- Home

- Packaging Products

- Machine Finished Paper Market Size, Future Growth and Forecast 2033

Machine Finished Paper Market Size, Future Growth and Forecast 2033

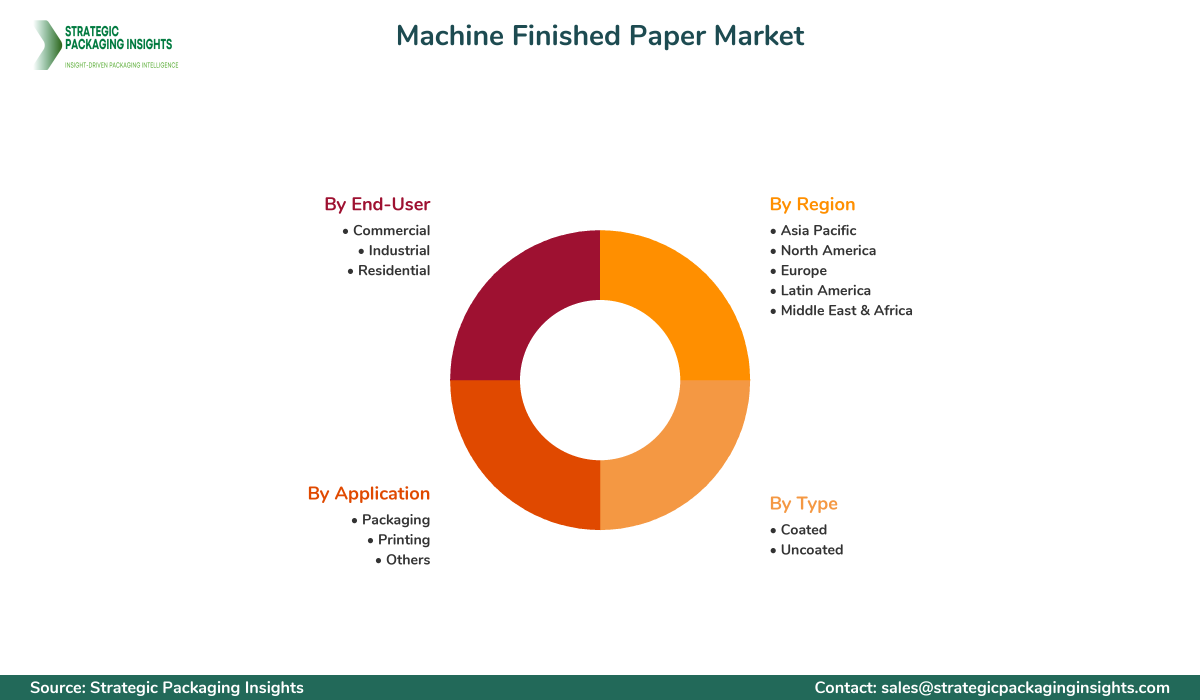

Machine Finished Paper Market Segments - by Type (Coated, Uncoated), Application (Packaging, Printing, Others), End-User (Commercial, Industrial, Residential), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Machine Finished Paper Market Outlook

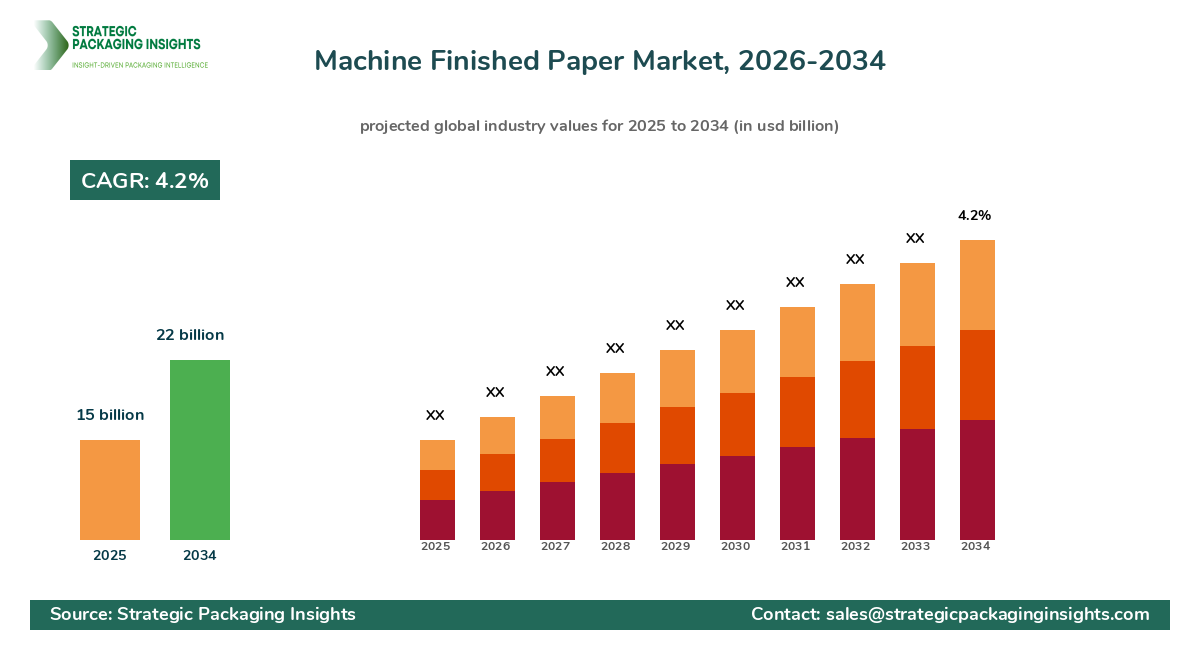

The machine finished paper market was valued at $15 billion in 2024 and is projected to reach $22 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and Recyclable Packaging solutions, as well as the growing e-commerce industry which requires efficient and cost-effective packaging materials. The versatility of machine finished paper, which can be used in various applications such as packaging, printing, and labeling, further fuels its demand. Additionally, advancements in paper manufacturing technologies have enhanced the quality and performance of machine finished paper, making it a preferred choice for many industries.

Report Scope

| Attributes | Details |

| Report Title | Machine Finished Paper Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 232 |

| Type | Coated, Uncoated |

| Application | Packaging, Printing, Others |

| End-User | Commercial, Industrial, Residential |

| Region | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the machine finished paper market is the rising consumer preference for eco-friendly and Biodegradable Packaging solutions. As environmental concerns continue to grow, consumers and businesses alike are seeking sustainable alternatives to traditional packaging materials. Machine finished paper, being recyclable and biodegradable, fits well into this trend, offering a viable solution for companies looking to reduce their environmental footprint. Furthermore, the increasing penetration of e-commerce and online retailing presents a substantial opportunity for the machine finished paper market, as these sectors require efficient and Sustainable Packaging solutions to meet the demands of shipping and logistics.

Another opportunity lies in the technological advancements in paper manufacturing processes. Innovations in production techniques have led to the development of high-quality machine finished paper with enhanced strength, printability, and aesthetic appeal. These advancements enable manufacturers to cater to a broader range of applications, including premium packaging and high-end printing, thereby expanding their market reach. Additionally, the growing trend of digital printing is expected to drive the demand for machine finished paper, as it offers excellent print quality and compatibility with digital printing technologies.

However, the machine finished paper market faces certain restraints, such as the volatility in raw material prices. The cost of pulp, a primary raw material for paper production, is subject to fluctuations due to factors like supply chain disruptions and changes in demand. These price variations can impact the profitability of paper manufacturers and pose a challenge to market growth. Moreover, the increasing competition from alternative packaging materials, such as plastics and composites, presents a threat to the machine finished paper market. These materials often offer superior performance characteristics, such as moisture resistance and durability, which can limit the adoption of machine finished paper in certain applications.

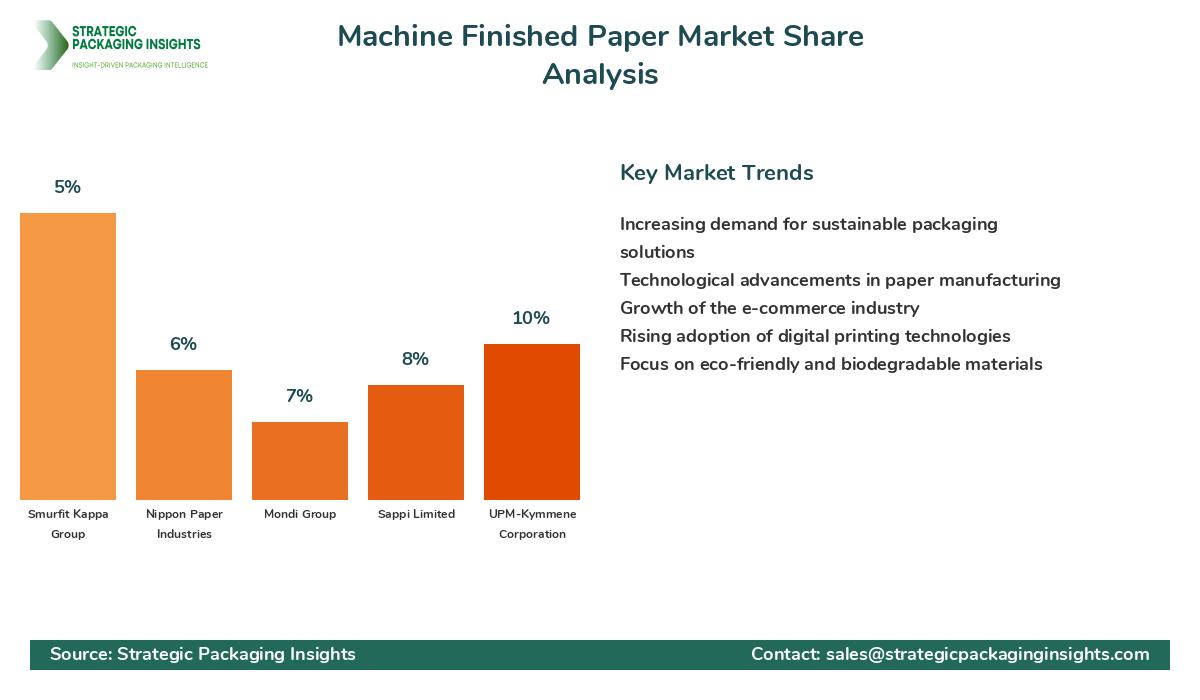

The machine finished paper market is characterized by a competitive landscape with several key players vying for market share. Companies in this market are focusing on strategic initiatives such as mergers and acquisitions, product innovations, and capacity expansions to strengthen their market position. The competitive rivalry is intense, with players striving to differentiate their offerings through quality, sustainability, and cost-effectiveness. The market is also witnessing collaborations and partnerships between paper manufacturers and end-users to develop customized solutions that meet specific requirements.

Leading companies in the machine finished paper market include International Paper, Stora Enso, UPM-Kymmene Corporation, Sappi Limited, and Mondi Group. International Paper is a prominent player with a significant market share, known for its extensive product portfolio and strong distribution network. Stora Enso, another key player, focuses on sustainability and innovation, offering a range of eco-friendly paper products. UPM-Kymmene Corporation is recognized for its advanced manufacturing technologies and commitment to environmental responsibility.

Sappi Limited is a global leader in the production of high-quality paper products, with a focus on innovation and customer-centric solutions. Mondi Group is known for its integrated approach to paper production, offering a wide range of machine finished paper products for various applications. These companies, along with others, are investing in research and development to enhance product quality and expand their market presence.

Other notable players in the market include Nippon Paper Industries, Smurfit Kappa Group, DS Smith, Nine Dragons Paper Holdings, and Oji Holdings Corporation. Nippon Paper Industries is a key player in the Asian market, known for its diverse product offerings and strong customer relationships. Smurfit Kappa Group is a leading provider of sustainable packaging solutions, with a focus on innovation and customer satisfaction. DS Smith is recognized for its commitment to sustainability and circular economy principles, offering a range of recyclable paper products.

Key Highlights Machine Finished Paper Market

- The machine finished paper market is projected to grow at a CAGR of 4.2% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Technological advancements in paper manufacturing are enhancing product quality and performance.

- The e-commerce industry's growth is boosting demand for efficient packaging materials.

- Volatility in raw material prices poses a challenge to market growth.

- Competition from alternative packaging materials is a potential threat to the market.

- Key players are focusing on strategic initiatives to strengthen their market position.

- Collaborations and partnerships are driving innovation and customized solutions.

- Asia Pacific is expected to be the fastest-growing region in the machine finished paper market.

- Environmental concerns are leading to increased adoption of eco-friendly paper products.

Competitive Intelligence

The machine finished paper market is dominated by several key players who are actively engaged in strategic initiatives to maintain their competitive edge. International Paper, with its extensive product portfolio and strong distribution network, holds a significant market share. The company focuses on sustainability and innovation, offering a range of eco-friendly paper products. Stora Enso is another major player, known for its commitment to sustainability and advanced manufacturing technologies. The company offers a wide range of machine finished paper products, catering to various applications.

UPM-Kymmene Corporation is recognized for its innovative approach to paper production, with a focus on environmental responsibility. The company has a strong presence in the global market, offering high-quality paper products for diverse applications. Sappi Limited is a global leader in the production of premium paper products, with a focus on innovation and customer-centric solutions. The company is investing in research and development to enhance product quality and expand its market presence.

Mondi Group is known for its integrated approach to paper production, offering a wide range of machine finished paper products for various applications. The company is focused on sustainability and innovation, providing eco-friendly solutions to meet the growing demand for sustainable packaging. Nippon Paper Industries is a key player in the Asian market, known for its diverse product offerings and strong customer relationships. The company is investing in advanced manufacturing technologies to enhance product quality and performance.

Smurfit Kappa Group is a leading provider of sustainable packaging solutions, with a focus on innovation and customer satisfaction. The company offers a range of recyclable paper products, catering to the growing demand for eco-friendly packaging. DS Smith is recognized for its commitment to sustainability and circular economy principles, offering a range of recyclable paper products. The company is focused on innovation and customer-centric solutions, driving growth in the machine finished paper market.

Regional Market Intelligence of Machine Finished Paper

The global machine finished paper market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major paper manufacturers. The region is expected to witness steady growth, supported by advancements in paper manufacturing technologies and the growing e-commerce industry.

In Europe, the machine finished paper market is characterized by a strong focus on sustainability and environmental responsibility. The region is home to several leading paper manufacturers who are investing in research and development to enhance product quality and performance. The market is expected to grow at a moderate pace, driven by the increasing adoption of eco-friendly packaging solutions and the growing demand for high-quality paper products.

The Asia-Pacific region is expected to be the fastest-growing market for machine finished paper, driven by the rapid industrialization and urbanization in countries like China and India. The region is witnessing a surge in demand for sustainable packaging solutions, supported by government initiatives promoting environmental sustainability. The growing e-commerce industry and the increasing adoption of digital printing technologies are also contributing to market growth in this region.

In Latin America, the machine finished paper market is driven by the increasing demand for packaging materials in the food and beverage industry. The region is expected to witness moderate growth, supported by the growing focus on sustainability and the adoption of eco-friendly packaging solutions. The Middle East & Africa region is characterized by a growing demand for paper products in the packaging and printing industries. The market is expected to grow at a steady pace, driven by the increasing adoption of sustainable packaging solutions and the growing e-commerce industry.

Top Countries Insights in Machine Finished Paper

In the machine finished paper market, China is a leading country with a market size of $3.5 billion and a CAGR of 6%. The country's rapid industrialization and urbanization are driving the demand for sustainable packaging solutions. Government initiatives promoting environmental sustainability and the growing e-commerce industry are also contributing to market growth.

United States is another key market, with a market size of $2.8 billion and a CAGR of 4%. The country's focus on sustainability and the presence of major paper manufacturers are driving market growth. The growing demand for eco-friendly packaging solutions and advancements in paper manufacturing technologies are also contributing to market expansion.

In Germany, the machine finished paper market is valued at $1.5 billion with a CAGR of 3%. The country's strong focus on sustainability and environmental responsibility is driving the demand for eco-friendly paper products. The presence of leading paper manufacturers and the growing adoption of digital printing technologies are also contributing to market growth.

India is witnessing significant growth in the machine finished paper market, with a market size of $1.2 billion and a CAGR of 7%. The country's rapid industrialization and urbanization are driving the demand for sustainable packaging solutions. Government initiatives promoting environmental sustainability and the growing e-commerce industry are also contributing to market growth.

In Brazil, the machine finished paper market is valued at $0.8 billion with a CAGR of 5%. The country's growing focus on sustainability and the adoption of eco-friendly packaging solutions are driving market growth. The increasing demand for packaging materials in the food and beverage industry is also contributing to market expansion.

Machine Finished Paper Market Segments Insights

Type Analysis

The machine finished paper market is segmented into coated and uncoated types. Coated machine finished paper is gaining popularity due to its enhanced printability and aesthetic appeal, making it suitable for high-quality printing applications. The demand for coated paper is driven by the growing trend of digital printing and the increasing need for premium packaging solutions. Manufacturers are focusing on developing innovative coating technologies to enhance the performance and quality of coated machine finished paper.

Uncoated machine finished paper, on the other hand, is preferred for its cost-effectiveness and versatility. It is widely used in applications such as packaging, labeling, and printing, where high print quality is not a primary requirement. The demand for uncoated paper is driven by the growing e-commerce industry and the increasing adoption of sustainable packaging solutions. Manufacturers are investing in advanced production technologies to improve the quality and performance of uncoated machine finished paper.

Application Analysis

The machine finished paper market is segmented by application into packaging, printing, and others. The packaging segment is the largest application segment, driven by the increasing demand for sustainable and recyclable packaging solutions. The growing e-commerce industry and the need for efficient packaging materials are contributing to the growth of this segment. Manufacturers are focusing on developing innovative packaging solutions to meet the evolving needs of consumers and businesses.

The printing segment is also witnessing significant growth, driven by the increasing adoption of digital printing technologies. Machine finished paper offers excellent print quality and compatibility with digital printing, making it a preferred choice for high-quality printing applications. The demand for machine finished paper in the printing segment is further supported by the growing trend of personalized and customized printing solutions.

End-User Analysis

The machine finished paper market is segmented by end-user into commercial, industrial, and residential. The commercial segment is the largest end-user segment, driven by the increasing demand for high-quality printing and packaging solutions. The growing e-commerce industry and the need for efficient packaging materials are contributing to the growth of this segment. Manufacturers are focusing on developing innovative solutions to meet the evolving needs of commercial end-users.

The industrial segment is also witnessing significant growth, driven by the increasing demand for sustainable and recyclable packaging solutions. The growing focus on environmental sustainability and the adoption of eco-friendly packaging materials are contributing to the growth of this segment. Manufacturers are investing in advanced production technologies to enhance the quality and performance of machine finished paper for industrial applications.

Region Analysis

The machine finished paper market is segmented by region into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. Asia Pacific is the largest and fastest-growing region, driven by the rapid industrialization and urbanization in countries like China and India. The region is witnessing a surge in demand for sustainable packaging solutions, supported by government initiatives promoting environmental sustainability.

North America and Europe are also significant markets for machine finished paper, driven by the increasing demand for eco-friendly packaging solutions and the presence of major paper manufacturers. The growing e-commerce industry and advancements in paper manufacturing technologies are contributing to market growth in these regions. Latin America and Middle East & Africa are witnessing moderate growth, driven by the increasing adoption of sustainable packaging solutions and the growing demand for paper products in the packaging and printing industries.

Market Share Analysis

The machine finished paper market is characterized by a competitive landscape with several key players vying for market share. International Paper, Stora Enso, UPM-Kymmene Corporation, Sappi Limited, and Mondi Group are among the leading companies in the market. These companies are focusing on strategic initiatives such as mergers and acquisitions, product innovations, and capacity expansions to strengthen their market position. The competitive rivalry is intense, with players striving to differentiate their offerings through quality, sustainability, and cost-effectiveness. The market is also witnessing collaborations and partnerships between paper manufacturers and end-users to develop customized solutions that meet specific requirements. The market share distribution affects pricing, innovation, and partnerships, with leading companies setting industry standards and influencing market trends.

Machine Finished Paper Market Segments

The Machine Finished Paper market has been segmented on the basis of

Type

- Coated

- Uncoated

Application

- Packaging

- Printing

- Others

End-User

- Commercial

- Industrial

- Residential

Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the machine finished paper market?

What challenges does the machine finished paper market face?

How are companies in the machine finished paper market addressing sustainability?

Which regions are expected to see the most growth in the machine finished paper market?

What role does digital printing play in the machine finished paper market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.