- Home

- Packaging Products

- Roll-fed Labels Market Size, Future Growth and Forecast 2033

Roll-fed Labels Market Size, Future Growth and Forecast 2033

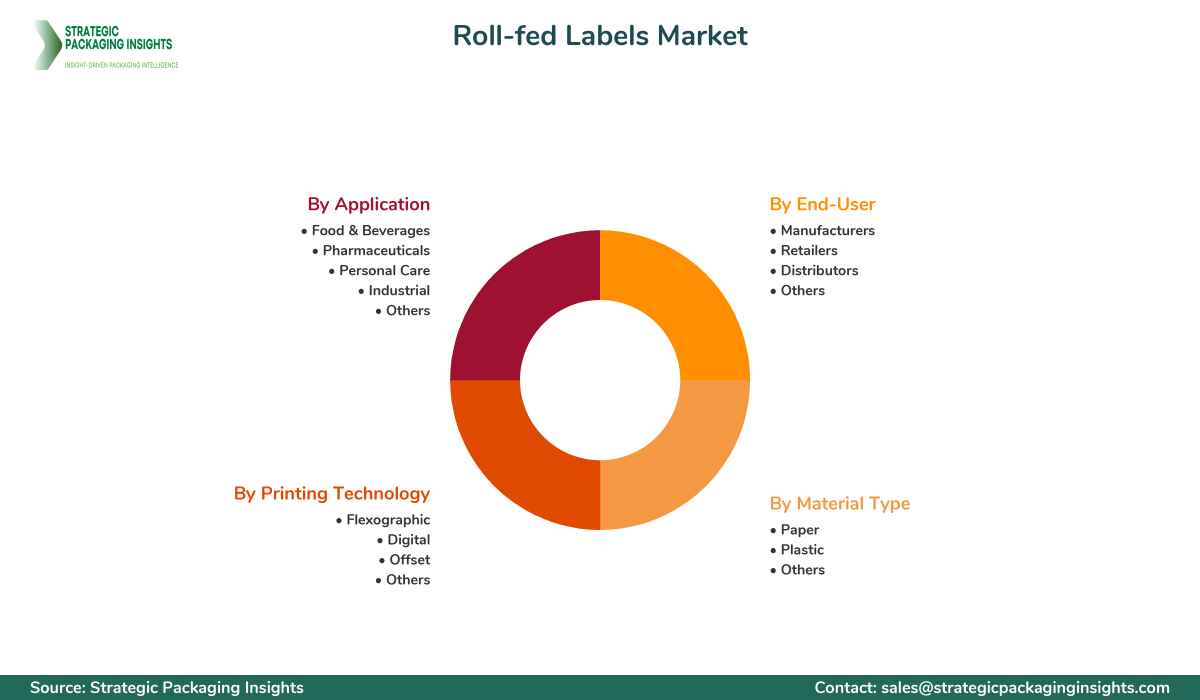

Roll-fed Labels Market Segments - by Material Type (Paper, Plastic, Others), Printing Technology (Flexographic, Digital, Offset, Others), Application (Food & Beverages, Pharmaceuticals, Personal Care, Industrial, Others), and End-User (Manufacturers, Retailers, Distributors, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Roll-fed Labels Market Outlook

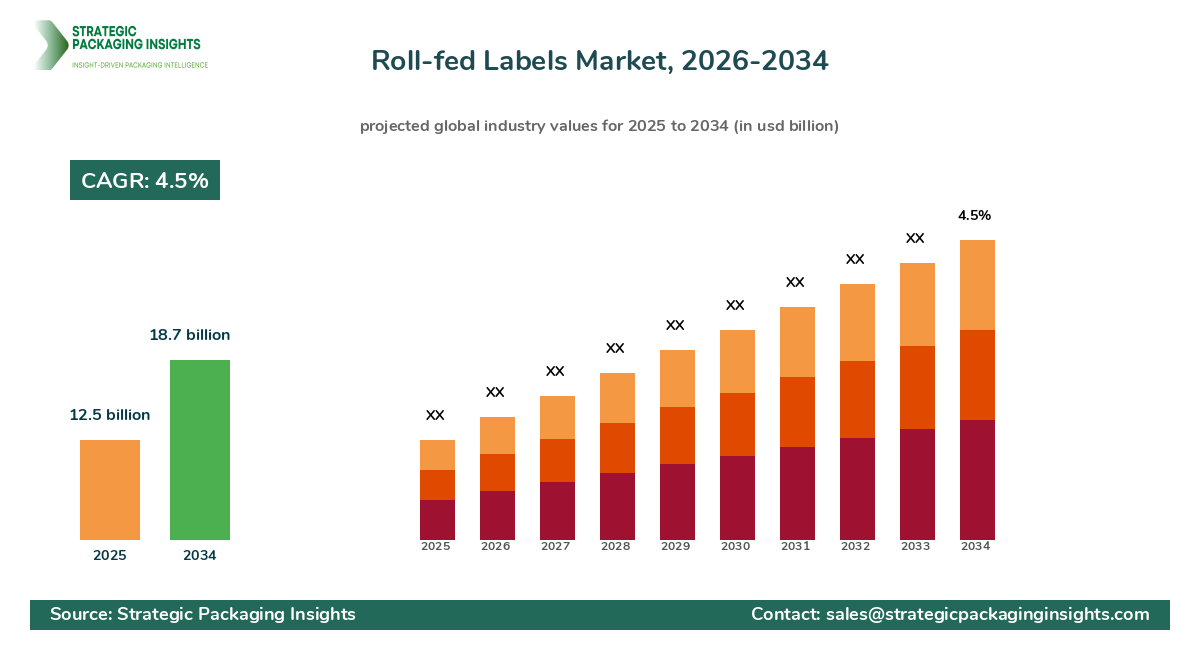

The roll-fed Labels market was valued at $12.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. This market is witnessing significant growth due to the increasing demand for efficient and cost-effective labeling solutions across various industries. Roll-fed labels are particularly popular in the food and beverage sector, where they are used extensively for branding and information purposes. The market is also driven by advancements in printing technologies, which have enhanced the quality and durability of these labels. Additionally, the rise in consumer awareness regarding product information and safety is propelling the demand for roll-fed labels, as they provide ample space for detailed product descriptions and regulatory information.

Report Scope

| Attributes | Details |

| Report Title | Roll-fed Labels Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 130 |

| Material Type | Paper, Plastic, Others |

| Printing Technology | Flexographic, Digital, Offset, Others |

| Application | Food & Beverages, Pharmaceuticals, Personal Care, Industrial, Others |

| End-User | Manufacturers, Retailers, Distributors, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the key opportunities in the roll-fed labels market is the growing trend towards sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a rising demand for labels made from recyclable and biodegradable materials. This shift is encouraging manufacturers to innovate and develop new materials that meet these sustainability criteria. Furthermore, the increasing adoption of digital printing technology offers significant opportunities for customization and personalization of labels, which is becoming a crucial factor for brand differentiation in competitive markets. The ability to produce short runs of customized labels quickly and cost-effectively is attracting more businesses to adopt roll-fed labels.

Another opportunity lies in the expanding e-commerce sector, which is driving the demand for efficient packaging and labeling solutions. As online shopping continues to grow, the need for labels that can withstand various handling and shipping conditions is increasing. Roll-fed labels, known for their durability and versatility, are well-suited to meet these requirements. Additionally, the rise of Smart Labels, which incorporate technologies like QR codes and NFC, presents new avenues for growth. These labels offer enhanced consumer engagement and data tracking capabilities, providing brands with valuable insights into consumer behavior and preferences.

However, the roll-fed labels market faces certain challenges that could hinder its growth. One of the primary restrainers is the volatility in raw material prices, particularly for plastics and paper, which are the main components of roll-fed labels. Fluctuations in these prices can impact the overall production costs and profit margins for manufacturers. Additionally, stringent regulations regarding packaging waste and recycling are putting pressure on companies to adopt more sustainable practices, which may require significant investments in new technologies and processes. The competitive landscape is also intensifying, with numerous players vying for market share, leading to price wars and reduced profitability.

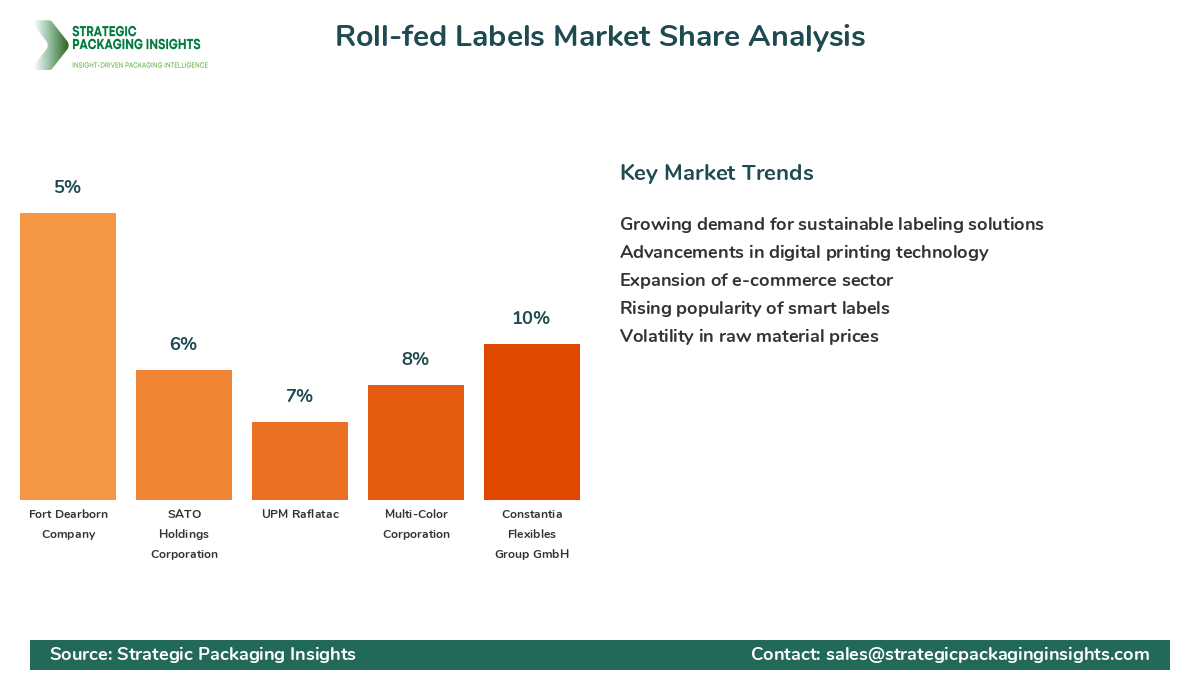

The roll-fed labels market is characterized by a highly competitive landscape, with numerous players striving to capture significant market share. The market is dominated by a mix of large multinational corporations and smaller regional players, each offering a diverse range of products and services. The competitive dynamics are influenced by factors such as product innovation, pricing strategies, distribution networks, and customer service. Companies are increasingly focusing on expanding their product portfolios and enhancing their production capabilities to cater to the growing demand for roll-fed labels across various industries.

Leading companies in the roll-fed labels market include Avery Dennison Corporation, CCL Industries Inc., Constantia Flexibles Group GmbH, and Multi-Color Corporation. Avery Dennison is known for its innovative labeling solutions and strong global presence, while CCL Industries is recognized for its extensive product range and advanced printing technologies. Constantia Flexibles is a key player in the flexible packaging industry, offering a wide array of labeling solutions, and Multi-Color Corporation is renowned for its expertise in label design and production.

Other notable players include UPM Raflatac, a leader in sustainable labeling solutions, and SATO Holdings Corporation, which specializes in barcode and RFID technologies. Fort Dearborn Company is another significant player, known for its comprehensive labeling services and strong customer relationships. Additionally, companies like Inland Packaging, WS Packaging Group, and Coveris Holdings S.A. are making significant strides in the market by focusing on innovation and customer-centric solutions.

These companies are actively engaging in strategic partnerships, mergers, and acquisitions to strengthen their market positions and expand their geographical reach. For instance, recent mergers and acquisitions have enabled companies to enhance their product offerings and tap into new markets. The competitive landscape is also shaped by the increasing emphasis on sustainability, with companies investing in eco-friendly materials and processes to meet the evolving consumer preferences and regulatory requirements.

Key Highlights Roll-fed Labels Market

- The roll-fed labels market is projected to grow at a CAGR of 4.5% from 2025 to 2033.

- Increasing demand for sustainable and eco-friendly labeling solutions is driving market growth.

- Advancements in digital printing technology are enhancing customization and personalization capabilities.

- The expanding e-commerce sector is boosting the demand for durable and versatile labeling solutions.

- Smart labels incorporating QR codes and NFC are gaining popularity for enhanced consumer engagement.

- Volatility in raw material prices poses a challenge to market growth.

- Stringent regulations regarding packaging waste and recycling are influencing market dynamics.

- Leading companies are focusing on strategic partnerships and acquisitions to strengthen their market positions.

- The competitive landscape is characterized by a mix of large multinational corporations and smaller regional players.

- Companies are investing in eco-friendly materials and processes to meet evolving consumer preferences.

Premium Insights - Key Investment Analysis

The roll-fed labels market is attracting significant investment interest due to its promising growth prospects and evolving consumer preferences. Investment trends indicate a strong focus on sustainable and eco-friendly labeling solutions, with venture capitalists and private equity firms actively funding companies that are innovating in this space. The rise of digital printing technology is also drawing investments, as it offers enhanced customization and efficiency, which are critical for meeting the demands of modern consumers.

Merger and acquisition (M&A) activity in the roll-fed labels market is robust, with companies seeking to expand their product portfolios and geographic reach. Recent M&A transactions have been driven by the strategic rationale of acquiring complementary technologies and capabilities, as well as accessing new customer segments. Capital allocation patterns reveal a growing emphasis on research and development (R&D) to drive innovation and maintain competitive advantage.

Investment valuations in the roll-fed labels market are influenced by factors such as market size, growth potential, and the ability to meet sustainability criteria. Investors are increasingly considering the environmental impact of labeling solutions, with a preference for companies that demonstrate a commitment to reducing their carbon footprint. Return on investment (ROI) expectations are high, given the market's growth trajectory and the increasing demand for innovative labeling solutions.

Emerging investment themes in the roll-fed labels market include the development of smart labels, which offer enhanced consumer engagement and data tracking capabilities. These labels are attracting investor interest due to their potential to revolutionize the way brands interact with consumers. Additionally, sectors such as food and beverages, pharmaceuticals, and personal care are garnering significant attention from investors, as they represent high-potential areas for growth and innovation.

Roll-fed Labels Market Segments Insights

Material Type Analysis

The roll-fed labels market is segmented by material type into paper, plastic, and others. Paper-based roll-fed labels are gaining traction due to their eco-friendly nature and recyclability. They are widely used in the food and beverage industry, where sustainability is a key concern. Plastic roll-fed labels, on the other hand, offer durability and resistance to moisture, making them suitable for applications in harsh environments. The demand for plastic labels is driven by their versatility and ability to accommodate various printing technologies. Other materials, such as metalized films and biodegradable substrates, are also being explored to meet specific industry requirements and consumer preferences.

The choice of material is influenced by factors such as cost, performance, and environmental impact. Companies are increasingly focusing on developing innovative materials that offer a balance between functionality and sustainability. The trend towards lightweight and flexible materials is gaining momentum, as it aligns with the broader industry shift towards sustainable packaging solutions. Additionally, advancements in material science are enabling the development of labels with enhanced barrier properties, which are crucial for preserving product quality and extending shelf life.

Printing Technology Analysis

Printing technology is a critical factor in the roll-fed labels market, with segments including flexographic, digital, offset, and others. Flexographic printing remains a popular choice due to its cost-effectiveness and ability to produce high-quality labels at high speeds. It is widely used for large-volume production runs, particularly in the food and beverage sector. Digital printing, however, is gaining ground due to its flexibility and ability to produce short runs of customized labels. The demand for digital printing is driven by the growing trend towards personalization and the need for quick turnaround times.

Offset printing is another widely used technology, known for its superior print quality and color consistency. It is preferred for applications where high-resolution images and intricate designs are required. Other printing technologies, such as gravure and screen printing, are also employed for specific applications, depending on the desired print quality and production volume. The choice of printing technology is influenced by factors such as cost, speed, and the complexity of the label design. Companies are investing in advanced printing technologies to enhance their production capabilities and meet the evolving demands of their customers.

Application Analysis

The roll-fed labels market serves a wide range of applications, including food and beverages, pharmaceuticals, personal care, industrial, and others. The food and beverage sector is the largest application segment, driven by the need for attractive and informative labels that enhance brand visibility and provide essential product information. Roll-fed labels are widely used for labeling bottles, cans, and other packaging formats in this sector. The pharmaceutical industry also represents a significant application area, where labels play a crucial role in ensuring compliance with regulatory requirements and providing critical information to consumers.

In the personal care industry, roll-fed labels are used for branding and product differentiation, as well as for conveying important usage instructions and safety information. The industrial sector utilizes roll-fed labels for a variety of applications, including product identification, inventory management, and logistics. The versatility and durability of roll-fed labels make them suitable for use in challenging environments, where they must withstand exposure to moisture, chemicals, and abrasion. The demand for roll-fed labels in these application areas is driven by factors such as product innovation, regulatory compliance, and the need for efficient supply chain management.

End-User Analysis

The roll-fed labels market is segmented by end-user into manufacturers, retailers, distributors, and others. Manufacturers are the primary end-users of roll-fed labels, as they require efficient labeling solutions for their products. The demand from manufacturers is driven by the need for high-quality labels that enhance brand visibility and provide essential product information. Retailers also represent a significant end-user segment, as they require labels for product identification, pricing, and promotional purposes. The demand from retailers is influenced by factors such as consumer preferences, regulatory requirements, and the need for effective merchandising strategies.

Distributors play a crucial role in the roll-fed labels market, as they facilitate the distribution of labels to various end-users. The demand from distributors is driven by the need for efficient supply chain management and the ability to meet the diverse labeling requirements of their customers. Other end-users, such as logistics companies and service providers, also contribute to the demand for roll-fed labels, as they require labels for inventory management, tracking, and logistics operations. The demand from these end-users is influenced by factors such as cost, performance, and the ability to meet specific industry requirements.

Market Share Analysis

The roll-fed labels market is characterized by a diverse range of players, each vying for a share of the market. Leading companies such as Avery Dennison Corporation, CCL Industries Inc., and Constantia Flexibles Group GmbH hold significant market shares due to their extensive product portfolios and strong global presence. These companies are known for their innovative labeling solutions and advanced printing technologies, which enable them to cater to the diverse needs of their customers.

Other notable players in the market include Multi-Color Corporation, UPM Raflatac, and SATO Holdings Corporation, each offering a unique range of products and services. These companies are actively engaging in strategic partnerships and acquisitions to strengthen their market positions and expand their geographical reach. The competitive landscape is also shaped by the increasing emphasis on sustainability, with companies investing in eco-friendly materials and processes to meet the evolving consumer preferences and regulatory requirements.

Top Countries Insights in Roll-fed Labels

The United States is a leading market for roll-fed labels, with a market size of $3.5 billion and a CAGR of 5%. The growth in this market is driven by the strong demand from the food and beverage sector, as well as the increasing adoption of digital printing technology. The presence of major players and the focus on sustainability are also contributing to the market's growth.

Germany is another significant market, with a market size of $2.1 billion and a CAGR of 4%. The demand for roll-fed labels in Germany is driven by the robust manufacturing sector and the emphasis on high-quality labeling solutions. The country's stringent regulations regarding packaging waste and recycling are also influencing market dynamics.

China is experiencing rapid growth in the roll-fed labels market, with a market size of $1.8 billion and a CAGR of 7%. The expansion of the e-commerce sector and the increasing demand for efficient packaging solutions are key drivers of growth in this market. The focus on innovation and the adoption of advanced printing technologies are also contributing to the market's expansion.

India is emerging as a promising market for roll-fed labels, with a market size of $1.2 billion and a CAGR of 6%. The growth in this market is driven by the increasing demand from the food and beverage sector, as well as the rising awareness of sustainable packaging solutions. The government's initiatives to promote manufacturing and exports are also supporting market growth.

Brazil is a growing market for roll-fed labels, with a market size of $0.9 billion and a CAGR of 5%. The demand for roll-fed labels in Brazil is driven by the expanding food and beverage industry and the increasing focus on product differentiation and branding. The country's economic growth and the rise of the middle class are also contributing to the market's expansion.

Roll-fed Labels Market Segments

The Roll-fed Labels market has been segmented on the basis of

Material Type

- Paper

- Plastic

- Others

Printing Technology

- Flexographic

- Digital

- Offset

- Others

Application

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Industrial

- Others

End-User

- Manufacturers

- Retailers

- Distributors

- Others

Primary Interview Insights

What are the key drivers of growth in the roll-fed labels market?

What challenges does the roll-fed labels market face?

How is digital printing technology impacting the roll-fed labels market?

What role does sustainability play in the roll-fed labels market?

Which sectors are driving demand for roll-fed labels?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.