- Home

- Eco-Friendly Packaging

- E Commerce Paper Packaging Market Size, Future Growth and Forecast 2033

E Commerce Paper Packaging Market Size, Future Growth and Forecast 2033

E Commerce Paper Packaging Market Segments - by Material Type (Corrugated Boxes, Paper Bags, Cartons, Envelopes), Application (Electronics, Fashion and Apparel, Food and Beverages, Health and Personal Care, Home Products), End-User (Retailers, Manufacturers, Distributors), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

E Commerce Paper Packaging Market Outlook

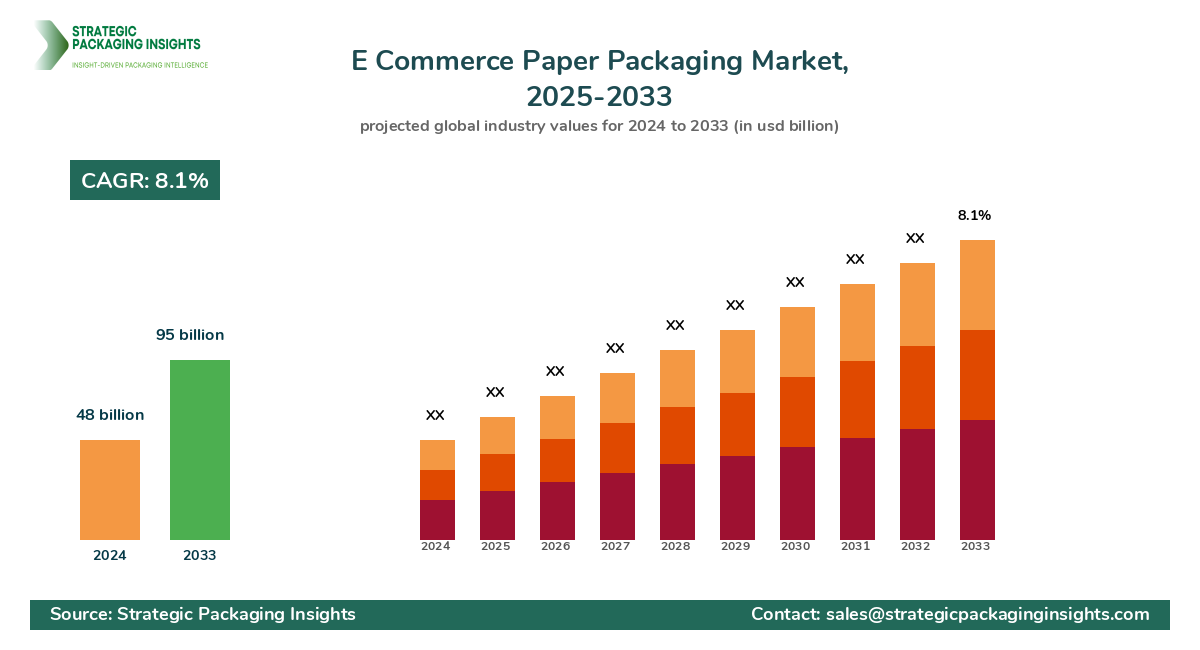

The E Commerce Paper Packaging market was valued at $48 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 8.1% during the forecast period 2025–2033. This market is witnessing significant growth due to the increasing demand for sustainable packaging solutions driven by the e-commerce boom. As consumers become more environmentally conscious, the shift towards paper-based packaging is accelerating, offering a biodegradable and recyclable alternative to plastic. The rise in online shopping, particularly in emerging markets, is further propelling the demand for paper packaging solutions. Additionally, advancements in packaging technology and design are enhancing the functionality and appeal of paper packaging, making it a preferred choice for e-commerce businesses.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations that could impact production costs and profitability. Despite these challenges, the market holds immense growth potential, driven by innovations in packaging materials and the increasing adoption of digital printing technologies. These advancements are enabling manufacturers to offer customized and aesthetically appealing packaging solutions, catering to the diverse needs of e-commerce businesses. Furthermore, strategic collaborations and partnerships among key players are expected to enhance market competitiveness and drive growth in the coming years.

Report Scope

| Attributes | Details |

| Report Title | E Commerce Paper Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2024 |

| Historic Data | 2017-2023 |

| Forecast Period | 2025-2033 |

| Number of Pages | 173 |

| Material Type | Corrugated Boxes, Paper Bags |

| Application | Electronics, Fashion and Apparel |

| End-User | Retailers, Manufacturers |

| Regional | Asia Pacific, North America |

| Customization Available | Yes* |

Opportunities & Threats

The E Commerce Paper Packaging market presents numerous opportunities for growth, primarily driven by the increasing consumer preference for eco-friendly packaging solutions. As environmental concerns continue to rise, consumers are actively seeking sustainable alternatives, prompting e-commerce businesses to adopt paper-based packaging. This shift is creating a significant demand for innovative and sustainable packaging solutions, offering lucrative opportunities for market players to expand their product portfolios and capture a larger market share. Additionally, the growing trend of online shopping, particularly in developing regions, is further fueling the demand for paper packaging, providing a robust platform for market expansion.

Another opportunity lies in the technological advancements in packaging materials and design. Innovations such as water-resistant coatings, enhanced durability, and improved printing techniques are enhancing the functionality and appeal of paper packaging, making it a preferred choice for e-commerce businesses. These advancements are enabling manufacturers to offer customized and aesthetically appealing packaging solutions, catering to the diverse needs of e-commerce businesses. Furthermore, strategic collaborations and partnerships among key players are expected to enhance market competitiveness and drive growth in the coming years.

Despite the promising growth prospects, the E Commerce Paper Packaging market faces several challenges that could hinder its growth. One of the primary restrainers is the fluctuating prices of raw materials, which can significantly impact production costs and profitability. Additionally, stringent environmental regulations and compliance requirements pose a challenge for manufacturers, as they need to invest in sustainable production processes and materials to meet regulatory standards. These factors could potentially limit the market's growth, necessitating strategic planning and investment in research and development to overcome these challenges.

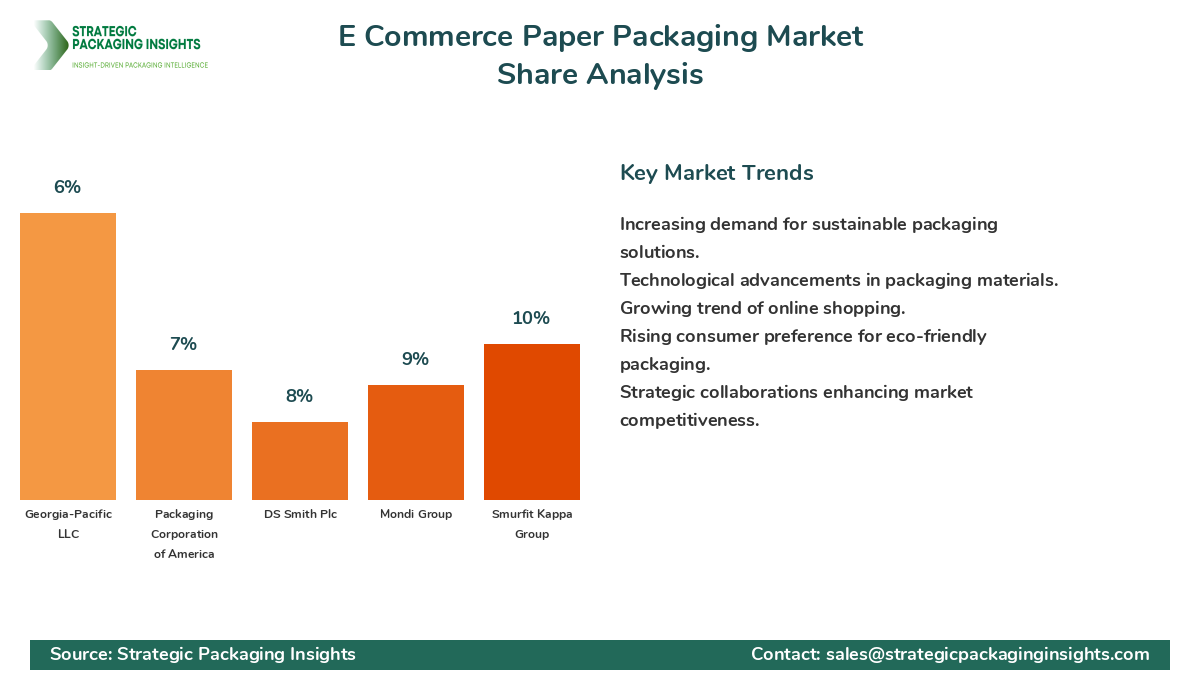

The competitive landscape of the E Commerce Paper Packaging market is characterized by the presence of several key players, each striving to enhance their market position through strategic initiatives such as mergers and acquisitions, partnerships, and product innovations. The market is highly fragmented, with a mix of global and regional players competing for market share. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to cater to the growing demand for sustainable packaging solutions. Additionally, investments in research and development are enabling companies to introduce innovative packaging solutions that meet the evolving needs of e-commerce businesses.

Leading companies in the market include International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, and DS Smith Plc. These companies hold a significant share of the market, driven by their extensive product offerings, strong distribution networks, and strategic partnerships. International Paper Company, for instance, is a leading player in the market, known for its innovative packaging solutions and commitment to sustainability. The company has a strong presence in North America and Europe, with a focus on expanding its operations in emerging markets.

WestRock Company is another major player, renowned for its comprehensive range of paper packaging solutions and strong focus on customer satisfaction. The company has a robust global presence, with operations in over 30 countries, and is committed to delivering sustainable packaging solutions that meet the needs of its diverse customer base. Smurfit Kappa Group, a leading provider of paper-based packaging solutions, is known for its innovative approach to packaging design and sustainability. The company has a strong presence in Europe and the Americas, with a focus on expanding its operations in Asia and Africa.

Mondi Group, a global leader in packaging and paper, is recognized for its commitment to sustainability and innovation. The company offers a wide range of paper packaging solutions, catering to various industries, including e-commerce. DS Smith Plc, a leading provider of sustainable packaging solutions, is known for its innovative approach to packaging design and commitment to sustainability. The company has a strong presence in Europe and is focused on expanding its operations in North America and Asia.

Key Highlights E Commerce Paper Packaging Market

- The market is projected to grow at a CAGR of 8.1% from 2025 to 2033.

- Increasing demand for sustainable packaging solutions is driving market growth.

- Technological advancements in packaging materials and design are enhancing market appeal.

- Fluctuating raw material prices pose a challenge to market growth.

- Stringent environmental regulations are impacting production processes.

- Strategic collaborations and partnerships are enhancing market competitiveness.

- Customization and digital printing technologies are driving innovation in the market.

- Emerging markets offer significant growth opportunities for market players.

- Key players are focusing on expanding their product portfolios and production capabilities.

- Investments in research and development are driving product innovations.

Top Countries Insights in E Commerce Paper Packaging

The United States is a leading market for E Commerce Paper Packaging, with a market size of $12 billion and a CAGR of 7%. The country's strong e-commerce sector and increasing consumer preference for sustainable packaging solutions are driving market growth. Additionally, favorable government policies promoting sustainable practices are further boosting the market.

China is another significant market, with a market size of $10 billion and a CAGR of 9%. The country's booming e-commerce industry and growing awareness of environmental issues are driving the demand for paper packaging solutions. Government initiatives promoting sustainable practices are also contributing to market growth.

Germany, with a market size of $8 billion and a CAGR of 6%, is a key market in Europe. The country's strong focus on sustainability and innovation in packaging materials is driving market growth. Additionally, the presence of leading packaging companies and a robust e-commerce sector are contributing to market expansion.

India, with a market size of $6 billion and a CAGR of 10%, is an emerging market with significant growth potential. The country's rapidly growing e-commerce sector and increasing consumer awareness of environmental issues are driving the demand for paper packaging solutions. Government initiatives promoting sustainable practices are also supporting market growth.

The United Kingdom, with a market size of $5 billion and a CAGR of 5%, is a mature market with a strong focus on sustainability. The country's well-established e-commerce sector and increasing consumer preference for eco-friendly packaging solutions are driving market growth. Additionally, government regulations promoting sustainable practices are further boosting the market.

Value Chain Profitability Analysis

The value chain of the E Commerce Paper Packaging market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and retailers. Each stage of the value chain plays a crucial role in determining the overall profitability of the market. Raw material suppliers provide the necessary inputs for the production of paper packaging, with profit margins typically ranging from 10% to 15%. Manufacturers, who convert raw materials into finished products, capture a significant share of the market value, with profit margins ranging from 20% to 25%.

Distributors and retailers play a vital role in the value chain, ensuring the availability of paper packaging products to end-users. Distributors typically operate with profit margins of 10% to 12%, while retailers capture margins of 15% to 20%. The increasing adoption of digital transformation technologies is reshaping the value chain, enabling stakeholders to optimize their operations and enhance profitability. For instance, manufacturers are leveraging digital printing technologies to offer customized packaging solutions, capturing a larger share of the market value.

Overall, the value chain of the E Commerce Paper Packaging market is characterized by a competitive landscape, with stakeholders striving to enhance their profitability through strategic initiatives such as cost optimization, product innovation, and strategic partnerships. The increasing focus on sustainability and digital transformation is expected to drive further changes in the value chain, offering new revenue opportunities for market players.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The E Commerce Paper Packaging market has undergone significant changes between 2018 and 2024, driven by the increasing demand for sustainable packaging solutions and the rapid growth of the e-commerce sector. During this period, the market witnessed a CAGR of 6.5%, with a market size evolution from $35 billion in 2018 to $48 billion in 2024. The segment distribution shifted towards corrugated boxes and Paper Bags, driven by their versatility and eco-friendly nature. The regional contribution also changed, with Asia Pacific emerging as a key market, driven by the booming e-commerce industry in countries like China and India.

Looking ahead to the forecast period of 2025 to 2033, the market is expected to grow at a CAGR of 8.1%, with a projected market size of $95 billion by 2033. The segment distribution is expected to further shift towards innovative packaging solutions, driven by advancements in packaging materials and design. The regional contribution is also expected to change, with emerging markets such as India and Brazil gaining prominence due to their rapidly growing e-commerce sectors. Technological impact factors such as digital printing and customization are expected to drive innovation in the market, catering to the evolving needs of e-commerce businesses.

Overall, the E Commerce Paper Packaging market is expected to witness significant growth in the coming years, driven by the increasing demand for sustainable packaging solutions and the rapid growth of the e-commerce sector. Strategic imperatives for market players include investing in research and development, expanding product portfolios, and enhancing production capabilities to capture a larger share of the market. Additionally, strategic collaborations and partnerships are expected to enhance market competitiveness and drive growth in the coming years.

E Commerce Paper Packaging Market Segments Insights

Material Type Analysis

The material type segment of the E Commerce Paper Packaging market is dominated by corrugated boxes, which are widely used due to their durability and versatility. Corrugated boxes offer excellent protection for products during transit, making them a preferred choice for e-commerce businesses. The increasing demand for sustainable packaging solutions is driving the adoption of corrugated boxes, as they are recyclable and biodegradable. Additionally, advancements in packaging technology are enhancing the functionality and appeal of corrugated boxes, further driving their demand in the market.

Paper bags are another significant sub-segment, driven by their eco-friendly nature and versatility. Paper bags are widely used for packaging lightweight products, offering a sustainable alternative to plastic bags. The increasing consumer preference for eco-friendly packaging solutions is driving the demand for paper bags, particularly in the fashion and apparel sector. Additionally, innovations in paper bag design and printing are enhancing their appeal, making them a popular choice for e-commerce businesses.

Application Analysis

The application segment of the E Commerce Paper Packaging market is dominated by the electronics sector, which accounts for a significant share of the market. The increasing demand for electronic products and the need for secure packaging solutions are driving the adoption of paper packaging in this sector. Paper packaging offers excellent protection for electronic products during transit, making it a preferred choice for e-commerce businesses. Additionally, the growing trend of online shopping is further fueling the demand for paper packaging in the electronics sector.

The fashion and apparel sector is another significant sub-segment, driven by the increasing demand for sustainable packaging solutions. The growing consumer preference for eco-friendly packaging is driving the adoption of paper packaging in this sector, offering a sustainable alternative to plastic packaging. Additionally, innovations in packaging design and printing are enhancing the appeal of paper packaging, making it a popular choice for fashion and apparel e-commerce businesses.

End-User Analysis

The end-user segment of the E Commerce Paper Packaging market is dominated by retailers, who account for a significant share of the market. Retailers are increasingly adopting paper packaging solutions to meet the growing demand for sustainable packaging from consumers. The increasing focus on sustainability and environmental responsibility is driving retailers to adopt paper packaging, offering a biodegradable and recyclable alternative to plastic packaging. Additionally, the growing trend of online shopping is further fueling the demand for paper packaging among retailers.

Manufacturers are another significant sub-segment, driven by the increasing demand for customized and innovative packaging solutions. Manufacturers are leveraging advancements in packaging technology to offer customized packaging solutions that meet the diverse needs of e-commerce businesses. Additionally, strategic collaborations and partnerships among manufacturers are enhancing market competitiveness and driving growth in the market.

Regional Analysis

The regional segment of the E Commerce Paper Packaging market is dominated by Asia Pacific, which accounts for a significant share of the market. The region's booming e-commerce industry and increasing consumer preference for sustainable packaging solutions are driving market growth. Additionally, government initiatives promoting sustainable practices are further boosting the market in the region. North America is another significant market, driven by the strong e-commerce sector and increasing consumer awareness of environmental issues. The presence of leading packaging companies and favorable government policies are contributing to market growth in the region.

Europe is a mature market with a strong focus on sustainability and innovation in packaging materials. The region's well-established e-commerce sector and increasing consumer preference for eco-friendly packaging solutions are driving market growth. Additionally, government regulations promoting sustainable practices are further boosting the market in the region. Latin America and the Middle East & Africa are emerging markets with significant growth potential, driven by the increasing demand for sustainable packaging solutions and the growing e-commerce sector.

E Commerce Paper Packaging Market Segments

The E Commerce Paper Packaging market has been segmented on the basis of

Material Type

- Corrugated Boxes

- Paper Bags

Application

- Electronics

- Fashion and Apparel

End-User

- Retailers

- Manufacturers

Regional

- Asia Pacific

- North America

Primary Interview Insights

What are the key drivers of growth in the E Commerce Paper Packaging market?

What challenges does the E Commerce Paper Packaging market face?

How are technological advancements impacting the market?

What opportunities exist for market players?

Which regions offer significant growth potential?

Latest Reports

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The resealable films market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The foodservice disposables market was valued at $23.5 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The Kraft Paper market was valued at $17.5 billion in 2024 and is projected to reach $25.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The adhesive tape films market was valued at $62 billion in 2024 and is projected to reach $95 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The advanced chip packaging market was valued at $35 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025–2033.

The oxo-biodegradable plastic packaging market was valued at $3.2 billion in 2024 and is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The bakery cases market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The food and beverage packaging market was valued at $305 billion in 2024 and is projected to reach $450 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The pharmaceutical contract packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The industrial textile chemicals market was valued at $28.47 billion in 2024 and is projected to reach $39.52 billion by 2033, growing at a CAGR of 3.71% during the forecast period 2025–2033.

The Single Zero Aluminum Foil market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033.

The Packaging Accessories market was valued at $72.5 billion in 2024 and is projected to reach $117.38 billion by 2033, growing at a CAGR of 5.50% during the forecast period 2025–2033.

The Packaging Tensioner market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Ethical Label market was valued at $1.5 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Hot Melt Glue Labeler market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Automatic Labeling Machine market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The Smart Container market was valued at $2.5 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2025–2033.

The self-heating food packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Aluminium Foil Packaging market was valued at $25 billion in 2024 and is projected to reach $40 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The plastic card market was valued at $27.5 billion in 2024 and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025–2033.

The print label market was valued at $39.5 billion in 2024 and is projected to reach $59.2 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The holographic film market was valued at $2.5 billion in 2024 and is projected to reach $4.8 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025–2033.

The clamshell labelling machines market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The consumer packaging market was valued at $1.2 trillion in 2024 and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The self-adhesive label market was valued at $40 billion in 2024 and is projected to reach $60 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.