- Home

- Food Packaging

- Food Packaging Cans Market Size, Future Growth and Forecast 2033

Food Packaging Cans Market Size, Future Growth and Forecast 2033

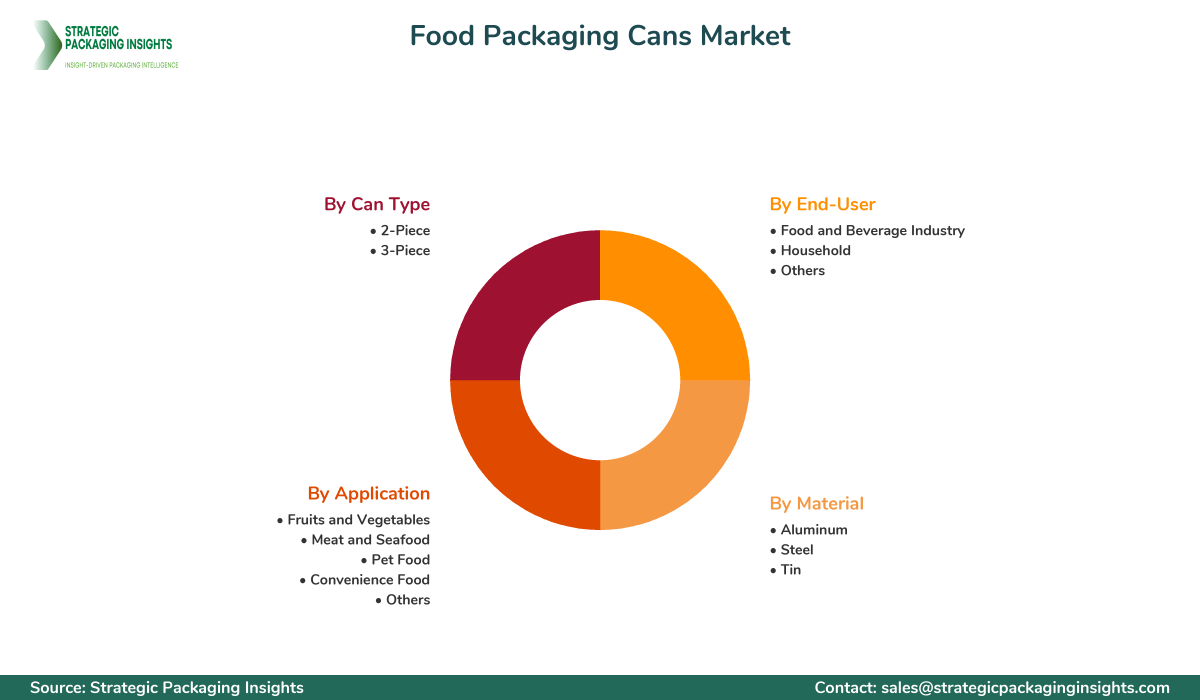

Food Packaging Cans Market Segments - by Material (Aluminum, Steel, Tin), Application (Fruits and Vegetables, Meat and Seafood, Pet Food, Convenience Food, Others), Can Type (2-Piece, 3-Piece), and End-User (Food and Beverage Industry, Household, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Packaging Cans Market Outlook

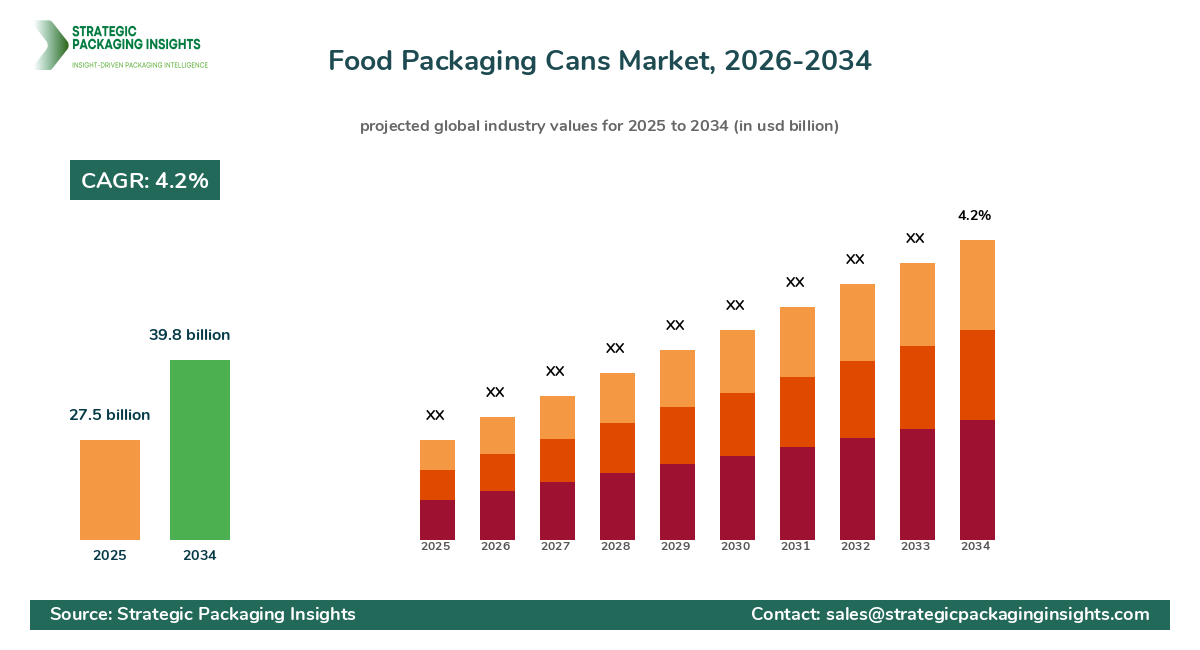

The food packaging cans market was valued at $27.5 billion in 2024 and is projected to reach $39.8 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This growth is driven by increasing consumer demand for convenient and sustainable packaging solutions. The shift towards urbanization and the rising disposable income levels have further fueled the demand for packaged food products, thereby boosting the market for food packaging cans. Additionally, the growing awareness about the environmental impact of packaging materials has led to a preference for recyclable and eco-friendly options, such as aluminum and Steel Cans, which are easily recyclable and have a lower carbon footprint compared to other packaging materials.

Report Scope

| Attributes | Details |

| Report Title | Food Packaging Cans Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 194 |

| Material | Aluminum, Steel, Tin |

| Application | Fruits and Vegetables, Meat and Seafood, Pet Food, Convenience Food, Others |

| Can Type | 2-Piece, 3-Piece |

| End-User | Food and Beverage Industry, Household, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the food packaging cans market is the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable and have a minimal environmental impact. This trend is particularly evident in developed regions where stringent regulations regarding packaging waste are in place. Companies that can innovate and offer eco-friendly packaging solutions are likely to gain a competitive edge in the market. Additionally, the rise in e-commerce and online grocery shopping has increased the demand for durable and Protective Packaging, further driving the growth of the food packaging cans market.

Another opportunity lies in the expanding market for ready-to-eat and convenience foods. With the fast-paced lifestyle of modern consumers, there is a growing demand for food products that are easy to prepare and consume. Food packaging cans offer a convenient solution for preserving and storing such products, thereby driving their demand. Moreover, the increasing trend of single-serve packaging, particularly in the beverage and pet food segments, presents a lucrative opportunity for manufacturers to expand their product offerings and cater to the changing consumer preferences.

However, the market faces certain restraints, such as the volatility in raw material prices. The prices of metals like aluminum and steel, which are commonly used in the production of food packaging cans, are subject to fluctuations due to changes in supply and demand dynamics, geopolitical tensions, and trade policies. These fluctuations can impact the profitability of manufacturers and pose a challenge to the growth of the market. Additionally, the increasing competition from alternative packaging solutions, such as Flexible Packaging and biodegradable materials, could hinder the growth of the food packaging cans market.

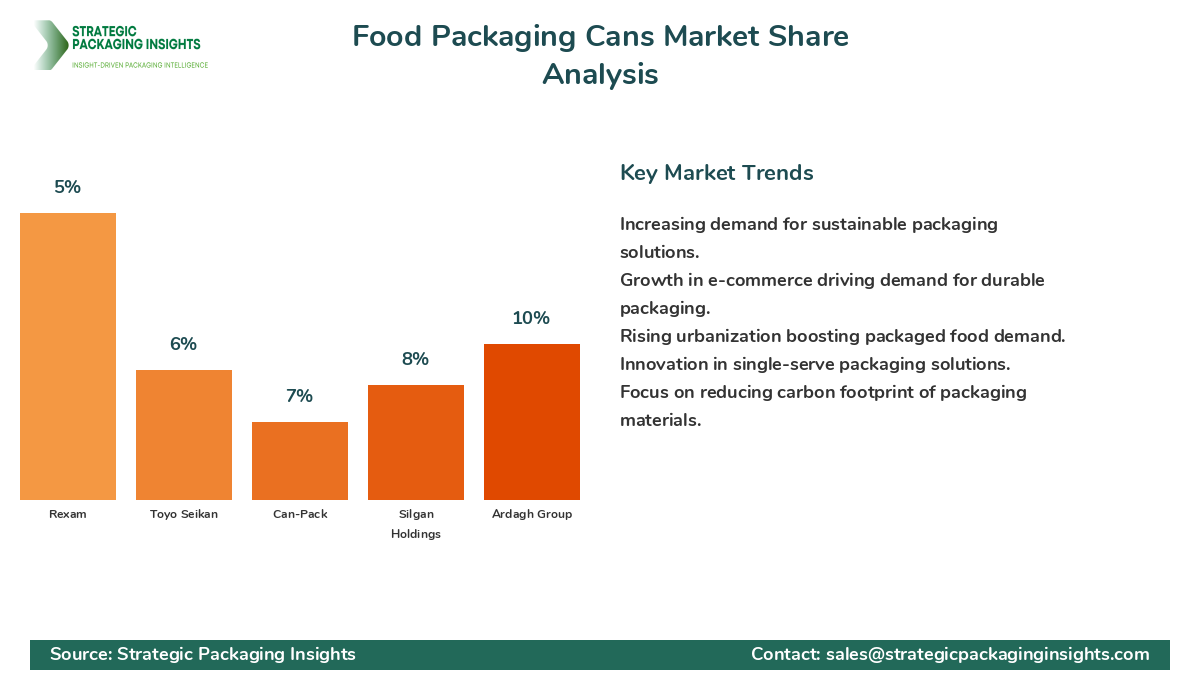

The competitive landscape of the food packaging cans market is characterized by the presence of several key players who hold significant market shares. These companies are focusing on strategies such as mergers and acquisitions, product innovations, and expansions to strengthen their market position. The market is moderately consolidated, with a few major players dominating the market share. However, the presence of numerous small and medium-sized enterprises adds to the competitive intensity of the market.

Ball Corporation is one of the leading players in the food packaging cans market, known for its innovative and Sustainable Packaging solutions. The company has a strong presence in North America and Europe and is expanding its operations in emerging markets to capitalize on the growing demand for canned food products. Crown Holdings, Inc. is another major player, offering a wide range of metal packaging solutions for the food and beverage industry. The company focuses on product innovation and sustainability to maintain its competitive edge in the market.

Ardagh Group is a prominent player in the market, providing metal and Glass Packaging solutions to various industries, including food and beverages. The company has a strong global presence and is committed to sustainability, with initiatives aimed at reducing its carbon footprint and promoting recycling. Silgan Holdings Inc. is also a key player, offering a diverse range of packaging solutions, including metal containers for food products. The company focuses on strategic acquisitions to expand its product portfolio and enhance its market presence.

Other notable players in the market include Can-Pack S.A., a leading manufacturer of aluminum beverage cans and packaging solutions, and Toyo Seikan Group Holdings, Ltd., which offers a wide range of packaging products, including Metal Cans for food and beverages. These companies are investing in research and development to introduce innovative packaging solutions and meet the evolving demands of consumers.

Key Highlights Food Packaging Cans Market

- The market is projected to grow at a CAGR of 4.2% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Rising urbanization and disposable income levels are boosting the demand for packaged food products.

- The market is moderately consolidated, with key players focusing on product innovation and sustainability.

- Volatility in raw material prices poses a challenge to market growth.

- Expanding e-commerce and online grocery shopping are increasing the demand for durable packaging.

- Single-serve packaging trends are creating new opportunities for manufacturers.

- North America and Europe are leading markets, with significant growth potential in Asia-Pacific.

- Stringent regulations regarding packaging waste are influencing market dynamics.

Competitive Intelligence

The food packaging cans market is highly competitive, with several key players vying for market share. Ball Corporation, with its focus on sustainability and innovation, is a leader in the market, offering a wide range of metal packaging solutions. The company has a strong presence in North America and Europe and is expanding its operations in emerging markets to capitalize on the growing demand for canned food products. Crown Holdings, Inc. is another major player, known for its diverse range of metal packaging solutions and commitment to sustainability. The company focuses on product innovation and strategic acquisitions to maintain its competitive edge.

Ardagh Group is a prominent player in the market, providing metal and glass packaging solutions to various industries, including food and beverages. The company has a strong global presence and is committed to sustainability, with initiatives aimed at reducing its carbon footprint and promoting recycling. Silgan Holdings Inc. is also a key player, offering a diverse range of packaging solutions, including metal containers for food products. The company focuses on strategic acquisitions to expand its product portfolio and enhance its market presence.

Can-Pack S.A., a leading manufacturer of aluminum beverage cans and packaging solutions, is investing in research and development to introduce innovative packaging solutions and meet the evolving demands of consumers. Toyo Seikan Group Holdings, Ltd. offers a wide range of packaging products, including metal cans for food and beverages, and is focused on expanding its global footprint. These companies are leveraging their strengths in innovation, sustainability, and strategic partnerships to gain a competitive advantage in the market.

Regional Market Intelligence of Food Packaging Cans

The global food packaging cans market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the high demand for packaged food products and the presence of major players in the region. The increasing focus on sustainability and recycling is also contributing to market growth. Europe is another significant market, with stringent regulations regarding packaging waste and a strong emphasis on sustainability driving the demand for recyclable packaging solutions.

In the Asia-Pacific region, the market is experiencing rapid growth due to the increasing urbanization, rising disposable income levels, and changing consumer preferences towards convenience foods. The expanding e-commerce sector is also boosting the demand for durable and protective packaging solutions. Latin America is witnessing moderate growth, driven by the increasing demand for packaged food products and the growing awareness about sustainable packaging solutions. In the Middle East & Africa, the market is growing steadily, with the rising demand for convenience foods and the increasing focus on sustainability driving market growth.

Top Countries Insights in Food Packaging Cans

In the United States, the food packaging cans market is valued at $8.5 billion with a CAGR of 3%. The market is driven by the high demand for packaged food products and the presence of major players in the region. The increasing focus on sustainability and recycling is also contributing to market growth. In China, the market is valued at $5.2 billion with a CAGR of 6%, driven by the increasing urbanization, rising disposable income levels, and changing consumer preferences towards convenience foods.

In Germany, the market is valued at $3.1 billion with a CAGR of 4%. The market is driven by stringent regulations regarding packaging waste and a strong emphasis on sustainability. In Brazil, the market is valued at $2.4 billion with a CAGR of 5%, driven by the increasing demand for packaged food products and the growing awareness about sustainable packaging solutions. In India, the market is valued at $1.8 billion with a CAGR of 7%, driven by the expanding e-commerce sector and the rising demand for durable and protective packaging solutions.

Food Packaging Cans Market Segments Insights

Material Analysis

The food packaging cans market is segmented by material into aluminum, steel, and tin. Aluminum cans are highly favored due to their lightweight nature, recyclability, and ability to preserve the freshness of food products. The demand for aluminum cans is driven by the increasing focus on sustainability and the growing preference for eco-friendly packaging solutions. Steel cans are also popular due to their durability and ability to withstand high temperatures, making them suitable for packaging a wide range of food products. Tin cans, although less common, are used for specific applications where corrosion resistance is a priority.

The competition among manufacturers is intense, with companies focusing on product innovation and sustainability to gain a competitive edge. The demand for recyclable and eco-friendly packaging solutions is driving manufacturers to invest in research and development to introduce innovative products that meet the evolving needs of consumers. The increasing focus on reducing the carbon footprint of packaging materials is also influencing the choice of materials used in the production of food packaging cans.

Application Analysis

The food packaging cans market is segmented by application into fruits and vegetables, meat and seafood, pet food, convenience food, and others. The demand for canned fruits and vegetables is driven by the increasing consumer preference for convenient and ready-to-eat food products. Canned meat and seafood are popular due to their long shelf life and ability to preserve the nutritional value of the products. The pet food segment is also witnessing significant growth, driven by the increasing demand for convenient and nutritious pet food options.

The convenience food segment is experiencing rapid growth, driven by the fast-paced lifestyle of modern consumers and the increasing demand for ready-to-eat meals. The demand for single-serve packaging solutions is also contributing to the growth of this segment. Manufacturers are focusing on product innovation and packaging design to cater to the changing consumer preferences and enhance the appeal of their products.

Can Type Analysis

The food packaging cans market is segmented by can type into 2-piece and 3-piece cans. 2-piece cans are popular due to their lightweight nature and ability to provide a hermetic seal, ensuring the freshness and safety of the packaged food products. The demand for 2-piece cans is driven by the increasing focus on sustainability and the growing preference for eco-friendly packaging solutions. 3-piece cans, although less common, are used for specific applications where additional strength and durability are required.

The competition among manufacturers is intense, with companies focusing on product innovation and sustainability to gain a competitive edge. The demand for recyclable and eco-friendly packaging solutions is driving manufacturers to invest in research and development to introduce innovative products that meet the evolving needs of consumers. The increasing focus on reducing the carbon footprint of packaging materials is also influencing the choice of can types used in the production of food packaging cans.

End-User Analysis

The food packaging cans market is segmented by end-user into the food and beverage industry, household, and others. The food and beverage industry is the largest end-user segment, driven by the increasing demand for packaged food products and the growing focus on sustainability. The demand for recyclable and eco-friendly packaging solutions is driving manufacturers to invest in research and development to introduce innovative products that meet the evolving needs of consumers.

The household segment is also witnessing significant growth, driven by the increasing consumer preference for convenient and ready-to-eat food products. The demand for single-serve packaging solutions is contributing to the growth of this segment. Manufacturers are focusing on product innovation and packaging design to cater to the changing consumer preferences and enhance the appeal of their products.

Market Share Analysis

The market share distribution of key players in the food packaging cans market is influenced by several factors, including product innovation, sustainability, and strategic partnerships. Companies like Ball Corporation and Crown Holdings, Inc. are leading the market, leveraging their strengths in innovation and sustainability to gain a competitive advantage. The presence of numerous small and medium-sized enterprises adds to the competitive intensity of the market, with these companies focusing on niche markets and product differentiation to gain market share.

The market share distribution affects pricing, innovation, and partnerships, with leading companies setting the benchmark for product quality and sustainability. The increasing focus on eco-friendly packaging solutions is driving manufacturers to invest in research and development to introduce innovative products that meet the evolving needs of consumers. The competitive landscape is characterized by strategic partnerships and collaborations, with companies seeking to expand their product offerings and enhance their market presence.

Food Packaging Cans Market Segments

The Food Packaging Cans market has been segmented on the basis of

Material

- Aluminum

- Steel

- Tin

Application

- Fruits and Vegetables

- Meat and Seafood

- Pet Food

- Convenience Food

- Others

Can Type

- 2-Piece

- 3-Piece

End-User

- Food and Beverage Industry

- Household

- Others

Primary Interview Insights

What are the key drivers of growth in the food packaging cans market?

What challenges does the food packaging cans market face?

How are companies addressing sustainability in the food packaging cans market?

Which regions are leading the growth in the food packaging cans market?

What trends are shaping the future of the food packaging cans market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.