- Home

- Packaging Products

- Front And Back Labelers Market Size, Future Growth and Forecast 2033

Front And Back Labelers Market Size, Future Growth and Forecast 2033

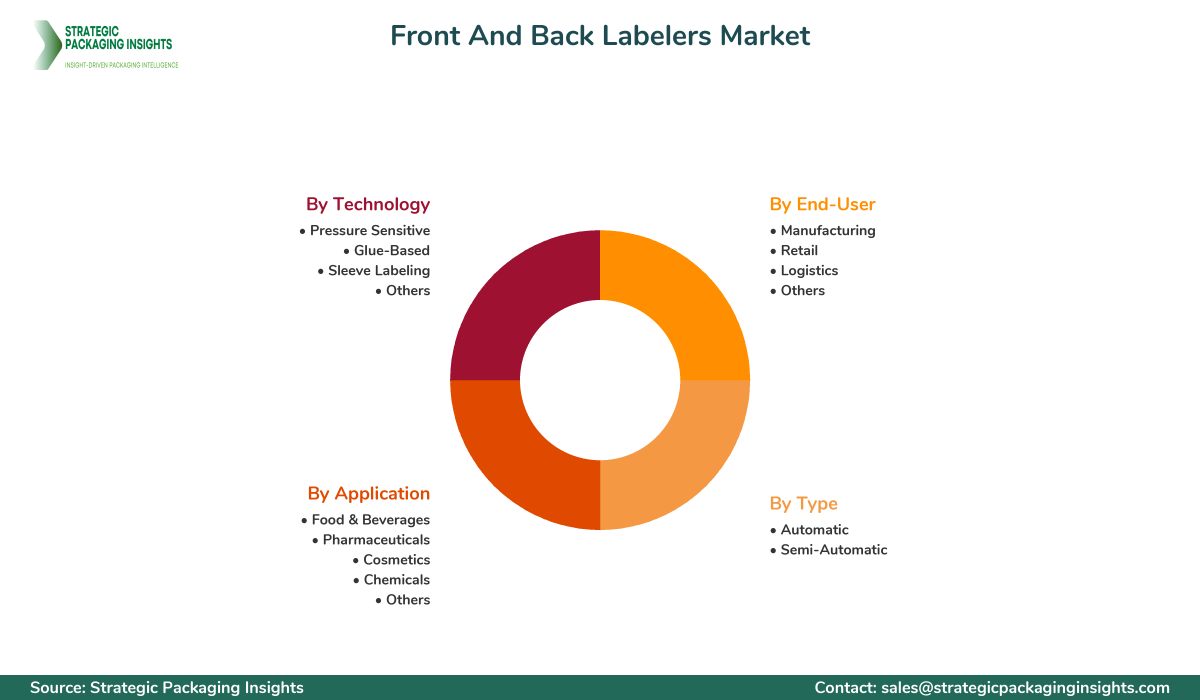

Front And Back Labelers Market Segments - by Type (Automatic, Semi-Automatic), Application (Food & Beverages, Pharmaceuticals, Cosmetics, Chemicals, Others), Technology (Pressure Sensitive, Glue-Based, Sleeve Labeling, Others), End-User (Manufacturing, Retail, Logistics, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Front And Back Labelers Market Outlook

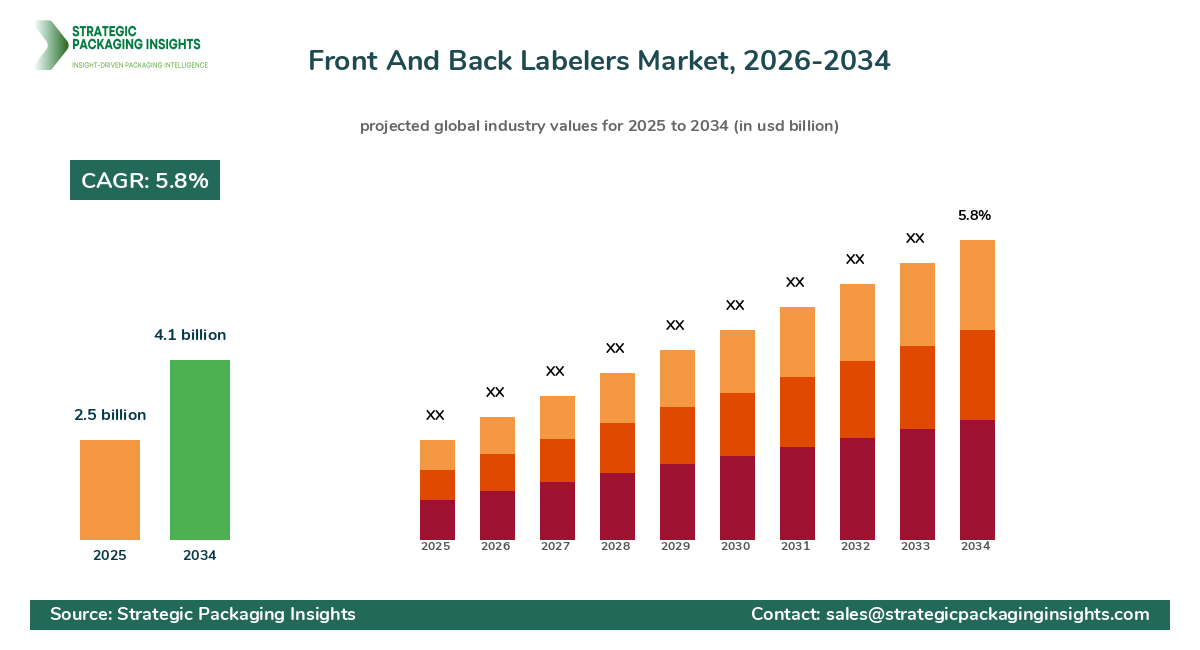

The Front and Back Labelers market was valued at $2.5 billion in 2024 and is projected to reach $4.1 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033. This market is witnessing significant growth due to the increasing demand for efficient labeling solutions across various industries such as food and beverages, pharmaceuticals, and cosmetics. The need for precise and high-speed labeling to enhance product presentation and compliance with labeling regulations is driving the adoption of advanced labeling technologies. Additionally, the rise in automation in manufacturing processes is further propelling the market growth, as companies seek to improve operational efficiency and reduce labor costs.

However, the market faces challenges such as high initial investment costs and the need for regular maintenance of labeling equipment. Regulatory constraints related to labeling standards and environmental concerns regarding the use of certain labeling materials also pose potential restraints. Despite these challenges, the market holds substantial growth potential, driven by technological advancements in labeling machines, such as the integration of IoT and AI for enhanced functionality and real-time monitoring. The increasing trend of customization and personalization in product labeling is also expected to create new opportunities for market players.

Report Scope

| Attributes | Details |

| Report Title | Front And Back Labelers Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 204 |

| Type | Automatic, Semi-Automatic |

| Application | Food & Beverages, Pharmaceuticals, Cosmetics, Chemicals, Others |

| Technology | Pressure Sensitive, Glue-Based, Sleeve Labeling, Others |

| End-User | Manufacturing, Retail, Logistics, Others |

| Customization Available | Yes* |

Opportunities & Threats

The Front and Back Labelers market presents numerous opportunities, particularly with the growing trend of automation in the packaging industry. As manufacturers strive to enhance productivity and reduce operational costs, the demand for automated labeling solutions is on the rise. This trend is further supported by advancements in technology, such as the integration of IoT and AI, which enable real-time monitoring and predictive maintenance of labeling equipment. Additionally, the increasing focus on sustainability and eco-friendly packaging solutions is driving the demand for innovative labeling technologies that minimize waste and energy consumption.

Another significant opportunity lies in the expanding e-commerce sector, which is driving the need for efficient and accurate labeling solutions to manage the high volume of packages. The rise of online retail has led to an increased demand for labeling machines that can handle diverse packaging formats and sizes, ensuring that products are accurately labeled and tracked throughout the supply chain. Furthermore, the growing trend of product customization and personalization is creating new avenues for market growth, as consumers seek unique and tailored labeling solutions that enhance brand identity and consumer engagement.

Despite these opportunities, the market faces certain threats, including the high initial investment costs associated with advanced labeling equipment. Small and medium-sized enterprises may find it challenging to invest in state-of-the-art labeling technologies due to budget constraints. Additionally, the market is subject to stringent regulatory standards related to labeling accuracy and environmental impact, which can pose compliance challenges for manufacturers. The need for regular maintenance and technical expertise to operate and troubleshoot advanced labeling machines also adds to the operational costs, potentially hindering market growth.

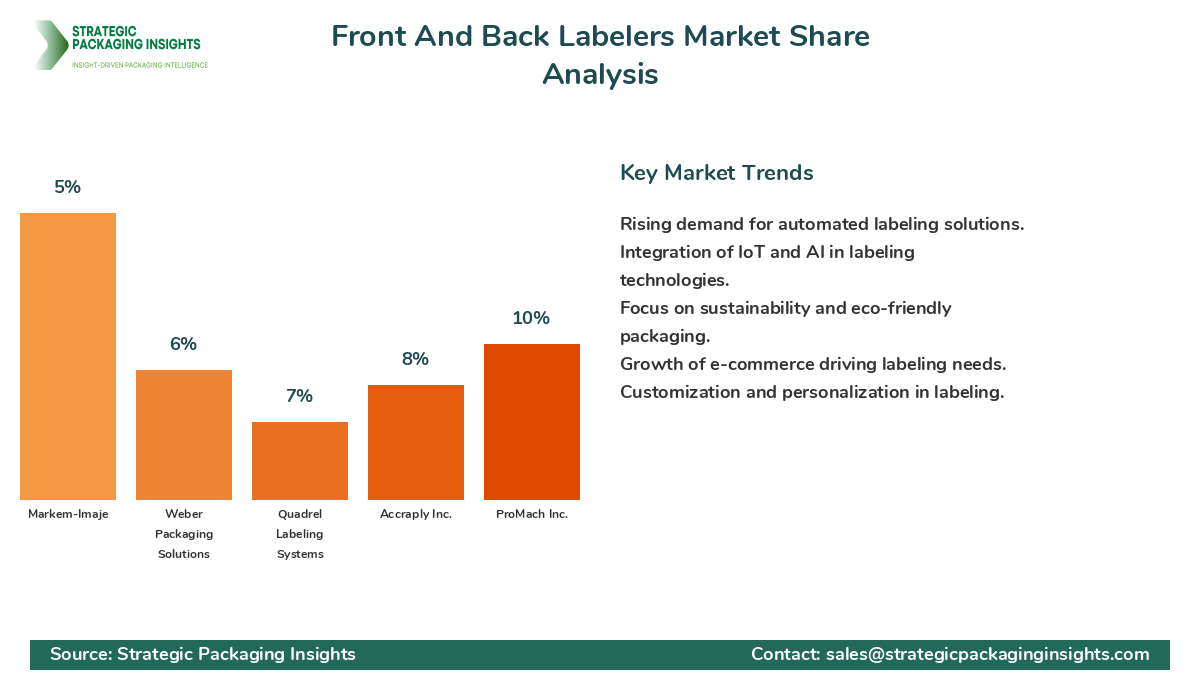

The Front and Back Labelers market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each offering a range of labeling solutions to cater to diverse industry needs. The competitive dynamics are influenced by factors such as product innovation, technological advancements, and strategic partnerships. Companies are focusing on expanding their product portfolios and enhancing their service offerings to gain a competitive edge in the market.

Among the major players in the market, companies like Krones AG, Herma GmbH, and ProMach Inc. hold significant market shares due to their extensive product offerings and strong global presence. Krones AG, for instance, is renowned for its comprehensive range of labeling machines that cater to various industries, including food and beverages, pharmaceuticals, and cosmetics. The company's focus on innovation and sustainability has enabled it to maintain a strong foothold in the market.

Herma GmbH is another key player known for its advanced labeling solutions that emphasize precision and efficiency. The company's commitment to research and development has resulted in the introduction of cutting-edge technologies that enhance labeling accuracy and speed. ProMach Inc., on the other hand, has established itself as a leader in the Packaging Machinery industry, offering a wide array of labeling solutions that cater to the needs of diverse end-users. The company's strategic acquisitions and partnerships have further strengthened its market position.

Other notable companies in the market include Accraply Inc., Quadrel Labeling Systems, and Weber Packaging Solutions. Accraply Inc. is recognized for its innovative labeling technologies that focus on flexibility and customization, catering to the evolving demands of the packaging industry. Quadrel Labeling Systems is known for its robust and reliable labeling machines that are designed to handle high-speed production environments. Weber Packaging Solutions, with its emphasis on customer-centric solutions, offers a range of labeling systems that are tailored to meet specific industry requirements.

Key Highlights Front And Back Labelers Market

- Increasing demand for automated labeling solutions across various industries.

- Technological advancements in labeling machines, including IoT and AI integration.

- Growing trend of product customization and personalization in labeling.

- Expansion of e-commerce driving the need for efficient labeling solutions.

- Focus on sustainability and eco-friendly packaging solutions.

- High initial investment costs and maintenance requirements as market restraints.

- Stringent regulatory standards related to labeling accuracy and environmental impact.

- Emergence of new players offering innovative labeling technologies.

- Strategic partnerships and acquisitions shaping the competitive landscape.

- Increasing adoption of digital labeling solutions for enhanced efficiency.

Top Countries Insights in Front And Back Labelers

The United States is a leading market for Front and Back Labelers, with a market size of $800 million and a CAGR of 6%. The country's strong manufacturing base and the presence of major players drive the demand for advanced labeling solutions. The focus on automation and technological innovation further supports market growth, while regulatory standards ensure high labeling accuracy and compliance.

Germany, with a market size of $600 million and a CAGR of 5%, is another key market, driven by its robust industrial sector and emphasis on precision engineering. The country's commitment to sustainability and eco-friendly packaging solutions is a significant growth driver, as companies seek to minimize environmental impact while enhancing operational efficiency.

China, with a market size of $500 million and a CAGR of 7%, is experiencing rapid growth due to its expanding manufacturing sector and increasing demand for efficient labeling solutions. The rise of e-commerce and the need for accurate labeling in logistics and supply chain management are key factors driving market expansion in the region.

Japan, with a market size of $400 million and a CAGR of 4%, is characterized by its focus on technological innovation and high-quality manufacturing standards. The country's aging population and the need for clear and accurate labeling in the pharmaceutical and healthcare sectors are significant growth drivers.

India, with a market size of $300 million and a CAGR of 8%, is witnessing significant growth due to its burgeoning manufacturing sector and increasing demand for consumer goods. The government's focus on 'Make in India' and the rise of domestic manufacturing capabilities are key factors propelling market growth.

Value Chain Profitability Analysis

The value chain of the Front and Back Labelers market involves several key stakeholders, each contributing to the overall profitability and efficiency of the industry. The primary stakeholders include labeling equipment manufacturers, technology providers, service providers, and end-users. Labeling equipment manufacturers capture a significant share of the market value, driven by the demand for advanced and automated labeling solutions. These manufacturers invest heavily in research and development to introduce innovative technologies that enhance labeling accuracy and speed.

Technology providers play a crucial role in the value chain by offering software solutions and digital platforms that enable real-time monitoring and predictive maintenance of labeling equipment. These providers capture a growing share of the market value as companies increasingly adopt IoT and AI technologies to enhance operational efficiency and reduce downtime. Service providers, including maintenance and repair services, also contribute to the value chain by ensuring the smooth operation of labeling machines and minimizing disruptions in production processes.

End-users, such as manufacturers and retailers, are the final stakeholders in the value chain, benefiting from the enhanced efficiency and accuracy of labeling solutions. The adoption of advanced labeling technologies enables end-users to improve product presentation, comply with regulatory standards, and enhance brand identity. The value chain profitability is further influenced by factors such as cost structures, pricing models, and profit margin percentages at each stage. Digital transformation is redistributing revenue opportunities throughout the industry, with technology providers capturing an increasing share of the overall market value.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The Front and Back Labelers market has undergone significant changes between 2018 and 2024, driven by technological advancements and evolving consumer demands. During this period, the market experienced a steady growth rate, with a CAGR of 4.5%, as companies increasingly adopted automated labeling solutions to enhance operational efficiency. The integration of IoT and AI technologies played a crucial role in transforming the market landscape, enabling real-time monitoring and predictive maintenance of labeling equipment.

Looking ahead to the forecast period of 2025–2033, the market is expected to witness accelerated growth, with a projected CAGR of 5.8%. The increasing focus on sustainability and eco-friendly packaging solutions is anticipated to drive the demand for innovative labeling technologies that minimize waste and energy consumption. The rise of e-commerce and the need for efficient labeling solutions to manage high volumes of packages are also expected to contribute to market expansion.

Strategic foresight for the future involves a focus on product customization and personalization, as consumers seek unique and tailored labeling solutions that enhance brand identity and consumer engagement. Companies are likely to invest in research and development to introduce cutting-edge technologies that cater to the evolving demands of the packaging industry. The competitive landscape is expected to be shaped by strategic partnerships and acquisitions, as companies seek to expand their product portfolios and enhance their market presence.

Front And Back Labelers Market Segments Insights

Type Analysis

The Front and Back Labelers market is segmented by type into automatic and semi-automatic labelers. Automatic labelers are gaining significant traction due to their ability to enhance operational efficiency and reduce labor costs. These machines are equipped with advanced technologies that enable high-speed labeling and precise application, making them ideal for large-scale production environments. The demand for automatic labelers is driven by the increasing focus on automation in manufacturing processes and the need for consistent and accurate labeling solutions.

Semi-automatic labelers, on the other hand, are preferred by small and medium-sized enterprises that require flexible and cost-effective labeling solutions. These machines offer a balance between manual and automated operations, allowing operators to control the labeling process while benefiting from enhanced efficiency. The demand for semi-automatic labelers is supported by the growing trend of customization and personalization in product labeling, as these machines offer the flexibility to handle diverse packaging formats and sizes.

Application Analysis

The application segment of the Front and Back Labelers market includes food and beverages, pharmaceuticals, cosmetics, chemicals, and others. The food and beverages industry is a major contributor to market growth, driven by the need for accurate and high-speed labeling solutions to enhance product presentation and comply with regulatory standards. The demand for labeling machines in this industry is further supported by the increasing trend of product differentiation and branding.

The pharmaceuticals industry is another key application area, where labeling accuracy and compliance with regulatory standards are of utmost importance. The demand for advanced labeling solutions in this industry is driven by the need for clear and precise labeling to ensure patient safety and adherence to stringent regulations. The cosmetics industry is also witnessing significant growth, as companies seek to enhance brand identity and consumer engagement through innovative labeling solutions.

Technology Analysis

The technology segment of the Front and Back Labelers market includes pressure-sensitive, glue-based, sleeve labeling, and others. Pressure-sensitive labeling technology is widely adopted due to its versatility and ability to handle a wide range of packaging materials and shapes. This technology offers high-speed labeling and precise application, making it ideal for industries such as food and beverages, pharmaceuticals, and cosmetics.

Glue-based labeling technology, on the other hand, is preferred for applications that require strong adhesion and durability. This technology is commonly used in the chemicals industry, where Labels need to withstand harsh environmental conditions. Sleeve labeling technology is gaining popularity due to its ability to provide 360-degree coverage and enhance product aesthetics. This technology is widely used in the beverages industry, where companies seek to differentiate their products through eye-catching and innovative labeling solutions.

End-User Analysis

The end-user segment of the Front and Back Labelers market includes manufacturing, retail, logistics, and others. The manufacturing sector is a major end-user, driven by the need for efficient and accurate labeling solutions to enhance operational efficiency and comply with regulatory standards. The demand for labeling machines in this sector is further supported by the increasing focus on automation and technological innovation.

The retail sector is also witnessing significant growth, as companies seek to enhance product presentation and consumer engagement through innovative labeling solutions. The logistics sector is another key end-user, where accurate labeling is essential for efficient supply chain management and tracking of packages. The demand for labeling machines in this sector is driven by the rise of e-commerce and the need for efficient labeling solutions to manage high volumes of packages.

Front And Back Labelers Market Segments

The Front And Back Labelers market has been segmented on the basis of

Type

- Automatic

- Semi-Automatic

Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

- Chemicals

- Others

Technology

- Pressure Sensitive

- Glue-Based

- Sleeve Labeling

- Others

End-User

- Manufacturing

- Retail

- Logistics

- Others

Primary Interview Insights

What are the key drivers for the Front and Back Labelers market?

What challenges does the market face?

How is the market expected to evolve in the coming years?

Which industries are driving the demand for labeling solutions?

What role does technology play in the market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.