- Home

- Eco-Friendly Packaging

- Edible Packaging Materials Market Size, Future Growth and Forecast 2033

Edible Packaging Materials Market Size, Future Growth and Forecast 2033

Edible Packaging Materials Market Segments - by Material Type (Proteins, Polysaccharides, Lipids, Composites), Application (Food & Beverages, Pharmaceuticals, Personal Care, Others), End-User (Food Manufacturers, Retailers, Consumers, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Edible Packaging Materials Market Outlook

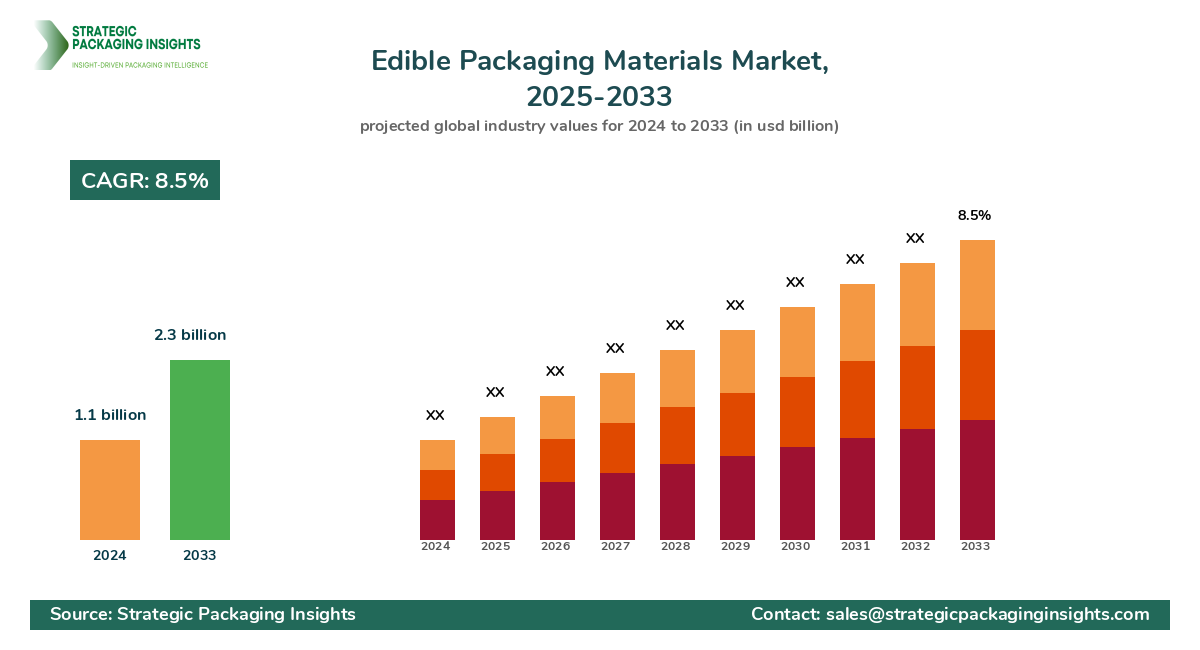

The edible packaging materials market was valued at $1.1 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033. This market is gaining traction due to increasing consumer demand for sustainable and eco-friendly packaging solutions. The shift towards reducing plastic waste and the growing awareness of environmental issues are significant drivers for this market. Edible packaging materials, which are biodegradable and often made from natural substances like proteins and polysaccharides, offer an innovative solution to traditional packaging challenges. The food and beverage industry, in particular, is a major adopter of these materials, as they align with the industry's push towards sustainability and reducing carbon footprints.

However, the market faces certain restraints, including regulatory challenges and the high cost of production compared to conventional packaging materials. The need for stringent quality control and safety standards can also pose hurdles for market growth. Despite these challenges, the edible packaging materials market holds significant growth potential, driven by technological advancements and increasing investments in research and development. Companies are focusing on developing new formulations and improving the functionality of edible packaging to enhance its appeal and usability. As consumer preferences continue to evolve towards more sustainable options, the market is expected to witness robust growth in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Edible Packaging Materials Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 188 |

| Material Type | Proteins, Polysaccharides, Lipids, Composites |

| Application | Food & Beverages, Pharmaceuticals, Personal Care, Others |

| End-User | Food Manufacturers, Retailers, Consumers, Others |

| Regional | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The edible packaging materials market presents numerous opportunities, particularly in the realm of innovation and sustainability. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize waste and reduce environmental impact. This trend is driving companies to invest in research and development to create new and improved edible packaging materials that are not only biodegradable but also enhance the shelf life and safety of the products they encase. The food and beverage industry, in particular, stands to benefit significantly from these innovations, as edible packaging can offer a unique selling proposition that aligns with consumer values.

Another opportunity lies in the potential for edible packaging to revolutionize the way products are consumed. By integrating flavors, nutrients, and functional ingredients into the packaging itself, companies can create a more engaging and interactive consumer experience. This approach not only adds value to the product but also opens up new avenues for product differentiation and brand loyalty. Additionally, the growing trend of personalized nutrition and health-conscious consumption is likely to drive demand for edible packaging solutions that cater to specific dietary needs and preferences.

Despite these opportunities, the market faces several threats that could hinder its growth. One of the primary challenges is the high cost of production associated with edible packaging materials. Compared to traditional packaging, edible materials often require more complex manufacturing processes and higher-quality raw materials, which can drive up costs. Furthermore, regulatory hurdles related to food safety and quality standards can pose significant barriers to market entry and expansion. Companies must navigate a complex landscape of regulations and certifications to ensure their products meet the necessary safety and quality requirements.

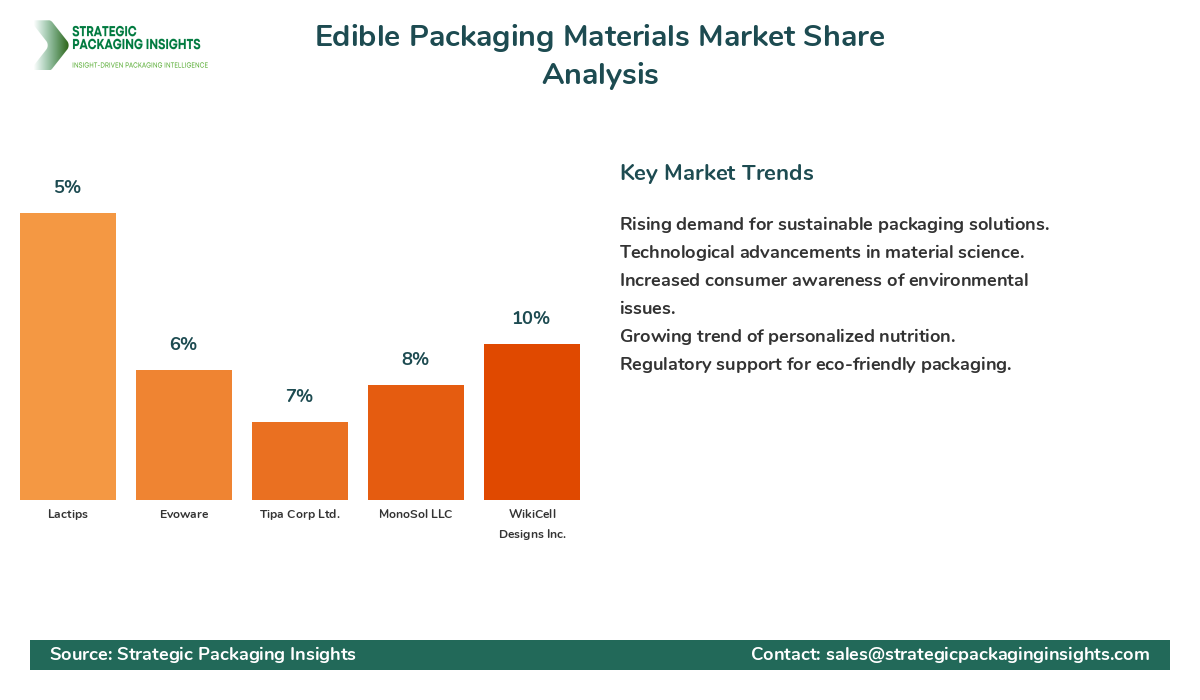

The edible packaging materials market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and innovative startups, each bringing unique strengths and capabilities to the table. The competitive dynamics are shaped by factors such as product innovation, pricing strategies, distribution networks, and brand reputation. Companies that can effectively leverage these factors are likely to gain a competitive edge in the market.

Among the major players in the market, Notpla Ltd. holds a significant share, known for its pioneering work in seaweed-based packaging solutions. The company's innovative approach to sustainable packaging has garnered significant attention and positioned it as a leader in the edible packaging space. Similarly, Loliware Inc. is another key player, recognized for its development of edible straws and cups made from seaweed and other natural materials. The company's focus on reducing plastic waste and promoting sustainability has resonated well with consumers and businesses alike.

Another notable company is WikiCell Designs Inc., which specializes in creating edible packaging for a variety of food and beverage products. The company's unique technology allows for the encapsulation of liquids and solids in edible membranes, offering a novel approach to packaging. Additionally, MonoSol LLC, a subsidiary of Kuraray Co., Ltd., is a prominent player in the market, known for its water-soluble films used in various applications, including edible packaging.

Other significant players in the market include Tipa Corp Ltd., which focuses on compostable packaging solutions, and Evoware, a company dedicated to developing seaweed-based packaging products. These companies, along with others such as Lactips, Biome Bioplastics, and Ingredion Incorporated, are actively contributing to the growth and development of the edible packaging materials market. Their efforts in research and development, coupled with strategic partnerships and collaborations, are expected to drive innovation and expand the market's reach in the coming years.

Key Highlights Edible Packaging Materials Market

- Increasing consumer demand for sustainable and eco-friendly packaging solutions.

- Significant growth potential driven by technological advancements and R&D investments.

- Regulatory challenges and high production costs as major market restraints.

- Opportunities for product differentiation through integration of flavors and nutrients.

- Growing trend of personalized nutrition driving demand for edible packaging.

- Competitive landscape characterized by a mix of established companies and startups.

- Key players include Notpla Ltd., Loliware Inc., and WikiCell Designs Inc.

- Focus on reducing plastic waste and promoting sustainability.

- Innovative approaches to packaging enhancing consumer engagement.

- Strategic partnerships and collaborations driving market expansion.

Top Countries Insights in Edible Packaging Materials

The United States is a leading market for edible packaging materials, with a current market size of approximately $300 million and a CAGR of 10%. The country's strong focus on sustainability and environmental conservation is a major growth driver, with consumers increasingly opting for eco-friendly packaging solutions. Government initiatives and regulations aimed at reducing plastic waste further support market growth. However, challenges such as high production costs and regulatory compliance remain significant hurdles for market players.

In Europe, the edible packaging materials market is valued at around $250 million, with a CAGR of 9%. The region's stringent environmental regulations and consumer demand for sustainable products are key growth drivers. Countries like Germany and France are at the forefront of adopting edible packaging solutions, driven by strong government support and consumer awareness. However, the market faces challenges related to the high cost of raw materials and production processes.

China is emerging as a significant player in the edible packaging materials market, with a market size of $200 million and a CAGR of 12%. The country's rapid industrialization and growing consumer awareness of environmental issues are driving demand for sustainable packaging solutions. Government policies promoting green technologies and reducing plastic waste are further boosting market growth. However, the market faces challenges related to regulatory compliance and quality control.

India's edible packaging materials market is valued at $150 million, with a CAGR of 15%. The country's large population and increasing consumer awareness of environmental issues are key growth drivers. Government initiatives promoting sustainable packaging solutions and reducing plastic waste are further supporting market growth. However, challenges such as high production costs and regulatory compliance remain significant hurdles for market players.

Brazil is another key market for edible packaging materials, with a market size of $100 million and a CAGR of 8%. The country's strong focus on sustainability and environmental conservation is driving demand for eco-friendly packaging solutions. Government initiatives and regulations aimed at reducing plastic waste further support market growth. However, challenges such as high production costs and regulatory compliance remain significant hurdles for market players.

Value Chain Profitability Analysis

The value chain for edible packaging materials involves several key stakeholders, each playing a crucial role in the production and distribution of these innovative solutions. The value chain begins with raw material suppliers, who provide the essential components such as proteins, polysaccharides, and lipids used in the production of edible packaging. These suppliers capture a significant portion of the value chain, with profit margins ranging from 15% to 20%, depending on the quality and availability of raw materials.

Manufacturers of edible packaging materials are the next critical link in the value chain. They are responsible for transforming raw materials into finished products through various processes such as extrusion, molding, and coating. Manufacturers typically capture profit margins of 20% to 25%, reflecting the complexity and innovation involved in producing edible packaging solutions. The high cost of production and the need for specialized equipment and technology contribute to these margins.

Distributors and retailers play a vital role in bringing edible packaging materials to market. They are responsible for marketing and selling these products to end-users, including food manufacturers, retailers, and consumers. Distributors and retailers capture profit margins of 10% to 15%, depending on their distribution networks and market reach. The growing demand for sustainable packaging solutions is driving increased interest and investment in this segment of the value chain.

Finally, end-users, including food manufacturers, retailers, and consumers, are the ultimate beneficiaries of edible packaging materials. These stakeholders benefit from the enhanced sustainability and environmental benefits offered by edible packaging solutions. The value captured by end-users is reflected in the increased consumer demand for eco-friendly products and the potential for cost savings through reduced waste and improved product shelf life.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The edible packaging materials market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences and technological advancements. During this period, the market experienced a CAGR of 7%, with a market size evolution from $800 million to $1.1 billion. The segment distribution shifted towards increased adoption of protein-based and polysaccharide-based materials, reflecting growing consumer demand for natural and sustainable solutions. Regional contributions also changed, with North America and Europe leading the market, driven by strong environmental regulations and consumer awareness.

Looking ahead to the forecast period of 2025 to 2033, the edible packaging materials market is expected to experience a CAGR of 8.5%, with a market size evolution from $1.1 billion to $2.3 billion. The segment distribution is anticipated to continue shifting towards more innovative and functional materials, such as composites and lipid-based solutions. Technological impact factors, including advancements in material science and manufacturing processes, are expected to drive further innovation and market growth. Client demand transformations will be influenced by increasing consumer awareness of environmental issues and the growing trend of personalized nutrition.

Edible Packaging Materials Market Segments Insights

Material Type Analysis

The edible packaging materials market is segmented by material type into proteins, polysaccharides, lipids, and composites. Protein-based materials, such as those derived from milk and soy, are gaining popularity due to their biodegradability and ability to form strong films. These materials are particularly favored in the food industry for their ability to enhance product shelf life and safety. Polysaccharides, including starch and cellulose, are also widely used due to their natural abundance and versatility. They offer excellent barrier properties and are often used in combination with other materials to enhance functionality.

Lipid-based materials, derived from natural oils and fats, are gaining traction for their ability to provide moisture barriers and improve the sensory attributes of packaged products. These materials are particularly useful in applications where moisture control is critical, such as in the packaging of baked goods and snacks. Composites, which combine multiple materials to enhance performance, are emerging as a key trend in the market. These materials offer the potential for improved mechanical properties and functionality, making them suitable for a wide range of applications.

Application Analysis

The application segment of the edible packaging materials market includes food and beverages, pharmaceuticals, personal care, and others. The food and beverage industry is the largest application segment, driven by the growing demand for sustainable packaging solutions that align with consumer preferences for eco-friendly products. Edible packaging materials are used in a variety of food applications, including snacks, confectionery, and dairy products, where they offer benefits such as extended shelf life and enhanced product safety.

In the pharmaceutical industry, edible packaging materials are used to create innovative drug delivery systems that improve patient compliance and convenience. These materials offer the potential for controlled release and targeted delivery of active ingredients, enhancing the efficacy and safety of pharmaceutical products. The personal care industry is also exploring the use of edible packaging materials in products such as cosmetics and toiletries, where they offer the potential for reduced environmental impact and improved consumer appeal.

End-User Analysis

The end-user segment of the edible packaging materials market includes food manufacturers, retailers, consumers, and others. Food manufacturers are the largest end-user segment, driven by the need to meet consumer demand for sustainable and eco-friendly packaging solutions. These companies are increasingly adopting edible packaging materials to enhance product appeal and differentiate their offerings in a competitive market. Retailers are also playing a key role in driving demand for edible packaging, as they seek to align with consumer preferences and reduce their environmental footprint.

Consumers are becoming increasingly aware of the environmental impact of packaging and are actively seeking out products that offer sustainable solutions. This trend is driving demand for edible packaging materials that offer the potential for reduced waste and improved product safety. Other end-users, including the hospitality and foodservice industries, are also exploring the use of edible packaging materials to enhance their sustainability efforts and improve customer satisfaction.

Regional Analysis

The edible packaging materials market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is the largest regional market, driven by strong consumer demand for sustainable packaging solutions and supportive government regulations. The region is home to several key players in the market, including Notpla Ltd. and Loliware Inc., who are driving innovation and market growth.

Europe is another significant market for edible packaging materials, with countries like Germany and France leading the way in terms of adoption and innovation. The region's stringent environmental regulations and strong consumer awareness are key drivers of market growth. Asia Pacific is emerging as a key growth region, driven by rapid industrialization and increasing consumer awareness of environmental issues. Countries like China and India are expected to see significant growth in the coming years, supported by government initiatives and investments in sustainable packaging solutions.

Edible Packaging Materials Market Segments

The Edible Packaging Materials market has been segmented on the basis of

Material Type

- Proteins

- Polysaccharides

- Lipids

- Composites

Application

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Others

End-User

- Food Manufacturers

- Retailers

- Consumers

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the edible packaging materials market?

What challenges does the edible packaging materials market face?

How is the competitive landscape shaping up in this market?

What opportunities exist for companies in this market?

Which regions are leading the market growth?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.