- Home

- Packaging Products

- North American Packaging Tape Printing Market Size, Future Growth and Forecast 2033

North American Packaging Tape Printing Market Size, Future Growth and Forecast 2033

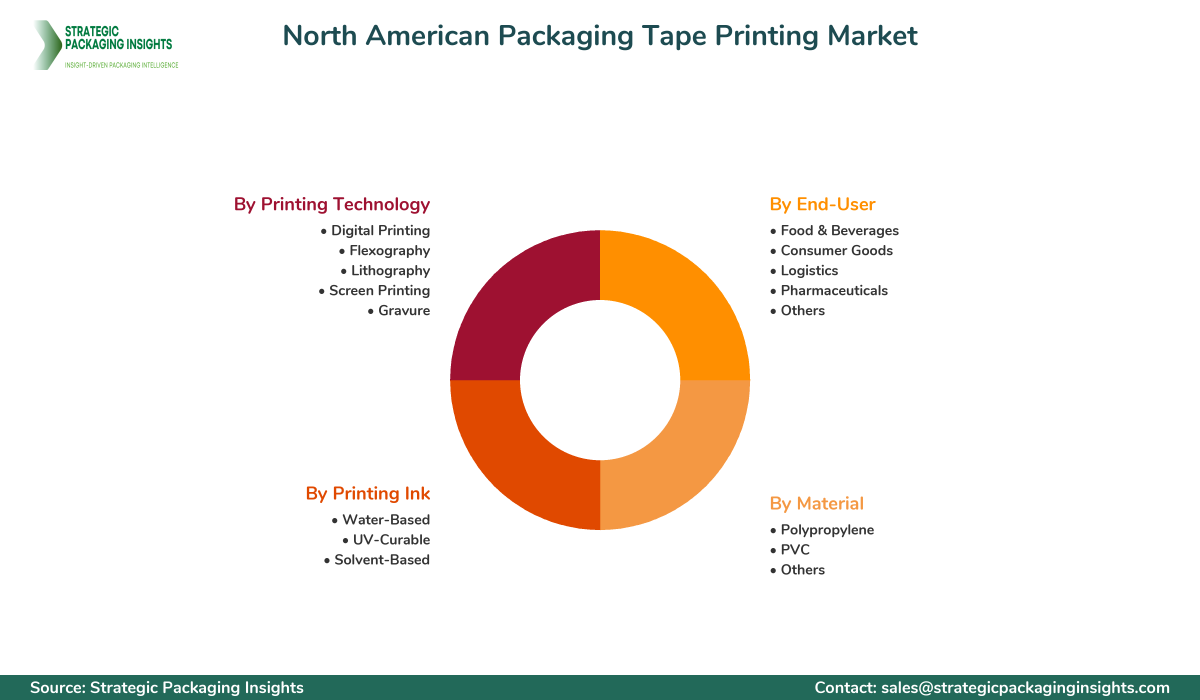

North American Packaging Tape Printing Market Segments - by Material (Polypropylene, PVC, Others), Printing Ink (Water-Based, UV-Curable, Solvent-Based), Printing Technology (Digital Printing, Flexography, Lithography, Screen Printing, Gravure), End-User (Food & Beverages, Consumer Goods, Logistics, Pharmaceuticals, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

North American Packaging Tape Printing Market Outlook

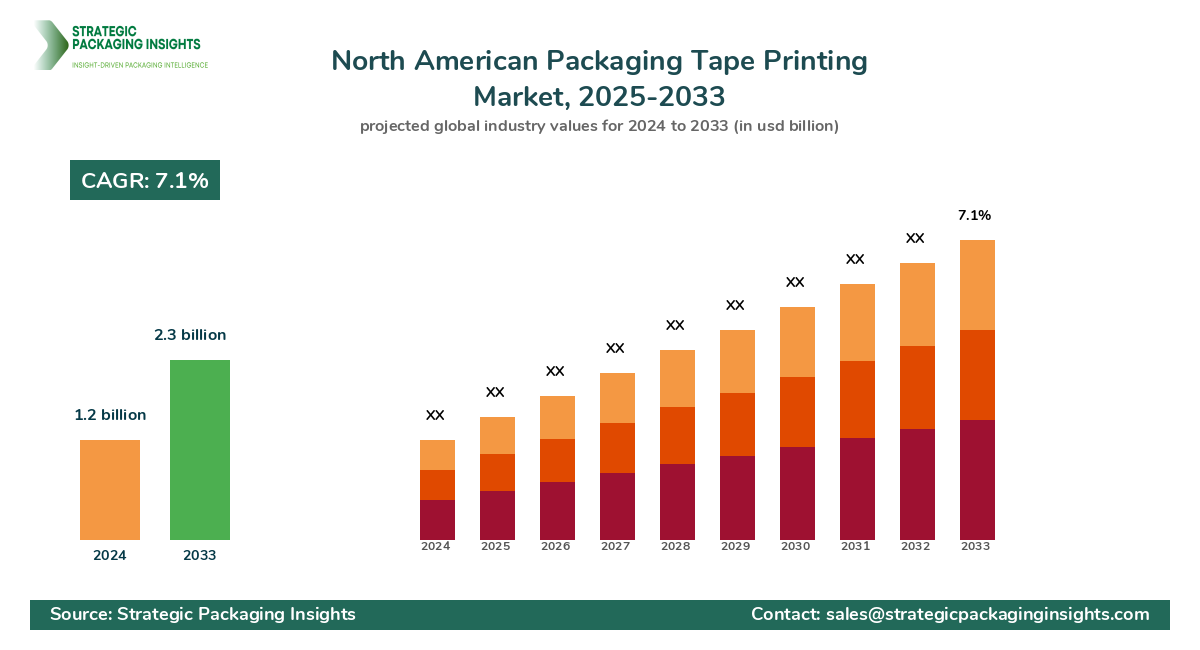

The North American packaging tape printing market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033. This market is driven by the increasing demand for aesthetically appealing packaging solutions that enhance brand visibility and consumer engagement. The rise in e-commerce and logistics sectors has further fueled the need for printed packaging tapes, as they offer an effective medium for branding and information dissemination. Additionally, advancements in printing technologies, such as digital and flexographic printing, have enabled high-quality, cost-effective solutions, further propelling market growth.

However, the market faces challenges such as stringent environmental regulations regarding the use of plastic materials and volatile raw material prices, which can impact production costs. Despite these restraints, the market holds significant growth potential due to the increasing adoption of sustainable and eco-friendly packaging solutions. Companies are investing in research and development to create biodegradable and recyclable packaging tapes, aligning with the growing consumer preference for sustainable products. This shift towards eco-friendly solutions is expected to open new avenues for market expansion in the coming years.

Report Scope

| Attributes | Details |

| Report Title | North American Packaging Tape Printing Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 167 |

| Material | Polypropylene, PVC, Others |

| Printing Ink | Water-Based, UV-Curable, Solvent-Based |

| Printing Technology | Digital Printing, Flexography, Lithography, Screen Printing, Gravure |

| End-User | Food & Beverages, Consumer Goods, Logistics, Pharmaceuticals, Others |

| Customization Available | Yes* |

Opportunities & Threats

The North American packaging tape printing market presents numerous opportunities, particularly with the growing trend towards customization and personalization in packaging. Businesses are increasingly seeking unique and tailored packaging solutions to differentiate their products in a competitive market. This demand for customized packaging tapes is driving innovation in printing technologies, enabling companies to offer a wide range of design options and color variations. Additionally, the rise of e-commerce has created a significant opportunity for packaging tape printing, as online retailers require distinctive packaging to enhance brand recognition and customer experience.

Another opportunity lies in the development of eco-friendly and sustainable packaging solutions. With increasing environmental awareness among consumers, there is a growing demand for packaging materials that are recyclable and biodegradable. Companies that invest in sustainable packaging solutions are likely to gain a competitive edge in the market. Furthermore, advancements in digital printing technology offer opportunities for cost-effective and high-quality printing solutions, enabling businesses to produce small batches of customized tapes efficiently.

Despite these opportunities, the market faces threats from stringent environmental regulations and fluctuating raw material prices. The packaging industry is under increasing pressure to reduce its environmental impact, leading to stricter regulations on the use of plastic materials. This can pose a challenge for companies that rely heavily on plastic-based packaging tapes. Additionally, the volatility in raw material prices can affect production costs and profit margins, posing a threat to market growth. Companies need to adopt strategies to mitigate these risks, such as diversifying their raw material sources and investing in sustainable alternatives.

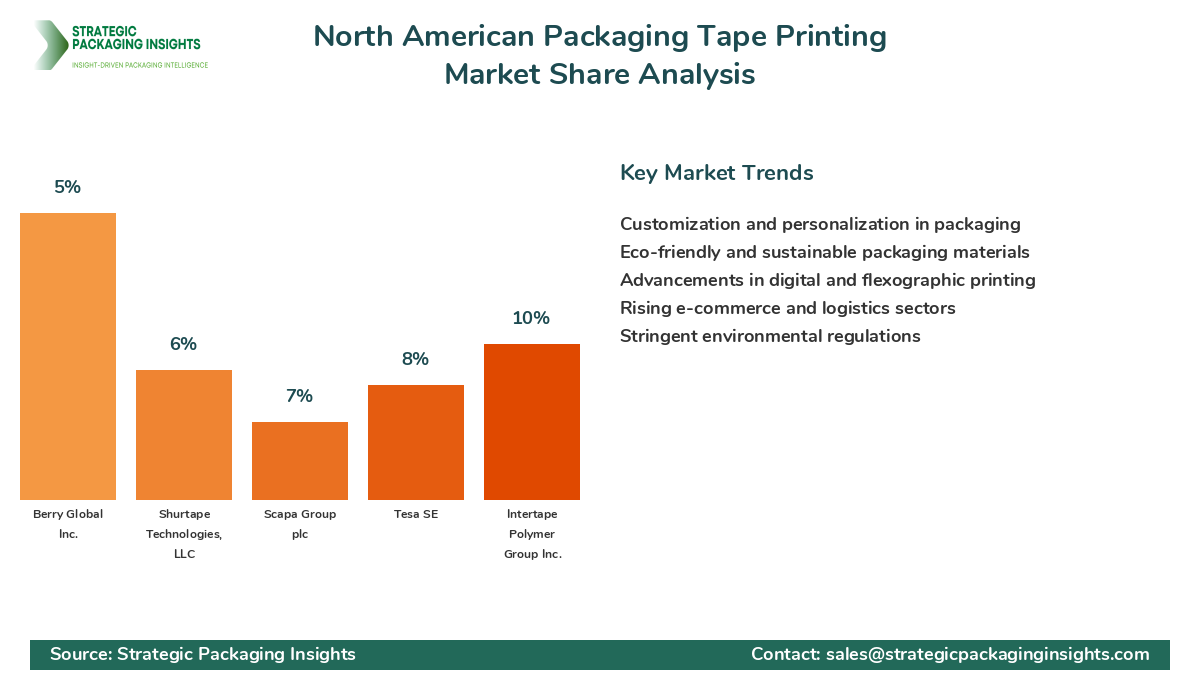

The North American packaging tape printing market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each offering a range of products and services to cater to diverse customer needs. The competitive environment is driven by factors such as product innovation, quality, pricing, and customer service. Companies are focusing on expanding their product portfolios and enhancing their printing capabilities to gain a competitive edge.

3M Company holds a significant share in the market, known for its innovative solutions and extensive product range. The company has a strong presence in the packaging industry, offering high-quality printed tapes that cater to various end-user industries. Avery Dennison Corporation is another major player, recognized for its advanced printing technologies and sustainable packaging solutions. The company's focus on research and development has enabled it to introduce eco-friendly products that align with consumer preferences.

Intertape Polymer Group Inc. is a key player in the market, offering a wide range of packaging tapes with customizable printing options. The company's commitment to sustainability and innovation has helped it maintain a strong market position. Similarly, Tesa SE is known for its high-performance adhesive tapes and printing solutions, catering to diverse industrial applications. The company's focus on quality and customer satisfaction has contributed to its success in the market.

Other notable companies in the market include Scapa Group plc, Shurtape Technologies, LLC, and Berry Global Inc. These companies are investing in advanced printing technologies and expanding their product offerings to meet the evolving demands of the market. The competitive landscape is expected to intensify as companies continue to innovate and adapt to changing market dynamics.

Key Highlights North American Packaging Tape Printing Market

- Increasing demand for customized and personalized packaging solutions.

- Growing adoption of eco-friendly and sustainable packaging materials.

- Advancements in digital and flexographic printing technologies.

- Rising e-commerce and logistics sectors driving market growth.

- Stringent environmental regulations impacting plastic-based packaging.

- Volatility in raw material prices affecting production costs.

- Focus on research and development for innovative packaging solutions.

- Expansion of product portfolios by key market players.

- Increasing consumer preference for recyclable and biodegradable packaging.

- Competitive landscape characterized by product innovation and quality.

Top Countries Insights in North American Packaging Tape Printing

The United States is the largest market for packaging tape printing in North America, with a market size of $800 million and a CAGR of 6%. The country's robust e-commerce sector and increasing demand for customized packaging solutions are key growth drivers. Additionally, the presence of major market players and advancements in printing technologies contribute to the market's expansion. However, challenges such as stringent environmental regulations and fluctuating raw material prices pose potential hurdles.

Canada is another significant market, with a market size of $250 million and a CAGR of 5%. The country's focus on sustainable packaging solutions and increasing consumer awareness about environmental issues are driving market growth. The Canadian government's initiatives to promote eco-friendly packaging further support the market's expansion. However, the market faces challenges from regulatory constraints and competition from international players.

Mexico, with a market size of $150 million and a CAGR of 7%, is experiencing growth due to the rising demand for packaging solutions in the food and beverage industry. The country's growing manufacturing sector and increasing exports are also contributing to market expansion. However, challenges such as economic instability and regulatory hurdles may impact growth prospects.

The market in Brazil is valued at $100 million with a CAGR of 4%. The country's expanding logistics and transportation sectors are driving demand for packaging tape printing. However, economic challenges and regulatory constraints pose potential threats to market growth. Companies are focusing on innovation and cost-effective solutions to overcome these challenges.

Argentina, with a market size of $50 million and a CAGR of 3%, is witnessing growth due to the increasing demand for packaging solutions in the consumer goods sector. The country's focus on sustainable packaging and government initiatives to promote eco-friendly solutions are supporting market expansion. However, economic instability and competition from international players remain challenges for market growth.

Value Chain Profitability Analysis

The value chain of the North American packaging tape printing market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Each stage of the value chain contributes to the overall profitability of the market, with varying profit margins and revenue distribution. Raw material suppliers play a crucial role in providing the necessary inputs for manufacturing packaging tapes, with profit margins typically ranging from 10% to 15%. Manufacturers, who convert raw materials into finished products, capture a significant share of the market value, with profit margins ranging from 20% to 25%.

Distributors and wholesalers are responsible for the distribution and sale of packaging tapes to end-users, capturing profit margins of 15% to 20%. End-users, including industries such as food and beverages, consumer goods, and logistics, utilize packaging tapes for various applications, contributing to the overall demand and profitability of the market. The value chain is influenced by factors such as raw material costs, production efficiency, and distribution networks, which impact the overall profitability of the market.

Digital transformation is reshaping the value chain by enabling more efficient production processes and distribution networks. Companies are leveraging digital technologies to optimize their operations, reduce costs, and enhance customer engagement. This shift towards digitalization is redistributing revenue opportunities throughout the industry, with manufacturers and distributors capturing increasing shares of the overall market value. As the market continues to evolve, stakeholders are focusing on innovation and sustainability to enhance their profitability and competitive advantage.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The North American packaging tape printing market has undergone significant changes between 2018 and 2024, driven by advancements in printing technologies and increasing demand for customized packaging solutions. During this period, the market experienced a CAGR of 5.5%, with a market size evolution from $900 million in 2018 to $1.2 billion in 2024. The segment distribution shifted towards digital and flexographic printing technologies, which gained popularity due to their cost-effectiveness and high-quality output. The regional contribution also saw changes, with the United States maintaining its dominance, while Canada and Mexico experienced moderate growth.

Looking ahead to the forecast period of 2025–2033, the market is expected to grow at a CAGR of 7.1%, reaching a market size of $2.3 billion by 2033. The segment distribution is anticipated to further shift towards sustainable and eco-friendly packaging solutions, driven by increasing consumer awareness and regulatory pressures. Technological impact factors, such as advancements in digital printing and the adoption of sustainable materials, will play a crucial role in shaping the market dynamics. Client demand transformations are expected to focus on customization, sustainability, and cost-effectiveness, influencing strategic imperatives for market players.

North American Packaging Tape Printing Market Segments Insights

Material Analysis

The material segment of the North American packaging tape printing market is primarily divided into polypropylene, PVC, and others. Polypropylene is the most widely used material due to its durability, cost-effectiveness, and versatility. It is favored by manufacturers for its excellent printability and resistance to moisture and chemicals, making it ideal for various industrial applications. The demand for polypropylene-based tapes is driven by the growing e-commerce and logistics sectors, which require durable and reliable packaging solutions.

PVC, on the other hand, is known for its superior strength and adhesive properties, making it suitable for heavy-duty applications. However, the use of PVC is declining due to environmental concerns and regulatory restrictions on plastic materials. Companies are increasingly exploring alternative materials that offer similar performance characteristics but with a lower environmental impact. The 'others' category includes materials such as paper and biodegradable plastics, which are gaining traction due to the growing demand for sustainable packaging solutions.

Printing Ink Analysis

The printing ink segment is categorized into water-based, UV-curable, and solvent-based inks. Water-based inks are the most popular choice due to their eco-friendly nature and low VOC emissions. They are widely used in the packaging industry for their excellent print quality and fast drying properties. The demand for water-based inks is driven by the increasing focus on sustainability and regulatory pressures to reduce environmental impact.

UV-curable inks are gaining popularity due to their ability to provide high-quality prints with excellent durability and resistance to fading. They are ideal for applications that require long-lasting and vibrant prints, such as branding and promotional packaging. Solvent-based inks, while offering excellent adhesion and print quality, are facing challenges due to their high VOC emissions and environmental concerns. Companies are investing in research and development to create low-VOC and eco-friendly alternatives to solvent-based inks.

Printing Technology Analysis

The printing technology segment includes digital printing, flexography, lithography, screen printing, and gravure. Digital printing is rapidly gaining traction due to its ability to produce high-quality prints with minimal setup time and cost. It is ideal for short-run and customized printing applications, making it a popular choice for businesses seeking personalized packaging solutions. The demand for digital printing is driven by the increasing trend towards customization and personalization in packaging.

Flexography is another widely used printing technology, known for its versatility and cost-effectiveness. It is suitable for high-volume printing applications and offers excellent print quality on a variety of substrates. Lithography, screen printing, and gravure are also used in the packaging tape printing market, each offering unique advantages and catering to specific applications. The choice of printing technology depends on factors such as print quality, cost, and production volume.

End-User Analysis

The end-user segment of the North American packaging tape printing market includes food and beverages, consumer goods, logistics, pharmaceuticals, and others. The food and beverage industry is a major consumer of printed packaging tapes, driven by the need for branding and product differentiation. The demand for packaging tapes in this industry is influenced by factors such as changing consumer preferences, regulatory requirements, and the growing trend towards sustainable packaging solutions.

The consumer goods sector is another significant end-user, with companies seeking innovative packaging solutions to enhance brand visibility and consumer engagement. The logistics and transportation industry also relies heavily on printed packaging tapes for secure and efficient packaging of goods. The pharmaceutical industry, while smaller in comparison, requires high-quality and reliable packaging solutions to ensure product safety and compliance with regulatory standards. The 'others' category includes industries such as electronics and automotive, which also utilize printed packaging tapes for various applications.

North American Packaging Tape Printing Market Segments

The North American Packaging Tape Printing market has been segmented on the basis of

Material

- Polypropylene

- PVC

- Others

Printing Ink

- Water-Based

- UV-Curable

- Solvent-Based

Printing Technology

- Digital Printing

- Flexography

- Lithography

- Screen Printing

- Gravure

End-User

- Food & Beverages

- Consumer Goods

- Logistics

- Pharmaceuticals

- Others

Primary Interview Insights

What are the key drivers for the North American packaging tape printing market?

What challenges does the market face?

How is sustainability impacting the market?

What role does digital printing play in the market?

Which end-user industries are driving market growth?

Latest Reports

The Active and Modified Atmospheric Packaging market was valued at $15.2 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The molded fiber packaging market was valued at $7.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The micro packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-counterfeit Pharmaceuticals Packaging market was valued at $80 billion in 2024 and is projected to reach $150 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The MDO-PE Film market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The compostable pouch market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The Smart Packaging market was valued at $23.5 billion in 2024 and is projected to reach $43.5 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The pharmaceutical glass packaging market was valued at $14.5 billion in 2024 and is projected to reach $22.3 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025–2033.

The tray liners market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Fan-Out Wafer Level Packaging (FOWLP) market was valued at $1.5 billion in 2024 and is projected to reach $4.2 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The cartoning machines market was valued at $3.5 billion in 2024 and is projected to reach $5.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The Twin Seal Bags market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The Polyvinyl Alcohol (PVA) Films market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The Ready-To-Eat Product Packaging market was valued at $95 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The Anti-Counterfeit Packaging market was valued at $105 billion in 2024 and is projected to reach $184 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The thermoformed skin packaging market was valued at $8.5 billion in 2024 and is projected to reach $13.2 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The packaging laminate market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The recycled cardboard market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033.

The holographic lamination film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033.

The Horizontal Continuous Band Sealer market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The Orbital Stretch Wrapper market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033.

The confectionery and bakery packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The LDPE Film market was valued at $35 billion in 2024 and is projected to reach $50 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The Bottle Case Packer market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The plastic shopping bag market was valued at $4.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The Active and Modified Atmospheric Packaging market was valued at $15.2 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The molded fiber packaging market was valued at $7.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The micro packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-counterfeit Pharmaceuticals Packaging market was valued at $80 billion in 2024 and is projected to reach $150 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The MDO-PE Film market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The compostable pouch market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The Smart Packaging market was valued at $23.5 billion in 2024 and is projected to reach $43.5 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The pharmaceutical glass packaging market was valued at $14.5 billion in 2024 and is projected to reach $22.3 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025–2033.

The tray liners market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Fan-Out Wafer Level Packaging (FOWLP) market was valued at $1.5 billion in 2024 and is projected to reach $4.2 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The cartoning machines market was valued at $3.5 billion in 2024 and is projected to reach $5.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The Twin Seal Bags market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The Polyvinyl Alcohol (PVA) Films market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The Ready-To-Eat Product Packaging market was valued at $95 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The Anti-Counterfeit Packaging market was valued at $105 billion in 2024 and is projected to reach $184 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The thermoformed skin packaging market was valued at $8.5 billion in 2024 and is projected to reach $13.2 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033.

The packaging laminate market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The recycled cardboard market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033.

The holographic lamination film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033.

The Horizontal Continuous Band Sealer market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The Orbital Stretch Wrapper market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033.

The confectionery and bakery packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The LDPE Film market was valued at $35 billion in 2024 and is projected to reach $50 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The Bottle Case Packer market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The plastic shopping bag market was valued at $4.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.