- Home

- Advanced Packaging

- High Temperature Label Market Size, Future Growth and Forecast 2033

High Temperature Label Market Size, Future Growth and Forecast 2033

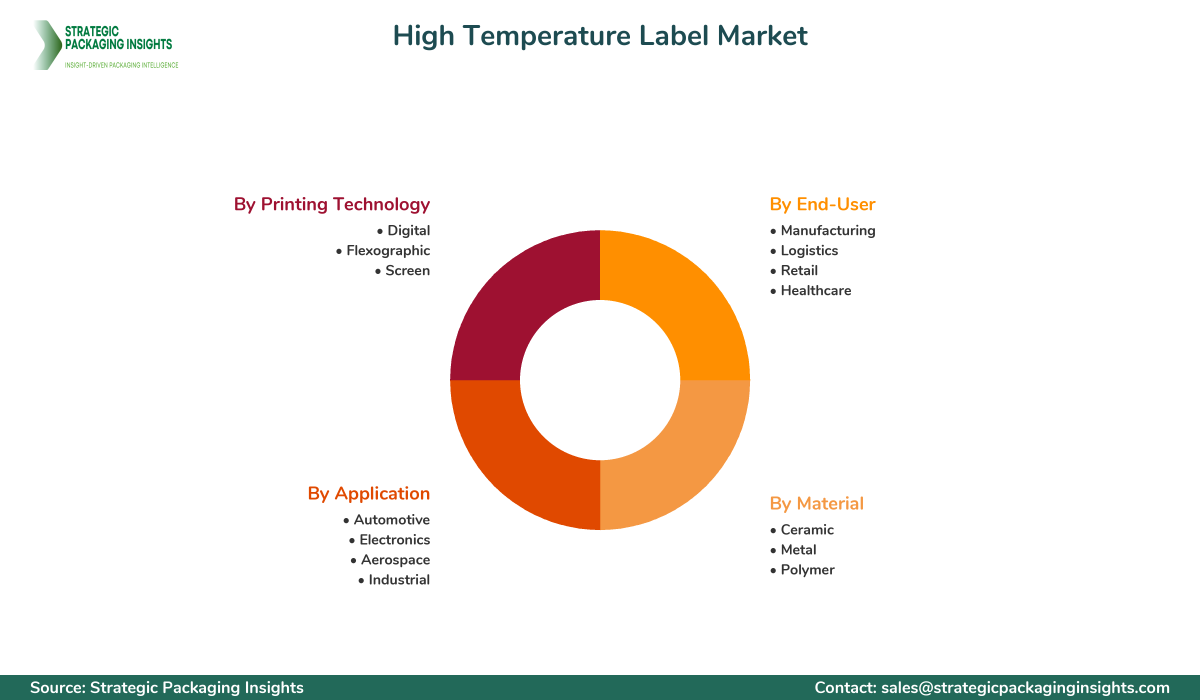

High Temperature Label Market Segments - by Material (Ceramic, Metal, Polymer), Application (Automotive, Electronics, Aerospace, Industrial), Printing Technology (Digital, Flexographic, Screen), and End-User (Manufacturing, Logistics, Retail, Healthcare) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

High Temperature Label Market Outlook

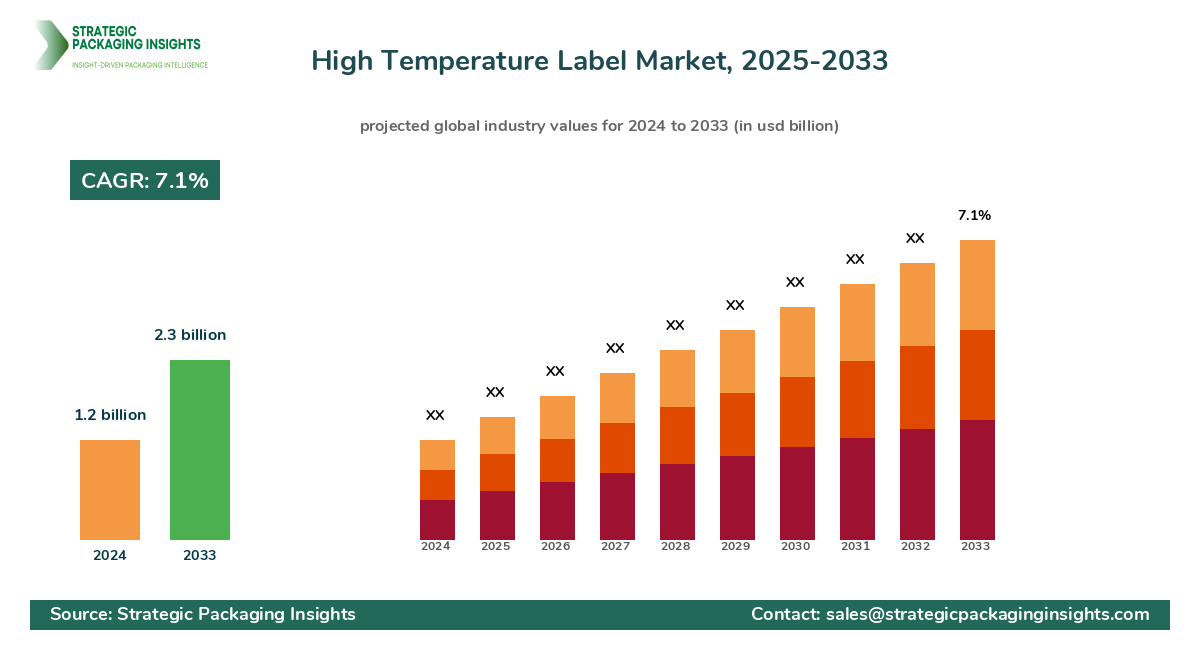

The High Temperature Label market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033. This market is driven by the increasing demand for durable labeling solutions in industries such as automotive, aerospace, and electronics, where Labels must withstand extreme temperatures and harsh environments. The growth is further fueled by advancements in material science, enabling the development of labels that can endure temperatures exceeding 1000°F. Additionally, the rise in industrial automation and the need for efficient asset tracking and management are propelling the demand for high temperature labels.

However, the market faces challenges such as the high cost of raw materials and the complexity of manufacturing processes, which can hinder growth. Regulatory standards and environmental concerns regarding the disposal and recycling of high temperature labels also pose significant restraints. Despite these challenges, the market holds substantial growth potential, particularly with the increasing adoption of IoT and smart labeling technologies that enhance traceability and operational efficiency. The integration of RFID technology in high temperature labels is expected to open new avenues for market expansion, offering enhanced data collection and management capabilities.

Report Scope

| Attributes | Details |

| Report Title | High Temperature Label Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 102 |

| Material | Ceramic, Metal, Polymer |

| Application | Automotive, Electronics, Aerospace, Industrial |

| Printing Technology | Digital, Flexographic, Screen |

| End-User | Manufacturing, Logistics, Retail, Healthcare |

| Customization Available | Yes* |

Opportunities & Threats

The High Temperature Label market presents numerous opportunities, particularly in the automotive and aerospace sectors, where the demand for reliable and durable labeling solutions is paramount. As these industries continue to evolve with technological advancements, the need for labels that can withstand extreme conditions becomes increasingly critical. The shift towards electric vehicles and the growing emphasis on sustainability are driving the demand for high-performance labeling solutions that can endure high temperatures while maintaining environmental compliance. Additionally, the rise of Industry 4.0 and the increasing adoption of automation in manufacturing processes are creating opportunities for high temperature labels to play a crucial role in asset tracking and inventory management.

Another significant opportunity lies in the integration of smart technologies, such as RFID and NFC, into high temperature labels. These technologies enable real-time data collection and monitoring, enhancing operational efficiency and traceability across various industries. The ability to provide detailed information about the condition and location of assets in extreme environments is becoming increasingly valuable, particularly in sectors such as logistics and supply chain management. Furthermore, the development of eco-friendly and recyclable high temperature labels is gaining traction, aligning with global sustainability goals and offering a competitive edge to manufacturers.

Despite the promising opportunities, the High Temperature Label market faces several threats that could impede its growth. The high cost of raw materials, such as ceramics and metals, used in the production of these labels can significantly impact profit margins. Additionally, the complexity of manufacturing processes and the need for specialized equipment can pose challenges for new entrants in the market. Regulatory standards and environmental concerns regarding the disposal and recycling of high temperature labels also present significant hurdles. Companies must navigate these challenges while ensuring compliance with stringent industry standards and maintaining competitive pricing strategies.

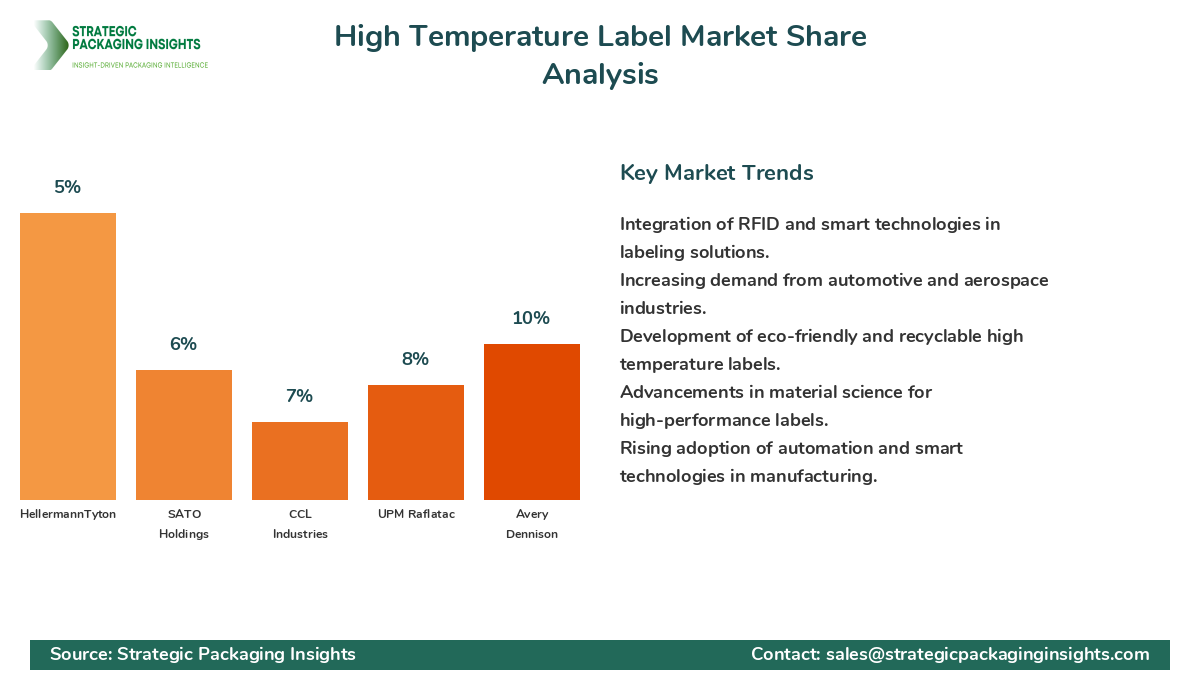

The High Temperature Label market is characterized by a competitive landscape with several key players vying for market share. Companies such as 3M, Brady Corporation, and Avery Dennison are leading the market with their extensive product portfolios and strong distribution networks. These companies have established themselves as industry leaders through continuous innovation and strategic partnerships. 3M, for instance, is renowned for its advanced material technologies and has a significant presence in the automotive and aerospace sectors. Brady Corporation, on the other hand, is known for its comprehensive range of labeling solutions and has a strong foothold in the industrial and electronics markets.

Avery Dennison is another major player in the High Temperature Label market, offering a wide array of labeling solutions that cater to various industries. The company's focus on sustainability and innovation has enabled it to maintain a competitive edge in the market. Other notable companies include UPM Raflatac, CCL Industries, and SATO Holdings, each contributing to the market with their unique offerings and technological advancements. UPM Raflatac, for example, is recognized for its eco-friendly labeling solutions, while CCL Industries is known for its expertise in specialty labels and packaging.

SATO Holdings, a leader in the auto-ID solutions market, has been expanding its presence in the High Temperature Label market through strategic acquisitions and partnerships. The company's focus on integrating RFID technology into its labeling solutions has positioned it as a key player in the market. Additionally, companies like HellermannTyton, Schreiner Group, and Polyonics are making significant contributions to the market with their innovative products and solutions. HellermannTyton, for instance, is known for its high-performance cable management solutions, while Schreiner Group specializes in functional labels and security solutions.

Polyonics, a pioneer in high temperature and harsh environment labeling solutions, continues to innovate with its advanced material technologies. The company's focus on developing labels that can withstand extreme temperatures and harsh chemicals has made it a preferred choice for industries such as electronics and aerospace. Overall, the competitive landscape of the High Temperature Label market is characterized by continuous innovation, strategic partnerships, and a focus on sustainability, with key players striving to enhance their product offerings and expand their market presence.

Key Highlights High Temperature Label Market

- The High Temperature Label market is projected to grow at a CAGR of 7.1% from 2025 to 2033.

- Increasing demand from the automotive and aerospace industries is driving market growth.

- Integration of RFID and smart technologies is enhancing operational efficiency and traceability.

- Eco-friendly and recyclable high temperature labels are gaining traction.

- High raw material costs and complex manufacturing processes pose challenges.

- Key players include 3M, Brady Corporation, Avery Dennison, and UPM Raflatac.

- Technological advancements in material science are enabling the development of high-performance labels.

- Regulatory standards and environmental concerns are significant market restraints.

- Strategic partnerships and acquisitions are shaping the competitive landscape.

Top Countries Insights in High Temperature Label

The United States is a leading market for High Temperature Labels, with a market size of $400 million and a CAGR of 6%. The country's strong industrial base and technological advancements in sectors such as automotive and aerospace are driving demand for high-performance labeling solutions. Government regulations promoting sustainability and environmental compliance are also influencing market growth. However, challenges such as high raw material costs and stringent regulatory standards remain significant hurdles.

Germany, with a market size of $300 million and a CAGR of 5%, is another key player in the High Temperature Label market. The country's robust manufacturing sector and emphasis on innovation and quality are driving demand for durable labeling solutions. The automotive industry, in particular, is a major growth driver, with increasing demand for labels that can withstand extreme temperatures and harsh environments. However, the market faces challenges such as high production costs and regulatory compliance.

China, with a market size of $250 million and a CAGR of 8%, is experiencing rapid growth in the High Temperature Label market. The country's expanding industrial base and increasing adoption of automation and smart technologies are driving demand for high-performance labeling solutions. Government initiatives promoting industrial growth and technological advancements are further fueling market expansion. However, challenges such as environmental concerns and regulatory compliance remain significant hurdles.

Japan, with a market size of $200 million and a CAGR of 4%, is a key market for High Temperature Labels. The country's strong focus on innovation and quality, coupled with its advanced manufacturing sector, is driving demand for durable labeling solutions. The electronics and automotive industries are major growth drivers, with increasing demand for labels that can withstand extreme conditions. However, challenges such as high production costs and regulatory compliance remain significant hurdles.

India, with a market size of $150 million and a CAGR of 7%, is emerging as a significant player in the High Temperature Label market. The country's expanding industrial base and increasing adoption of automation and smart technologies are driving demand for high-performance labeling solutions. Government initiatives promoting industrial growth and technological advancements are further fueling market expansion. However, challenges such as environmental concerns and regulatory compliance remain significant hurdles.

Value Chain Profitability Analysis

The High Temperature Label market's value chain profitability analysis reveals a complex ecosystem involving various stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Raw material suppliers, such as those providing ceramics, metals, and polymers, play a crucial role in the value chain, with profit margins typically ranging from 10% to 15%. Manufacturers, who convert these raw materials into high temperature labels, capture a significant share of the market value, with profit margins ranging from 20% to 25%.

Distributors and wholesalers, responsible for the distribution and sale of high temperature labels, typically operate with profit margins of 10% to 15%. End-users, including industries such as automotive, aerospace, and electronics, are the final consumers in the value chain. The integration of digital technologies and smart labeling solutions is reshaping the value chain, enabling manufacturers and distributors to capture additional value through enhanced data collection and management capabilities.

Digital transformation is playing a pivotal role in redistributing revenue opportunities throughout the industry. The adoption of IoT and smart technologies is enabling stakeholders to enhance operational efficiency and traceability, thereby capturing increased shares of the overall market value. As a result, companies that invest in digital transformation and innovation are well-positioned to capitalize on emerging opportunities and drive profitability in the High Temperature Label market.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The High Temperature Label market has undergone significant transformations between 2018 and 2024, driven by technological advancements and evolving industry demands. During this period, the market experienced a steady growth rate, with a CAGR of 5.5%, as industries such as automotive, aerospace, and electronics increasingly adopted high-performance labeling solutions. The integration of smart technologies, such as RFID and NFC, played a crucial role in enhancing operational efficiency and traceability, driving demand for high temperature labels.

Looking ahead to the forecast period of 2025 to 2033, the High Temperature Label market is expected to experience accelerated growth, with a projected CAGR of 7.1%. This growth is driven by the increasing adoption of automation and smart technologies across various industries, as well as the rising demand for eco-friendly and recyclable labeling solutions. The market is also expected to benefit from advancements in material science, enabling the development of labels that can withstand even higher temperatures and harsher environments.

Strategic foresight for the High Temperature Label market involves a focus on innovation and sustainability, with companies investing in research and development to enhance their product offerings and expand their market presence. The integration of digital technologies and smart labeling solutions is expected to play a pivotal role in shaping the future of the market, enabling stakeholders to capture increased shares of the overall market value. As a result, companies that prioritize innovation and sustainability are well-positioned to capitalize on emerging opportunities and drive growth in the High Temperature Label market.

High Temperature Label Market Segments Insights

Material Analysis

The High Temperature Label market is segmented by material into ceramic, metal, and polymer. Ceramic labels are highly sought after for their exceptional heat resistance, making them ideal for applications in the aerospace and automotive industries. These labels can withstand temperatures exceeding 1000°F, providing reliable performance in extreme environments. The demand for ceramic labels is driven by the need for durable and long-lasting labeling solutions that can endure harsh conditions without compromising on quality.

Metal labels, on the other hand, offer excellent durability and resistance to abrasion, making them suitable for industrial applications where labels are exposed to harsh chemicals and physical wear. The demand for metal labels is particularly strong in the electronics and manufacturing sectors, where the need for reliable and high-performance labeling solutions is paramount. Polymer labels, known for their flexibility and versatility, are widely used in applications where labels need to conform to irregular surfaces and withstand moderate temperatures.

Application Analysis

The High Temperature Label market is segmented by application into automotive, electronics, aerospace, and industrial. The automotive industry is a major driver of demand for high temperature labels, with the increasing adoption of electric vehicles and the need for reliable labeling solutions that can withstand extreme temperatures and harsh environments. The aerospace industry also presents significant growth opportunities, with the demand for high-performance labels that can endure the rigors of space travel and extreme conditions.

In the electronics sector, high temperature labels are essential for ensuring the reliability and performance of electronic components and devices. The demand for these labels is driven by the increasing complexity of electronic devices and the need for efficient asset tracking and management. The industrial sector, encompassing a wide range of applications, also presents significant growth opportunities for high temperature labels, with the increasing adoption of automation and smart technologies driving demand for reliable and durable labeling solutions.

Printing Technology Analysis

The High Temperature Label market is segmented by printing technology into digital, flexographic, and screen printing. Digital printing technology is gaining traction in the market due to its ability to produce high-quality labels with intricate designs and variable data. The demand for digital printing is driven by the need for customization and personalization in labeling solutions, particularly in industries such as retail and logistics.

Flexographic printing, known for its efficiency and cost-effectiveness, is widely used in the production of high temperature labels for industrial applications. The demand for flexographic printing is driven by the need for high-volume production and the ability to print on a wide range of materials. Screen printing, known for its durability and resistance to harsh environments, is commonly used in the production of labels for the automotive and aerospace industries, where labels are exposed to extreme conditions.

End-User Analysis

The High Temperature Label market is segmented by end-user into manufacturing, logistics, retail, and healthcare. The manufacturing sector is a major driver of demand for high temperature labels, with the increasing adoption of automation and smart technologies driving the need for reliable and durable labeling solutions. The logistics sector also presents significant growth opportunities, with the demand for efficient asset tracking and management driving the adoption of high temperature labels.

In the retail sector, high temperature labels are essential for ensuring the reliability and performance of products, particularly in applications where labels are exposed to extreme temperatures and harsh environments. The healthcare sector also presents significant growth opportunities, with the demand for reliable and durable labeling solutions that can withstand the rigors of medical environments and ensure the safety and efficacy of medical products.

High Temperature Label Market Segments

The High Temperature Label market has been segmented on the basis of

Material

- Ceramic

- Metal

- Polymer

Application

- Automotive

- Electronics

- Aerospace

- Industrial

Printing Technology

- Digital

- Flexographic

- Screen

End-User

- Manufacturing

- Logistics

- Retail

- Healthcare

Primary Interview Insights

What are the key drivers of growth in the High Temperature Label market?

What challenges does the High Temperature Label market face?

How is digital transformation impacting the High Temperature Label market?

What role does sustainability play in the High Temperature Label market?

What are the future growth opportunities in the High Temperature Label market?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.