- Home

- Eco-Friendly Packaging

- Paper Based Flow Wrap Market Size, Future Growth and Forecast 2033

Paper Based Flow Wrap Market Size, Future Growth and Forecast 2033

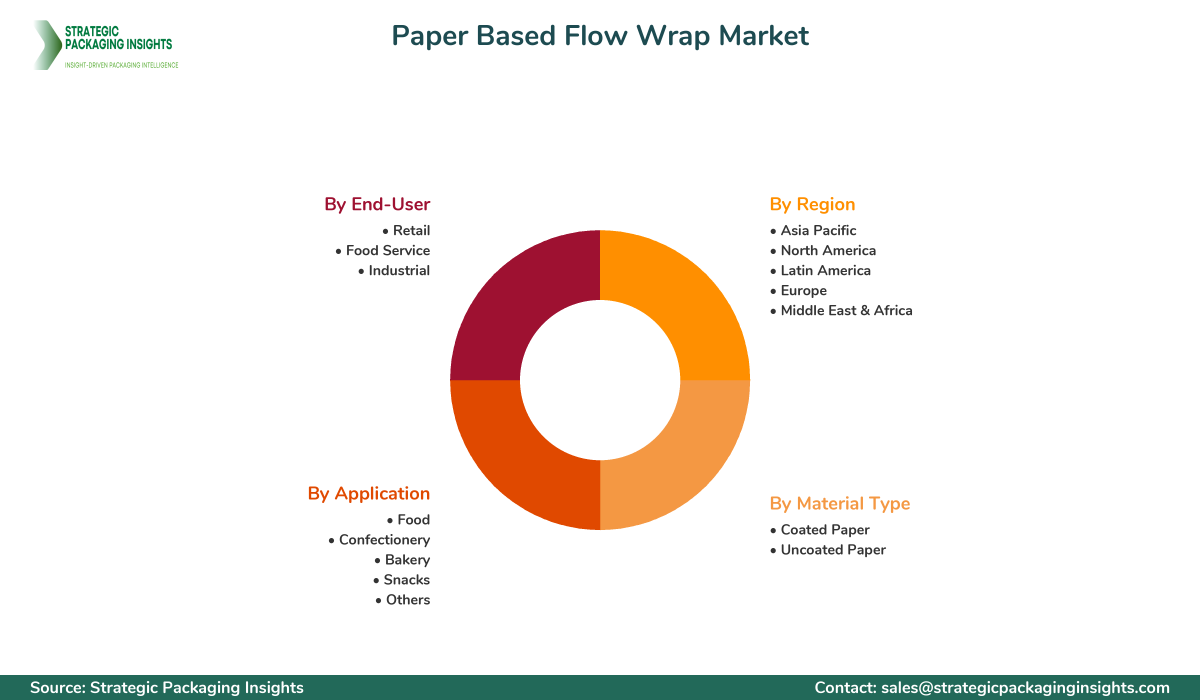

Paper Based Flow Wrap Market Segments - by Material Type (Coated Paper, Uncoated Paper), Application (Food, Confectionery, Bakery, Snacks, Others), End-User (Retail, Food Service, Industrial), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Paper Based Flow Wrap Market Outlook

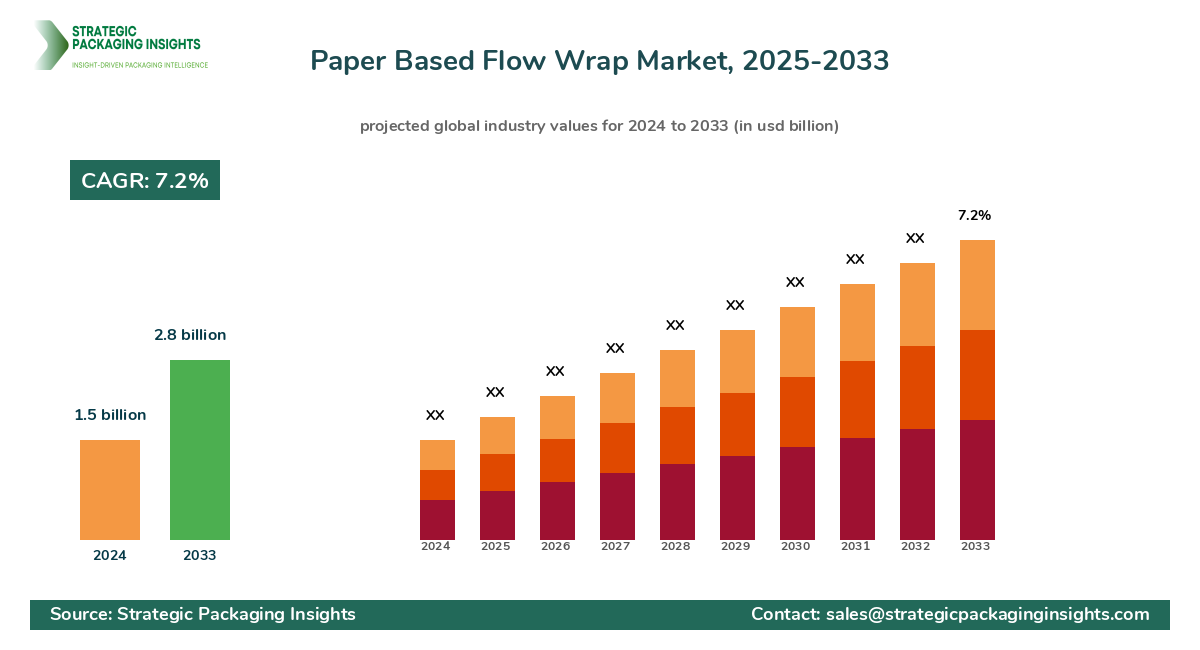

The paper based flow wrap market was valued at $1.5 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033. This market is experiencing significant growth due to the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, the shift from plastic to paper-based packaging is gaining momentum. The food industry, in particular, is driving this demand as companies seek to reduce their carbon footprint and comply with stringent environmental regulations. The versatility of paper-based flow wraps, which can be used for a variety of products including confectionery, bakery items, and snacks, further enhances their appeal.

Report Scope

| Attributes | Details |

| Report Title | Paper Based Flow Wrap Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 140 |

| Material Type | Coated Paper, Uncoated Paper |

| Application | Food, Confectionery, Bakery, Snacks, Others |

| End-User | Retail, Food Service, Industrial |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

One of the primary opportunities in the paper based flow wrap market is the growing consumer preference for sustainable packaging. As awareness about environmental issues increases, consumers are actively seeking products that are packaged in eco-friendly materials. This trend is encouraging manufacturers to innovate and develop paper-based solutions that are not only sustainable but also cost-effective. Additionally, advancements in technology are enabling the production of high-quality paper wraps that offer excellent barrier properties, making them suitable for a wide range of applications. The potential for customization and branding on paper wraps also presents a lucrative opportunity for companies looking to enhance their product visibility and appeal.

Another significant opportunity lies in the expanding food and beverage industry, particularly in emerging markets. As disposable incomes rise and urbanization continues, there is an increasing demand for packaged food products. This trend is driving the need for efficient and sustainable packaging solutions, such as paper-based flow wraps. Moreover, the regulatory push towards reducing plastic usage is further propelling the adoption of paper-based alternatives. Companies that can offer innovative and compliant packaging solutions are likely to gain a competitive edge in this growing market.

However, the market faces certain restraints, primarily related to the cost and availability of raw materials. The production of high-quality paper wraps requires specific types of paper, which can be expensive and subject to supply chain disruptions. Additionally, the performance of paper-based wraps in terms of moisture resistance and durability can be a concern for certain applications. Manufacturers need to invest in research and development to overcome these challenges and ensure that their products meet the required standards. The competition from plastic and other alternative packaging materials also poses a threat to the growth of the paper-based flow wrap market.

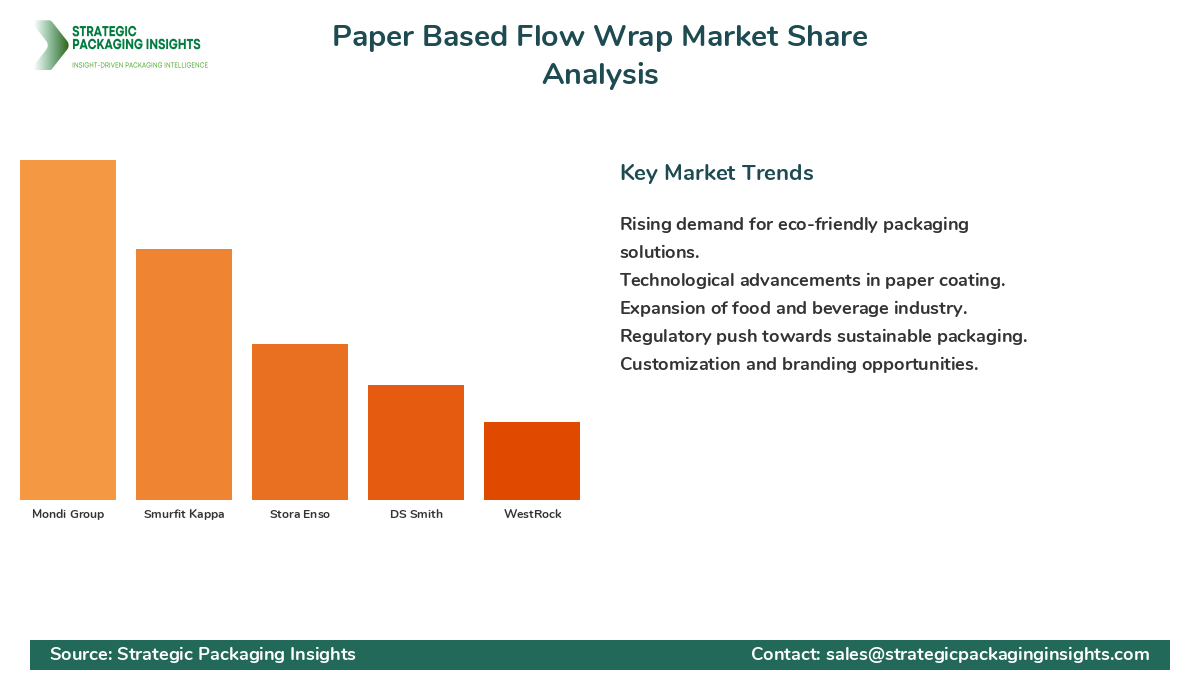

The paper based flow wrap market is characterized by a competitive landscape with several key players vying for market share. Companies are focusing on innovation, sustainability, and strategic partnerships to strengthen their position in the market. The competitive dynamics are influenced by factors such as product quality, pricing strategies, and distribution networks. Leading companies are investing in research and development to enhance the performance and appeal of their paper-based wraps. They are also expanding their production capacities to meet the growing demand from various end-user industries.

Among the major players in the market, Mondi Group holds a significant share due to its extensive product portfolio and strong focus on sustainability. The company offers a range of paper-based packaging solutions that cater to different industries, including food and beverage, retail, and industrial sectors. Another key player, Smurfit Kappa, is known for its innovative packaging solutions and commitment to environmental responsibility. The company has a strong presence in Europe and is expanding its operations in other regions to capitalize on the growing demand for sustainable packaging.

Stora Enso is another prominent player in the paper based flow wrap market, with a focus on renewable materials and circular economy principles. The company is investing in new technologies to enhance the performance of its paper-based products and reduce environmental impact. Similarly, DS Smith is leveraging its expertise in sustainable packaging to offer innovative solutions that meet the evolving needs of consumers and businesses. The company's strategic acquisitions and partnerships are helping it to expand its market presence and strengthen its competitive position.

Other notable companies in the market include WestRock, UPM-Kymmene Corporation, and International Paper. These companies are actively investing in research and development to improve the quality and functionality of their paper-based wraps. They are also focusing on expanding their distribution networks and enhancing customer engagement to drive growth. The competitive landscape is expected to remain dynamic, with companies continuously striving to innovate and differentiate their offerings to capture a larger share of the market.

Key Highlights Paper Based Flow Wrap Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Growing consumer preference for paper-based packaging over plastic.

- Expansion of the food and beverage industry driving market growth.

- Technological advancements enhancing the quality of paper wraps.

- Regulatory push towards reducing plastic usage boosting adoption.

- Customization and branding opportunities on paper wraps.

- Challenges related to raw material costs and supply chain disruptions.

- Competition from plastic and alternative packaging materials.

- Focus on innovation and strategic partnerships among key players.

- Expansion of production capacities to meet growing demand.

Premium Insights - Key Investment Analysis

The paper based flow wrap market is attracting significant investment as companies seek to capitalize on the growing demand for sustainable packaging solutions. Funding trends indicate a strong interest in developing innovative paper-based products that offer superior performance and environmental benefits. Venture capital activity is focused on startups and emerging companies that are pioneering new technologies and materials in the packaging industry. M&A transactions are also on the rise, with larger companies acquiring smaller firms to enhance their product portfolios and expand their market reach.

Investment valuations in the paper based flow wrap market are driven by factors such as market potential, technological advancements, and regulatory compliance. Investors are keen on companies that demonstrate a strong commitment to sustainability and have a clear strategy for growth. ROI expectations are high, given the increasing consumer demand for eco-friendly packaging and the regulatory push towards reducing plastic usage. Emerging investment themes include the development of biodegradable and compostable paper wraps, as well as the integration of smart packaging technologies.

Risk factors in the market include fluctuations in raw material prices, supply chain disruptions, and competition from alternative packaging materials. However, the strategic rationale behind major deals is centered around the potential for long-term growth and the ability to meet evolving consumer preferences. High-potential investment opportunities are present in regions with strong regulatory support for sustainable packaging, such as Europe and North America. Sectors attracting the most investor interest include food and beverage, retail, and industrial packaging, where the demand for paper-based solutions is particularly strong.

Paper Based Flow Wrap Market Segments Insights

Material Type Analysis

The material type segment of the paper based flow wrap market is primarily divided into coated and uncoated paper. Coated paper is gaining traction due to its enhanced barrier properties, which make it suitable for packaging applications that require moisture resistance and durability. The demand for coated paper is particularly high in the food industry, where it is used to package products such as confectionery, bakery items, and snacks. Manufacturers are focusing on developing innovative coatings that improve the performance of paper wraps while maintaining their eco-friendly attributes.

Uncoated paper, on the other hand, is preferred for applications where cost-effectiveness and recyclability are the primary considerations. This type of paper is widely used in the retail sector for packaging products that do not require high barrier properties. The growing emphasis on sustainability and the circular economy is driving the demand for uncoated paper, as it is easier to recycle and has a lower environmental impact. Companies are investing in research and development to enhance the quality and functionality of uncoated paper wraps, making them more competitive with alternative packaging materials.

Application Analysis

The application segment of the paper based flow wrap market includes food, confectionery, bakery, snacks, and others. The food industry is the largest consumer of paper-based flow wraps, driven by the increasing demand for sustainable packaging solutions. As consumers become more health-conscious and environmentally aware, there is a growing preference for products that are packaged in eco-friendly materials. Paper-based wraps offer a versatile and attractive packaging option for a wide range of food products, from fresh produce to processed foods.

In the confectionery and bakery sectors, paper-based flow wraps are gaining popularity due to their ability to preserve the freshness and quality of products. The aesthetic appeal of paper wraps, combined with their potential for customization and branding, makes them an attractive choice for manufacturers looking to differentiate their products in a competitive market. The snacks segment is also witnessing significant growth, as consumers seek convenient and sustainable packaging options for on-the-go consumption. Companies are exploring innovative designs and materials to enhance the functionality and appeal of paper-based wraps in this segment.

End-User Analysis

The end-user segment of the paper based flow wrap market is categorized into retail, food service, and industrial sectors. The retail sector is a major driver of demand for paper-based wraps, as retailers seek to offer sustainable packaging solutions that align with consumer preferences. The shift towards eco-friendly packaging is particularly pronounced in the food and beverage industry, where retailers are under pressure to reduce their environmental impact and comply with regulatory requirements. Paper-based wraps offer a cost-effective and versatile solution for packaging a wide range of products, from fresh produce to processed foods.

The food service sector is also a significant consumer of paper-based flow wraps, driven by the increasing demand for sustainable packaging solutions in the hospitality and catering industries. As consumers become more environmentally conscious, there is a growing preference for food service establishments that use eco-friendly packaging. Paper-based wraps offer a practical and attractive solution for packaging takeaway and delivery items, enhancing the overall customer experience. The industrial sector is also adopting paper-based wraps for packaging applications that require durability and protection, such as automotive and electronics components.

Regional Analysis

The regional analysis of the paper based flow wrap market reveals significant growth opportunities in Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia Pacific is expected to witness the highest growth rate, driven by the increasing demand for sustainable packaging solutions in emerging markets such as China and India. The region's expanding food and beverage industry, coupled with rising consumer awareness about environmental issues, is fueling the demand for paper-based wraps. Companies are investing in expanding their production capacities and distribution networks to capitalize on the growing market potential in this region.

North America and Europe are also key markets for paper-based flow wraps, driven by strong regulatory support for sustainable packaging and a high level of consumer awareness. The demand for eco-friendly packaging solutions is particularly strong in the food and beverage industry, where companies are under pressure to reduce their environmental impact and comply with stringent regulations. The Middle East & Africa and Latin America are emerging markets for paper-based wraps, with growing demand from the food and beverage and retail sectors. Companies are exploring strategic partnerships and acquisitions to expand their market presence and capture a larger share of the growing demand in these regions.

Market Share Analysis

The market share distribution of key players in the paper based flow wrap market is influenced by factors such as product quality, innovation, and strategic partnerships. Leading companies such as Mondi Group, Smurfit Kappa, and Stora Enso are at the forefront of the market, leveraging their expertise in sustainable packaging to capture a significant share. These companies are investing in research and development to enhance the performance and appeal of their paper-based wraps, while also expanding their production capacities to meet the growing demand from various end-user industries.

Companies that are gaining market share are those that can offer innovative and sustainable packaging solutions that meet the evolving needs of consumers and businesses. The competitive positioning of companies is also influenced by their ability to establish strong distribution networks and strategic partnerships. Companies that are falling behind are those that are unable to keep pace with the rapid advancements in technology and changing consumer preferences. The market share distribution affects pricing, innovation, and partnerships, as companies strive to differentiate their offerings and capture a larger share of the market.

Top Countries Insights in Paper Based Flow Wrap

The United States is one of the leading markets for paper based flow wraps, with a market size of $450 million and a CAGR of 6%. The country's strong regulatory support for sustainable packaging and high level of consumer awareness are driving the demand for eco-friendly packaging solutions. The food and beverage industry is a major driver of growth, with companies seeking to reduce their environmental impact and comply with stringent regulations.

Germany is another key market, with a market size of $300 million and a CAGR of 5%. The country's strong focus on sustainability and circular economy principles is driving the demand for paper-based wraps. The food and beverage industry is a major consumer of paper-based wraps, with companies seeking to enhance their product visibility and appeal through innovative packaging solutions.

China is expected to witness significant growth, with a market size of $250 million and a CAGR of 8%. The country's expanding food and beverage industry, coupled with rising consumer awareness about environmental issues, is fueling the demand for paper-based wraps. Companies are investing in expanding their production capacities and distribution networks to capitalize on the growing market potential in this region.

India is another emerging market, with a market size of $200 million and a CAGR of 9%. The country's growing middle class and increasing demand for packaged food products are driving the need for sustainable packaging solutions. The regulatory push towards reducing plastic usage is also propelling the adoption of paper-based alternatives.

Brazil is also witnessing growth, with a market size of $150 million and a CAGR of 7%. The country's expanding food and beverage industry and growing consumer preference for eco-friendly packaging are driving the demand for paper-based wraps. Companies are exploring strategic partnerships and acquisitions to expand their market presence and capture a larger share of the growing demand in this region.

Paper Based Flow Wrap Market Segments

The Paper Based Flow Wrap market has been segmented on the basis of

Material Type

- Coated Paper

- Uncoated Paper

Application

- Food

- Confectionery

- Bakery

- Snacks

- Others

End-User

- Retail

- Food Service

- Industrial

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What is driving the growth of the paper based flow wrap market?

What are the major challenges faced by the market?

Which regions are expected to witness the highest growth?

How are companies addressing the demand for sustainable packaging?

What are the key investment opportunities in the market?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.