- Home

- Advanced Packaging

- Wrapping And Packaging Machines Market Size, Future Growth and Forecast 2033

Wrapping And Packaging Machines Market Size, Future Growth and Forecast 2033

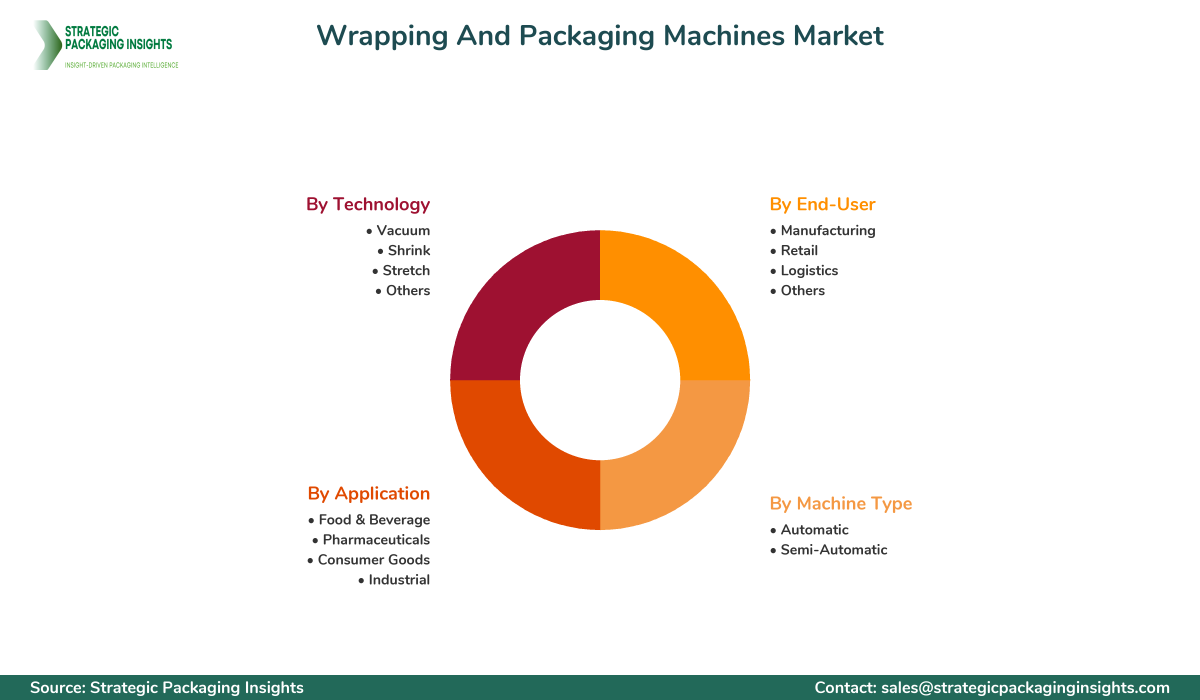

Wrapping And Packaging Machines Market Segments - by Machine Type (Automatic, Semi-Automatic), Application (Food & Beverage, Pharmaceuticals, Consumer Goods, Industrial), Technology (Vacuum, Shrink, Stretch, Others), and End-User (Manufacturing, Retail, Logistics, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Wrapping And Packaging Machines Market Outlook

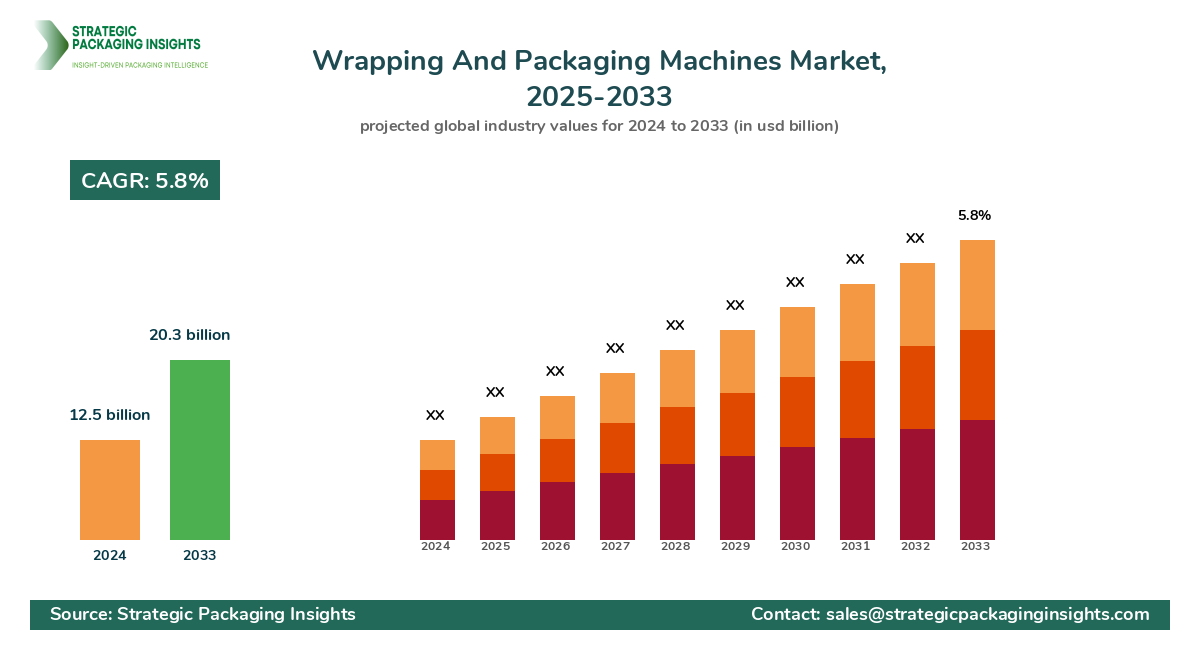

The wrapping and packaging machines market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033. This market is driven by the increasing demand for efficient and automated packaging solutions across various industries, including food and beverage, pharmaceuticals, and consumer goods. The rise in e-commerce and the need for sustainable packaging solutions are also contributing to the market's growth. As companies strive to enhance their operational efficiency and reduce labor costs, the adoption of advanced packaging machines is expected to rise significantly.

Report Scope

| Attributes | Details |

| Report Title | Wrapping And Packaging Machines Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 228 |

| Machine Type | Automatic, Semi-Automatic |

| Application | Food & Beverage, Pharmaceuticals, Consumer Goods, Industrial |

| Technology | Vacuum, Shrink, Stretch, Others |

| End-User | Manufacturing, Retail, Logistics, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the wrapping and packaging machines market is the growing demand for sustainable and eco-friendly packaging solutions. With increasing environmental concerns and stringent regulations, companies are focusing on reducing their carbon footprint by adopting biodegradable and recyclable packaging materials. This shift towards sustainability is driving the demand for innovative packaging machines that can handle these new materials efficiently. Additionally, the rise of smart packaging solutions, which incorporate technologies like IoT and AI, presents a lucrative opportunity for manufacturers to offer advanced machines that enhance product tracking and consumer engagement.

Another opportunity lies in the expansion of the e-commerce sector, which is driving the need for efficient packaging solutions to handle the high volume of shipments. As online shopping continues to grow, companies are investing in automated packaging machines to improve their packaging speed and accuracy. This trend is particularly prominent in the food and beverage and consumer goods industries, where timely delivery and product safety are critical. Furthermore, the increasing demand for customized packaging solutions is encouraging manufacturers to develop machines that offer flexibility and adaptability to different packaging requirements.

However, the market faces certain restraints, such as the high initial investment required for advanced packaging machines. Small and medium-sized enterprises (SMEs) may find it challenging to afford these machines, which could limit their adoption. Additionally, the complexity of integrating new technologies into existing production lines can pose a challenge for companies. The need for skilled operators to manage and maintain these machines is another factor that could hinder market growth. Despite these challenges, the long-term benefits of automation and efficiency are expected to outweigh the initial costs, driving the market forward.

The wrapping and packaging machines market is characterized by intense competition, with several key players vying for market share. The competitive landscape is marked by the presence of both established companies and new entrants, each striving to offer innovative solutions to meet the evolving needs of their customers. Companies are focusing on expanding their product portfolios and enhancing their technological capabilities to gain a competitive edge. Strategic partnerships, mergers, and acquisitions are common strategies employed by market players to strengthen their market position and expand their global reach.

Some of the major companies in the wrapping and packaging machines market include Bosch Packaging Technology, Krones AG, Coesia Group, IMA Group, and ProMach Inc. Bosch Packaging Technology is known for its comprehensive range of packaging solutions, catering to various industries such as food, pharmaceuticals, and consumer goods. The company focuses on innovation and sustainability, offering machines that enhance efficiency and reduce environmental impact. Krones AG, a leading provider of packaging and bottling solutions, is renowned for its advanced technology and extensive global presence. The company emphasizes research and development to deliver cutting-edge solutions that meet the diverse needs of its customers.

Coesia Group, another prominent player, offers a wide range of packaging machines and solutions for different industries. The company's commitment to innovation and customer satisfaction has helped it maintain a strong market position. IMA Group, known for its expertise in the pharmaceutical and food industries, provides high-quality packaging machines that ensure product safety and compliance with regulatory standards. ProMach Inc., a leading provider of integrated packaging solutions, focuses on delivering customized solutions that enhance operational efficiency and productivity.

Key Highlights Wrapping And Packaging Machines Market

- Increasing demand for automated and efficient packaging solutions across various industries.

- Growing emphasis on sustainable and eco-friendly packaging materials.

- Expansion of the e-commerce sector driving the need for advanced packaging machines.

- Rising adoption of smart packaging solutions incorporating IoT and AI technologies.

- High initial investment and complexity of integrating new technologies as market restraints.

- Strategic partnerships and acquisitions as key strategies for market players.

- Customization and flexibility in packaging solutions gaining importance.

- Focus on enhancing operational efficiency and reducing labor costs.

- Increasing demand for biodegradable and recyclable packaging materials.

- Technological advancements driving innovation in packaging machines.

Premium Insights - Key Investment Analysis

The wrapping and packaging machines market is witnessing significant investment activity, driven by the need for advanced and efficient packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer innovative technologies and sustainable packaging solutions. The rise of smart packaging and the integration of IoT and AI technologies are attracting substantial investments, as these solutions enhance product tracking, consumer engagement, and operational efficiency.

Merger and acquisition (M&A) activity is also prominent in this market, with companies seeking to expand their product portfolios and strengthen their market position. Strategic acquisitions allow companies to access new technologies, enter new markets, and enhance their competitive edge. The focus on sustainability and eco-friendly packaging solutions is driving investments in companies that offer biodegradable and recyclable materials. Investors are also keen on companies that provide customized and flexible packaging solutions, as these are becoming increasingly important in meeting diverse customer needs.

Investment valuations in the wrapping and packaging machines market are influenced by factors such as technological advancements, market demand, and regulatory compliance. Companies that demonstrate strong growth potential, innovative capabilities, and a commitment to sustainability are attracting higher valuations. The return on investment (ROI) expectations in this market are driven by the long-term benefits of automation, efficiency, and sustainability. As the market continues to evolve, identifying high-potential investment opportunities and sectors that attract the most investor interest will be crucial for stakeholders.

Wrapping And Packaging Machines Market Segments Insights

Machine Type Analysis

The wrapping and packaging machines market is segmented by machine type into automatic and semi-automatic machines. Automatic machines are gaining popularity due to their ability to enhance operational efficiency and reduce labor costs. These machines are equipped with advanced technologies that enable high-speed packaging, precision, and consistency. The demand for automatic machines is particularly high in industries such as food and beverage, pharmaceuticals, and consumer goods, where speed and accuracy are critical. Semi-automatic machines, on the other hand, are preferred by small and medium-sized enterprises (SMEs) due to their lower cost and ease of operation. These machines offer flexibility and are suitable for businesses with moderate production volumes.

The trend towards automation is driving the growth of the automatic machines segment, as companies seek to improve their production efficiency and reduce human intervention. The integration of IoT and AI technologies in automatic machines is further enhancing their capabilities, allowing for real-time monitoring and data analysis. This trend is expected to continue, with manufacturers focusing on developing machines that offer greater automation, connectivity, and intelligence. The semi-automatic machines segment, while growing at a slower pace, remains important for SMEs and niche applications where full automation is not feasible or cost-effective.

Application Analysis

The application segment of the wrapping and packaging machines market includes food and beverage, pharmaceuticals, consumer goods, and industrial applications. The food and beverage industry is the largest application segment, driven by the increasing demand for packaged food products and beverages. Packaging machines in this industry are used for various applications, including wrapping, sealing, labeling, and coding. The need for efficient and hygienic packaging solutions is driving the adoption of advanced machines that ensure product safety and compliance with regulatory standards.

The pharmaceuticals industry is another significant application segment, where packaging machines play a crucial role in ensuring the safety and integrity of pharmaceutical products. The demand for packaging machines in this industry is driven by the need for tamper-evident and child-resistant packaging solutions. The consumer goods industry is also witnessing significant growth, with packaging machines being used for a wide range of products, including personal care, household, and electronics. The industrial segment, while smaller, is growing steadily, driven by the need for efficient packaging solutions in sectors such as automotive, chemicals, and electronics.

Technology Analysis

The wrapping and packaging machines market is segmented by technology into vacuum, shrink, stretch, and others. Vacuum Packaging machines are widely used in the food industry to extend the shelf life of perishable products by removing air and sealing the package. The demand for vacuum packaging machines is driven by the increasing consumer preference for fresh and minimally processed foods. Shrink packaging machines are used for a variety of applications, including bundling products and providing tamper-evident seals. The demand for shrink packaging machines is driven by the need for attractive and secure packaging solutions.

Stretch packaging machines are used for wrapping products with stretch film, providing stability and protection during transportation and storage. The demand for stretch packaging machines is driven by the need for cost-effective and efficient packaging solutions in industries such as logistics and retail. Other technologies, including flow wrapping and blister packaging, are also gaining traction, driven by the need for specialized packaging solutions in industries such as pharmaceuticals and electronics. The trend towards smart packaging solutions is driving innovation in packaging technologies, with manufacturers focusing on developing machines that offer greater automation, connectivity, and intelligence.

End-User Analysis

The end-user segment of the wrapping and packaging machines market includes manufacturing, retail, logistics, and others. The manufacturing sector is the largest end-user segment, driven by the need for efficient and automated packaging solutions to enhance production efficiency and reduce labor costs. Packaging machines in this sector are used for a wide range of applications, including wrapping, sealing, labeling, and coding. The demand for packaging machines in the manufacturing sector is driven by the increasing focus on automation and efficiency.

The retail sector is another significant end-user segment, where packaging machines are used for various applications, including product bundling, labeling, and coding. The demand for packaging machines in the retail sector is driven by the need for attractive and secure packaging solutions that enhance product visibility and consumer engagement. The logistics sector is also witnessing significant growth, with packaging machines being used for a wide range of applications, including palletizing, stretch wrapping, and labeling. The demand for packaging machines in the logistics sector is driven by the need for efficient and cost-effective packaging solutions that ensure product safety and integrity during transportation and storage.

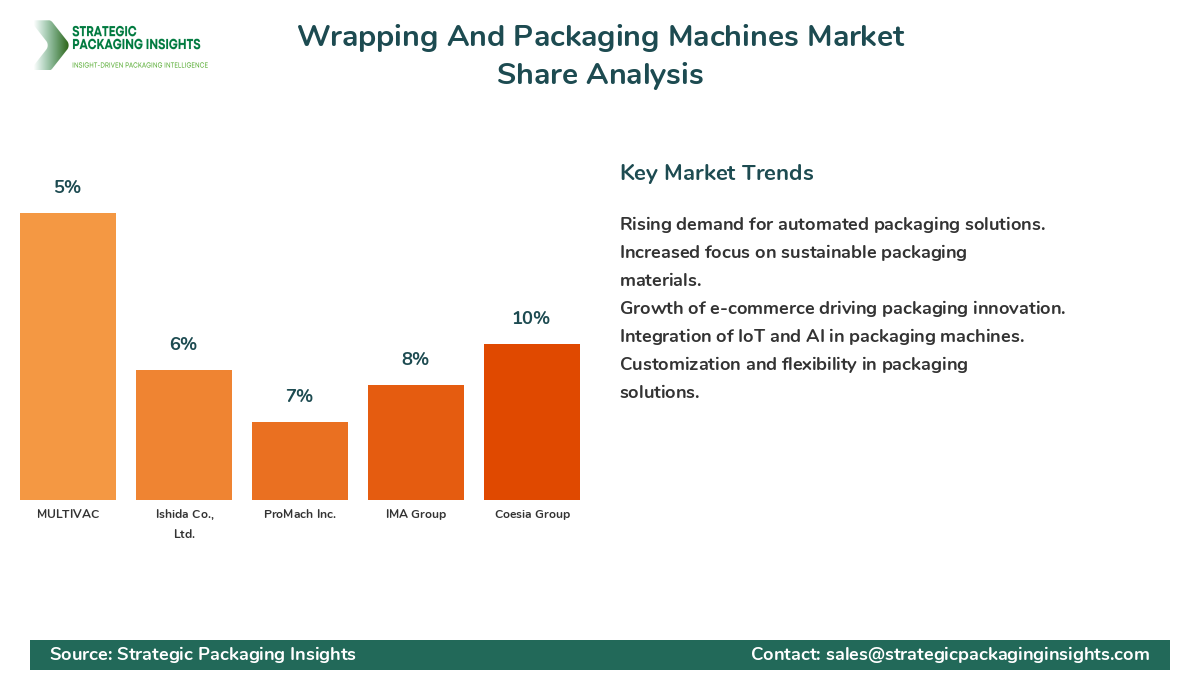

Market Share Analysis

The market share distribution of key players in the wrapping and packaging machines market is influenced by factors such as technological capabilities, product portfolio, and global presence. Companies that offer a comprehensive range of packaging solutions and have a strong focus on innovation and sustainability are leading the market. Bosch Packaging Technology, Krones AG, and Coesia Group are among the leading companies, with significant market shares. These companies are known for their advanced technology, extensive product portfolios, and strong global presence.

Companies that are gaining market share are focusing on expanding their product offerings and enhancing their technological capabilities. Strategic partnerships and acquisitions are common strategies employed by these companies to strengthen their market position and expand their global reach. Companies that are falling behind are those that have limited product offerings or lack technological capabilities. The market share distribution affects pricing, innovation, and partnerships, with leading companies having greater pricing power and the ability to invest in research and development. The competitive landscape is expected to remain dynamic, with companies focusing on innovation and sustainability to gain a competitive edge.

Top Countries Insights in Wrapping And Packaging Machines

The United States is one of the largest markets for wrapping and packaging machines, with a market size of $3.5 billion and a CAGR of 6%. The demand for packaging machines in the US is driven by the need for efficient and automated packaging solutions in industries such as food and beverage, pharmaceuticals, and consumer goods. The focus on sustainability and eco-friendly packaging solutions is also driving the demand for advanced machines that can handle biodegradable and recyclable materials.

Germany is another significant market, with a market size of $2.8 billion and a CAGR of 5%. The demand for packaging machines in Germany is driven by the need for high-quality and efficient packaging solutions in industries such as food and beverage, pharmaceuticals, and consumer goods. The focus on innovation and sustainability is driving the demand for advanced machines that offer greater automation and connectivity.

China is a rapidly growing market, with a market size of $2.5 billion and a CAGR of 8%. The demand for packaging machines in China is driven by the rapid growth of the e-commerce sector and the need for efficient packaging solutions to handle the high volume of shipments. The focus on automation and efficiency is driving the demand for advanced machines that enhance production efficiency and reduce labor costs.

India is another growing market, with a market size of $1.8 billion and a CAGR of 7%. The demand for packaging machines in India is driven by the increasing demand for packaged food products and beverages, as well as the growth of the e-commerce sector. The focus on sustainability and eco-friendly packaging solutions is also driving the demand for advanced machines that can handle biodegradable and recyclable materials.

Japan is a mature market, with a market size of $1.5 billion and a CAGR of 4%. The demand for packaging machines in Japan is driven by the need for high-quality and efficient packaging solutions in industries such as food and beverage, pharmaceuticals, and consumer goods. The focus on innovation and sustainability is driving the demand for advanced machines that offer greater automation and connectivity.

Wrapping And Packaging Machines Market Segments

The Wrapping And Packaging Machines market has been segmented on the basis of

Machine Type

- Automatic

- Semi-Automatic

Application

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Industrial

Technology

- Vacuum

- Shrink

- Stretch

- Others

End-User

- Manufacturing

- Retail

- Logistics

- Others

Primary Interview Insights

What are the key drivers of growth in the wrapping and packaging machines market?

What challenges does the market face?

How is the market responding to the demand for sustainable packaging solutions?

What role does technology play in the market?

What are the emerging trends in the market?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.