- Home

- Food Packaging

- Food Easy Open Ends Market Size, Future Growth and Forecast 2033

Food Easy Open Ends Market Size, Future Growth and Forecast 2033

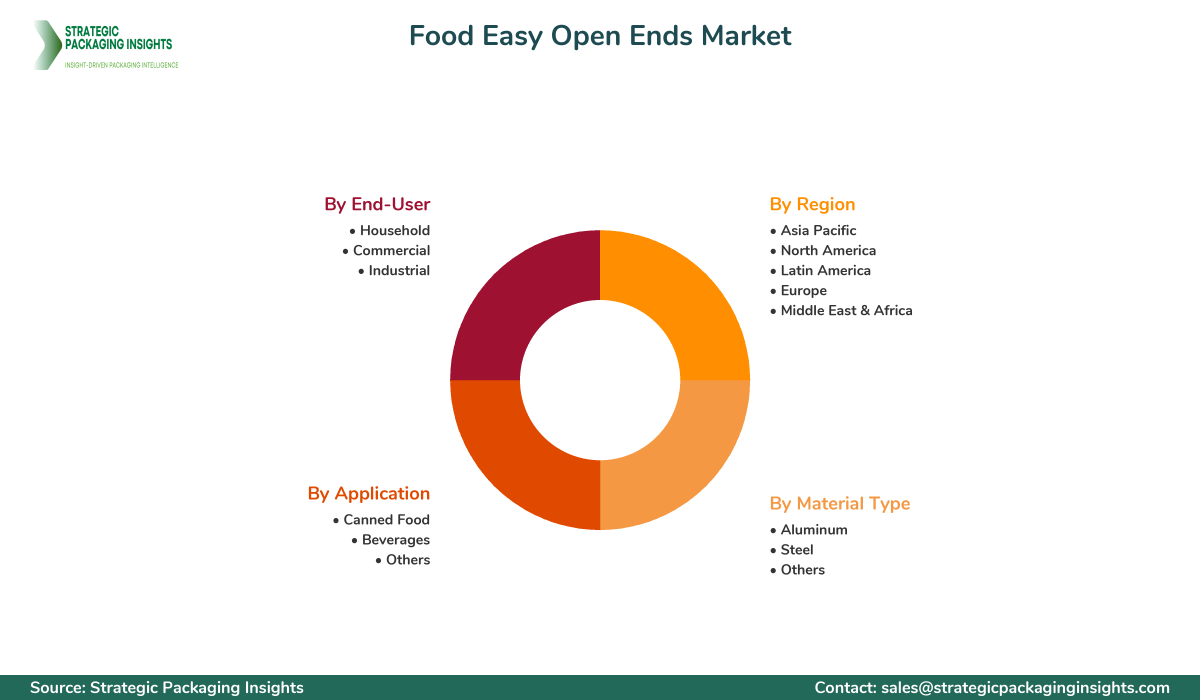

Food Easy Open Ends Market Segments - by Material Type (Aluminum, Steel, Others), Application (Canned Food, Beverages, Others), End-User (Household, Commercial, Industrial), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Easy Open Ends Market Outlook

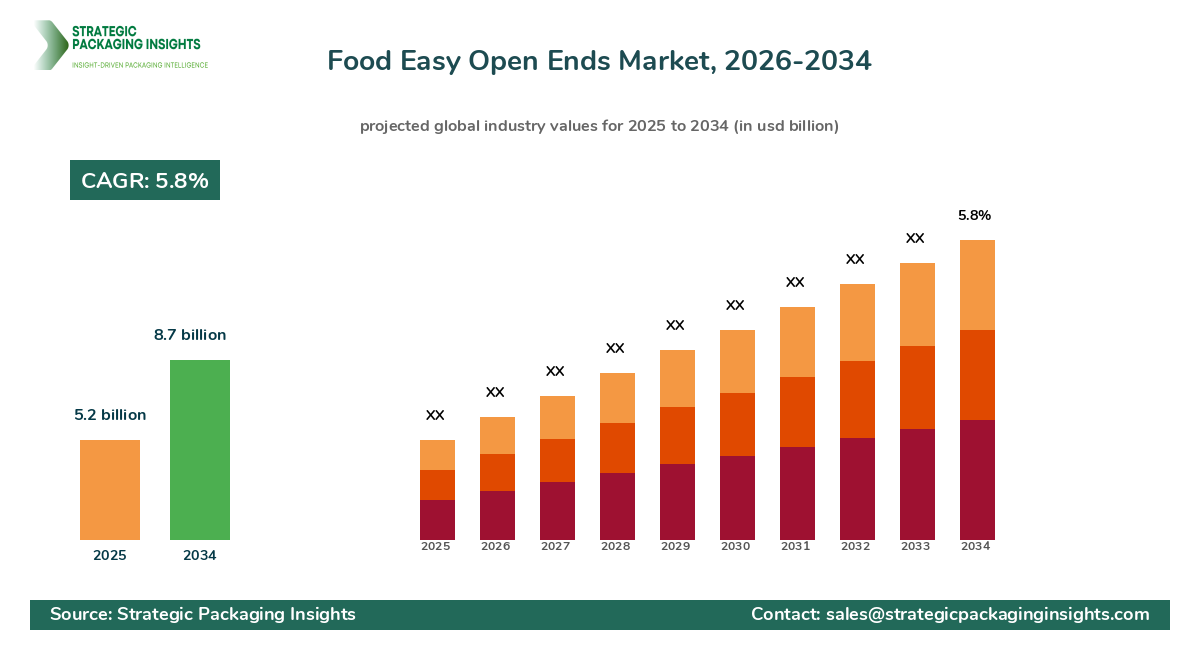

The Food Easy Open Ends market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033. This market is driven by the increasing demand for convenience in food packaging, as consumers seek products that offer ease of use and accessibility. The rise in urbanization and the busy lifestyles of consumers have further fueled the demand for easy open ends, as they provide a quick and efficient way to access food products. Additionally, the growing trend of on-the-go consumption and the increasing popularity of canned foods are significant factors contributing to the market's growth. The market is also benefiting from technological advancements in packaging solutions, which have led to the development of innovative and sustainable easy open ends.

Report Scope

| Attributes | Details |

| Report Title | Food Easy Open Ends Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 171 |

| Material Type | Aluminum, Steel, Others |

| Application | Canned Food, Beverages, Others |

| End-User | Household, Commercial, Industrial |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the Food Easy Open Ends market is the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging that minimizes environmental impact. This trend is encouraging manufacturers to develop easy open ends made from recyclable and biodegradable materials, which not only meet consumer expectations but also comply with stringent environmental regulations. Furthermore, the expansion of the food and beverage industry, particularly in emerging markets, presents lucrative opportunities for market players to expand their product offerings and capture a larger market share.

Another opportunity lies in the technological advancements in packaging machinery and materials. Innovations in manufacturing processes have enabled the production of easy open ends that are not only more efficient but also more cost-effective. This has allowed manufacturers to offer competitive pricing, thereby attracting a broader customer base. Additionally, the integration of smart packaging technologies, such as QR codes and NFC tags, into easy open ends is opening new avenues for enhancing consumer engagement and providing value-added services.

However, the market faces certain restraints, such as the volatility in raw material prices, which can impact the overall production costs of easy open ends. Fluctuations in the prices of metals like aluminum and steel, which are commonly used in the manufacturing of easy open ends, can pose challenges for manufacturers in maintaining profitability. Moreover, the presence of stringent regulations regarding food safety and packaging standards can also act as a barrier to market growth, as companies need to ensure compliance with these regulations to avoid penalties and maintain consumer trust.

The competitive landscape of the Food Easy Open Ends market is characterized by the presence of several key players who hold significant market shares. These companies are actively engaged in strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to strengthen their market position. The market is highly competitive, with players focusing on expanding their product portfolios and enhancing their distribution networks to cater to a wider customer base. The leading companies in the market are leveraging their strong brand presence and extensive industry experience to maintain a competitive edge.

Some of the major companies in the Food Easy Open Ends market include Crown Holdings, Inc., Silgan Holdings Inc., Ardagh Group S.A., Sonoco Products Company, and Can-Pack S.A. Crown Holdings, Inc. is a prominent player known for its innovative packaging solutions and extensive product range. The company has a strong global presence and is committed to sustainability, which is reflected in its efforts to develop eco-friendly packaging solutions. Silgan Holdings Inc. is another key player, recognized for its comprehensive portfolio of metal and Plastic Packaging solutions. The company focuses on delivering high-quality products and has a robust distribution network that supports its global operations.

Ardagh Group S.A. is a leading provider of metal and Glass Packaging solutions, with a strong emphasis on innovation and sustainability. The company has a diverse product offering and serves a wide range of industries, including food and beverage. Sonoco Products Company is known for its Sustainable Packaging solutions and has a strong focus on research and development to drive product innovation. Can-Pack S.A. is a major player in the metal packaging industry, offering a wide range of products, including easy open ends, to meet the diverse needs of its customers.

Key Highlights Food Easy Open Ends Market

- The market is projected to grow at a CAGR of 5.8% from 2025 to 2033.

- Increasing demand for convenience and on-the-go food products is driving market growth.

- Technological advancements in packaging solutions are enhancing product offerings.

- Growing preference for sustainable and eco-friendly packaging solutions.

- Expansion of the food and beverage industry in emerging markets presents growth opportunities.

- Volatility in raw material prices poses a challenge to market growth.

- Stringent regulations regarding food safety and packaging standards.

- Key players are focusing on strategic initiatives to strengthen their market position.

- Integration of smart packaging technologies is enhancing consumer engagement.

- Strong competition among market players is driving innovation and product development.

Premium Insights - Key Investment Analysis

The Food Easy Open Ends market is witnessing significant investment activity, driven by the increasing demand for innovative and sustainable packaging solutions. Venture capital firms and private equity investors are actively investing in companies that are developing Advanced Packaging technologies and materials. The market is also seeing a rise in mergers and acquisitions, as companies seek to expand their product portfolios and enhance their market presence. These strategic deals are often aimed at acquiring new technologies, entering new markets, and achieving economies of scale.

Investment valuations in the Food Easy Open Ends market are influenced by factors such as the company's market position, growth potential, and technological capabilities. Investors are particularly interested in companies that demonstrate a strong commitment to sustainability and have a track record of innovation. The return on investment (ROI) expectations in this market are high, given the growing demand for easy open ends and the potential for market expansion. Emerging investment themes include the development of eco-friendly packaging solutions, the integration of smart packaging technologies, and the expansion of production capacities to meet increasing demand.

Risk factors in the Food Easy Open Ends market include fluctuations in raw material prices, regulatory challenges, and intense competition. However, the strategic rationale behind major deals often involves mitigating these risks by diversifying product offerings, enhancing operational efficiencies, and leveraging technological advancements. High-potential investment opportunities exist in regions with rapidly growing food and beverage industries, such as Asia Pacific and Latin America, where demand for easy open ends is expected to rise significantly.

Food Easy Open Ends Market Segments Insights

Material Type Analysis

The Food Easy Open Ends market is segmented by material type into aluminum, steel, and others. Aluminum is the most widely used material due to its lightweight, corrosion-resistant properties, and recyclability. The demand for aluminum easy open ends is driven by the increasing focus on sustainability and the need for Lightweight Packaging solutions. Steel, on the other hand, is favored for its strength and durability, making it suitable for packaging products that require a higher level of protection. The market for steel easy open ends is supported by the growing demand for canned food products, which require robust packaging solutions.

In recent years, there has been a growing trend towards the use of alternative materials, such as biodegradable and compostable materials, in the production of easy open ends. This trend is driven by the increasing consumer preference for eco-friendly packaging solutions and the need to comply with stringent environmental regulations. Manufacturers are investing in research and development to explore new materials that offer the same level of functionality and convenience as traditional materials, while minimizing environmental impact.

Application Analysis

The application segment of the Food Easy Open Ends market includes canned food, beverages, and others. The canned food segment holds a significant share of the market, driven by the increasing demand for convenient and long-shelf-life food products. Easy open ends are widely used in the packaging of canned vegetables, fruits, meats, and ready-to-eat meals, as they provide a quick and easy way to access the contents. The beverages segment is also experiencing growth, as easy open ends are commonly used in the packaging of carbonated drinks, juices, and alcoholic beverages.

The market is witnessing a shift towards the use of easy open ends in non-traditional applications, such as pet food and personal care products. This trend is driven by the growing demand for convenience and the need for packaging solutions that offer ease of use and accessibility. Manufacturers are exploring new applications for easy open ends to tap into emerging markets and expand their customer base.

End-User Analysis

The end-user segment of the Food Easy Open Ends market includes household, commercial, and industrial users. The household segment is the largest end-user, driven by the increasing demand for convenient and easy-to-use packaging solutions for everyday food products. Consumers are increasingly opting for easy open ends due to their convenience and the ability to preserve the freshness and quality of food products.

The commercial segment, which includes restaurants, cafes, and catering services, is also a significant contributor to the market. The demand for easy open ends in this segment is driven by the need for efficient and time-saving packaging solutions that enhance operational efficiency. The industrial segment, which includes food processing and manufacturing companies, is experiencing growth due to the increasing demand for Bulk Packaging Solutions that offer ease of use and accessibility.

Regional Analysis

The Food Easy Open Ends market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Asia Pacific is the largest market for easy open ends, driven by the rapid growth of the food and beverage industry in countries such as China, India, and Japan. The increasing urbanization and changing consumer lifestyles in this region are contributing to the growing demand for convenient packaging solutions.

North America and Europe are also significant markets for easy open ends, driven by the high demand for canned food and beverages. The presence of established food and beverage companies in these regions is supporting market growth. Latin America and Middle East & Africa are emerging markets, with increasing demand for easy open ends driven by the growing food and beverage industry and the rising consumer preference for convenient packaging solutions.

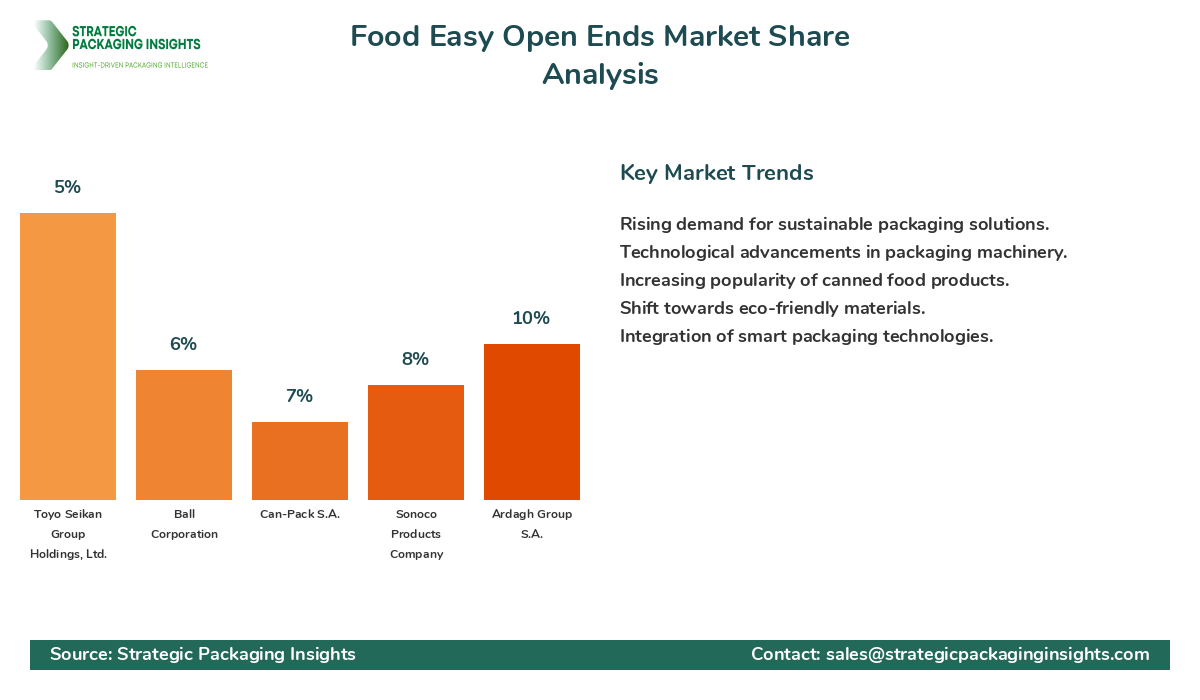

Market Share Analysis

The market share distribution of key players in the Food Easy Open Ends market is influenced by factors such as product innovation, brand reputation, and distribution network. Companies that are leading the market, such as Crown Holdings, Inc. and Silgan Holdings Inc., have a strong focus on innovation and sustainability, which has helped them maintain a competitive edge. These companies are continuously investing in research and development to enhance their product offerings and meet the evolving needs of consumers.

Companies that are gaining market share are those that have successfully expanded their product portfolios and entered new markets. For instance, Ardagh Group S.A. has been expanding its presence in emerging markets, which has contributed to its growing market share. On the other hand, companies that are falling behind are those that have not kept pace with technological advancements and changing consumer preferences. The market share distribution affects pricing, as companies with a larger market share have greater pricing power and can offer competitive pricing to attract customers.

Top Countries Insights in Food Easy Open Ends

In the Food Easy Open Ends market, the United States is a leading country with a market size of $1.2 billion and a CAGR of 4%. The demand for easy open ends in the U.S. is driven by the high consumption of canned food and beverages, as well as the presence of established food and beverage companies. The country is also witnessing a growing trend towards sustainable packaging solutions, which is contributing to market growth.

China is another significant market, with a market size of $1 billion and a CAGR of 6%. The rapid growth of the food and beverage industry in China, coupled with increasing urbanization and changing consumer lifestyles, is driving the demand for easy open ends. The country is also experiencing a shift towards eco-friendly packaging solutions, which is creating opportunities for market players.

Germany is a key market in Europe, with a market size of $800 million and a CAGR of 5%. The demand for easy open ends in Germany is driven by the high consumption of canned food and beverages, as well as the growing preference for convenient packaging solutions. The country is also witnessing a trend towards sustainable packaging, which is supporting market growth.

Brazil is an emerging market in Latin America, with a market size of $600 million and a CAGR of 7%. The growing food and beverage industry in Brazil, along with the rising consumer preference for convenient packaging solutions, is driving the demand for easy open ends. The country is also experiencing a shift towards eco-friendly packaging, which is creating opportunities for market players.

India is a rapidly growing market in Asia Pacific, with a market size of $500 million and a CAGR of 8%. The increasing urbanization and changing consumer lifestyles in India are contributing to the growing demand for easy open ends. The country is also witnessing a trend towards sustainable packaging solutions, which is supporting market growth.

Food Easy Open Ends Market Segments

The Food Easy Open Ends market has been segmented on the basis of

Material Type

- Aluminum

- Steel

- Others

Application

- Canned Food

- Beverages

- Others

End-User

- Household

- Commercial

- Industrial

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the Food Easy Open Ends market?

What challenges does the market face?

Which regions are expected to see the most growth?

How are companies addressing sustainability in packaging?

What role does innovation play in this market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.