- Home

- Food Packaging

- Metal Food Steel Cans Market Size, Future Growth and Forecast 2033

Metal Food Steel Cans Market Size, Future Growth and Forecast 2033

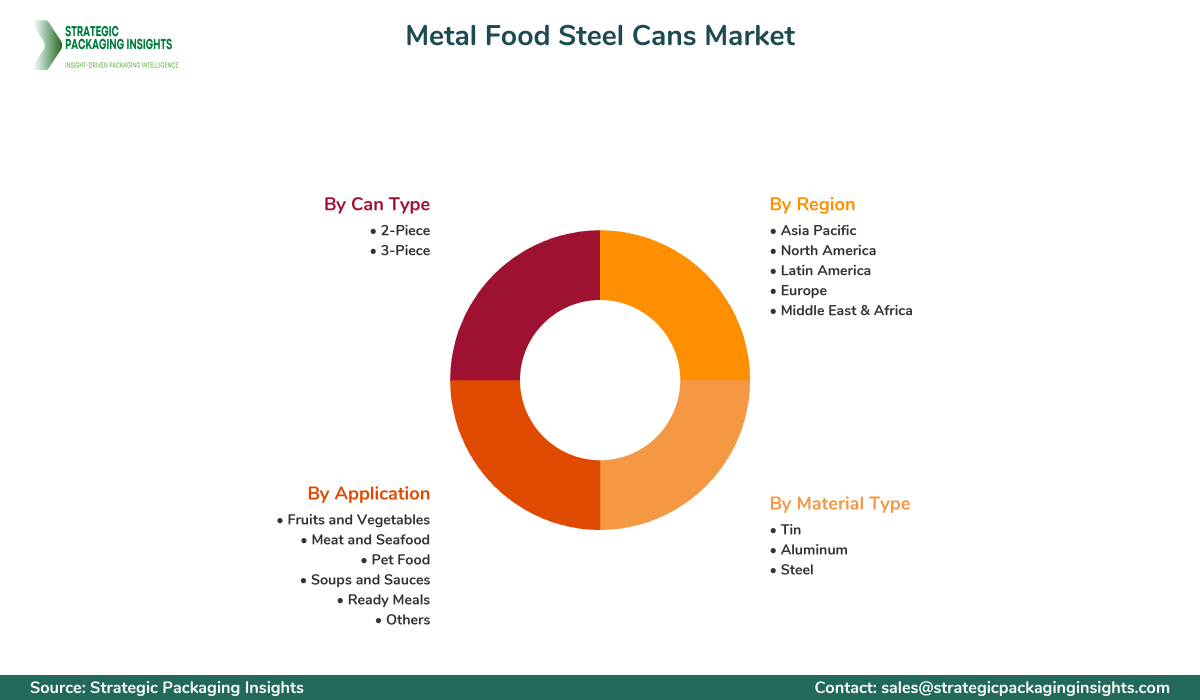

Metal Food Steel Cans Market Segments - by Material Type (Tin, Aluminum, Steel), Application (Fruits and Vegetables, Meat and Seafood, Pet Food, Soups and Sauces, Ready Meals, Others), Can Type (2-Piece, 3-Piece), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Metal Food Steel Cans Market Outlook

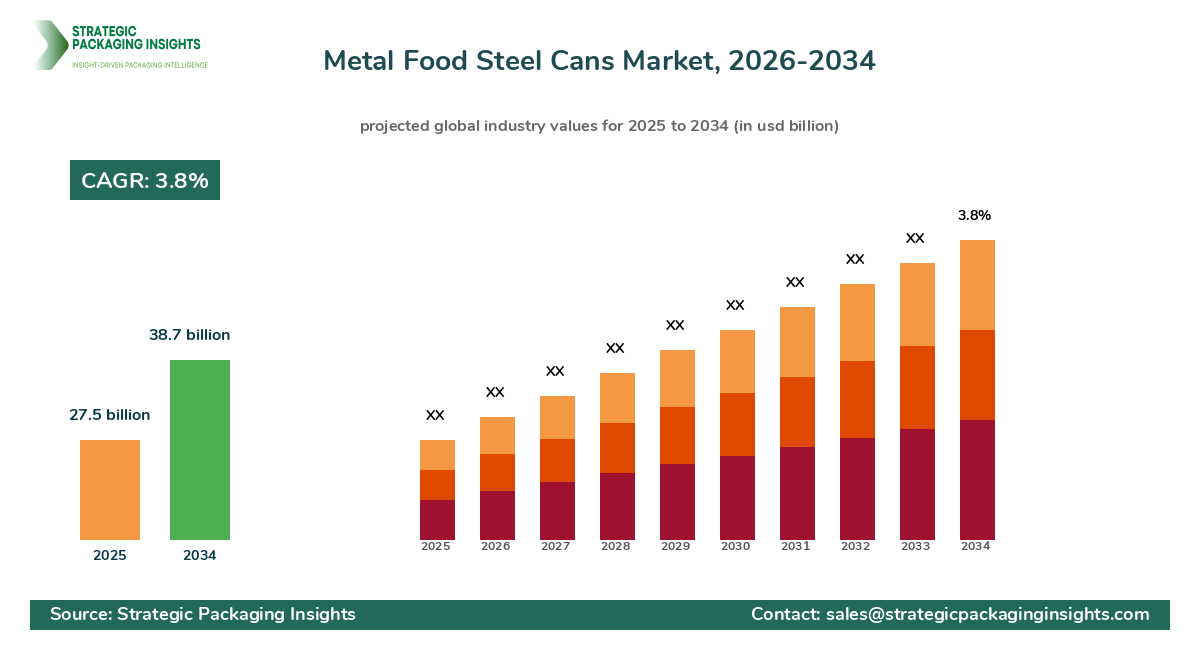

The metal food Steel Cans market was valued at $27.5 billion in 2024 and is projected to reach $38.7 billion by 2033, growing at a CAGR of 3.8% during the forecast period 2025-2033. This growth is driven by increasing consumer demand for sustainable and recyclable packaging solutions, as well as the rising consumption of canned food products due to their convenience and long shelf life. The market is also benefiting from technological advancements in can manufacturing, which enhance product safety and extend shelf life. Additionally, the growing trend of urbanization and the busy lifestyles of consumers are contributing to the increased demand for ready-to-eat and easy-to-store food products, further propelling the market growth.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding Metal Packaging waste. Despite these challenges, the market holds significant growth potential due to the increasing focus on eco-friendly packaging solutions and the development of innovative can designs that cater to consumer preferences. The market is also witnessing a shift towards lightweight and easy-to-open cans, which are gaining popularity among consumers. Furthermore, the expansion of the food and beverage industry in emerging economies presents lucrative opportunities for market players to expand their presence and increase their market share.

Report Scope

| Attributes | Details |

| Report Title | Metal Food Steel Cans Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 185 |

| Material Type | Tin, Aluminum, Steel |

| Application | Fruits and Vegetables, Meat and Seafood, Pet Food, Soups and Sauces, Ready Meals, Others |

| Can Type | 2-Piece, 3-Piece |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The metal food steel cans market presents numerous opportunities for growth, primarily driven by the increasing consumer preference for Sustainable Packaging solutions. As environmental concerns continue to rise, consumers are becoming more conscious of the impact of packaging waste on the environment. This has led to a growing demand for recyclable and eco-friendly packaging options, such as metal food steel cans, which are 100% recyclable and can be reused multiple times without losing quality. Additionally, the increasing popularity of canned food products, particularly among urban consumers with busy lifestyles, is driving the demand for metal food steel cans. The convenience, long shelf life, and safety of canned food products make them an attractive option for consumers, further boosting the market growth.

Another significant opportunity in the metal food steel cans market is the growing demand for innovative can designs that cater to consumer preferences. Manufacturers are increasingly focusing on developing lightweight and easy-to-open cans that enhance consumer convenience and improve the overall user experience. This trend is particularly evident in the pet food segment, where consumers are seeking convenient packaging solutions that make feeding pets easier and more efficient. Furthermore, the expansion of the food and beverage industry in emerging economies presents lucrative opportunities for market players to expand their presence and increase their market share. As disposable incomes rise and consumer preferences shift towards packaged and processed foods, the demand for metal food steel cans is expected to grow significantly in these regions.

Despite the numerous opportunities, the metal food steel cans market faces several threats that could hinder its growth. One of the primary challenges is the fluctuating prices of raw materials, such as steel and aluminum, which can impact the overall cost of production and affect profit margins for manufacturers. Additionally, stringent environmental regulations regarding metal packaging waste pose a significant challenge for market players. Governments and regulatory bodies are increasingly focusing on reducing packaging waste and promoting sustainable packaging solutions, which could lead to increased compliance costs for manufacturers. Moreover, the growing competition from alternative packaging solutions, such as plastic and glass, could also pose a threat to the market growth. These materials offer certain advantages, such as lightweight and cost-effectiveness, which could impact the demand for metal food steel cans.

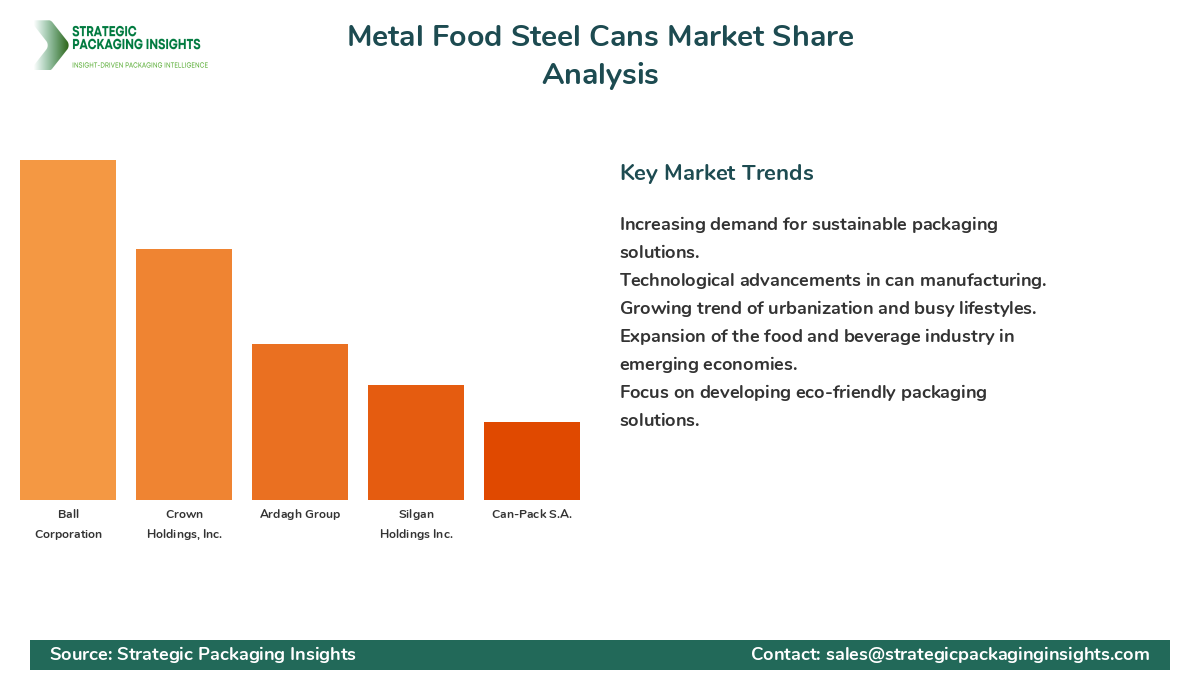

The metal food steel cans market is characterized by a highly competitive landscape, with several key players vying for market share. The market is dominated by a few major companies that hold significant market shares, while numerous smaller players compete in niche segments. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are increasingly focusing on developing innovative can designs and sustainable packaging solutions to differentiate themselves from competitors and capture a larger share of the market. Additionally, strategic partnerships and collaborations with food and beverage manufacturers are becoming increasingly important for market players to expand their reach and enhance their market presence.

Ball Corporation is one of the leading players in the metal food steel cans market, known for its extensive product portfolio and strong focus on sustainability. The company has a significant market share and is continuously investing in research and development to enhance its product offerings and meet the evolving needs of consumers. Crown Holdings, Inc. is another major player in the market, with a strong presence in both developed and emerging markets. The company is known for its innovative packaging solutions and commitment to sustainability, which has helped it maintain a competitive edge in the market.

Ardagh Group is a prominent player in the metal food steel cans market, with a diverse product portfolio and a strong focus on customer satisfaction. The company has a significant market share and is continuously expanding its operations to cater to the growing demand for metal food steel cans. Silgan Holdings Inc. is another key player in the market, known for its extensive distribution network and strong focus on product innovation. The company has a significant market share and is continuously investing in research and development to enhance its product offerings and meet the evolving needs of consumers.

Other notable players in the metal food steel cans market include Can-Pack S.A., Toyo Seikan Group Holdings, Ltd., and CPMC Holdings Limited. These companies are known for their strong focus on sustainability and commitment to developing innovative packaging solutions that cater to consumer preferences. The competitive landscape of the market is expected to remain dynamic, with companies continuously striving to enhance their product offerings and expand their market presence through strategic partnerships and collaborations.

Key Highlights Metal Food Steel Cans Market

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Technological advancements in can manufacturing are enhancing product safety and extending shelf life.

- Growing trend of urbanization and busy lifestyles are boosting demand for ready-to-eat and easy-to-store food products.

- Fluctuating raw material prices and stringent environmental regulations pose challenges for market players.

- Expansion of the food and beverage industry in emerging economies presents lucrative opportunities for market growth.

- Innovative can designs and lightweight, easy-to-open cans are gaining popularity among consumers.

- Strategic partnerships and collaborations with food and beverage manufacturers are becoming increasingly important for market players.

- Increasing competition from alternative packaging solutions, such as plastic and glass, could impact market growth.

- Focus on developing eco-friendly packaging solutions is driving innovation in the market.

- Rising disposable incomes and shifting consumer preferences towards packaged and processed foods are boosting demand for metal food steel cans.

Premium Insights - Key Investment Analysis

The metal food steel cans market is witnessing significant investment activity, driven by the increasing demand for sustainable packaging solutions and the growing popularity of canned food products. Venture capital activity in the market is focused on companies that are developing innovative can designs and eco-friendly packaging solutions. These investments are aimed at enhancing product offerings and meeting the evolving needs of consumers. Additionally, mergers and acquisitions are becoming increasingly common in the market, as companies seek to expand their product portfolios and strengthen their market presence. Strategic partnerships and collaborations with food and beverage manufacturers are also playing a crucial role in driving investment activity in the market.

Investment valuations in the metal food steel cans market are driven by factors such as the company's product portfolio, market share, and growth potential. Companies with a strong focus on sustainability and innovation are attracting significant investor interest, as they are well-positioned to capitalize on the growing demand for eco-friendly packaging solutions. Return on investment (ROI) expectations in the market are high, as the demand for metal food steel cans is expected to continue growing in the coming years. Emerging investment themes in the market include the development of lightweight and easy-to-open cans, as well as the expansion of operations in emerging economies.

Risk factors in the metal food steel cans market include fluctuating raw material prices, stringent environmental regulations, and increasing competition from alternative packaging solutions. However, the strategic rationale behind major deals in the market is focused on enhancing product offerings, expanding market presence, and meeting the evolving needs of consumers. High-potential investment opportunities in the market are concentrated in the development of innovative can designs and eco-friendly packaging solutions, as well as the expansion of operations in emerging economies. These sectors are attracting the most investor interest, as they offer significant growth potential and align with the increasing consumer demand for sustainable packaging solutions.

Metal Food Steel Cans Market Segments Insights

Material Type Analysis

The metal food steel cans market is segmented by material type into tin, aluminum, and steel. Steel is the most commonly used material for food cans due to its strength, durability, and recyclability. The demand for steel cans is driven by their ability to preserve food quality and extend shelf life, making them a popular choice for packaging a wide range of food products. Aluminum cans are also gaining popularity due to their lightweight and corrosion-resistant properties, which make them suitable for packaging acidic foods such as tomatoes and fruits. Tin Cans, although less common, are used for specific applications where additional protection against corrosion is required.

The market for steel cans is expected to continue growing, driven by the increasing demand for sustainable and Recyclable Packaging solutions. Manufacturers are focusing on developing innovative can designs that enhance consumer convenience and improve the overall user experience. The demand for aluminum cans is also expected to grow, particularly in the pet food segment, where consumers are seeking lightweight and easy-to-open packaging solutions. The market for tin cans is expected to remain stable, with demand driven by specific applications where additional protection against corrosion is required.

Application Analysis

The metal food steel cans market is segmented by application into fruits and vegetables, meat and seafood, pet food, soups and sauces, ready meals, and others. The demand for metal food steel cans is driven by the increasing consumption of canned food products, particularly among urban consumers with busy lifestyles. The fruits and vegetables segment is one of the largest application segments, driven by the demand for convenient and long-lasting packaging solutions. The meat and seafood segment is also a significant contributor to market growth, as canned meat and seafood products offer a convenient and safe option for consumers.

The pet food segment is expected to witness significant growth, driven by the increasing demand for convenient and easy-to-open packaging solutions. The soups and sauces segment is also expected to grow, as consumers seek convenient and ready-to-eat meal options. The ready meals segment is expected to witness steady growth, driven by the increasing demand for convenient and easy-to-store food products. The market for other applications, such as dairy products and beverages, is expected to remain stable, with demand driven by specific consumer preferences and regional trends.

Can Type Analysis

The metal food steel cans market is segmented by can type into 2-piece and 3-piece cans. 2-piece cans are the most commonly used can type, as they offer a seamless design that enhances product safety and extends shelf life. The demand for 2-piece cans is driven by their ability to preserve food quality and prevent contamination, making them a popular choice for packaging a wide range of food products. 3-piece cans, although less common, are used for specific applications where additional strength and durability are required.

The market for 2-piece cans is expected to continue growing, driven by the increasing demand for sustainable and recyclable packaging solutions. Manufacturers are focusing on developing innovative can designs that enhance consumer convenience and improve the overall user experience. The demand for 3-piece cans is expected to remain stable, with demand driven by specific applications where additional strength and durability are required. The market for both can types is expected to benefit from the increasing focus on eco-friendly packaging solutions and the development of lightweight and easy-to-open cans.

Regional Analysis

The metal food steel cans market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Asia Pacific is the largest market for metal food steel cans, driven by the increasing consumption of canned food products and the growing demand for sustainable packaging solutions. The market in North America is also significant, driven by the demand for convenient and long-lasting packaging solutions. The market in Europe is expected to witness steady growth, driven by the increasing focus on eco-friendly packaging solutions and the development of innovative can designs.

The market in Latin America is expected to witness significant growth, driven by the increasing demand for packaged and processed foods. The market in Middle East & Africa is expected to remain stable, with demand driven by specific consumer preferences and regional trends. The market in all regions is expected to benefit from the increasing focus on sustainable packaging solutions and the development of lightweight and easy-to-open cans. The expansion of the food and beverage industry in emerging economies presents lucrative opportunities for market players to expand their presence and increase their market share.

Market Share Analysis

The market share distribution of key players in the metal food steel cans market is characterized by a few dominant companies holding significant shares, while numerous smaller players compete in niche segments. Leading companies such as Ball Corporation, Crown Holdings, Inc., and Ardagh Group have established strong market positions through extensive product portfolios and a focus on sustainability and innovation. These companies are continuously investing in research and development to enhance their product offerings and meet the evolving needs of consumers. The competitive positioning of these companies is strengthened by strategic partnerships and collaborations with food and beverage manufacturers, which enable them to expand their reach and enhance their market presence.

Companies that are gaining market share are those that focus on developing innovative can designs and eco-friendly packaging solutions. These companies are well-positioned to capitalize on the growing demand for sustainable packaging solutions and the increasing popularity of canned food products. On the other hand, companies that are falling behind are those that fail to adapt to changing consumer preferences and market trends. The market share distribution affects pricing, innovation, and partnerships, as companies strive to differentiate themselves from competitors and capture a larger share of the market. The competitive landscape of the market is expected to remain dynamic, with companies continuously striving to enhance their product offerings and expand their market presence through strategic partnerships and collaborations.

Top Countries Insights in Metal Food Steel Cans

The United States is one of the largest markets for metal food steel cans, with a market size of $7.5 billion and a CAGR of 3%. The demand for metal food steel cans in the United States is driven by the increasing consumption of canned food products and the growing demand for sustainable packaging solutions. The market is also benefiting from the expansion of the food and beverage industry and the development of innovative can designs that cater to consumer preferences.

China is another significant market for metal food steel cans, with a market size of $5.2 billion and a CAGR of 5%. The demand for metal food steel cans in China is driven by the increasing consumption of packaged and processed foods and the growing focus on eco-friendly packaging solutions. The market is also benefiting from the expansion of the food and beverage industry and the development of lightweight and easy-to-open cans.

Germany is a key market for metal food steel cans in Europe, with a market size of $3.8 billion and a CAGR of 2%. The demand for metal food steel cans in Germany is driven by the increasing focus on sustainable packaging solutions and the development of innovative can designs. The market is also benefiting from the expansion of the food and beverage industry and the growing popularity of canned food products.

Brazil is a significant market for metal food steel cans in Latin America, with a market size of $2.5 billion and a CAGR of 4%. The demand for metal food steel cans in Brazil is driven by the increasing consumption of packaged and processed foods and the growing focus on eco-friendly packaging solutions. The market is also benefiting from the expansion of the food and beverage industry and the development of lightweight and easy-to-open cans.

India is an emerging market for metal food steel cans, with a market size of $1.8 billion and a CAGR of 6%. The demand for metal food steel cans in India is driven by the increasing consumption of canned food products and the growing demand for sustainable packaging solutions. The market is also benefiting from the expansion of the food and beverage industry and the development of innovative can designs that cater to consumer preferences.

Metal Food Steel Cans Market Segments

The Metal Food Steel Cans market has been segmented on the basis of

Material Type

- Tin

- Aluminum

- Steel

Application

- Fruits and Vegetables

- Meat and Seafood

- Pet Food

- Soups and Sauces

- Ready Meals

- Others

Can Type

- 2-Piece

- 3-Piece

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the metal food steel cans market?

What challenges does the metal food steel cans market face?

How are companies in the metal food steel cans market addressing sustainability?

What investment opportunities exist in the metal food steel cans market?

What are the emerging trends in the metal food steel cans market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.