- Home

- Food Packaging

- Pie Packaging Market Size, Future Growth and Forecast 2033

Pie Packaging Market Size, Future Growth and Forecast 2033

Pie Packaging Market Segments - by Material (Plastic, Paper, Metal, Glass), Application (Food & Beverages, Bakery, Confectionery, Ready-to-Eat Meals), Packaging Type (Primary, Secondary, Tertiary), and End-User (Retail, Food Service, Industrial) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Pie Packaging Market Outlook

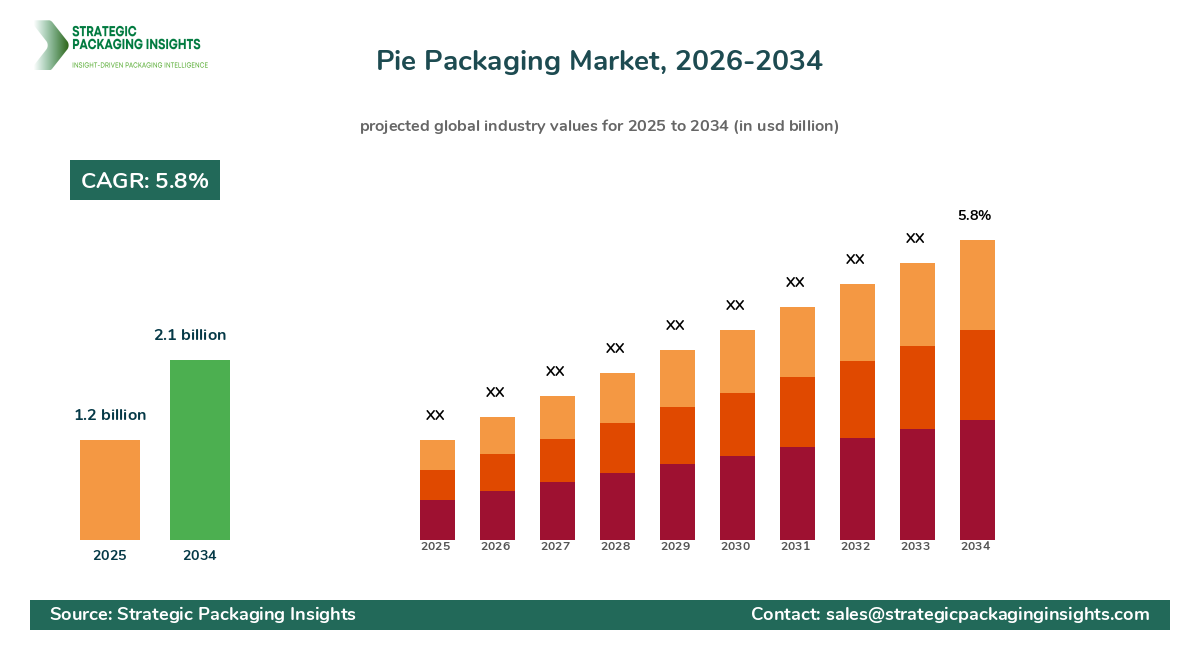

The pie packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033. This growth is driven by the increasing demand for convenient and Sustainable Packaging solutions in the food industry. As consumer preferences shift towards ready-to-eat meals and on-the-go snacks, the need for innovative packaging that preserves freshness and extends shelf life is becoming more critical. Additionally, the rise in e-commerce and food delivery services is further propelling the demand for efficient pie packaging solutions that ensure product safety during transit.

However, the market faces challenges such as stringent regulations on packaging waste and environmental concerns related to plastic usage. Despite these restraints, the pie packaging market holds significant growth potential due to advancements in biodegradable materials and eco-friendly packaging technologies. Companies are investing in research and development to create sustainable packaging options that meet regulatory standards while appealing to environmentally conscious consumers. The integration of smart packaging technologies, such as QR codes and RFID tags, is also expected to enhance consumer engagement and provide valuable data insights for manufacturers.

Report Scope

| Attributes | Details |

| Report Title | Pie Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 189 |

| Material | Plastic, Paper, Metal, Glass |

| Application | Food & Beverages, Bakery, Confectionery, Ready-to-Eat Meals |

| Packaging Type | Primary, Secondary, Tertiary |

| End-User | Retail, Food Service, Industrial |

| Customization Available | Yes* |

Opportunities & Threats

The pie packaging market presents numerous opportunities for growth, particularly in the development of sustainable and eco-friendly packaging solutions. With increasing consumer awareness about environmental issues, there is a growing demand for packaging materials that are biodegradable, recyclable, and made from renewable resources. This trend is encouraging manufacturers to innovate and invest in green technologies, which not only reduce the carbon footprint but also enhance brand reputation and customer loyalty. Additionally, the rise of digitalization and smart packaging solutions offers opportunities for companies to differentiate their products and provide added value to consumers through interactive and informative packaging.

Another significant opportunity lies in the expansion of the food delivery and e-commerce sectors. As more consumers opt for online shopping and home delivery services, the demand for secure and efficient packaging solutions is on the rise. Pie packaging that ensures product integrity and freshness during transit is becoming increasingly important, driving innovation in packaging design and materials. Companies that can offer cost-effective and reliable packaging solutions tailored to the needs of the food delivery market are likely to gain a competitive edge.

Despite these opportunities, the pie packaging market faces threats from regulatory pressures and environmental concerns. Governments worldwide are implementing stricter regulations on packaging waste and promoting the use of sustainable materials. This poses a challenge for manufacturers who rely heavily on Plastic Packaging, as they must adapt to new standards and invest in alternative materials. Additionally, the fluctuating prices of raw materials and the impact of economic uncertainties on consumer spending can affect market growth. Companies need to navigate these challenges by adopting flexible strategies and focusing on innovation to remain competitive.

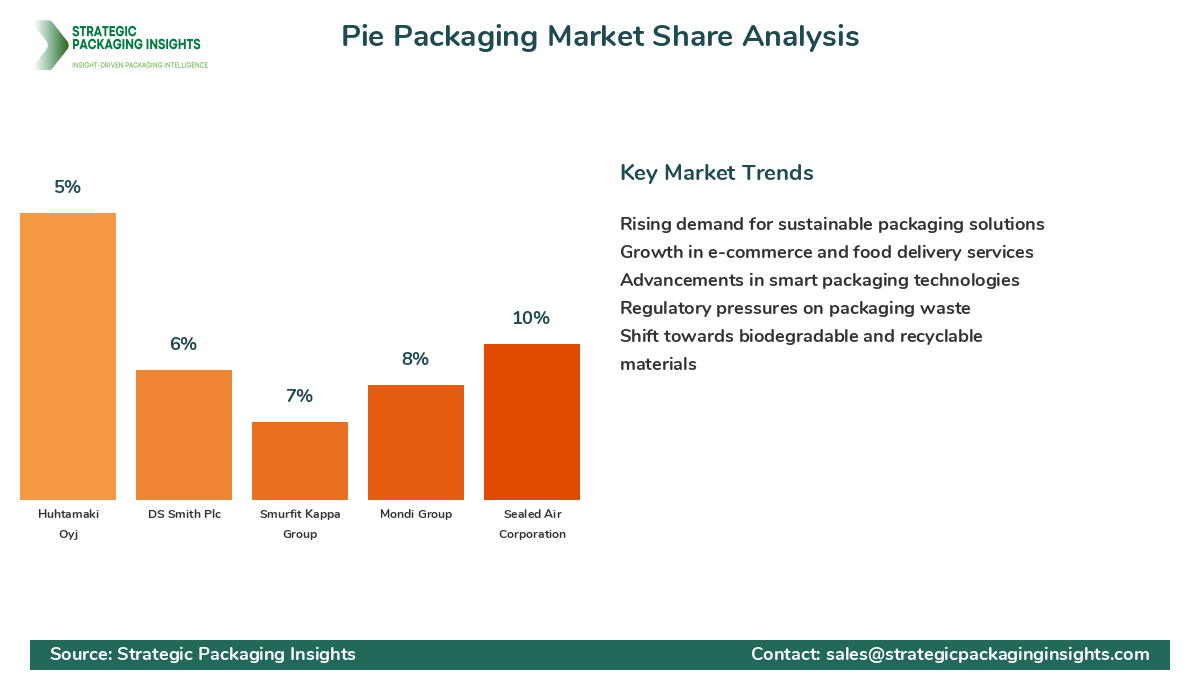

The pie packaging market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of large multinational corporations and regional players, each offering a diverse range of packaging solutions. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to meet the growing demand for innovative and sustainable packaging. Strategic partnerships, mergers, and acquisitions are common strategies employed by market leaders to strengthen their market position and expand their geographical presence.

Among the major companies in the pie packaging market, Amcor Limited holds a significant market share due to its extensive product offerings and strong global presence. The company is known for its commitment to sustainability and innovation, providing a wide range of eco-friendly packaging solutions. Another key player, Berry Global Inc., is recognized for its advanced manufacturing technologies and focus on customer-centric solutions. The company's expertise in plastic packaging and its efforts to develop sustainable alternatives have contributed to its strong market position.

Sealed Air Corporation is another prominent player in the pie packaging market, known for its innovative packaging designs and commitment to reducing environmental impact. The company's focus on research and development has led to the introduction of several cutting-edge packaging solutions that cater to the evolving needs of the food industry. Additionally, Mondi Group is a leading provider of paper-based packaging solutions, offering a range of sustainable options that align with the growing demand for eco-friendly materials.

Other notable companies in the market include Smurfit Kappa Group, known for its comprehensive range of Corrugated Packaging solutions, and DS Smith Plc, which specializes in sustainable packaging and recycling services. These companies are leveraging their expertise and resources to develop innovative packaging solutions that meet the changing demands of consumers and regulatory requirements. The competitive landscape of the pie packaging market is expected to evolve as companies continue to invest in sustainability and technological advancements.

Key Highlights Pie Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Growth in the food delivery and e-commerce sectors driving packaging innovation.

- Advancements in smart packaging technologies enhancing consumer engagement.

- Regulatory pressures promoting the use of biodegradable and recyclable materials.

- Strategic partnerships and acquisitions shaping the competitive landscape.

- Focus on reducing carbon footprint and enhancing brand reputation.

- Rising consumer awareness about environmental issues influencing packaging choices.

- Integration of digital technologies in packaging design and functionality.

- Expansion of product portfolios to cater to diverse consumer needs.

- Investment in research and development for innovative packaging solutions.

Top Countries Insights in Pie Packaging

The United States is a leading market for pie packaging, with a current market size of $350 million and a CAGR of 6%. The country's robust food delivery and e-commerce sectors are key growth drivers, along with consumer demand for convenient and sustainable packaging solutions. Government initiatives promoting the use of eco-friendly materials are also contributing to market growth.

In the United Kingdom, the pie packaging market is valued at $200 million, with a CAGR of 5%. The market is driven by the increasing popularity of ready-to-eat meals and the growing emphasis on reducing packaging waste. Innovations in biodegradable materials and smart packaging technologies are gaining traction, supported by government regulations and consumer preferences.

China's pie packaging market is experiencing rapid growth, with a market size of $300 million and a CAGR of 8%. The expansion of the food delivery industry and rising consumer awareness about environmental issues are key factors driving demand for sustainable packaging solutions. The government's focus on reducing plastic waste and promoting green technologies is further boosting market growth.

Germany's pie packaging market is valued at $150 million, with a CAGR of 4%. The market is characterized by a strong emphasis on sustainability and innovation, with companies investing in research and development to create eco-friendly packaging options. The country's stringent regulations on packaging waste and recycling are influencing market dynamics.

Australia's pie packaging market is valued at $100 million, with a CAGR of 3%. The market is driven by the growing demand for convenient and sustainable packaging solutions in the food industry. The rise of online food delivery services and consumer preferences for eco-friendly materials are key growth drivers, supported by government initiatives promoting sustainability.

Value Chain Profitability Analysis

The pie packaging market's value chain involves several key stakeholders, including raw material suppliers, packaging manufacturers, distributors, and end-users. Each stage of the value chain contributes to the overall profitability and efficiency of the market. Raw material suppliers provide essential inputs such as plastic, paper, and biodegradable materials, which are crucial for manufacturing packaging solutions. The cost structure at this stage is influenced by the availability and price fluctuations of raw materials, impacting the overall profitability of the value chain.

Packaging manufacturers play a critical role in the value chain, transforming raw materials into finished products that meet the specific needs of end-users. This stage involves significant investment in technology and innovation to develop sustainable and efficient packaging solutions. Manufacturers' profitability is determined by their ability to optimize production processes, reduce waste, and meet regulatory standards. The integration of digital technologies and automation is enhancing operational efficiency and reducing costs, contributing to higher profit margins.

Distributors and logistics providers are responsible for ensuring the timely delivery of packaging products to end-users. This stage involves managing transportation costs, inventory, and supply chain logistics. Efficient distribution networks and strategic partnerships with retailers and food service providers are essential for maximizing profitability. The rise of e-commerce and food delivery services is reshaping distribution strategies, with companies focusing on optimizing last-mile delivery and enhancing customer experience.

End-users, including retailers, food service providers, and industrial clients, are the final link in the value chain. Their demand for innovative and sustainable packaging solutions drives market growth and influences profitability across the value chain. Companies that can offer customized and value-added packaging solutions are likely to capture a larger share of the market. The shift towards eco-friendly materials and smart packaging technologies is creating new revenue opportunities and reshaping the competitive landscape.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The pie packaging market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences, regulatory pressures, and technological advancements. During this period, the market experienced a steady growth rate, with a focus on developing sustainable and innovative packaging solutions. The rise of e-commerce and food delivery services played a crucial role in shaping market dynamics, leading to increased demand for efficient and secure packaging options.

Looking ahead to the forecast period of 2025–2033, the pie packaging market is expected to witness accelerated growth, driven by advancements in smart packaging technologies and the increasing emphasis on sustainability. The integration of digital technologies, such as QR codes and RFID tags, is anticipated to enhance consumer engagement and provide valuable data insights for manufacturers. Additionally, the shift towards biodegradable and recyclable materials is expected to gain momentum, supported by government regulations and consumer preferences.

The competitive landscape of the pie packaging market is likely to evolve as companies continue to invest in research and development to create innovative packaging solutions. Strategic partnerships, mergers, and acquisitions are expected to shape market dynamics, with companies focusing on expanding their product portfolios and enhancing their production capabilities. The rise of digitalization and automation is also expected to drive operational efficiency and reduce costs, contributing to higher profit margins and increased market share.

Pie Packaging Market Segments Insights

Material Analysis

The material segment of the pie packaging market is dominated by plastic, paper, metal, and glass, each offering unique advantages and challenges. Plastic remains the most widely used material due to its versatility, durability, and cost-effectiveness. However, environmental concerns and regulatory pressures are driving the shift towards biodegradable and recyclable alternatives. Paper-based packaging is gaining popularity for its eco-friendly properties and ability to be easily customized. Metal and Glass Packaging, while less common, offer superior protection and are often used for premium products.

The demand for sustainable materials is a key driver in this segment, with companies investing in research and development to create innovative solutions that meet regulatory standards and consumer preferences. The rise of biodegradable plastics and compostable materials is expected to reshape the material landscape, offering new opportunities for growth and differentiation. Additionally, advancements in material technologies, such as barrier coatings and lightweight designs, are enhancing the functionality and appeal of pie packaging solutions.

Application Analysis

The application segment of the pie packaging market includes food and beverages, bakery, confectionery, and ready-to-eat meals. The food and beverages sector is the largest application segment, driven by the increasing demand for convenient and sustainable packaging solutions. The rise of online food delivery services and the growing popularity of ready-to-eat meals are key factors contributing to the growth of this segment. Bakery and confectionery products also represent significant opportunities, with consumers seeking packaging that preserves freshness and enhances product presentation.

Innovation in packaging design and materials is a critical driver in this segment, with companies focusing on creating solutions that meet the specific needs of different applications. The integration of smart packaging technologies, such as QR codes and RFID tags, is enhancing consumer engagement and providing valuable data insights for manufacturers. Additionally, the shift towards eco-friendly materials and sustainable packaging solutions is gaining traction, supported by regulatory pressures and consumer preferences.

Packaging Type Analysis

The packaging type segment of the pie packaging market includes primary, secondary, and tertiary packaging. Primary packaging, which comes into direct contact with the product, is the most critical type, as it ensures product safety and integrity. Secondary Packaging, used for branding and marketing purposes, plays a crucial role in enhancing product appeal and consumer engagement. Tertiary packaging, used for transportation and storage, is essential for ensuring product safety during transit.

The demand for innovative and sustainable packaging solutions is driving growth in this segment, with companies focusing on creating packaging that meets the specific needs of different applications. The rise of e-commerce and food delivery services is reshaping packaging strategies, with companies focusing on optimizing packaging design and materials to enhance product safety and reduce environmental impact. Additionally, advancements in digital technologies and automation are enhancing operational efficiency and reducing costs, contributing to higher profit margins and increased market share.

End-User Analysis

The end-user segment of the pie packaging market includes retail, food service, and industrial clients. The retail sector is the largest end-user segment, driven by the increasing demand for convenient and sustainable packaging solutions. The rise of online shopping and home delivery services is reshaping packaging strategies, with companies focusing on creating packaging that meets the specific needs of different applications. The food service sector also represents significant opportunities, with companies seeking packaging that ensures product safety and enhances consumer engagement.

Innovation in packaging design and materials is a critical driver in this segment, with companies focusing on creating solutions that meet the specific needs of different end-users. The integration of smart packaging technologies, such as QR codes and RFID tags, is enhancing consumer engagement and providing valuable data insights for manufacturers. Additionally, the shift towards eco-friendly materials and sustainable packaging solutions is gaining traction, supported by regulatory pressures and consumer preferences.

Pie Packaging Market Segments

The Pie Packaging market has been segmented on the basis of

Material

- Plastic

- Paper

- Metal

- Glass

Application

- Food & Beverages

- Bakery

- Confectionery

- Ready-to-Eat Meals

Packaging Type

- Primary

- Secondary

- Tertiary

End-User

- Retail

- Food Service

- Industrial

Primary Interview Insights

What are the key drivers of growth in the pie packaging market?

How are companies addressing environmental concerns in the pie packaging market?

What challenges does the pie packaging market face?

How is the competitive landscape evolving in the pie packaging market?

What role does innovation play in the pie packaging market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.