- Home

- Advanced Packaging

- Tire Packing Machine Market Size, Future Growth and Forecast 2033

Tire Packing Machine Market Size, Future Growth and Forecast 2033

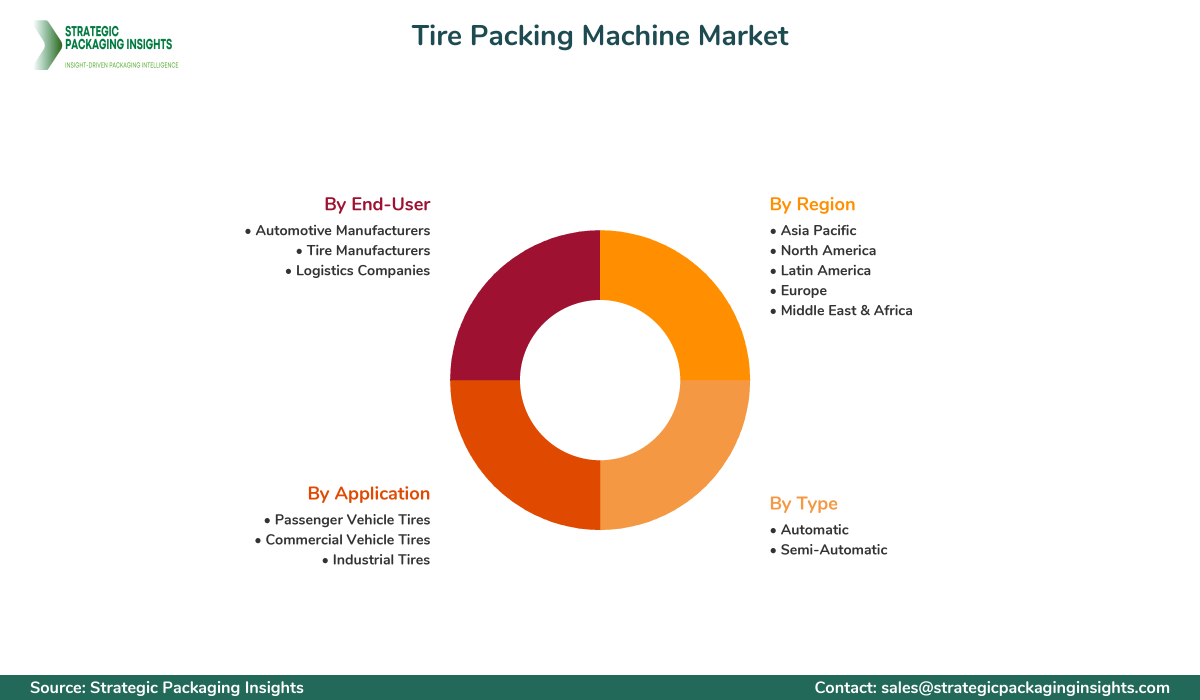

Tire Packing Machine Market Segments - by Type (Automatic, Semi-Automatic), Application (Passenger Vehicle Tires, Commercial Vehicle Tires, Industrial Tires), End-User (Automotive Manufacturers, Tire Manufacturers, Logistics Companies), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Tire Packing Machine Market Outlook

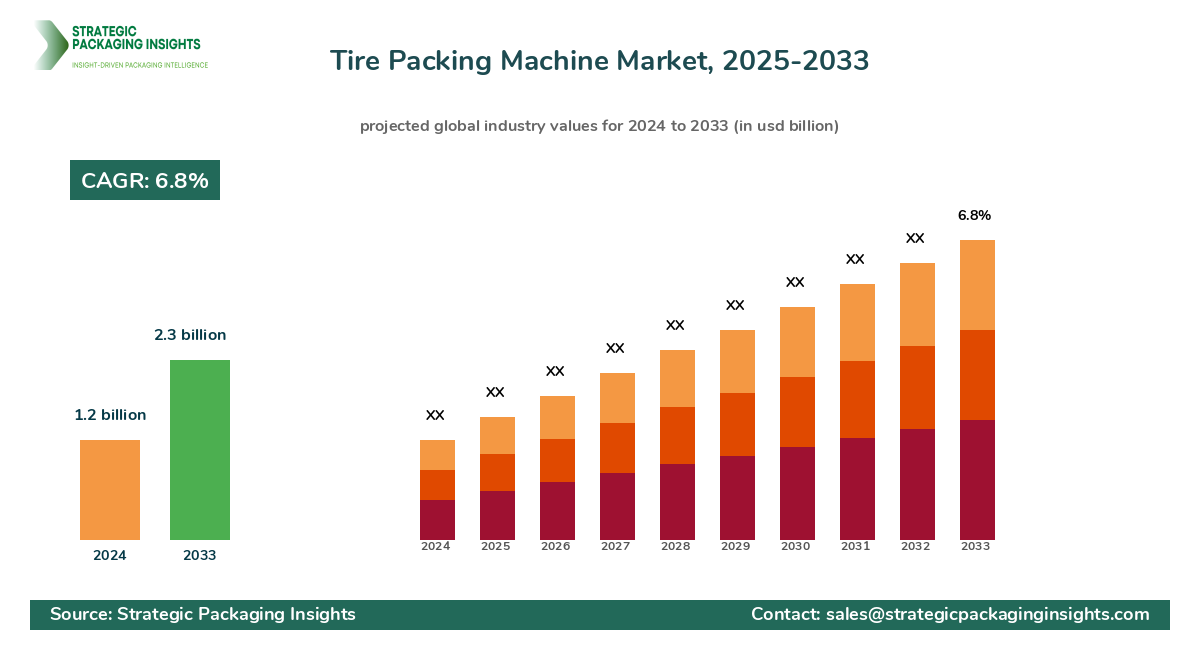

The tire packing machine market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025–2033. This growth is driven by the increasing demand for efficient and automated packaging solutions in the tire manufacturing industry. As the automotive sector continues to expand globally, the need for robust packaging solutions that ensure the safe transportation and storage of tires is becoming more critical. The rise in e-commerce and logistics activities further propels the demand for tire packing machines, as these sectors require efficient packaging to handle large volumes of tires. Additionally, technological advancements in packaging machinery, such as the integration of IoT and AI for enhanced operational efficiency, are expected to fuel market growth.

Report Scope

| Attributes | Details |

| Report Title | Tire Packing Machine Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 177 |

| Type | Automatic, Semi-Automatic |

| Application | Passenger Vehicle Tires, Commercial Vehicle Tires, Industrial Tires |

| End-User | Automotive Manufacturers, Tire Manufacturers, Logistics Companies |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The tire packing machine market presents significant opportunities for growth, primarily driven by the increasing adoption of automation in the tire manufacturing process. Automation not only enhances the efficiency of packaging operations but also reduces labor costs and minimizes human errors. This trend is particularly prominent in developed regions where labor costs are high, and manufacturers are keen on optimizing their operations. Furthermore, the growing focus on sustainability and eco-friendly packaging solutions offers lucrative opportunities for market players to innovate and develop machines that use biodegradable materials and energy-efficient technologies.

Another opportunity lies in the expanding automotive industry in emerging economies. As countries like China, India, and Brazil witness rapid industrialization and urbanization, the demand for vehicles—and consequently, tires—is on the rise. This surge in demand necessitates efficient packaging solutions to ensure the safe and secure transportation of tires, thereby driving the need for advanced tire packing machines. Additionally, the increasing investments in infrastructure development in these regions are expected to boost the logistics and transportation sectors, further augmenting the demand for tire packing machines.

However, the market faces certain restraints, such as the high initial investment required for setting up advanced tire packing machinery. Small and medium-sized enterprises (SMEs) may find it challenging to afford these machines, which could limit market growth. Additionally, the lack of skilled labor to operate and maintain these sophisticated machines poses a challenge, particularly in developing regions. Moreover, fluctuations in raw material prices and stringent government regulations regarding packaging standards could hinder market expansion.

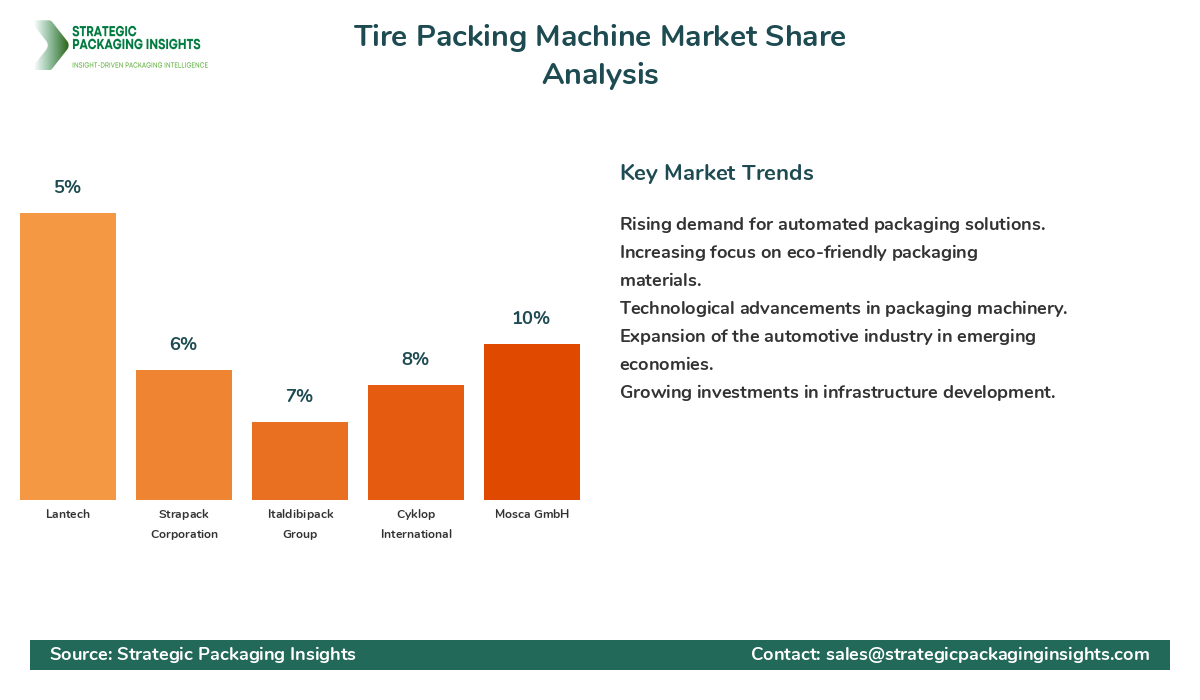

The tire packing machine market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each striving to enhance their product offerings and expand their geographical presence. The competitive rivalry is intense, with companies focusing on innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The presence of numerous players in the market also leads to price competition, which can impact profit margins.

Leading companies in the tire packing machine market include Signode Industrial Group, which holds a significant market share due to its extensive product portfolio and strong distribution network. The company is known for its innovative packaging solutions and has a robust presence in both developed and emerging markets. Another major player is FROMM Packaging Systems, which offers a wide range of packaging machines and has a strong focus on research and development to introduce advanced technologies in its products.

Other notable companies include Mosca GmbH, which is renowned for its high-quality strapping machines and has a strong customer base in Europe and North America. The company emphasizes sustainability and has developed eco-friendly packaging solutions to cater to the growing demand for green packaging. Similarly, Cyklop International is a key player with a diverse product range and a strong emphasis on customer service and support. The company has a global presence and is known for its reliable and efficient packaging machines.

Furthermore, companies like Italdibipack Group and Strapack Corporation are also prominent players in the market, offering a variety of packaging solutions tailored to meet the specific needs of the tire industry. These companies focus on expanding their product lines and enhancing their technological capabilities to stay competitive in the market. Overall, the tire packing machine market is poised for growth, with companies continuously innovating to meet the evolving demands of the automotive and logistics sectors.

Key Highlights Tire Packing Machine Market

- Increasing demand for automated packaging solutions in the tire industry.

- Rising adoption of eco-friendly and sustainable packaging materials.

- Technological advancements in packaging machinery, including IoT and AI integration.

- Growing automotive industry in emerging economies driving market growth.

- High initial investment costs pose a challenge for SMEs.

- Intense competition among key players leading to price competition.

- Expansion of e-commerce and logistics sectors boosting demand for tire packing machines.

- Focus on innovation and strategic partnerships among market players.

- Stringent government regulations regarding packaging standards impacting market dynamics.

- Increasing investments in infrastructure development in emerging regions.

Top Countries Insights in Tire Packing Machine

The United States is a leading market for tire packing machines, with a current market size of $300 million and a CAGR of 5%. The country's well-established automotive industry and the presence of major tire manufacturers drive the demand for efficient packaging solutions. Additionally, the growing focus on automation and technological advancements in packaging machinery contribute to market growth. However, the high cost of advanced machines and stringent regulatory standards pose challenges for market players.

China is another significant market, with a market size of $250 million and a CAGR of 8%. The rapid industrialization and urbanization in the country have led to a surge in vehicle production, thereby increasing the demand for tires and, consequently, tire packing machines. The government's focus on infrastructure development and the expansion of the logistics sector further boost market growth. However, the market faces challenges such as fluctuating raw material prices and the need for skilled labor to operate advanced machinery.

Germany, with a market size of $200 million and a CAGR of 6%, is a key player in the European tire packing machine market. The country's strong automotive industry and emphasis on innovation and sustainability drive the demand for advanced packaging solutions. The presence of leading packaging machinery manufacturers and a focus on eco-friendly packaging materials further contribute to market growth. However, the high cost of labor and stringent environmental regulations pose challenges for market players.

India, with a market size of $150 million and a CAGR of 10%, is an emerging market for tire packing machines. The country's growing automotive industry and increasing investments in infrastructure development drive the demand for efficient packaging solutions. The government's focus on promoting manufacturing and the expansion of the logistics sector further boost market growth. However, the market faces challenges such as the high cost of advanced machinery and the lack of skilled labor.

Brazil, with a market size of $100 million and a CAGR of 7%, is a key market in Latin America. The country's expanding automotive industry and the growing focus on automation drive the demand for tire packing machines. The government's investments in infrastructure development and the expansion of the logistics sector further contribute to market growth. However, the market faces challenges such as economic instability and the high cost of advanced machinery.

Value Chain Profitability Analysis

The tire packing machine market's value chain profitability analysis reveals a complex ecosystem involving various stakeholders, including service providers, consultancies, technology platforms, and freelancers. Each stakeholder plays a crucial role in the market, contributing to the overall value chain and capturing different shares of the market value. Service providers, such as manufacturers and distributors, capture a significant portion of the market value due to their direct involvement in the production and distribution of tire packing machines. These stakeholders benefit from economies of scale and have the advantage of established distribution networks, allowing them to capture higher profit margins.

Consultancies and technology platforms also play a vital role in the value chain, providing essential services such as market research, product development, and technological integration. These stakeholders capture a moderate share of the market value, as their services are crucial for the development and implementation of advanced packaging solutions. Freelancers, on the other hand, capture a smaller share of the market value, as their involvement is typically limited to specific projects or tasks.

The cost structures and pricing models vary across different stages of the value chain, with manufacturers and distributors typically incurring higher costs due to production and logistics expenses. However, these stakeholders also have the potential to capture higher profit margins due to their direct involvement in the market. Consultancies and technology platforms, while incurring lower costs, capture moderate profit margins due to the value-added services they provide. Freelancers, with minimal overhead costs, capture lower profit margins due to their limited involvement in the market.

Digital transformation is redistributing revenue opportunities throughout the industry, with technology platforms and consultancies capturing increasing shares of the market value. The integration of IoT and AI in packaging machinery is driving demand for technological expertise, allowing these stakeholders to capture higher profit margins. As the market continues to evolve, stakeholders that can adapt to changing market dynamics and leverage digital transformation will be well-positioned to capture increasing shares of the overall market value.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The tire packing machine market has undergone significant changes between 2018 and 2024, with key market dynamics shaping the industry's evolution. During this period, the market experienced steady growth, driven by the increasing demand for automated packaging solutions and the expansion of the automotive and logistics sectors. The market size grew from $900 million in 2018 to $1.2 billion in 2024, with a CAGR of 5.1%. The segment distribution shifted towards automated machines, with a growing preference for eco-friendly packaging materials. The regional contribution also changed, with Asia Pacific emerging as a key market due to rapid industrialization and urbanization.

Looking ahead to the forecast period of 2025–2033, the tire packing machine market is expected to experience accelerated growth, with a projected CAGR of 6.8%. The market size is anticipated to reach $2.3 billion by 2033, driven by technological advancements and the increasing adoption of automation in the tire manufacturing process. The segment distribution is expected to continue shifting towards automated machines, with a growing focus on sustainability and eco-friendly packaging solutions. The regional contribution is also expected to change, with emerging economies in Asia Pacific and Latin America driving market growth.

Technological impact factors, such as the integration of IoT and AI in packaging machinery, are expected to play a crucial role in shaping the market's future dynamics. These technologies are anticipated to enhance operational efficiency and reduce costs, driving demand for advanced packaging solutions. Client demand transformations are also expected to influence market dynamics, with a growing preference for customized and sustainable packaging solutions. As the market continues to evolve, companies that can adapt to changing market dynamics and leverage technological advancements will be well-positioned to capture increasing shares of the overall market value.

Tire Packing Machine Market Segments Insights

Type Analysis

The tire packing machine market is segmented by type into automatic and semi-automatic machines. Automatic machines are gaining traction due to their ability to enhance operational efficiency and reduce labor costs. These machines are equipped with advanced technologies such as IoT and AI, enabling seamless integration with existing manufacturing processes. The demand for automatic machines is particularly high in developed regions where labor costs are significant, and manufacturers are keen on optimizing their operations. The growing focus on automation and technological advancements in packaging machinery are expected to drive the demand for automatic tire packing machines.

Semi-automatic machines, on the other hand, are preferred by small and medium-sized enterprises (SMEs) due to their lower initial investment costs. These machines offer a balance between automation and manual operation, making them suitable for companies with limited budgets. The demand for semi-automatic machines is expected to remain steady, particularly in developing regions where labor costs are lower, and companies are looking for cost-effective packaging solutions. However, the growing trend towards automation and the increasing adoption of advanced technologies are expected to gradually shift the demand towards automatic machines in the long term.

Application Analysis

The tire packing machine market is segmented by application into passenger vehicle tires, commercial vehicle tires, and industrial tires. The demand for tire packing machines in the passenger vehicle segment is driven by the increasing production of passenger vehicles globally. As the automotive industry continues to expand, the need for efficient packaging solutions to ensure the safe transportation and storage of passenger vehicle tires is becoming more critical. The growing focus on sustainability and eco-friendly packaging solutions is also driving the demand for advanced tire packing machines in this segment.

In the commercial vehicle segment, the demand for tire packing machines is driven by the expanding logistics and transportation sectors. As the demand for commercial vehicles increases, the need for robust packaging solutions to handle large volumes of tires is becoming more critical. The industrial tire segment, on the other hand, is driven by the growing demand for heavy-duty vehicles in industries such as construction and mining. The need for durable and efficient packaging solutions to ensure the safe transportation of industrial tires is driving the demand for tire packing machines in this segment.

End-User Analysis

The tire packing machine market is segmented by end-user into automotive manufacturers, tire manufacturers, and logistics companies. Automotive manufacturers are a key end-user segment, driven by the increasing production of vehicles globally. The need for efficient packaging solutions to ensure the safe transportation and storage of tires is becoming more critical, driving the demand for tire packing machines in this segment. The growing focus on automation and technological advancements in packaging machinery are also driving the demand for advanced tire packing machines among automotive manufacturers.

Tire manufacturers are another key end-user segment, driven by the increasing demand for tires globally. As the automotive industry continues to expand, the need for efficient packaging solutions to handle large volumes of tires is becoming more critical. The logistics companies segment is driven by the expanding e-commerce and logistics sectors, which require efficient packaging solutions to handle large volumes of tires. The growing focus on sustainability and eco-friendly packaging solutions is also driving the demand for advanced tire packing machines among logistics companies.

Regional Analysis

The tire packing machine market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Asia Pacific is a key market, driven by the rapid industrialization and urbanization in countries like China and India. The growing automotive industry and the increasing demand for efficient packaging solutions are driving the demand for tire packing machines in this region. The government's focus on infrastructure development and the expansion of the logistics sector further boost market growth.

North America is another significant market, driven by the well-established automotive industry and the presence of major tire manufacturers. The growing focus on automation and technological advancements in packaging machinery are driving the demand for advanced tire packing machines in this region. Europe is also a key market, driven by the strong automotive industry and the emphasis on innovation and sustainability. The presence of leading packaging machinery manufacturers and a focus on eco-friendly packaging materials further contribute to market growth in this region.

Tire Packing Machine Market Segments

The Tire Packing Machine market has been segmented on the basis of

Type

- Automatic

- Semi-Automatic

Application

- Passenger Vehicle Tires

- Commercial Vehicle Tires

- Industrial Tires

End-User

- Automotive Manufacturers

- Tire Manufacturers

- Logistics Companies

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the tire packing machine market?

What challenges does the tire packing machine market face?

How is digital transformation impacting the tire packing machine market?

What opportunities exist for market players in the tire packing machine market?

How are technological advancements shaping the future of the tire packing machine market?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.