- Home

- Food Packaging

- Food Grade Glassine Paper Market Size, Future Growth and Forecast 2033

Food Grade Glassine Paper Market Size, Future Growth and Forecast 2033

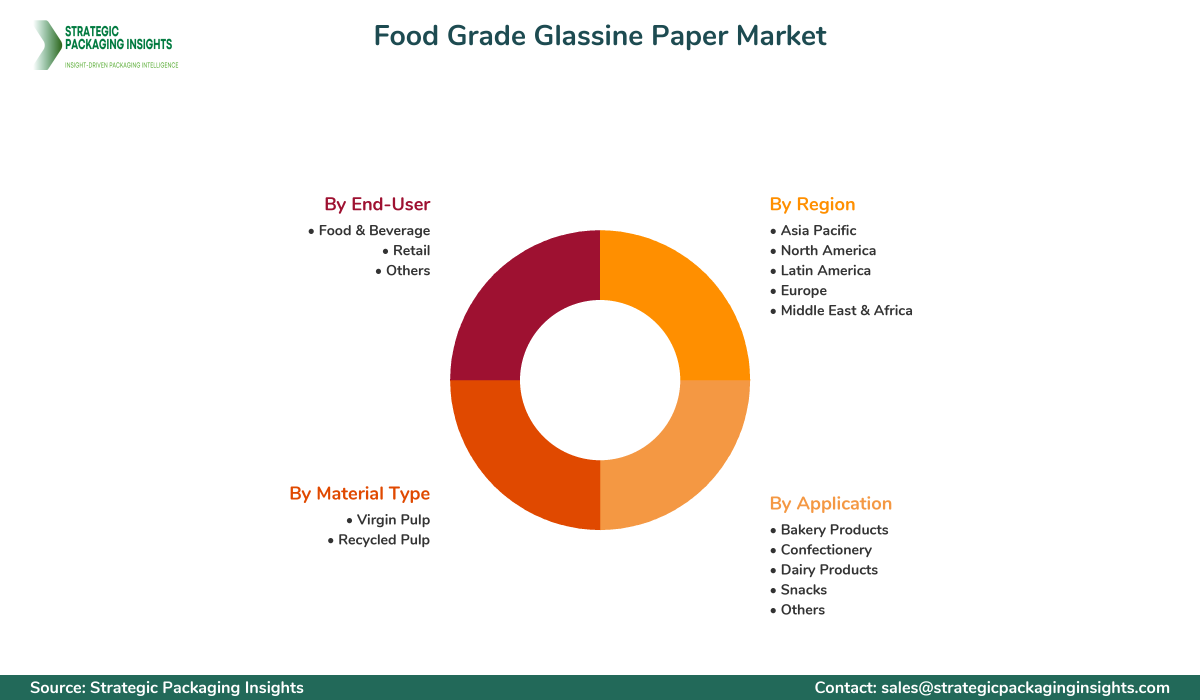

Food Grade Glassine Paper Market Segments - by Application (Bakery Products, Confectionery, Dairy Products, Snacks, Others), Material Type (Virgin Pulp, Recycled Pulp), End-User (Food & Beverage, Retail, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Grade Glassine Paper Market Outlook

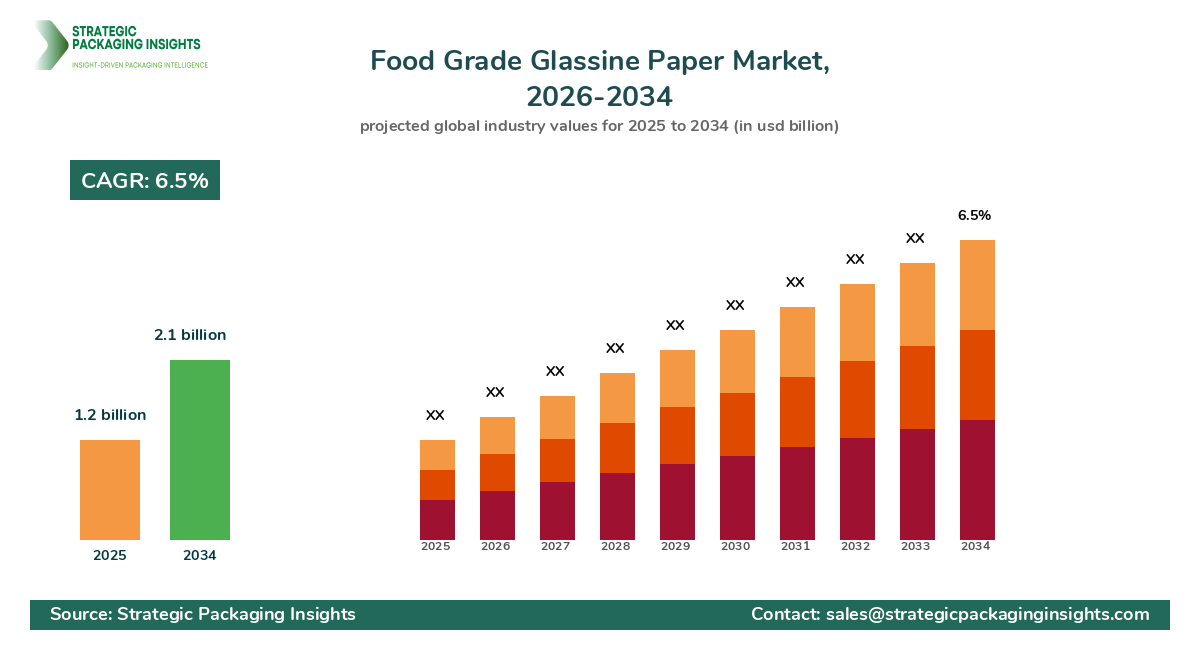

The food grade glassine paper market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and eco-friendly packaging solutions in the food industry. Glassine paper, known for its smooth and glossy finish, is gaining popularity due to its biodegradable nature and ability to provide a moisture-resistant barrier, making it ideal for food packaging. The rise in consumer awareness regarding environmental issues and the shift towards Sustainable Packaging are significant factors propelling the market growth. Additionally, the expanding food and beverage industry, coupled with the growing trend of on-the-go food consumption, is further boosting the demand for food grade glassine paper.

However, the market faces certain restraints, such as the high cost of production and the availability of alternative packaging materials like plastic and aluminum foil, which offer similar properties at a lower cost. Regulatory challenges related to food safety standards and the need for compliance with stringent packaging regulations also pose challenges to market growth. Despite these challenges, the market holds significant growth potential due to the increasing adoption of Glassine paper in emerging economies, where the food packaging industry is witnessing rapid expansion. The development of innovative and cost-effective production techniques is expected to create new opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Food Grade Glassine Paper Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 192 |

| Application | Bakery Products, Confectionery, Dairy Products, Snacks, Others |

| Material Type | Virgin Pulp, Recycled Pulp |

| End-User | Food & Beverage, Retail, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The food grade glassine paper market presents numerous opportunities for growth, primarily driven by the increasing consumer preference for sustainable and eco-friendly packaging solutions. As environmental concerns continue to rise, consumers are becoming more conscious of the impact of packaging materials on the environment. This shift in consumer behavior is encouraging manufacturers to adopt glassine paper, which is biodegradable and recyclable, as a preferred packaging material. Additionally, the growing trend of organic and natural food products is further boosting the demand for glassine paper, as it aligns with the eco-friendly image of these products. The expansion of the food and beverage industry, particularly in emerging economies, is also creating new opportunities for market players to tap into untapped markets and expand their customer base.

Another significant opportunity lies in the development of innovative and cost-effective production techniques for glassine paper. Manufacturers are investing in research and development to enhance the properties of glassine paper, such as improving its moisture resistance and strength, to cater to the evolving needs of the food packaging industry. The introduction of advanced manufacturing processes and the use of sustainable raw materials are expected to reduce production costs and increase the competitiveness of glassine paper in the market. Furthermore, the increasing adoption of glassine paper in non-food applications, such as pharmaceuticals and cosmetics, is opening up new avenues for market growth.

Despite the promising opportunities, the food grade glassine paper market faces certain threats that could hinder its growth. One of the primary challenges is the high cost of production, which makes glassine paper less competitive compared to alternative packaging materials like plastic and aluminum foil. The availability of cheaper substitutes poses a significant threat to the market, as manufacturers may opt for cost-effective options to reduce production costs. Additionally, the stringent regulations related to food safety and packaging standards can pose challenges for market players, as they need to ensure compliance with these regulations to maintain product quality and safety. The fluctuating prices of raw materials, such as pulp, also add to the challenges faced by manufacturers in the glassine paper market.

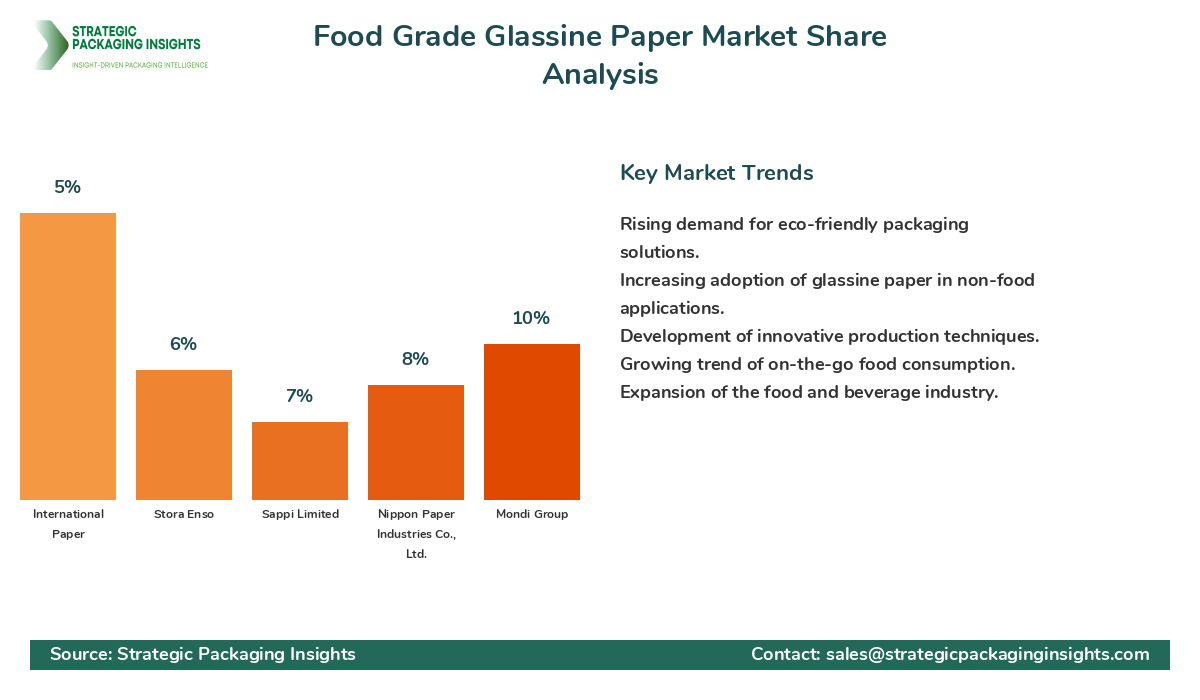

The competitive landscape of the food grade glassine paper market is characterized by the presence of several key players who are actively engaged in product innovation and expansion strategies to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing for market share. The leading companies in the market are focusing on expanding their product portfolios and enhancing their production capabilities to meet the growing demand for glassine paper. Strategic partnerships, mergers, and acquisitions are common strategies adopted by market players to gain a competitive edge and expand their geographical presence.

One of the major players in the market is Ahlstrom-Munksjö, which holds a significant market share due to its extensive product portfolio and strong distribution network. The company is known for its high-quality glassine paper products that cater to various applications in the food packaging industry. Another key player is UPM-Kymmene Corporation, which is recognized for its sustainable packaging solutions and commitment to environmental responsibility. The company's focus on innovation and product development has helped it maintain a strong position in the market.

Other notable players in the market include Mondi Group, Nippon Paper Industries Co., Ltd., and Sappi Limited. Mondi Group is known for its comprehensive range of packaging solutions, including glassine paper, and its focus on sustainability and innovation. Nippon Paper Industries Co., Ltd. is a leading player in the paper industry, offering a wide range of paper products, including glassine paper, for various applications. Sappi Limited is recognized for its high-quality paper products and commitment to sustainability, making it a key player in the glassine paper market.

In addition to these major players, several regional players are also contributing to the market growth by offering customized solutions and catering to the specific needs of local markets. The competitive landscape is expected to intensify in the coming years, with companies focusing on expanding their product offerings and enhancing their production capabilities to meet the growing demand for food grade glassine paper. The market share distribution is likely to be influenced by factors such as pricing strategies, product quality, and innovation, which will play a crucial role in determining the competitive positioning of market players.

Key Highlights Food Grade Glassine Paper Market

- Increasing demand for sustainable and eco-friendly packaging solutions is driving market growth.

- Glassine paper is gaining popularity due to its biodegradable nature and moisture-resistant properties.

- The expanding food and beverage industry is boosting the demand for food grade glassine paper.

- Innovative and cost-effective production techniques are creating new opportunities for market players.

- Stringent regulations related to food safety and packaging standards pose challenges for market growth.

- The market is characterized by the presence of several key players engaged in product innovation and expansion strategies.

- Strategic partnerships, mergers, and acquisitions are common strategies adopted by market players to gain a competitive edge.

- The market is moderately fragmented, with a mix of global and regional players competing for market share.

- The increasing adoption of glassine paper in non-food applications is opening up new avenues for market growth.

- The competitive landscape is expected to intensify in the coming years, with companies focusing on expanding their product offerings and enhancing their production capabilities.

Competitive Intelligence

The competitive landscape of the food grade glassine paper market is shaped by the presence of several key players who are actively engaged in product innovation and expansion strategies to strengthen their market position. Ahlstrom-Munksjö, a leading player in the market, is known for its extensive product portfolio and strong distribution network. The company focuses on delivering high-quality glassine paper products that cater to various applications in the food packaging industry. UPM-Kymmene Corporation is another major player recognized for its sustainable packaging solutions and commitment to environmental responsibility. The company's focus on innovation and product development has helped it maintain a strong position in the market.

Mondi Group, Nippon Paper Industries Co., Ltd., and Sappi Limited are also notable players in the market. Mondi Group is known for its comprehensive range of packaging solutions, including glassine paper, and its focus on sustainability and innovation. Nippon Paper Industries Co., Ltd. is a leading player in the paper industry, offering a wide range of paper products, including glassine paper, for various applications. Sappi Limited is recognized for its high-quality paper products and commitment to sustainability, making it a key player in the glassine paper market.

In addition to these major players, several regional players are also contributing to the market growth by offering customized solutions and catering to the specific needs of local markets. The competitive landscape is expected to intensify in the coming years, with companies focusing on expanding their product offerings and enhancing their production capabilities to meet the growing demand for food grade glassine paper. The market share distribution is likely to be influenced by factors such as pricing strategies, product quality, and innovation, which will play a crucial role in determining the competitive positioning of market players.

The competitive intelligence analysis reveals that companies are increasingly focusing on strategic partnerships, mergers, and acquisitions to gain a competitive edge and expand their geographical presence. The development of innovative and cost-effective production techniques is also a key focus area for market players, as it enables them to enhance the properties of glassine paper and cater to the evolving needs of the food packaging industry. The increasing adoption of glassine paper in non-food applications, such as pharmaceuticals and cosmetics, is opening up new avenues for market growth and providing opportunities for companies to diversify their product offerings.

Regional Market Intelligence of Food Grade Glassine Paper

The global food grade glassine paper market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region exhibits unique growth drivers and market dynamics that influence the overall market performance. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of a well-established food and beverage industry. The region's focus on environmental sustainability and the adoption of eco-friendly packaging materials are key factors contributing to market growth.

In Europe, the market is characterized by stringent regulations related to food safety and packaging standards, which drive the demand for high-quality and compliant packaging materials like glassine paper. The region's emphasis on sustainability and the growing trend of organic and natural food products are also boosting the demand for glassine paper. The presence of major market players and their focus on innovation and product development further contribute to the market's growth in Europe.

The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the expanding food and beverage industry and the increasing adoption of sustainable packaging solutions. The region's growing population and rising disposable incomes are contributing to the demand for packaged food products, thereby boosting the demand for glassine paper. The presence of emerging economies, such as China and India, with rapidly growing food packaging industries, presents lucrative opportunities for market players.

In Latin America, the market is driven by the increasing demand for eco-friendly packaging solutions and the growing awareness of environmental issues. The region's focus on sustainability and the adoption of Biodegradable Packaging materials are key factors contributing to market growth. The presence of a growing food and beverage industry and the increasing trend of on-the-go food consumption are also boosting the demand for glassine paper in Latin America.

The Middle East & Africa region is expected to witness moderate growth during the forecast period, driven by the increasing demand for sustainable packaging solutions and the presence of a growing food and beverage industry. The region's focus on environmental sustainability and the adoption of eco-friendly packaging materials are key factors contributing to market growth. The presence of emerging economies and the increasing trend of on-the-go food consumption are also boosting the demand for glassine paper in the Middle East & Africa.

Top Countries Insights in Food Grade Glassine Paper

In the food grade glassine paper market, United States is a key player with a market size of $300 million and a CAGR of 5%. The country's focus on sustainability and the presence of a well-established food and beverage industry are driving the demand for glassine paper. The increasing adoption of eco-friendly packaging solutions and the growing trend of organic and natural food products are also contributing to market growth.

Germany is another significant market, with a market size of $250 million and a CAGR of 4%. The country's stringent regulations related to food safety and packaging standards drive the demand for high-quality and compliant packaging materials like glassine paper. The emphasis on sustainability and the growing trend of organic and natural food products are also boosting the demand for glassine paper in Germany.

In China, the market is expected to witness significant growth, with a market size of $200 million and a CAGR of 7%. The country's expanding food and beverage industry and the increasing adoption of sustainable packaging solutions are key factors contributing to market growth. The presence of a large population and rising disposable incomes are also boosting the demand for packaged food products, thereby driving the demand for glassine paper.

India is another emerging market, with a market size of $150 million and a CAGR of 8%. The country's growing food packaging industry and the increasing demand for eco-friendly packaging solutions are driving the demand for glassine paper. The presence of a large population and the increasing trend of on-the-go food consumption are also contributing to market growth in India.

In Brazil, the market is driven by the increasing demand for sustainable packaging solutions and the growing awareness of environmental issues. The country's focus on sustainability and the adoption of biodegradable packaging materials are key factors contributing to market growth. The presence of a growing food and beverage industry and the increasing trend of on-the-go food consumption are also boosting the demand for glassine paper in Brazil.

Food Grade Glassine Paper Market Segments Insights

Application Analysis

The application segment of the food grade glassine paper market is diverse, encompassing various end-use industries such as bakery products, confectionery, dairy products, snacks, and others. The bakery products segment is a major contributor to the market, driven by the increasing demand for convenient and ready-to-eat bakery items. Glassine paper is widely used in the packaging of bakery products due to its moisture-resistant properties, which help maintain the freshness and quality of the products. The growing trend of on-the-go food consumption and the increasing popularity of artisanal and specialty bakery products are further boosting the demand for glassine paper in this segment.

The confectionery segment is another significant application area for glassine paper, driven by the increasing demand for premium and high-quality confectionery products. Glassine paper is preferred for confectionery packaging due to its smooth and glossy finish, which enhances the visual appeal of the products. The growing trend of gifting confectionery items and the increasing popularity of personalized and customized confectionery products are also contributing to the demand for glassine paper in this segment. Additionally, the dairy products segment is witnessing growth, driven by the increasing demand for sustainable and eco-friendly packaging solutions in the dairy industry.

Material Type Analysis

The material type segment of the food grade glassine paper market is categorized into virgin pulp and recycled pulp. The virgin pulp segment holds a significant share of the market, driven by the increasing demand for high-quality and hygienic packaging materials in the food industry. Virgin pulp glassine paper is preferred for food packaging due to its superior strength and moisture-resistant properties, which help maintain the freshness and quality of the products. The growing trend of premium and high-quality food products is further boosting the demand for virgin pulp glassine paper.

The recycled pulp segment is also witnessing growth, driven by the increasing focus on sustainability and the adoption of eco-friendly packaging solutions. Recycled pulp glassine paper is gaining popularity due to its environmental benefits and cost-effectiveness. The growing awareness of environmental issues and the increasing demand for sustainable packaging materials are key factors contributing to the growth of the recycled pulp segment. Additionally, the development of advanced recycling technologies and the increasing availability of high-quality recycled pulp are expected to drive the demand for recycled pulp glassine paper in the coming years.

End-User Analysis

The end-user segment of the food grade glassine paper market is diverse, encompassing various industries such as food & beverage, retail, and others. The food & beverage industry is a major end-user of glassine paper, driven by the increasing demand for sustainable and eco-friendly packaging solutions. Glassine paper is widely used in the packaging of food and beverage products due to its moisture-resistant properties and ability to maintain the freshness and quality of the products. The growing trend of on-the-go food consumption and the increasing popularity of organic and natural food products are further boosting the demand for glassine paper in this segment.

The retail industry is another significant end-user of glassine paper, driven by the increasing demand for sustainable packaging solutions in the retail sector. Glassine paper is preferred for retail packaging due to its smooth and glossy finish, which enhances the visual appeal of the products. The growing trend of personalized and customized packaging solutions and the increasing focus on sustainability in the retail sector are also contributing to the demand for glassine paper in this segment. Additionally, the increasing adoption of glassine paper in non-food applications, such as pharmaceuticals and cosmetics, is opening up new avenues for market growth.

Regional Analysis

The regional analysis of the food grade glassine paper market reveals significant growth opportunities across various regions. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of a well-established food and beverage industry. The region's focus on environmental sustainability and the adoption of eco-friendly packaging materials are key factors contributing to market growth. In Europe, the market is characterized by stringent regulations related to food safety and packaging standards, which drive the demand for high-quality and compliant packaging materials like glassine paper. The region's emphasis on sustainability and the growing trend of organic and natural food products are also boosting the demand for glassine paper.

The Asia-Pacific region is expected to witness significant growth during the forecast period, driven by the expanding food and beverage industry and the increasing adoption of sustainable packaging solutions. The region's growing population and rising disposable incomes are contributing to the demand for packaged food products, thereby boosting the demand for glassine paper. The presence of emerging economies, such as China and India, with rapidly growing food packaging industries, presents lucrative opportunities for market players. In Latin America, the market is driven by the increasing demand for eco-friendly packaging solutions and the growing awareness of environmental issues. The region's focus on sustainability and the adoption of biodegradable packaging materials are key factors contributing to market growth.

Market Share Analysis

The market share distribution of key players in the food grade glassine paper market is influenced by several factors, including pricing strategies, product quality, and innovation. Leading companies such as Ahlstrom-Munksjö, UPM-Kymmene Corporation, Mondi Group, Nippon Paper Industries Co., Ltd., and Sappi Limited hold significant market shares due to their extensive product portfolios and strong distribution networks. These companies are actively engaged in product innovation and expansion strategies to strengthen their market position and meet the growing demand for glassine paper. The competitive landscape is characterized by the presence of both global and regional players, with strategic partnerships, mergers, and acquisitions being common strategies adopted by market players to gain a competitive edge and expand their geographical presence.

Food Grade Glassine Paper Market Segments

The Food Grade Glassine Paper market has been segmented on the basis of

Application

- Bakery Products

- Confectionery

- Dairy Products

- Snacks

- Others

Material Type

- Virgin Pulp

- Recycled Pulp

End-User

- Food & Beverage

- Retail

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of the food grade glassine paper market?

What challenges does the food grade glassine paper market face?

How is the competitive landscape of the market evolving?

What opportunities exist for market players in the food grade glassine paper market?

Which regions are expected to witness significant growth in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.