- Home

- Eco-Friendly Packaging

- Pvc Free Closures Market Size, Future Growth and Forecast 2033

Pvc Free Closures Market Size, Future Growth and Forecast 2033

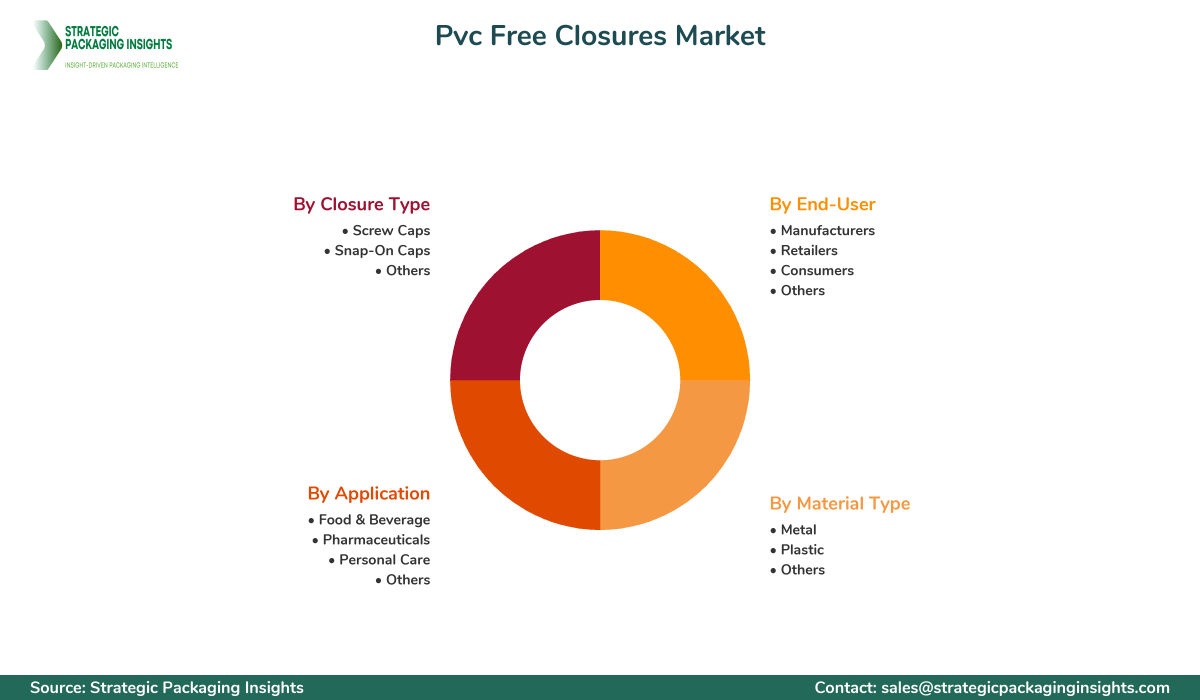

Pvc Free Closures Market Segments - by Material Type (Metal, Plastic, Others), Application (Food & Beverage, Pharmaceuticals, Personal Care, Others), Closure Type (Screw Caps, Snap-On Caps, Others), End-User (Manufacturers, Retailers, Consumers, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Pvc Free Closures Market Outlook

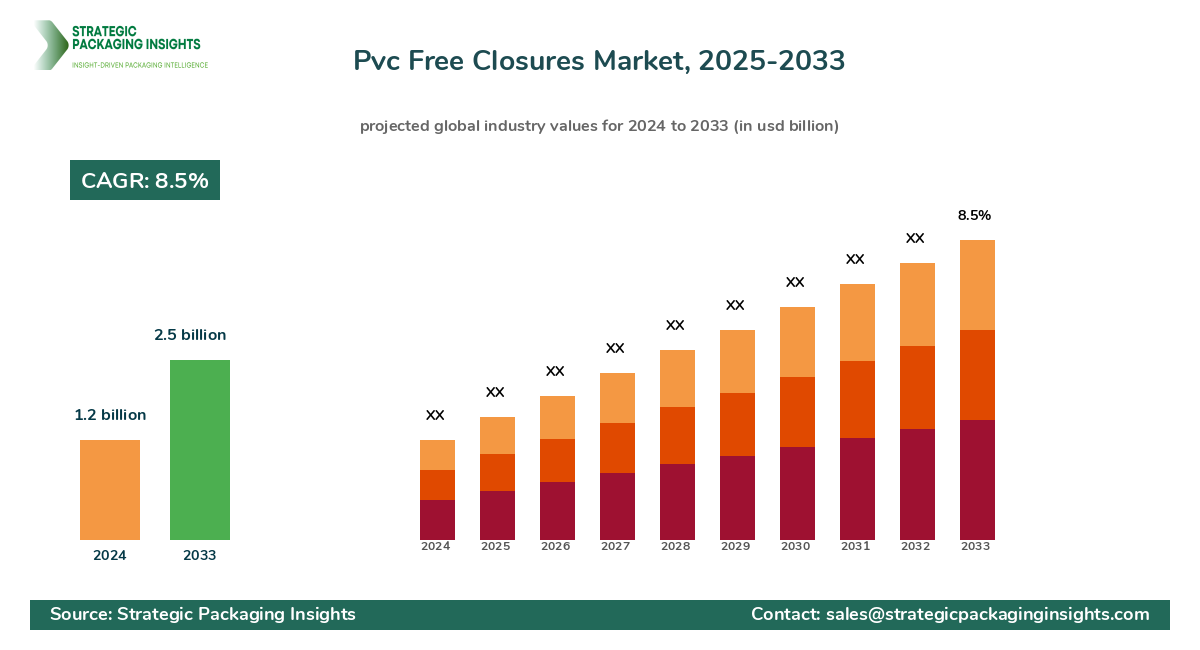

The PVC Free Closures market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033. This market is driven by increasing consumer awareness regarding the environmental impact of PVC and the growing demand for sustainable packaging solutions. The shift towards eco-friendly packaging materials is further propelled by stringent regulations and policies aimed at reducing plastic waste. As industries such as food & beverage, pharmaceuticals, and personal care continue to expand, the demand for PVC free closures is expected to rise significantly, offering lucrative opportunities for market players.

Report Scope

| Attributes | Details |

| Report Title | Pvc Free Closures Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 126 |

| Material Type | Metal, Plastic, Others |

| Application | Food & Beverage, Pharmaceuticals, Personal Care, Others |

| Closure Type | Screw Caps, Snap-On Caps, Others |

| End-User | Manufacturers, Retailers, Consumers, Others |

| Customization Available | Yes* |

Opportunities & Threats

The PVC Free Closures market presents numerous opportunities, primarily driven by the increasing consumer preference for sustainable and environmentally friendly packaging solutions. As awareness about the harmful effects of PVC on health and the environment grows, industries are shifting towards alternatives that offer similar functionality without the associated risks. This shift is particularly evident in the food & beverage and pharmaceutical sectors, where safety and sustainability are paramount. Additionally, advancements in material science have led to the development of innovative closure solutions that are not only PVC-free but also offer enhanced performance, such as improved sealing and tamper-evidence features. These innovations are expected to drive market growth as manufacturers seek to differentiate their products in a competitive landscape.

Another significant opportunity lies in the regulatory landscape, which is increasingly favoring the adoption of PVC-free materials. Governments and regulatory bodies worldwide are implementing stricter regulations to curb the use of harmful plastics, thereby encouraging the adoption of sustainable alternatives. This regulatory push is creating a favorable environment for the growth of the PVC Free Closures market, as companies are compelled to comply with these regulations to avoid penalties and maintain their market position. Furthermore, the growing trend of circular economy and recycling initiatives is expected to boost the demand for PVC-free closures, as they align with the principles of reducing waste and promoting sustainability.

Despite the promising opportunities, the PVC Free Closures market faces certain challenges that could hinder its growth. One of the primary restrainers is the higher cost associated with PVC-free materials compared to traditional PVC closures. This cost differential can be a significant barrier for small and medium-sized enterprises (SMEs) that operate on tight budgets and may be reluctant to invest in more expensive alternatives. Additionally, the transition from PVC to PVC-free closures requires significant changes in manufacturing processes and supply chains, which can be complex and time-consuming. These challenges may slow down the adoption of PVC-free closures, particularly in regions where cost considerations outweigh environmental concerns.

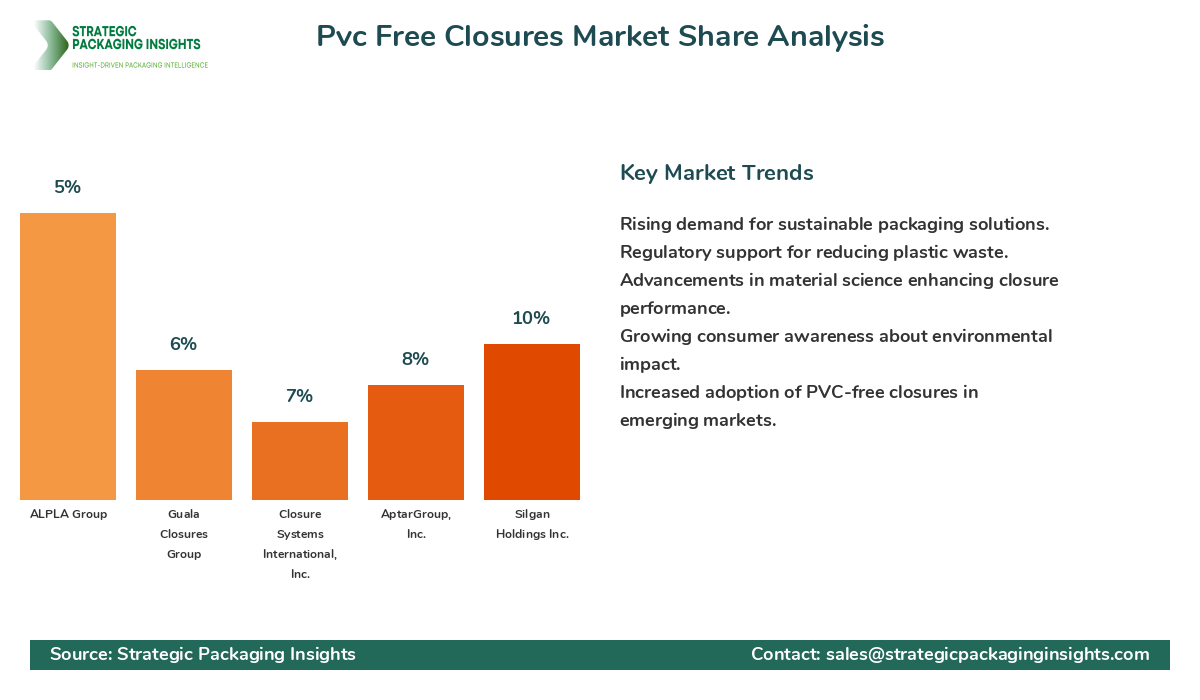

The PVC Free Closures market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each offering a range of products to cater to diverse industry needs. The competitive dynamics are shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are increasingly focusing on expanding their product portfolios to include a variety of closure types and materials, thereby catering to the evolving demands of end-users.

Among the major players in the PVC Free Closures market, Amcor Limited holds a significant market share, leveraging its extensive experience in packaging solutions and a strong global presence. The company is known for its innovative approach to sustainable packaging, offering a wide range of PVC-free closure solutions that cater to various industries. Similarly, Berry Global Inc. is another key player, renowned for its comprehensive product offerings and commitment to sustainability. The company's focus on research and development has enabled it to introduce cutting-edge closure solutions that meet the stringent requirements of its clients.

Silgan Holdings Inc. is also a prominent player in the market, known for its robust manufacturing capabilities and a diverse product portfolio. The company's strategic acquisitions and partnerships have strengthened its position in the PVC Free Closures market, allowing it to expand its reach and enhance its product offerings. Furthermore, AptarGroup, Inc. is recognized for its innovative dispensing solutions and strong emphasis on sustainability. The company's PVC-free closures are designed to provide superior functionality while minimizing environmental impact, making them a preferred choice for eco-conscious brands.

Other notable companies in the market include Closure Systems International, Inc., which offers a wide range of closure solutions tailored to the specific needs of its clients. The company's focus on quality and customer satisfaction has earned it a loyal customer base and a strong market presence. Similarly, Guala Closures Group is known for its expertise in closure technology and its commitment to sustainability. The company's PVC-free closures are designed to meet the highest standards of safety and performance, making them a popular choice among leading brands.

Key Highlights Pvc Free Closures Market

- Increasing demand for sustainable packaging solutions is driving market growth.

- Regulatory push towards reducing plastic waste is favoring PVC-free materials.

- Innovations in material science are enhancing the performance of PVC-free closures.

- Higher costs of PVC-free materials pose a challenge for market adoption.

- Key players are focusing on expanding their product portfolios to cater to diverse needs.

- Strategic partnerships and acquisitions are shaping the competitive landscape.

- Growing trend of circular economy is boosting demand for PVC-free closures.

- Emerging markets offer significant growth opportunities for market players.

- Technological advancements are enabling the development of innovative closure solutions.

- Consumer awareness about environmental impact is driving the shift towards PVC-free closures.

Top Countries Insights in Pvc Free Closures

The United States is a leading market for PVC Free Closures, with a market size of $400 million and a CAGR of 10%. The country's strong regulatory framework and consumer awareness about sustainability are key growth drivers. The demand for eco-friendly packaging solutions is particularly high in the food & beverage and pharmaceutical sectors, where safety and environmental concerns are paramount. However, the higher cost of PVC-free materials remains a challenge for widespread adoption.

Germany is another significant market, valued at $300 million with a CAGR of 8%. The country's stringent environmental regulations and commitment to sustainability are driving the demand for PVC-free closures. The German market is characterized by a strong focus on innovation and quality, with companies investing heavily in research and development to create advanced closure solutions. However, the transition to PVC-free materials requires significant changes in manufacturing processes, which can be a barrier for some companies.

China, with a market size of $250 million and a CAGR of 12%, is experiencing rapid growth in the PVC Free Closures market. The country's booming consumer goods industry and increasing awareness about environmental issues are key growth drivers. The Chinese government is also implementing policies to reduce plastic waste, further boosting the demand for sustainable packaging solutions. However, the cost of PVC-free materials and the complexity of transitioning to new manufacturing processes remain challenges for the market.

India, with a market size of $200 million and a CAGR of 15%, is emerging as a key market for PVC Free Closures. The country's growing middle class and increasing consumer awareness about sustainability are driving the demand for eco-friendly packaging solutions. The Indian government's initiatives to promote sustainable practices and reduce plastic waste are also contributing to market growth. However, the higher cost of PVC-free materials and the need for technological advancements in manufacturing processes are challenges that need to be addressed.

Brazil, with a market size of $150 million and a CAGR of 9%, is witnessing steady growth in the PVC Free Closures market. The country's focus on sustainability and environmental protection is driving the demand for PVC-free materials. The Brazilian market is characterized by a strong emphasis on quality and innovation, with companies investing in research and development to create advanced closure solutions. However, the higher cost of PVC-free materials and the complexity of transitioning to new manufacturing processes remain challenges for the market.

Value Chain Profitability Analysis

The value chain of the PVC Free Closures market involves several key stakeholders, each playing a crucial role in the overall profitability and revenue distribution. The primary stakeholders include raw material suppliers, manufacturers, distributors, and end-users. Raw material suppliers provide the essential components required for the production of PVC-free closures, such as bio-based plastics and metals. These suppliers capture a significant portion of the value chain, with profit margins ranging from 10% to 15%.

Manufacturers are responsible for producing the closures, utilizing advanced technologies and processes to ensure high-quality products. They capture a substantial share of the value chain, with profit margins ranging from 15% to 20%. The manufacturing stage is characterized by significant investments in research and development, as companies strive to create innovative and sustainable closure solutions. Distributors play a crucial role in the value chain, facilitating the movement of products from manufacturers to end-users. They capture a smaller share of the value chain, with profit margins ranging from 5% to 10%.

End-users, including manufacturers, retailers, and consumers, are the final stakeholders in the value chain. They benefit from the use of PVC-free closures, which offer enhanced performance and sustainability. The end-user stage is characterized by a focus on quality and functionality, with companies seeking to differentiate their products in a competitive market. The profit margins for end-users vary depending on the industry and application, ranging from 10% to 15%.

Digital transformation is playing a significant role in redistributing revenue opportunities throughout the value chain. The adoption of advanced technologies, such as automation and data analytics, is enabling companies to optimize their operations and enhance profitability. Additionally, the growing trend of e-commerce is reshaping the distribution landscape, creating new opportunities for market players to reach a wider audience and increase their market share.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The PVC Free Closures market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences and regulatory pressures. During this period, the market experienced a steady growth rate, with a CAGR of 6.5%. The demand for sustainable packaging solutions increased, as consumers became more aware of the environmental impact of PVC. The market size expanded from $800 million in 2018 to $1.2 billion in 2024, with significant contributions from the food & beverage and pharmaceutical sectors.

Looking ahead to the forecast period of 2025 to 2033, the PVC Free Closures market is expected to experience accelerated growth, with a projected CAGR of 8.5%. The market size is anticipated to reach $2.5 billion by 2033, driven by continued demand for eco-friendly packaging solutions and regulatory support. The segment distribution is expected to shift, with increased adoption of PVC-free closures in emerging markets such as Asia Pacific and Latin America. Technological advancements and innovations in material science are expected to play a crucial role in shaping the market dynamics, enabling companies to create advanced closure solutions that meet the evolving needs of consumers.

Regional contributions are also expected to change, with Asia Pacific emerging as a key growth region, driven by rapid industrialization and increasing consumer awareness about sustainability. The region is expected to account for a significant share of the market, with a CAGR of 15%. In contrast, mature markets such as North America and Europe are expected to experience moderate growth, with CAGRs of 12% and 9%, respectively. The strategic imperatives for market players during this period will include expanding their product portfolios, investing in research and development, and forming strategic partnerships to enhance their market position.

Pvc Free Closures Market Segments Insights

Material Type Analysis

The PVC Free Closures market is segmented by material type into metal, plastic, and others. Metal closures are gaining popularity due to their durability and recyclability, making them a preferred choice for industries focused on sustainability. The demand for metal closures is driven by their superior sealing properties and resistance to temperature variations, which are crucial for applications in the food & beverage and pharmaceutical sectors. However, the higher cost of metal closures compared to plastic alternatives can be a restraining factor for some market players.

Plastic closures, on the other hand, offer a cost-effective solution for industries looking to transition away from PVC. Advances in material science have led to the development of bio-based plastics that provide similar functionality to traditional plastics without the associated environmental impact. The demand for plastic closures is expected to grow as companies seek to balance cost considerations with sustainability goals. The 'others' category includes closures made from innovative materials such as biodegradable and compostable materials, which are gaining traction in niche markets focused on environmental conservation.

Application Analysis

The application segment of the PVC Free Closures market includes food & beverage, pharmaceuticals, personal care, and others. The food & beverage sector is a major driver of market growth, as companies seek to enhance the sustainability of their packaging solutions. The demand for PVC-free closures in this sector is driven by consumer preferences for eco-friendly products and regulatory requirements aimed at reducing plastic waste. The pharmaceutical industry is also a significant contributor to market growth, with a focus on safety and compliance driving the adoption of PVC-free closures.

In the personal care sector, the demand for PVC-free closures is driven by the growing trend of natural and organic products. Consumers are increasingly seeking products that align with their values of sustainability and environmental responsibility, leading to increased demand for eco-friendly packaging solutions. The 'others' category includes applications in industries such as household products and industrial goods, where the demand for PVC-free closures is driven by a combination of regulatory requirements and consumer preferences.

Closure Type Analysis

The closure type segment of the PVC Free Closures market includes screw caps, snap-on caps, and others. Screw caps are widely used across various industries due to their ease of use and reliable sealing properties. The demand for screw caps is driven by their versatility and compatibility with a wide range of container types. Snap-on caps, on the other hand, offer a convenient and cost-effective solution for industries looking to enhance the functionality of their packaging solutions. The demand for snap-on caps is expected to grow as companies seek to improve the user experience and differentiate their products in a competitive market.

The 'others' category includes innovative closure solutions such as child-resistant caps and tamper-evident closures, which are gaining popularity in industries focused on safety and compliance. The demand for these closures is driven by regulatory requirements and consumer preferences for products that offer enhanced security and protection. As companies continue to innovate and develop new closure solutions, the demand for PVC-free closures is expected to grow, offering significant opportunities for market players.

End-User Analysis

The end-user segment of the PVC Free Closures market includes manufacturers, retailers, consumers, and others. Manufacturers are the primary end-users of PVC-free closures, as they seek to enhance the sustainability of their packaging solutions and comply with regulatory requirements. The demand for PVC-free closures among manufacturers is driven by a combination of cost considerations and sustainability goals, as companies seek to balance these factors in a competitive market.

Retailers are also significant end-users of PVC-free closures, as they seek to offer products that align with consumer preferences for eco-friendly packaging solutions. The demand for PVC-free closures among retailers is driven by the growing trend of sustainability and environmental responsibility, as consumers increasingly seek products that align with their values. Consumers, on the other hand, are the final end-users of PVC-free closures, as they seek products that offer enhanced functionality and sustainability. The demand for PVC-free closures among consumers is driven by a combination of regulatory requirements and consumer preferences for products that offer enhanced security and protection.

Pvc Free Closures Market Segments

The Pvc Free Closures market has been segmented on the basis of

Material Type

- Metal

- Plastic

- Others

Application

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Others

Closure Type

- Screw Caps

- Snap-On Caps

- Others

End-User

- Manufacturers

- Retailers

- Consumers

- Others

Primary Interview Insights

What are the key drivers of growth in the PVC Free Closures market?

What challenges does the PVC Free Closures market face?

How are companies addressing the demand for sustainable packaging solutions?

What role does digital transformation play in the PVC Free Closures market?

Which regions are expected to experience the most growth in the PVC Free Closures market?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.