- Home

- Packaging Products

- Thin Wall Plastic Packaging Market Size, Future Growth and Forecast 2033

Thin Wall Plastic Packaging Market Size, Future Growth and Forecast 2033

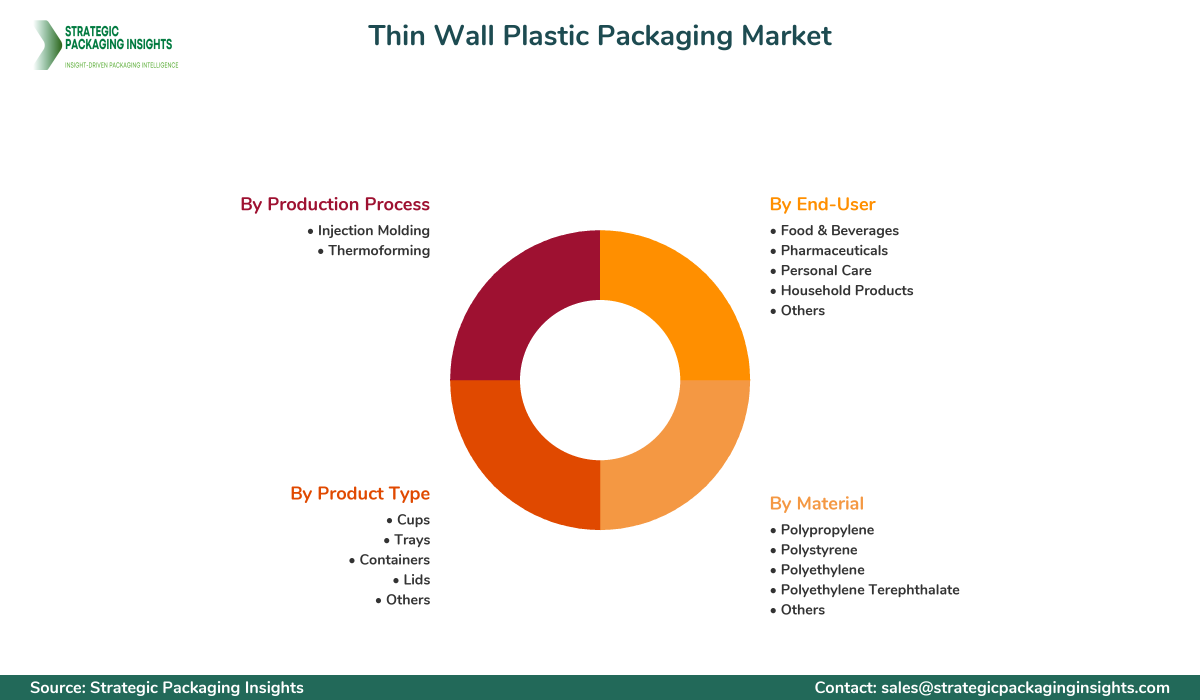

Thin Wall Plastic Packaging Market Segments - by Material (Polypropylene, Polystyrene, Polyethylene, Polyethylene Terephthalate, Others), Product Type (Cups, Trays, Containers, Lids, Others), Production Process (Injection Molding, Thermoforming), End-User (Food & Beverages, Pharmaceuticals, Personal Care, Household Products, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Thin Wall Plastic Packaging Market Outlook

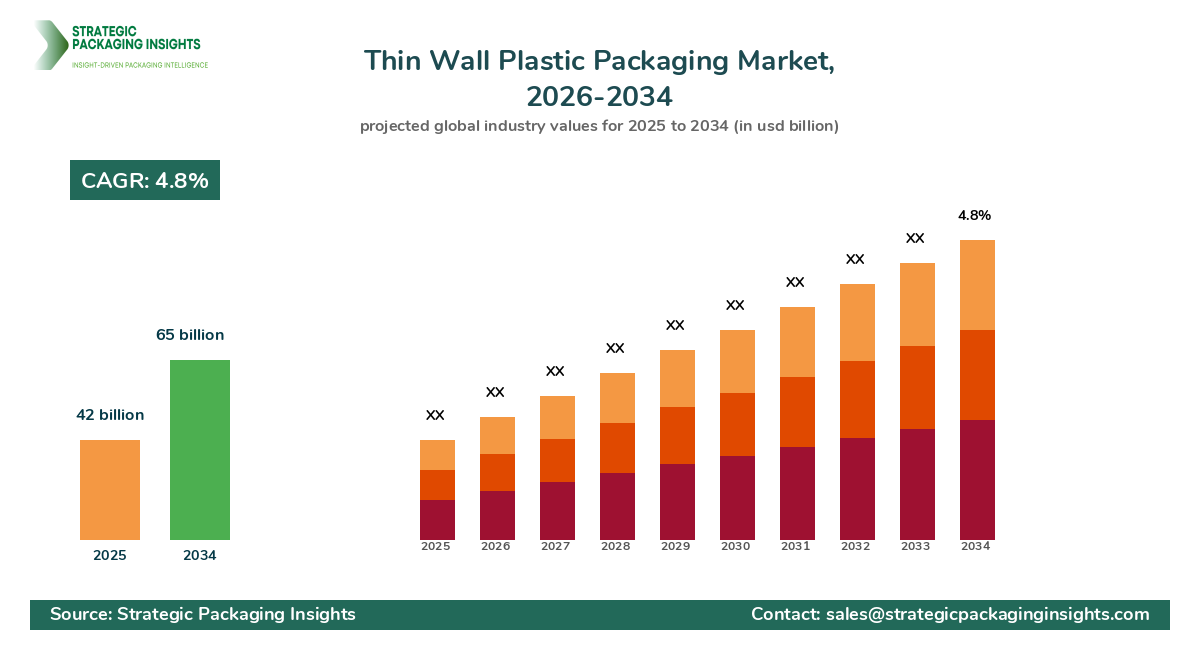

The thin wall Plastic Packaging market was valued at $42 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033. This market is driven by the increasing demand for lightweight and cost-effective packaging solutions across various industries, including food and beverages, pharmaceuticals, and personal care. The growing trend towards convenience and ready-to-eat food products has significantly boosted the demand for thin wall plastic packaging, as it offers excellent barrier properties and extends the shelf life of products. Additionally, advancements in material science and production technologies have enabled manufacturers to produce thinner and more durable packaging solutions, further propelling market growth.

Report Scope

| Attributes | Details |

| Report Title | Thin Wall Plastic Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 232 |

| Material | Polypropylene, Polystyrene, Polyethylene, Polyethylene Terephthalate, Others |

| Product Type | Cups, Trays, Containers, Lids, Others |

| Production Process | Injection Molding, Thermoforming |

| End-User | Food & Beverages, Pharmaceuticals, Personal Care, Household Products, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the thin wall plastic packaging market is the rising consumer preference for sustainable and eco-friendly packaging solutions. With increasing environmental awareness, consumers and businesses are seeking packaging options that minimize environmental impact. This trend has led to the development of biodegradable and recyclable thin wall plastic packaging, which is expected to gain traction in the coming years. Moreover, the growing e-commerce industry presents a lucrative opportunity for market players, as the demand for efficient and Protective Packaging solutions for shipping and logistics continues to rise.

Another opportunity lies in the technological advancements in production processes, such as injection molding and thermoforming. These advancements have enabled manufacturers to produce high-quality thin wall plastic packaging with improved strength and reduced material usage. The ability to customize packaging designs and incorporate innovative features, such as tamper-evident seals and easy-open lids, further enhances the appeal of thin wall plastic packaging among consumers and businesses alike. As a result, companies investing in research and development to enhance their production capabilities are likely to gain a competitive edge in the market.

However, the market faces certain restraints, including stringent regulations on plastic usage and disposal. Governments worldwide are implementing policies to reduce plastic waste and promote recycling, which poses a challenge for the thin wall plastic packaging industry. Additionally, the volatility in raw material prices, particularly petroleum-based resins, can impact the profitability of manufacturers. To mitigate these challenges, companies are focusing on developing alternative materials and improving their recycling processes to align with regulatory requirements and consumer expectations.

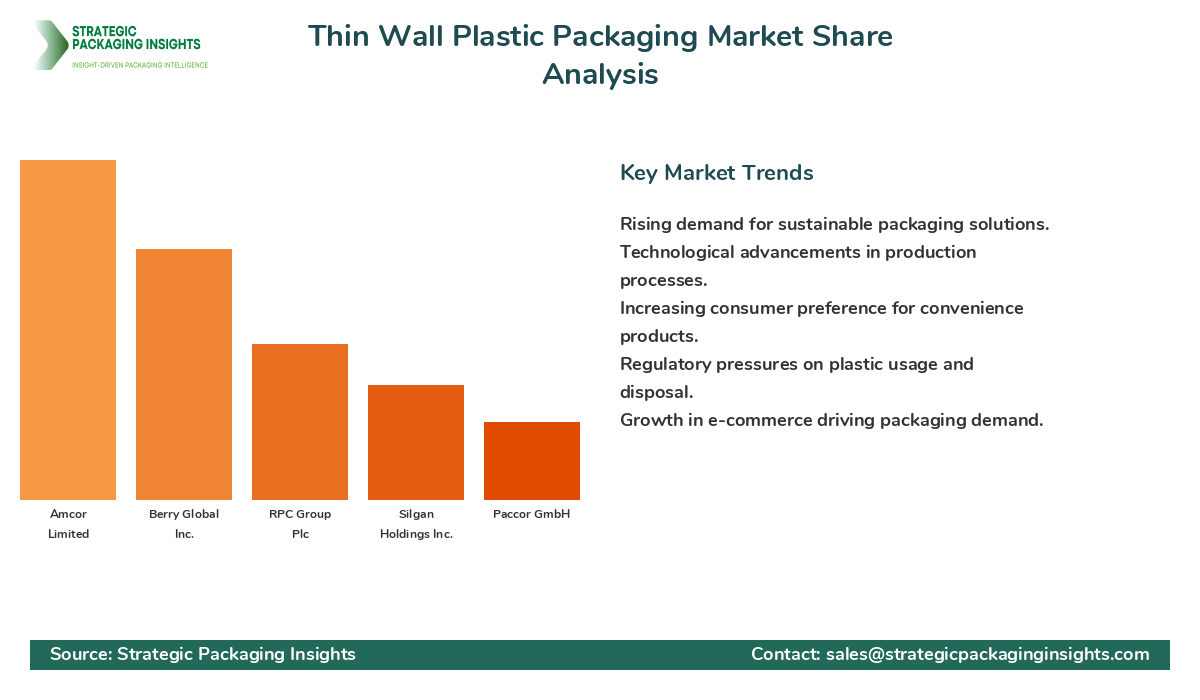

The thin wall plastic packaging market is characterized by intense competition among key players striving to expand their market share through strategic initiatives such as mergers and acquisitions, partnerships, and product innovations. The competitive landscape is dominated by a mix of global and regional players, each vying for a larger share of the market. Companies are focusing on enhancing their production capabilities and expanding their product portfolios to cater to the diverse needs of end-users across various industries.

Major companies in the market include Amcor Limited, Berry Global Inc., RPC Group Plc, Silgan Holdings Inc., and Paccor GmbH. Amcor Limited, for instance, is a leading player known for its innovative packaging solutions and strong focus on sustainability. The company has a significant presence in the global market, with a wide range of products catering to different industries. Berry Global Inc. is another key player, renowned for its extensive product portfolio and commitment to delivering high-quality packaging solutions.

RPC Group Plc, now part of Berry Global, has been a prominent player in the thin wall plastic packaging market, offering a diverse range of products and services. The company's expertise in injection molding and thermoforming processes has enabled it to maintain a strong market position. Silgan Holdings Inc. is known for its focus on innovation and customer-centric approach, providing customized packaging solutions to meet specific client requirements.

Paccor GmbH is a notable player in the European market, with a strong emphasis on sustainability and eco-friendly packaging solutions. The company's commitment to reducing its environmental footprint and developing Recyclable Packaging options has resonated well with environmentally conscious consumers. These companies, along with others, are continuously investing in research and development to enhance their product offerings and maintain a competitive edge in the market.

Key Highlights Thin Wall Plastic Packaging Market

- Increasing demand for lightweight and cost-effective packaging solutions across various industries.

- Growing trend towards convenience and ready-to-eat food products driving market growth.

- Advancements in material science and production technologies enabling thinner and more durable packaging solutions.

- Rising consumer preference for sustainable and eco-friendly packaging options.

- Technological advancements in production processes, such as injection molding and thermoforming.

- Stringent regulations on plastic usage and disposal posing challenges for the industry.

- Volatility in raw material prices impacting profitability of manufacturers.

- Focus on developing alternative materials and improving recycling processes to align with regulatory requirements.

- Intense competition among key players driving strategic initiatives and product innovations.

- Significant presence of global and regional players in the market.

Premium Insights - Key Investment Analysis

The thin wall plastic packaging market has witnessed significant investment activity, driven by the growing demand for innovative and Sustainable Packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and recyclable packaging options, as these align with the global shift towards sustainability. The market has also seen a surge in mergers and acquisitions, with larger players acquiring smaller companies to expand their product portfolios and enhance their market presence.

Investment valuations in the thin wall plastic packaging market are influenced by factors such as technological advancements, regulatory compliance, and market demand. Companies that demonstrate strong research and development capabilities and a commitment to sustainability are attracting higher valuations. The return on investment (ROI) expectations in this market are driven by the potential for cost savings through material reduction and improved production efficiencies.

Emerging investment themes in the market include the development of biodegradable and compostable packaging materials, as well as the integration of smart packaging technologies. These innovations are expected to drive future growth and attract significant investor interest. However, investors must also consider risk factors such as regulatory changes, raw material price fluctuations, and competitive pressures when evaluating investment opportunities in this market.

High-potential investment opportunities exist in regions with strong demand for packaged food and beverages, such as Asia Pacific and North America. These regions offer a favorable environment for market growth, driven by increasing consumer spending and a growing preference for convenience products. Companies that can effectively navigate the regulatory landscape and capitalize on emerging trends are likely to attract substantial investment and achieve long-term success in the thin wall plastic packaging market.

Thin Wall Plastic Packaging Market Segments Insights

Material Analysis

The material segment of the thin wall plastic packaging market is dominated by polypropylene, which is widely used due to its excellent barrier properties and cost-effectiveness. Polypropylene offers high resistance to moisture and chemicals, making it ideal for packaging applications in the food and beverage industry. The demand for polypropylene is further driven by its recyclability and ability to be molded into various shapes and sizes, providing manufacturers with flexibility in design.

Polystyrene is another significant material used in thin wall plastic packaging, known for its lightweight and insulating properties. It is commonly used in the production of cups and trays for food service applications. However, the use of polystyrene is facing challenges due to environmental concerns and regulatory restrictions, prompting manufacturers to explore alternative materials. Polyethylene and polyethylene terephthalate are also gaining traction in the market, offering durability and clarity for packaging applications.

Product Type Analysis

The product type segment of the thin wall plastic packaging market includes cups, trays, containers, lids, and others. Cups and containers are the most widely used products, driven by the increasing demand for convenience and ready-to-eat food products. These products offer excellent barrier properties and are available in various sizes and designs to cater to different consumer preferences.

Trays are commonly used in the food service industry for packaging fresh produce, meat, and bakery products. The demand for trays is driven by their ability to extend the shelf life of products and enhance their visual appeal. Lids are an essential component of thin wall plastic packaging, providing secure sealing and protection for packaged products. The development of innovative lid designs, such as tamper-evident and easy-open lids, is further boosting their demand in the market.

Production Process Analysis

The production process segment of the thin wall plastic packaging market is dominated by injection molding, which offers high precision and efficiency in manufacturing. Injection molding allows for the production of complex shapes and designs, making it ideal for creating customized packaging solutions. The process is widely used for producing cups, containers, and lids, offering manufacturers the ability to meet diverse consumer needs.

Thermoforming is another significant production process used in the market, known for its cost-effectiveness and ability to produce Lightweight Packaging solutions. Thermoforming is commonly used for producing trays and Clamshell Packaging, offering excellent clarity and durability. The process is gaining popularity due to its ability to reduce material usage and production costs, making it an attractive option for manufacturers seeking to enhance their profitability.

End-User Analysis

The end-user segment of the thin wall plastic packaging market is dominated by the food and beverage industry, which accounts for the largest share of the market. The demand for thin wall plastic packaging in this industry is driven by the growing trend towards convenience and ready-to-eat food products. The packaging solutions offer excellent barrier properties, ensuring the freshness and quality of packaged products.

The pharmaceutical industry is another significant end-user of thin wall plastic packaging, utilizing it for packaging medicines and healthcare products. The demand for packaging solutions in this industry is driven by the need for secure and tamper-evident packaging to ensure product safety. The personal care and household products industries also contribute to the demand for thin wall plastic packaging, utilizing it for packaging cosmetics, cleaning products, and other consumer goods.

Market Share Analysis

The market share distribution of key players in the thin wall plastic packaging market is influenced by factors such as product innovation, production capabilities, and strategic partnerships. Companies that invest in research and development to enhance their product offerings and align with consumer preferences are likely to gain a competitive edge. The market is characterized by intense competition, with players striving to expand their market share through mergers and acquisitions, collaborations, and product launches.

Leading companies in the market, such as Amcor Limited and Berry Global Inc., have established strong market positions through their extensive product portfolios and focus on sustainability. These companies are continuously investing in advanced production technologies and sustainable materials to meet the evolving needs of consumers and regulatory requirements. The competitive positioning of companies in the market affects pricing strategies, with players seeking to offer cost-effective solutions without compromising on quality.

Top Countries Insights in Thin Wall Plastic Packaging

The United States is one of the leading markets for thin wall plastic packaging, with a market size of $12 billion and a CAGR of 5%. The demand in the country is driven by the growing preference for convenience and ready-to-eat food products, as well as the increasing focus on sustainable packaging solutions. The presence of major market players and advancements in production technologies further contribute to the market's growth.

China is another significant market, with a market size of $10 billion and a CAGR of 6%. The country's rapid urbanization and increasing consumer spending on packaged food and beverages are driving the demand for thin wall plastic packaging. The government's initiatives to promote sustainable packaging and reduce plastic waste are also influencing market dynamics, encouraging manufacturers to develop eco-friendly solutions.

Germany, with a market size of $8 billion and a CAGR of 4%, is a key market in Europe. The country's strong focus on sustainability and recycling has led to the adoption of innovative packaging solutions. The demand for thin wall plastic packaging in Germany is driven by the food and beverage industry, which seeks to enhance product shelf life and reduce environmental impact.

India, with a market size of $6 billion and a CAGR of 7%, is an emerging market for thin wall plastic packaging. The country's growing population and increasing disposable income are driving the demand for packaged food and beverages. The government's initiatives to promote sustainable packaging and reduce plastic waste are also influencing market dynamics, encouraging manufacturers to develop eco-friendly solutions.

Brazil, with a market size of $4 billion and a CAGR of 5%, is a significant market in Latin America. The demand for thin wall plastic packaging in the country is driven by the food and beverage industry, which seeks to enhance product shelf life and reduce environmental impact. The presence of major market players and advancements in production technologies further contribute to the market's growth.

Thin Wall Plastic Packaging Market Segments

The Thin Wall Plastic Packaging market has been segmented on the basis of

Material

- Polypropylene

- Polystyrene

- Polyethylene

- Polyethylene Terephthalate

- Others

Product Type

- Cups

- Trays

- Containers

- Lids

- Others

Production Process

- Injection Molding

- Thermoforming

End-User

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Household Products

- Others

Primary Interview Insights

What are the key drivers of growth in the thin wall plastic packaging market?

How are companies addressing environmental concerns in the thin wall plastic packaging market?

What challenges do manufacturers face in the thin wall plastic packaging market?

Which regions offer the most significant growth opportunities in the thin wall plastic packaging market?

What are the emerging investment themes in the thin wall plastic packaging market?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.