- Home

- Eco-Friendly Packaging

- Nylon Resin For Packaging Market Size, Future Growth and Forecast 2033

Nylon Resin For Packaging Market Size, Future Growth and Forecast 2033

Nylon Resin For Packaging Market Segments – by Resin Type (PA6, PA66, MXD6, Bio-based PA11/PA12), Packaging Format (Films & Pouches, Bottles & Barrier Layers, Trays & Thermoformed Items, Caps & Closures), Processing Technology (BOPA/Oriented Films, Blown & Cast Coextrusion, Multilayer Injection/Blow Molding, Solventless Lamination & Coating), End-Use Industry (Food & Beverage, Meat & Cheese, Pharmaceuticals & Medical, Personal Care & Household) – Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Nylon Resin For Packaging Market Outlook

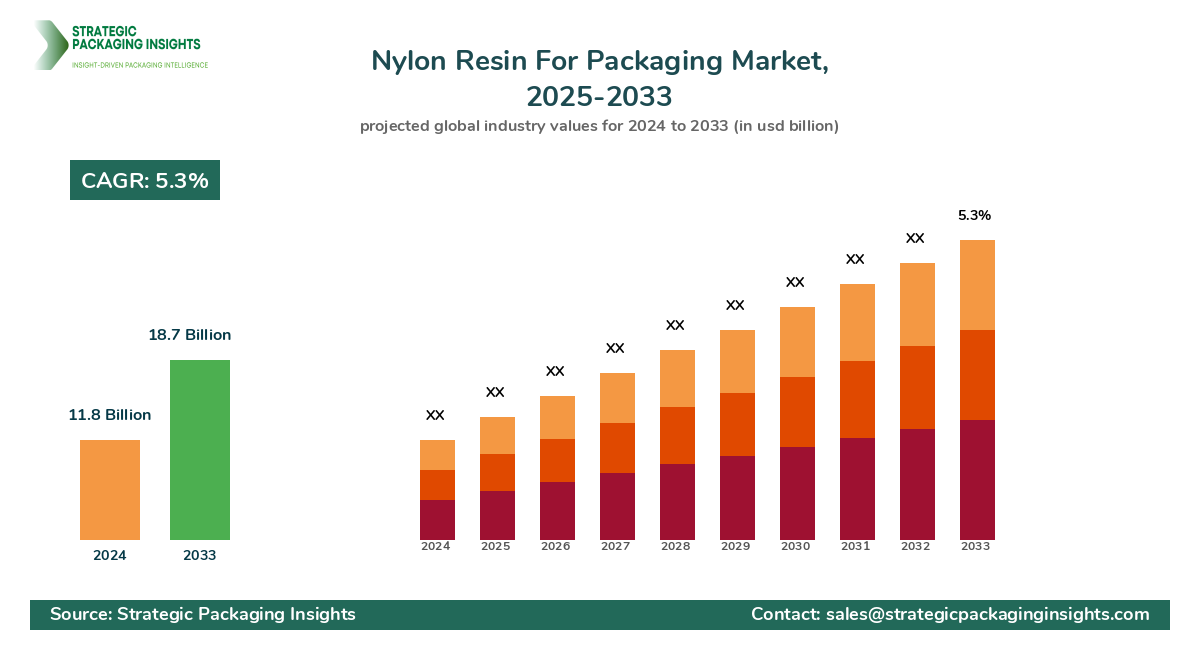

The nylon resin for packaging market was valued at $11.8 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2025–2033. Growth follows sustained adoption of oriented and coextruded nylon films in vacuum and MAP meat, cheese, retort pouches, Stand-up Pouches, and premium dry food packaging, where puncture resistance, flex-crack durability, and oxygen barrier upgrades extend shelf life and reduce waste. PA6 dominates film extrusion thanks to processability and balance of stiffness and toughness, while MXD6 expands in barrier layers for PET bottles and high-clarity laminates, and PA66 serves specialty high-heat retort applications. As brands shift from cans and rigid tubs to lightweight flexible formats, nylon layers enable down-gauging without sacrificing abuse resistance, helping converters meet performance targets with fewer materials and lower transport emissions. Demand is amplified by cold-chain expansion, e-grocery penetration, and omnichannel fulfillment, which intensify the need for robust, scuff-resistant packages that survive handling. Regulatory pressure on food waste and recyclability pushes multilayer redesigns toward solventless lamination, water-based inks, and simplified structures where nylon’s mechanical durability supports thinner total lamination calipers. Supply security improves as Asia-based PA6 capacity debottlenecks and North American producers upgrade energy efficiency, while brand owners emphasize verified chain-of-custody and LCA-backed data to meet ESG scorecards and EPR-driven fees.

Report Scope

| Attributes | Details |

| Report Title | Nylon Resin For Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 170 |

| Resin Type | PA6, MXD6 |

| Packaging Format | Films & Pouches, Bottles & Barrier Layers |

| Processing Technology | BOPA/Oriented Films, Blown & Cast Coextrusion |

| End-Use Industry | Food & Beverage, Pharmaceuticals & Medical |

| Customization Available | Yes* |

Opportunities & Threats

Nylon resins gain from the worldwide pivot to high-performance flexible packaging that extends freshness, curbs product loss, and resists puncture across distribution. Opportunity aligns with premium meat and cheese, pet food, and ready-to-eat meals where PA6 and PA66 layers pass retort and hot-fill stress while maintaining seal integrity and abuse resistance. Film converters are investing in BOPA lines, five-to-nine layer blown film lines, and hybrid coextrusion that integrates PA with PE, PP, EVOH, and tie layers to fine-tune oxygen, aroma, and moisture barrier. In addition, e-commerce-ready formats such as abrasion-resistant mailer pouches and ship-in-own-container packs use nylon skins to withstand conveyor friction and drop impacts. Brand owners increasingly request thinner laminations with equal shelf life, pushing nylon into down-gauged structures that keep stiffness and prevent pinholing. Growth also rides on the resurgence of retort pouches replacing cans in soups, sauces, and baby food, where nylon’s temperature resistance and flex life beat simple polyolefin stacks.

Another opportunity lies in circularity and regulatory compliance. EPR in Europe and emerging U.S. state programs incentivize waste reduction through downgauging, longer shelf life, and verified recyclability claims, all areas where nylon can help reduce overall material usage and food waste. Bio-based PA11/PA12 derived from castor oil offers a premium, low-carbon route in specialty caps, closures, and high-abuse films, attracting brands with net-zero roadmaps. In PET bottles, MXD6 improves barrier to enable lower additive loads or thinner walls for carbonated and oxygen-sensitive beverages, and compatibilization technologies continue to improve PET recycling yields. Technology partnerships with adhesive, ink, and compatibilizer suppliers create new mono-material-leaning designs and recycling pilots, while digital printing opens short-run premium SKUs that demand tougher outer webs. Emerging markets in Southeast Asia, India, and Latin America are building multilayer film and retort capacities, creating localized demand for nylon resin grades tuned to regional machinery and feedstocks.

Restraints concentrate on cost volatility, recycling complexity in multilayer structures, and competition from alternatives like high-barrier PE/PP, EVOH-centric designs, and metallized or ALD-coated webs. Caprolactam and adipic/hexamethylene diamine price swings, coupled with energy costs, can pressure converter margins and trigger periodic light-weighting cycles that challenge nylon share. Monolayer polyolefin innovations and new barrier coatings aim to displace nylon in some snack and dry food applications, while consumer-facing recyclability Labels push buyers to simplify structures. Infrastructure for chemically recycling nylon-containing laminates is still nascent, creating perception challenges despite improvements in compatibilization and mechanical recycling of PET/MXD6 streams. In medical and pharma pouches, regulatory validation timelines lengthen transitions to new nylon grades, and qualification costs can slow upgrades even when performance gains are proven. Suppliers that provide full LCAs, recycling test data, and stable long-term contracts mitigate these headwinds and defend premium positioning.

The competitive landscape blends integrated resin majors and specialty PA innovators with deep global footprints across food, beverage, and healthcare packaging value chains. Integrated leaders with captive monomer chains and multi-region polymerization—especially in PA6—hold pricing power, secure feedstock, and run broad grade slates for film extrusion, BOPA tentering, and multilayer blow molding. Asia Pacific concentrates capacity and film conversion, with Japanese and Chinese players strong in BOPA and coextruded Barrier Films, while North America emphasizes PA6 resin supply to large meat and cheese converters. Europe differentiates through sustainability leadership, solventless lamination, and advanced retort structures where PA66 and MXD6 play targeted roles. Market dynamics reward suppliers offering consistent viscosity control, low-gel resins, thermo-oxidative stability, and migration-compliant additives supported by global food-contact dossiers (FDA, EU 10/2011) and pharma change-control discipline.

At the brand and converter interface, long-term agreements prioritize performance consistency, film optics, and defect rates along with shelf-life targets verified via oxygen transmission (OTR) and flex-crack tests. Company Name: BASF; Market Share: ~11–12% globally in nylon for packaging across PA6/66 grades and solution support, leveraging Ultramid lines and pan-regional technical centers. Company Name: UBE Corporation; Market Share: ~9–10% with strong PA6 resin and caprolactam integration, a preferred supplier to BOPA and high-clarity coextrusion films. Company Name: Toray Industries; Market Share: ~8–9% via integrated BOPA presence and tailored PA resins for oriented and coex films, supported by robust film technology. Company Name: AdvanSix; Market Share: ~7–8% centered on Aegis PA6 for North American film extrusion and thermoforming. Company Name: Asahi Kasei; Market Share: ~6–7% with specialty PA grades for retort pouches and medical/pharma packaging. Company Name: Celanese (Zytel portfolio); Market Share: ~6–7% supplying packaging-capable PA6/66 for film and barrier parts after acquiring DuPont’s M&M business. Company Name: Envalior (Akulon/Novamid); Market Share: ~5–6% with established film grades and global regulatory support. Company Name: DOMO Chemicals; Market Share: ~4–5% with PA6/66 offerings and growing film-grade portfolio. Company Name: Arkema; Market Share: ~3–4% through bio-based PA11/PA12 niches in caps, closures, and abuse-resistant films. Company Name: Mitsubishi Gas Chemical; Market Share: ~3–4% as a leading supplier of MXD6 barrier nylon to PET bottles and high-clarity laminates.

Innovation and collaboration define current competition. Suppliers invest in resin cleanliness and gel reduction to push BOPA yield and minimize optical defects, while stabilizer packages extend retort performance and recycle-compatibility. Partnerships with adhesive and coating makers target solventless lamination windows and improved PA-to-PE/PP adhesion for thinner stacks. MXD6 players develop PET-recycling-friendly grades that maintain bottle barrier without compromising rPET quality, aligning with beverage brand pledges. Bio-based PA11/PA12 expands in high-performance flexible packaging components, allowing premium low-carbon claims and value-added pricing. Technical service is a critical moat: vendors that simulate OTR under humidity cycling, quantify flex life, and validate seal performance across lines reduce trial time and win multi-plant rollouts.

Major companies emphasize regional reliability and compliance. BASF, UBE, and AdvanSix augment capacity efficiency and distribution to stabilize lead times during caprolactam and energy swings. Toray and Asahi Kasei integrate film know-how with resin tuning to accelerate structure qualification for converters. Celanese and Envalior leverage multi-decade food-contact registrations and migration data sets to streamline R&D for new pouch formats. DOMO Chemicals advances recycled-content pathways for PA in Technical Films, while Arkema leads in bio-based PA with lower cradle-to-gate CO2. Mitsubishi Gas Chemical’s MXD6 remains central to oxygen-sensitive beverage packaging and premium laminates, with ongoing work on recycling compatibility and reduced haze. Collectively, these strategies maintain pricing discipline while expanding the addressable market through downgauging and higher performance per micron.

Key Highlights Nylon Resin For Packaging Market

- Down-gauged nylon laminate structures reduce total material use by 8–15% while maintaining puncture resistance and OTR targets in meat and cheese packs.

- Retortable PA6/PA66 coex films gain share in ready meals and wet pet food, enabling can-to-pouch conversion and logistics efficiency.

- MXD6 adoption in PET bottles and film laminates grows with improved rPET-compatibility, supporting beverage brand recycling goals.

- Solventless lamination and water-based ink systems paired with nylon substrates decrease VOCs and speed compliance across EU and North American plants.

- Bio-based PA11/PA12 expands in premium closures and high-abuse films, delivering lower carbon footprints without sacrificing performance.

- Investments in BOPA lines and 7–9 layer blown film assets in Asia and India increase regional availability of high-spec nylon structures.

- Advanced stabilizers and anti-gel protocols enhance film optics, boosting yield and reducing waste on tenter-frame and blown lines.

- Growth in e-grocery and cold chain raises demand for abrasion-resistant outer webs where nylon surfaces outperform PE-only structures.

- Lifecycle data and EPR-driven scorecards push verified chain-of-custody and LCA-backed nylon grades in enterprise RFPs.

Premium Insights - Key Investment Analysis

Capital allocation favors resin makers with feedstock integration, energy-efficient polymerization, and regional redundancy that buffer volatility and ensure service continuity. Expansion projects prioritize PA6 debottlenecking, resin purification upgrades to cut gels, and specialty grade development for retort and high-clarity laminates. M&A targets include mid-size PA specialists and BOPA converters in high-growth corridors (India, ASEAN, LATAM), enabling resin-to-film alignment and faster time to market for new structures. Venture funding concentrates on recycling-compatible multilayer solutions, compatibilizers that improve PET/MXD6 reclamation, and solventless lamination chemistries that preserve nylon performance while reducing VOCs. Investor theses lean on stable mid-single-digit growth, low substitution risk in abuse-critical applications, and strong pricing power in certified, regulatory-ready grades. ROI typically stems from downgauging plus shelf-life extension benefits, translating to product-waste reduction that resonates in retailer scorecards and EPR fee models.

Valuations reward companies with credible ESG narratives, documented LCAs, and food/pharma compliance libraries that compress customer qualification timelines. Strategic deals increasingly attach to ecosystem plays—resin suppliers partnering with adhesive, ink, and machinery OEMs to pre-qualify nylon-rich structures for high-speed lines and e-grocery-ready distribution. Risks include caprolactam supply shocks, energy cost spikes in Europe and parts of Asia, and substitution by advanced polyolefin barrier stacks in non-retort foods; mitigations feature long-term feedstock contracts, regional energy hedging, and application-focused innovation. High-potential areas for capital include MXD6 for rPET-compatible bottle barriers, PA6 film grades optimized for solventless lamination, bio-based PA in high-abuse films and closures, and medical/pharma pouches requiring robust puncture resistance and sterilization stability. Private equity interest remains elevated in niche BOPA assets and converters with retort expertise, where EBITDA uplift follows mix upgrades and cross-selling into multinational brand programs.

Nylon Resin For Packaging Market Segments Insights

Resin Type Analysis

PA6 remains the workhorse resin for flexible packaging due to its balanced toughness, clarity, and processability across BOPA, blown, and cast coextrusion. Converters value narrow viscosity windows, low gel count, and thermal stability that preserves optics and barrier during orientation and lamination. PA66 plays in heat-intensive structures such as retort pouches and sterilizable medical packs where higher melting point and modulus offer margin against seal creep and burst. MXD6 delivers superior oxygen barrier and clarity when paired with PET or used as a thin barrier layer in laminates, enabling thinner total structures and longer shelf life for oxygen-sensitive foods and beverages. Bio-based PA11/PA12, while niche in total volume, offers compelling abrasion resistance and low moisture uptake for premium closures and high-abuse films, unlocking low-carbon branding that commands premiums in select categories.

Competition across resin types centers on delivering consistent mechanical performance after orientation, humidity cycling, and thermal stress while meeting global food-contact and migration limits. Suppliers differentiate with FDA/EU compliance dossiers, pharma change-control, and application labs that replicate customer lines. Resin cleanliness directly impacts film yield and optical acceptance rates, making gel control a frontline differentiator. Over the forecast, PA6 retains share on cost-performance balance, MXD6 outpaces in oxygen-sensitive applications, and bio-based PAs carve differentiated, value-added niches that align with brand ESG narratives and premiumization.

Packaging Format Analysis

Films & Pouches represent the largest demand pool, spanning vacuum and MAP meat, cheese, and ready meals, plus dry mixes and specialty snacks that need flex-crack resistance and odor control. Nylon layers enable significant downgauging while preserving abuse resistance in transit and at retail. In retort pouches, PA6/PA66 combinations protect against burst and delamination through thermal cycles, ensuring seal integrity and shelf-stable performance. Bottles & Barrier Layers, including PET containers, leverage MXD6 to reach oxygen targets without aluminum foil or heavy glass, and evolving compatibilizers improve rPET stream outcomes. Caps & Closures and thermoformed trays use nylon for thread strength, heat resistance, and dimensional stability where premium feel and performance are essential, especially in hot-fill or sterilization environments.

Customer demand trends favor clear windows in pouches, minimal curl, and robust tear resistance without over-structuring. Retailers demand consistent opening features, laser scoring compatibility, and reduced pack weight per serving. In beverages, oxygen barrier stability during distribution and shelf life is critical to flavor retention, making MXD6 layers attractive alongside oxygen scavengers. Across formats, nylon’s role is increasingly to do more with less—boosting toughness and OTR performance so that total laminate thickness can fall, aiding EPR scorecards and transport efficiency metrics.

Processing Technology Analysis

BOPA/Oriented Films deliver high clarity, puncture resistance, and dimensional stability, with nylon resins tuned for tenter-frame draw ratios and precise moisture conditioning. Blown & Cast Coextrusion leverages multi-layer stacks where PA sits between polyolefin layers and EVOH to balance sealability, toughness, and barrier in stand-up pouches and vacuum packs. Multilayer Injection/Blow Molding supports PET bottles with MXD6 barrier layers and multilayer structures for medical liquids and specialty beverages. Solventless Lamination & Coating gains traction as converters target VOC reduction and energy savings, placing higher demands on nylon surface energy, adhesion, and heat resistance to ensure bond strength and print fidelity at lower coat weights.

Competitive positioning hinges on resin grades with stable orientation behavior, minimal haze, and robust tie-layer adhesion. Converters adopt in-line inspection and AI-driven defect mapping to improve yield on BOPA lines, increasing the importance of resin cleanliness and thermal stability. In coextrusion, resin rheology tailored to layer uniformity reduces gels and streaks and stabilizes bubble dynamics on 7–9 layer blown film assets. Processing advances unlock thinner nylon layers without sacrificing performance, expanding addressable use cases and improving cost competitiveness against advanced polyolefin-only barriers.

End-Use Industry Analysis

Food & Beverage dominates nylon usage, with meat, cheese, and ready meals relying on nylon’s puncture resistance and barrier synergy to curb spoilage and extend shelf life. Pet food moves to retortable pouches for logistics and branding advantages, using PA layers to survive sterilization without failures. In Pharmaceuticals & Medical, nylon supports sterilizable pouches, device packaging, and diagnostic kits where clarity and tear resistance matter alongside regulatory rigor. Personal Care & Household products adopt nylon skins for abrasion resistance in e-commerce, preventing scuffs and leaks in shipment without excessive over-packaging.

Demand drivers include cold-chain expansion, urbanization, and retailer mandates for waste reduction and recyclable-ready structures. Multinationals standardize global specs with regionally sourced resins, pushing suppliers to verify compliance and performance across plants and climates. Over time, nylon’s role strengthens in premium, safety-critical, and abuse-prone applications, while cost-sensitive dry foods test polyolefin-only alternatives. Suppliers that document total-cost savings through downgauging, fewer returns, and shelf-life gains will capture share across these end-use verticals.

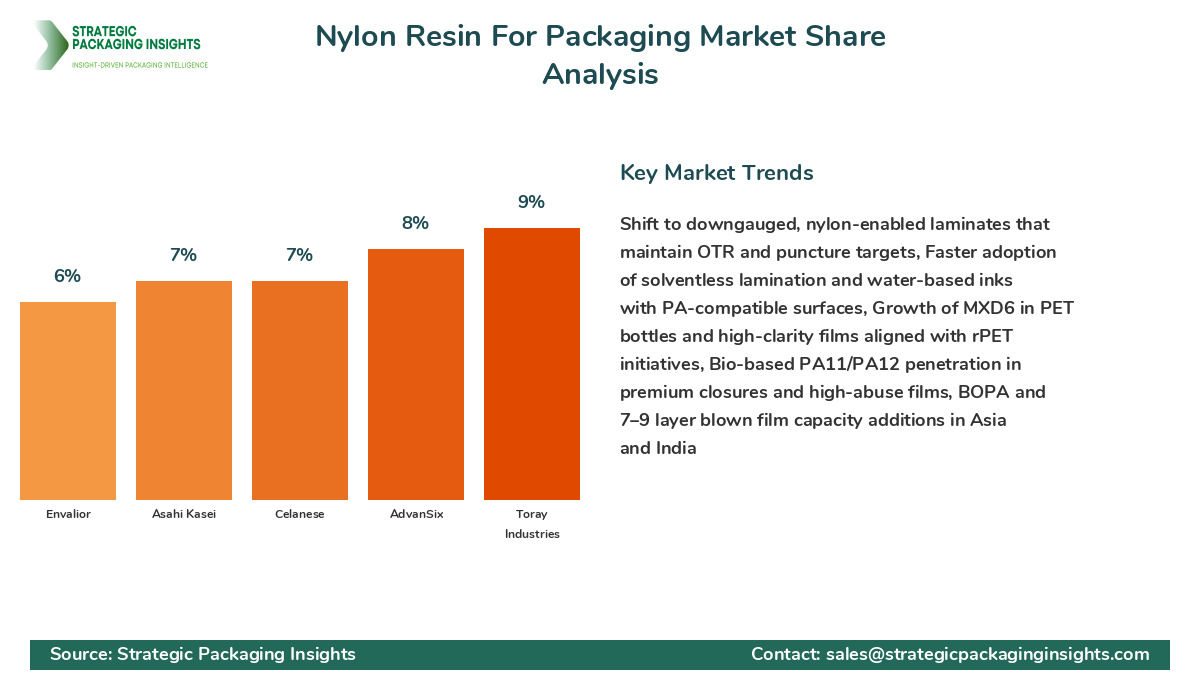

Market Share Analysis

Market share distribution shows a top tier of globally integrated suppliers—BASF, UBE Corporation, Toray Industries, AdvanSix, Asahi Kasei, Celanese, Envalior—followed by specialty and regional leaders including DOMO Chemicals, Arkema, and Mitsubishi Gas Chemical. Leaders gain share by combining feedstock integration, regional redundancy, and deep regulatory libraries that shorten qualification in food and pharma. Gainers emphasize gel control and orientation stability to lift BOPA and coex yields, while laggards face churn where optical defects or variable rheology increase waste. Concentration at the top stabilizes pricing during feedstock swings and channels investment toward bio-based, rPET-compatible, and downgauged structures. As alliances with adhesive and machinery OEMs expand, suppliers that pre-validate solventless and high-speed lamination windows lock in partnerships and influence specification standards, accelerating adoption and innovation cycles.

Top Countries Insights in Nylon Resin For Packaging

China (Market size: ~$2.8 billion; CAGR: 7): Rapid BOPA and multilayer blown film capacity growth, strong meat and dairy processing expansion, and rising modern retail drive nylon demand; policy support for advanced materials and new energy-efficient polymer lines improves cost positions, though energy price swings and regional environmental audits add variability. United States (Market size: ~$2.1 billion; CAGR: 4): Mature meat and cheese sectors, robust retort adoption, and e-grocery growth sustain PA6 demand; state-level EPR and recyclability labeling push downgauging and solventless lamination, with challenges from labor and energy costs balanced by integrated caprolactam and strong technical service ecosystems. Japan (Market size: ~$1.1 billion; CAGR: 3): High-spec films, meticulous quality standards, and leading BOPA technology keep nylon entrenched in retort and premium laminations; demographic shifts and flat consumption temper volumes, but innovation in high-clarity, low-gel grades and medical packaging maintains premium margins. Germany (Market size: ~$0.9 billion; CAGR: 3): Circularity leadership, solventless adoption, and strict food-contact compliance favor nylon’s role in down-gauged structures; energy costs and packaging-waste directives intensify structure redesigns and encourage MXD6-compatible rPET solutions. India (Market size: ~$0.8 billion; CAGR: 6): Fast growth in organized retail, cold chain, and ready-meal adoption accelerates nylon demand; investments in multilayer film assets and rising hygiene standards expand use in meat and dairy, with FX volatility and infrastructure gaps remaining near-term constraints.

Nylon Resin For Packaging Market Segments

The Nylon Resin For Packaging market has been segmented on the basis of

Resin Type

- PA6

- MXD6

Packaging Format

- Films & Pouches

- Bottles & Barrier Layers

Processing Technology

- BOPA/Oriented Films

- Blown & Cast Coextrusion

End-Use Industry

- Food & Beverage

- Pharmaceuticals & Medical

Primary Interview Insights

What keeps nylon central to flexible packaging design despite recyclability challenges?

Which properties matter most to converters running BOPA lines?

Where is MXD6 growth strongest?

How are EPR and retailer scorecards influencing resin selection?

Which end uses are most resilient to substitution by polyolefin-only barriers?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.