- Home

- Packaging Products

- Tin Closures Market Size, Future Growth and Forecast 2033

Tin Closures Market Size, Future Growth and Forecast 2033

Tin Closures Market Segments - by Type (Screw Caps, Lug Caps, Twist-Off Caps, Others), Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Others), Material (Tinplate, Aluminum, Others), End-User (Manufacturers, Distributors, Retailers, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Tin Closures Market Outlook

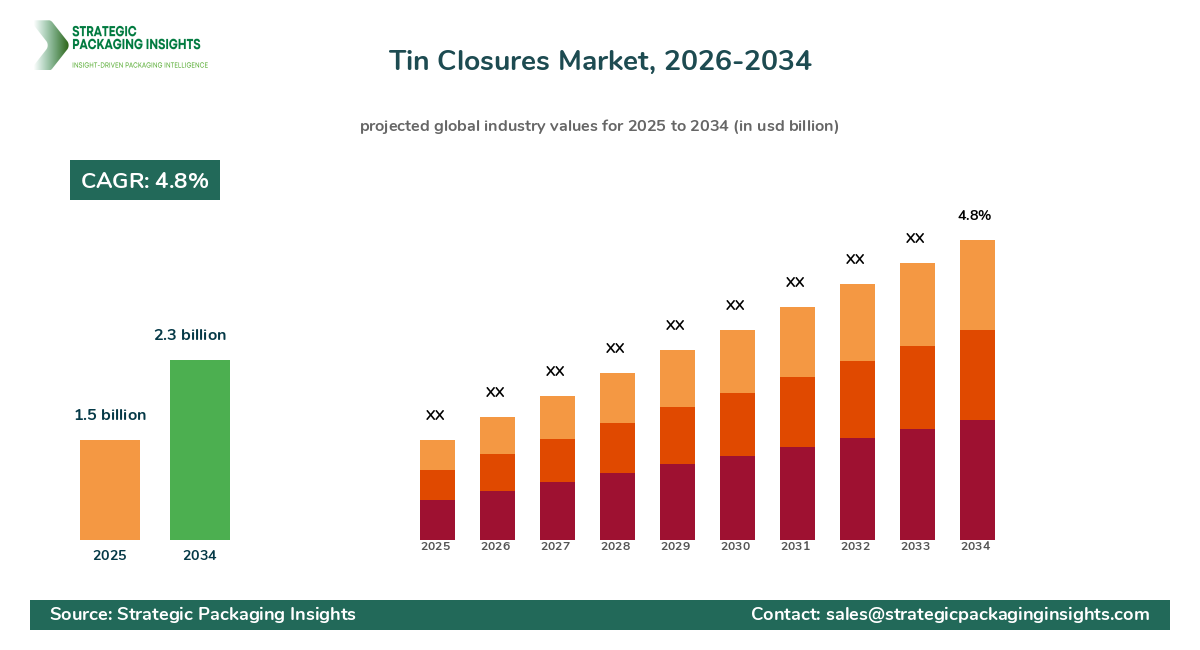

The tin closures market was valued at $1.5 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and Recyclable Packaging solutions, as tin closures offer excellent barrier properties and are highly recyclable. The food and beverage industry, in particular, is a significant consumer of tin closures due to their ability to preserve the freshness and quality of products. Additionally, the rising trend of premium packaging in the cosmetics and personal care sector is further propelling the market growth.

However, the market faces challenges such as the availability of alternative packaging materials like plastic and glass, which are often preferred due to their cost-effectiveness and versatility. Regulatory restrictions on the use of certain metals in packaging, aimed at reducing environmental impact, also pose a threat to market growth. Despite these challenges, the market holds significant potential for growth, driven by innovations in closure designs and the development of eco-friendly tin closure solutions.

Report Scope

| Attributes | Details |

| Report Title | Tin Closures Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 164 |

| Type | Screw Caps, Lug Caps, Twist-Off Caps, Others |

| Application | Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Others |

| Material | Tinplate, Aluminum, Others |

| End-User | Manufacturers, Distributors, Retailers, Others |

| Customization Available | Yes* |

Opportunities & Threats

The tin closures market presents numerous opportunities, particularly in the realm of sustainability. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that are not only effective but also eco-friendly. Tin closures, being highly recyclable, align well with this trend. Companies that invest in developing innovative, sustainable tin closure solutions are likely to gain a competitive edge. Additionally, the increasing popularity of premium and Luxury Packaging in sectors such as cosmetics and personal care offers a lucrative opportunity for market players to expand their product offerings and cater to high-end brands.

Another significant opportunity lies in the expansion of the food and beverage industry, particularly in emerging markets. As disposable incomes rise and consumer preferences shift towards packaged and processed foods, the demand for effective packaging solutions like tin closures is expected to increase. Market players can capitalize on this trend by expanding their presence in these regions and offering customized solutions that cater to local tastes and preferences. Furthermore, advancements in technology and manufacturing processes present opportunities for companies to enhance the quality and functionality of tin closures, thereby attracting a broader customer base.

Despite the opportunities, the tin closures market faces several threats that could hinder its growth. One of the primary challenges is the competition from alternative packaging materials such as plastic and glass. These materials are often preferred due to their cost-effectiveness and versatility, posing a significant threat to the demand for tin closures. Additionally, regulatory restrictions on the use of certain metals in packaging, aimed at reducing environmental impact, could limit the growth of the market. Companies need to navigate these challenges by investing in research and development to create innovative, sustainable solutions that meet regulatory standards and consumer expectations.

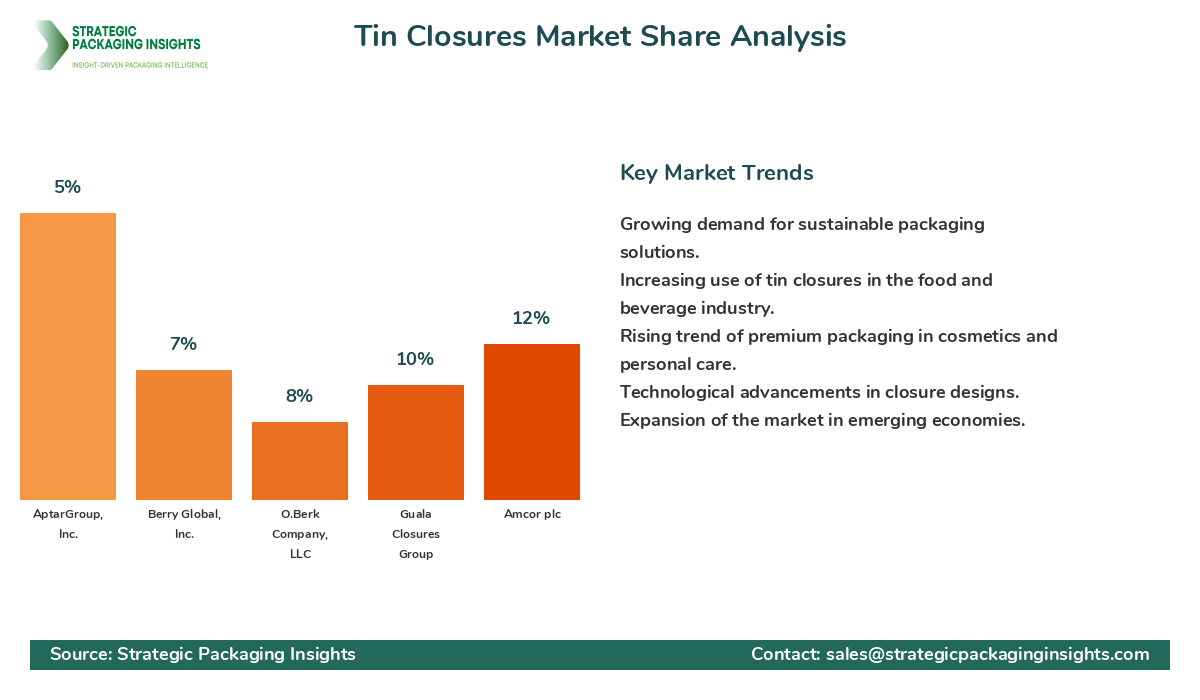

The tin closures market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few major companies that hold significant shares, while numerous smaller players contribute to the overall market dynamics. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies that can effectively differentiate their products and offer value-added services are likely to gain a competitive advantage.

Some of the major companies in the tin closures market include Crown Holdings, Inc., Silgan Holdings Inc., Amcor plc, Guala Closures Group, and O.Berk Company, LLC. Crown Holdings, Inc. is a leading player in the market, known for its extensive product portfolio and strong distribution network. The company focuses on innovation and sustainability, offering a range of eco-friendly tin closure solutions. Silgan Holdings Inc. is another prominent player, with a strong presence in the food and beverage sector. The company emphasizes product quality and customer service, which has helped it maintain a loyal customer base.

Amcor plc is a global leader in packaging solutions, offering a wide range of tin closures for various applications. The company's focus on sustainability and innovation has enabled it to capture a significant share of the market. Guala Closures Group is known for its advanced closure technologies and strong focus on research and development. The company has a diverse product portfolio and a strong presence in the premium packaging segment. O.Berk Company, LLC is a key player in the North American market, offering a range of tin closures for the food, beverage, and personal care industries.

Key Highlights Tin Closures Market

- The tin closures market is projected to grow at a CAGR of 4.8% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- The food and beverage industry is a significant consumer of tin closures.

- Premium packaging trends in the cosmetics and personal care sector are boosting demand.

- Regulatory restrictions on metal packaging pose a challenge to market growth.

- Technological advancements are enhancing the quality and functionality of tin closures.

- Emerging markets offer significant growth opportunities for market players.

- Competition from alternative packaging materials like plastic and glass is a major threat.

- Key players include Crown Holdings, Inc., Silgan Holdings Inc., and Amcor plc.

- Innovation and sustainability are key focus areas for market players.

Competitive Intelligence

The tin closures market is highly competitive, with several key players striving to maintain their market positions. Crown Holdings, Inc. is a dominant player, leveraging its extensive product portfolio and strong distribution network to capture a significant share of the market. The company's focus on innovation and sustainability has enabled it to offer a range of eco-friendly tin closure solutions, catering to the growing demand for Sustainable Packaging.

Silgan Holdings Inc. is another major player, known for its strong presence in the food and beverage sector. The company emphasizes product quality and customer service, which has helped it maintain a loyal customer base. Silgan Holdings Inc. is also investing in research and development to enhance its product offerings and meet the evolving needs of its customers.

Amcor plc is a global leader in packaging solutions, offering a wide range of tin closures for various applications. The company's focus on sustainability and innovation has enabled it to capture a significant share of the market. Amcor plc is also expanding its presence in emerging markets, where the demand for effective packaging solutions is on the rise.

Guala Closures Group is known for its advanced closure technologies and strong focus on research and development. The company has a diverse product portfolio and a strong presence in the premium packaging segment. Guala Closures Group is also investing in new technologies to enhance the functionality and appeal of its products.

O.Berk Company, LLC is a key player in the North American market, offering a range of tin closures for the food, beverage, and personal care industries. The company focuses on customer satisfaction and product innovation, which has helped it maintain a competitive edge in the market.

Regional Market Intelligence of Tin Closures

The global tin closures market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region presents unique growth opportunities and challenges, driven by factors such as consumer preferences, regulatory frameworks, and economic conditions.

In North America, the tin closures market is driven by the strong demand for sustainable packaging solutions in the food and beverage industry. The region's well-established distribution networks and advanced manufacturing capabilities also contribute to market growth. However, competition from alternative packaging materials poses a challenge to market players.

Europe is another significant market for tin closures, with a strong focus on sustainability and innovation. The region's stringent regulatory frameworks and emphasis on eco-friendly packaging solutions drive the demand for tin closures. Additionally, the presence of several key market players in the region enhances the competitive landscape.

The Asia-Pacific region is expected to witness the highest growth rate, driven by the expanding food and beverage industry and rising consumer awareness about sustainable packaging. Emerging markets such as China and India offer significant growth opportunities for market players, with increasing disposable incomes and changing consumer preferences.

In Latin America, the tin closures market is driven by the growing demand for packaged and processed foods. The region's economic growth and increasing urbanization also contribute to market expansion. However, the market faces challenges such as regulatory restrictions and competition from alternative packaging materials.

The Middle East & Africa region presents a mixed outlook, with growth driven by the expanding food and beverage industry and increasing consumer awareness about sustainable packaging. However, political instability and economic challenges in some countries pose a threat to market growth.

Top Countries Insights in Tin Closures

In the tin closures market, United States holds a significant share, with a market size of $400 million and a CAGR of 5%. The country's strong demand for sustainable packaging solutions and well-established distribution networks drive market growth. However, competition from alternative packaging materials poses a challenge.

Germany is another key market, with a market size of $300 million and a CAGR of 4%. The country's focus on sustainability and innovation, along with stringent regulatory frameworks, drives the demand for tin closures. The presence of several key market players also enhances the competitive landscape.

In China, the tin closures market is expected to grow at a CAGR of 7%, driven by the expanding food and beverage industry and rising consumer awareness about sustainable packaging. The country's large population and increasing disposable incomes offer significant growth opportunities for market players.

India is another emerging market, with a market size of $200 million and a CAGR of 6%. The country's growing demand for packaged and processed foods, along with increasing urbanization, drives market growth. However, regulatory restrictions and competition from alternative packaging materials pose challenges.

In Brazil, the tin closures market is driven by the growing demand for packaged foods and beverages. The country's economic growth and increasing consumer awareness about sustainable packaging contribute to market expansion. However, political instability and economic challenges pose a threat to market growth.

Tin Closures Market Segments Insights

Type Analysis

The tin closures market is segmented by type into screw caps, lug caps, twist-off caps, and others. Screw caps are widely used in the food and beverage industry due to their ease of use and effective sealing properties. The demand for screw caps is driven by the increasing consumption of bottled beverages and packaged foods. Lug caps, on the other hand, are popular in the home canning and food preservation sectors, offering a secure seal and easy opening mechanism. Twist-off caps are gaining popularity in the cosmetics and personal care industry, where convenience and aesthetics are key considerations. The market for other types of tin closures, such as snap-on caps and flip-top caps, is also growing, driven by innovations in closure designs and the development of eco-friendly solutions.

Application Analysis

The application segment of the tin closures market includes food and beverages, pharmaceuticals, cosmetics and personal care, and others. The food and beverage industry is the largest consumer of tin closures, driven by the need for effective packaging solutions that preserve the freshness and quality of products. The rising trend of premium packaging in the cosmetics and personal care sector is also boosting the demand for tin closures. In the pharmaceutical industry, tin closures are used for packaging medicines and health supplements, offering a secure seal and protection against contamination. The market for tin closures in other applications, such as household products and industrial goods, is also growing, driven by the increasing demand for sustainable and recyclable packaging solutions.

Material Analysis

The tin closures market is segmented by material into tinplate, aluminum, and others. Tinplate is the most commonly used material for tin closures, offering excellent barrier properties and recyclability. The demand for tinplate closures is driven by the increasing focus on sustainability and the need for effective packaging solutions in the food and beverage industry. Aluminum closures are gaining popularity in the cosmetics and personal care sector, where aesthetics and lightweight properties are key considerations. The market for other materials, such as plastic and composite closures, is also growing, driven by innovations in material science and the development of eco-friendly solutions.

End-User Analysis

The end-user segment of the tin closures market includes manufacturers, distributors, retailers, and others. Manufacturers are the largest consumers of tin closures, driven by the need for effective packaging solutions that enhance product appeal and shelf life. Distributors play a key role in the market, offering a wide range of tin closures to meet the diverse needs of end-users. Retailers are also significant consumers of tin closures, driven by the increasing demand for packaged and processed foods. The market for tin closures in other end-user segments, such as e-commerce and direct-to-consumer sales, is also growing, driven by the increasing popularity of online shopping and the need for convenient packaging solutions.

Market Share Analysis

The market share distribution of key players in the tin closures market is characterized by a few dominant companies holding significant shares, while numerous smaller players contribute to the overall market dynamics. Crown Holdings, Inc. is a leading player, leveraging its extensive product portfolio and strong distribution network to capture a significant share of the market. Silgan Holdings Inc. and Amcor plc are also major players, known for their focus on innovation and sustainability. The competitive positioning of these companies is influenced by factors such as product differentiation, pricing strategies, and distribution networks. Companies that can effectively differentiate their products and offer value-added services are likely to gain a competitive advantage. The market share distribution also affects pricing, innovation, and partnerships, as companies strive to maintain their market positions and capture new opportunities.

Tin Closures Market Segments

The Tin Closures market has been segmented on the basis of

Type

- Screw Caps

- Lug Caps

- Twist-Off Caps

- Others

Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

Material

- Tinplate

- Aluminum

- Others

End-User

- Manufacturers

- Distributors

- Retailers

- Others

Primary Interview Insights

What is driving the growth of the tin closures market?

What challenges does the tin closures market face?

Which regions offer the most growth opportunities for the tin closures market?

How are companies in the tin closures market addressing sustainability?

What role does innovation play in the tin closures market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.