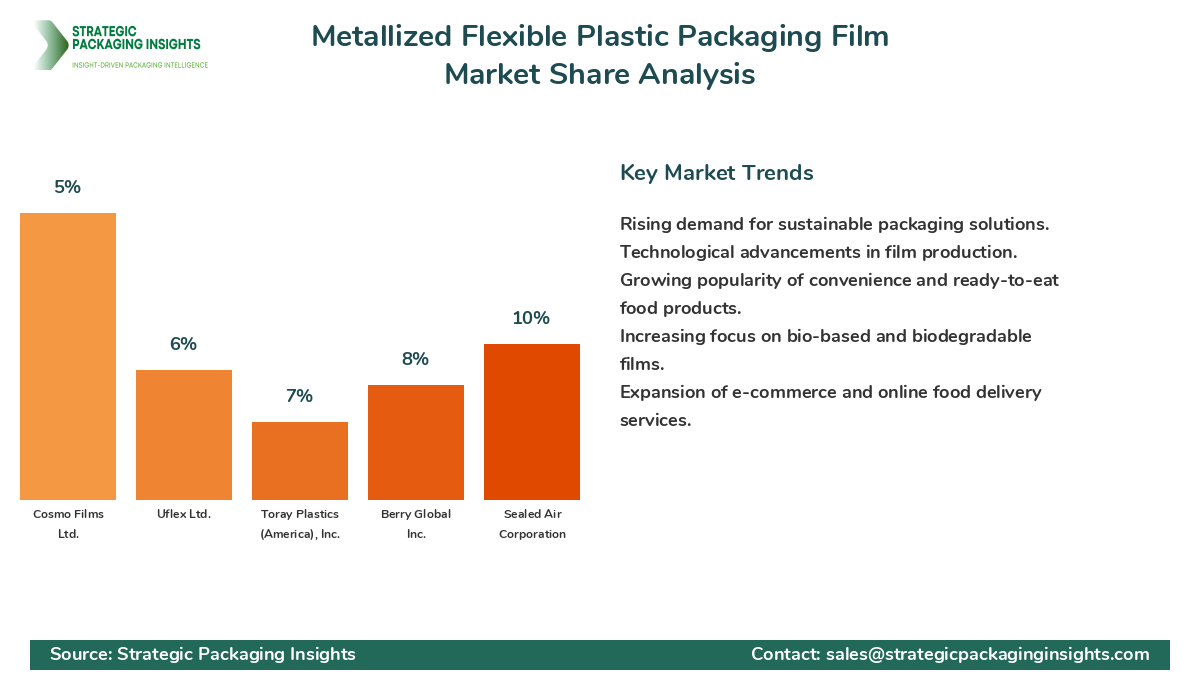

The metallized flexible plastic packaging film market is characterized by a highly competitive landscape, with numerous players striving to capture market share. The market is dominated by a mix of established players and emerging companies, each offering a diverse range of products and solutions. The competitive dynamics are influenced by factors such as product innovation, pricing strategies, and distribution networks. Companies are increasingly focusing on expanding their product portfolios and enhancing their production capabilities to meet the growing demand for metallized films across various industries.

Among the key players in the market, Amcor Limited holds a significant market share, driven by its extensive product offerings and strong global presence. The company is known for its innovative packaging solutions and commitment to sustainability, which have helped it maintain a competitive edge. Another major player, Mondi Group, is recognized for its comprehensive range of flexible packaging solutions, including metallized films. The company's focus on research and development and its strategic acquisitions have enabled it to strengthen its market position.

Sealed Air Corporation is another prominent player in the metallized flexible plastic packaging film market. The company is renowned for its Advanced Packaging technologies and solutions that cater to a wide range of industries. With a strong emphasis on sustainability and innovation, Sealed Air Corporation continues to expand its market presence. Additionally, Berry Global Inc. is a key player known for its diverse product portfolio and extensive distribution network. The company's strategic partnerships and acquisitions have further bolstered its market position.

Other notable companies in the market include Toray Plastics (America), Inc., Uflex Ltd., and Cosmo Films Ltd. These companies are actively engaged in product development and innovation to cater to the evolving needs of consumers and industries. The competitive landscape is further enriched by the presence of regional players who offer specialized solutions tailored to local market demands. As the market continues to evolve, companies are likely to focus on strategic collaborations and partnerships to enhance their market reach and strengthen their competitive position.

Key Highlights Metallized Flexible Plastic Packaging Film Market

- The market is projected to grow at a CAGR of 5.2% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Technological advancements in film production are enhancing product quality and performance.

- The food and beverage industry is a major end-user of metallized flexible plastic packaging films.

- Asia Pacific is expected to witness significant growth due to rising consumer demand and industrialization.

- Volatility in raw material prices poses a challenge to market players.

- Regulatory restrictions on plastics are influencing market dynamics.

- Companies are focusing on product innovation and strategic partnerships to gain a competitive edge.

- The development of bio-based and biodegradable films presents new growth opportunities.

- The market is characterized by intense competition among key players.

Top Countries Insights in Metallized Flexible Plastic Packaging Film

The United States is a leading market for metallized flexible plastic packaging films, with a market size of approximately $1.2 billion and a CAGR of 4%. The country's strong demand is driven by the food and beverage industry's need for high-quality packaging solutions that offer extended shelf life and product protection. Additionally, the growing trend towards sustainable packaging is encouraging manufacturers to adopt metallized films. However, regulatory challenges related to plastic usage and waste management remain a concern for market players.

China is another significant market, with a market size of $1 billion and a CAGR of 6%. The country's rapid industrialization and urbanization are driving the demand for flexible packaging solutions. The food and beverage sector, in particular, is a major contributor to market growth, as consumers increasingly seek convenient and ready-to-eat food products. Government initiatives promoting sustainable packaging practices are also supporting market expansion.

India, with a market size of $800 million and a CAGR of 7%, is experiencing robust growth in the metallized flexible plastic packaging film market. The country's expanding middle class and increasing disposable incomes are fueling demand for packaged food products, thereby boosting the need for flexible packaging solutions. The government's focus on reducing plastic waste and promoting eco-friendly packaging materials is further propelling market growth.

Germany, with a market size of $600 million and a CAGR of 3%, is a key player in the European market. The country's strong emphasis on sustainability and environmental protection is driving the adoption of metallized films. The food and beverage industry is a major end-user, with manufacturers seeking packaging solutions that offer superior barrier properties and reduce material usage.

Brazil, with a market size of $500 million and a CAGR of 5%, is a growing market for metallized flexible plastic packaging films. The country's expanding food and beverage industry, coupled with increasing consumer awareness of sustainable packaging, is driving demand. However, economic challenges and regulatory hurdles related to plastic usage pose potential obstacles to market growth.

Value Chain Profitability Analysis

The value chain of the metallized flexible plastic packaging film market involves several key stakeholders, each contributing to the overall profitability of the industry. The primary stages of the value chain include raw material suppliers, film manufacturers, converters, distributors, and end-users. Raw material suppliers provide essential inputs such as polymers and metallized coatings, which are critical for film production. The cost structure at this stage is influenced by the volatility of raw material prices, which can impact the overall profitability of the value chain.

Film manufacturers play a crucial role in the value chain, as they are responsible for producing metallized films with specific properties and characteristics. The profitability at this stage is determined by factors such as production efficiency, technological advancements, and economies of scale. Manufacturers that invest in advanced production technologies and sustainable practices can achieve higher profit margins by reducing material usage and energy consumption.

Converters are responsible for transforming metallized films into finished packaging products that meet the specific requirements of end-users. This stage of the value chain involves processes such as printing, laminating, and cutting, which add value to the final product. The profitability of converters is influenced by their ability to offer customized solutions and maintain high-quality standards. Efficient supply chain management and strategic partnerships with distributors and end-users can enhance profitability at this stage.

Distributors play a vital role in the value chain by ensuring the timely delivery of packaging products to end-users. Their profitability is influenced by factors such as distribution network efficiency, inventory management, and customer service. Distributors that can offer value-added services, such as technical support and logistics solutions, can capture a larger share of the market value.

End-users, including industries such as food and beverages, personal care, and pharmaceuticals, are the final consumers of metallized flexible plastic packaging films. Their demand for high-quality, sustainable packaging solutions drives the overall profitability of the value chain. End-users that prioritize sustainability and innovation in their packaging choices can benefit from enhanced brand reputation and customer loyalty.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The metallized flexible plastic packaging film market has undergone significant changes between 2018 and 2024, with evolving market dynamics shaping the industry's trajectory. During this period, the market experienced steady growth, driven by increasing demand for flexible packaging solutions across various industries. The CAGR for this period was approximately 4.5%, with a market size evolution from $2.8 billion in 2018 to $3.5 billion in 2024. The segment distribution shifted towards sustainable and recyclable packaging materials, as consumers and industries prioritized environmental concerns.

Technological advancements played a crucial role in enhancing the quality and performance of metallized films, with innovations in film production and coating technologies driving market growth. The regional contribution also witnessed changes, with Asia Pacific emerging as a key growth region due to rapid industrialization and rising consumer demand. The client demand transformation was characterized by a growing preference for convenience and ready-to-eat food products, which boosted the demand for flexible packaging solutions.

Looking ahead to the forecast period of 2025–2033, the market is expected to experience accelerated growth, with a projected CAGR of 5.2%. The market size is anticipated to reach $5.8 billion by 2033, driven by continued demand for sustainable packaging solutions and technological advancements. The segment distribution is expected to further shift towards bio-based and biodegradable films, as companies invest in research and development to meet regulatory standards and consumer preferences.

The regional contribution is likely to see significant growth in emerging economies, particularly in Asia Pacific and Latin America, where rising disposable incomes and urbanization are driving demand for packaged food products. The technological impact factors will continue to shape the market, with innovations in film production and digital transformation enhancing product quality and efficiency. The client demand transformation is expected to focus on sustainability and convenience, with consumers seeking packaging solutions that align with their environmental values and lifestyle preferences.

Metallized Flexible Plastic Packaging Film Market Segments Insights

Material Type Analysis

The metallized flexible plastic packaging film market is segmented by material type, with key materials including polypropylene, polyethylene, polyethylene terephthalate, and others. Polypropylene is a widely used material due to its excellent barrier properties, lightweight nature, and cost-effectiveness. It is favored in applications where moisture and oxygen barrier properties are critical, such as in food packaging. The demand for polypropylene films is driven by their versatility and ability to be easily metallized, making them suitable for a wide range of packaging applications.

Polyethylene, another key material, is known for its flexibility, durability, and resistance to chemicals. It is commonly used in applications where strength and puncture resistance are essential, such as in industrial and institutional packaging. The demand for polyethylene films is supported by their ability to provide a strong barrier against moisture and contaminants, making them ideal for packaging products that require extended shelf life.

Polyethylene terephthalate (PET) is a popular choice for metallized films due to its excellent clarity, strength, and barrier properties. It is widely used in applications where visual appeal and product protection are important, such as in personal care and Pharmaceutical Packaging. The demand for PET films is driven by their recyclability and ability to be easily metallized, making them a preferred choice for sustainable packaging solutions.

Application Analysis

The metallized flexible plastic packaging film market is segmented by application, with key applications including food and beverages, personal care, pharmaceuticals, and others. The food and beverage industry is a major end-user of metallized films, as these materials offer superior barrier properties that help extend the shelf life of perishable products. The demand for metallized films in this segment is driven by the growing popularity of convenience and ready-to-eat food products, as well as the increasing focus on sustainable packaging solutions.

In the personal care industry, metallized films are used for packaging products such as cosmetics, toiletries, and skincare items. The demand for metallized films in this segment is driven by their ability to provide a high-quality, visually appealing packaging solution that enhances brand image and product differentiation. The growing trend towards premium and luxury personal care products is further boosting the demand for metallized films in this segment.

The pharmaceutical industry is another key application area for metallized films, as these materials offer excellent barrier properties that protect sensitive products from moisture, light, and oxygen. The demand for metallized films in this segment is driven by the need for high-quality packaging solutions that ensure product safety and efficacy. The increasing focus on patient safety and regulatory compliance is further supporting the demand for metallized films in the pharmaceutical industry.

End-User Analysis

The metallized flexible plastic packaging film market is segmented by end-user, with key end-users including retail, industrial, and institutional sectors. The retail sector is a major consumer of metallized films, as these materials offer an attractive and functional packaging solution for a wide range of consumer products. The demand for metallized films in the retail sector is driven by the growing popularity of e-commerce and online shopping, which require packaging materials that can withstand the rigors of transportation and handling.

In the industrial sector, metallized films are used for packaging products such as chemicals, electronics, and automotive components. The demand for metallized films in this segment is driven by their ability to provide a strong barrier against moisture, dust, and contaminants, ensuring product protection and integrity. The increasing focus on sustainability and environmental responsibility is also driving the demand for metallized films in the industrial sector, as companies seek to reduce their environmental footprint.

The institutional sector, which includes healthcare, education, and government organizations, is another key end-user of metallized films. The demand for metallized films in this segment is driven by the need for high-quality, durable packaging solutions that meet specific regulatory and safety requirements. The growing emphasis on sustainability and cost-effectiveness is further supporting the demand for metallized films in the institutional sector.

Regional Analysis

The metallized flexible plastic packaging film market is segmented by region, with key regions including Asia Pacific, North America, Latin America, Europe, and the Middle East & Africa. Asia Pacific is expected to witness significant growth during the forecast period, driven by rapid industrialization, urbanization, and rising consumer demand for packaged food products. The region's strong manufacturing base and favorable government policies supporting sustainable packaging practices are further propelling market growth.

North America is another key region for the metallized flexible plastic packaging film market, with a strong demand for high-quality packaging solutions across various industries. The region's focus on sustainability and innovation is driving the adoption of metallized films, as companies seek to enhance their environmental credentials and meet consumer expectations. The growing popularity of e-commerce and online food delivery services is also boosting the demand for flexible packaging solutions in North America.

Europe is a mature market for metallized flexible plastic packaging films, with a strong emphasis on sustainability and environmental protection. The region's stringent regulatory framework and consumer demand for eco-friendly packaging solutions are driving the adoption of metallized films. The food and beverage industry is a major end-user in Europe, with manufacturers seeking packaging solutions that offer superior barrier properties and reduce material usage.

Metallized Flexible Plastic Packaging Film Market Segments

The Metallized Flexible Plastic Packaging Film market has been segmented on the basis of

Material Type

- Polypropylene

- Polyethylene

- Polyethylene Terephthalate

- Others

Application

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Others

End-User

- Retail

- Industrial

- Institutional

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the metallized flexible plastic packaging film market?

What challenges does the market face?

Which regions are expected to witness significant growth?

How are companies addressing sustainability concerns?

What role does technology play in the market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.